(This article was last updated on Nov. 14, 2023.)

Today, we will have an extensive review of BlackRock Funds. We will discuss all the important as well as the latest news related to BlackRock. Let us start by knowing some crucial details about BlackRock.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Below is a short video review on BlackRock Funds, especially ETFs:

Table of Contents

About BlackRock

BlackRock is an investment management company and the world’s largest asset manager. It has $8.6 trillion worth of assets under management as of the 2022 fourth quarter.

The company, headquartered in New York City, has 89 branches in 38 countries as of the time of update. Adding to that, the company offers its services to clients in 100 countries.

IShares group, which is the leading global provider of ETFs, is owned and managed by BlackRock. It acquired iShares from Barclays in 2009.

BlackRock’s strategy for making investments takes into account ESG factors (environmental, social, and governance), which are becoming increasingly significant. The organization is aware that ESG factors may have an effect on the performance of long-term investments; consequently, it has incorporated ESG factors into its investment processes as well as the investment products that it offers.

BlackRock provides clients with a variety of investment options that take ESG factors into account. These options include actively managed sustainable funds, iShares ESG ETFs (Exchange Traded Funds), and ESG integration across BlackRock’s overall investment platform.

Additionally, BlackRock engages with companies on ESG issues and advocates for improved corporate practices and disclosure. In addition, BlackRock produces its own Sustainability Report on an annual basis. This report details the company’s approach to sustainability and provides updates on its sustainability initiatives and progress.

The organization has stated its intention to address a variety of concerns, including diversity and inclusion, the reduction of its carbon footprint, and the promotion of sustainability within its own operations.

BlackRock also offers mutual funds and closed-end funds to their customers. To get the details on investment funds offered by BlackRock, you can visit their website.

BlackRock is trading on the New York Stock Exchange (NYSE) under the ticker symbol “BLK.” Its market cap presently stands at $102.68 billion, as per MarketWatch.

Types of BlackRock Funds

Most people who get the services of BlackRock are looking for:

— Mutual Funds

— ETFs

— Closed-end funds

— Investments concentrating on goals like retirement or college savings

What kind of funds do BlackRock offer?

BlackRock offers all kinds of funds. The main kinds are:

Managed Funds

These funds try to beat the market. For example, a BlackRock technology fund might try to beat the Nasdaq or S&P500. Likewise, a BlackRock energy fund will try to beat the average return of energy stocks on the indexes. However, some of their funds will simply try to lower the volatility to investors as well, rather than simply beat the benchmark.

Index Funds and Index-Linked ETFs

These funds track the index. The BlackRock S&P500 fund or indeed iShares S&P500 index fund simply tracks the performance of the market.

Socially responsible investing funds

These investments are of course still trying to get the investor a good return, but they are taking a specific moral stance. It is common for such funds to avoid oil companies as an example. BlackRock also have a range of Shariah and other religious funds.

Managed ETFs

These types of index funds are similar to the traditional ETFs but try to be a bit smarter by managing and tilting the index slightly. For example, the fund manager might try to tilt the index towards small caps, to beat the S&P500. We will speak about these funds more below.

What are the costs of BlackRock Funds?

Most of the funds offered by BlackRock cost around 1% to 2.5%. The managed indexes are usually around 0.5% per year.

For investors who invest more than $50 million, the fees can be lower than those mentioned above. There can be various types of charges depending on the amount invested and other factors.

Generally, BlackRock funds charge fees in the form of management fees, which are typically calculated as a percentage of the assets under management.

For BlackRock’s iShares ETFs, fees can be as low as 0.03% for some of the most popular equity ETFs, while bond ETFs can have fees ranging from 0.05% to 0.25%. Some specialized ETFs or those that focus on a particular investment theme or ESG factor may have slightly higher fees.

For actively managed funds, fees can vary widely depending on the investment strategy and asset class. BlackRock’s actively managed mutual funds, for example, may have fees ranging from 0.15% to 1.00% or more, depending on the investment strategy, fund size, and other factors. Hedge funds managed by BlackRock may have higher fees, which can include a management fee and a performance fee.

In addition to management fees, BlackRock funds may also charge other expenses, such as administrative expenses, distribution expenses, and other operating expenses. These expenses are typically disclosed in the fund’s prospectus or other offering documents. Investors should carefully review these documents before making any investment decisions.

What has the performance of BlackRock Funds been like?

The performance of BlackRock funds is dependent on many things, such as the market they have been focused on and whether they are active or passive funds.

For example, BlackRock’s S&P500 index fund has performed well long term, compared to the BlackRock Emerging Markets Index Fund. That could change in the future though, if emerging markets start to perform better.

Most of BlackRock’s index funds have performed well long term but of course suffer during periods of market falls. A lot of BlackRock’s managed funds underperform their vanilla indexes, even if they have a few years of over-performance.

The performance also depends on investor behavior. Countless people panic during periods like 2020 and 2008, and get too excited during moments when the market is on the rise.

So, a buy-and-hold investor in BlackRock funds will of course outperform somebody who tries to time the market.

How about the managed indexes?

Countless BlackRock funds are similar to traditional index funds but try to be a bit smarter. An example is the BlackRock Managed Index Portfolios Growth Fund.

This fund aims to get both capital growth and dividend yields. However, included in the fund are commodities, cash and many other things so even though it is relatively low-cost, it takes a more active approach to the traditional index funds and haven’t performed quite as well long term.

The only exception has been during periods of market turmoil, such as what we saw in 2020.

Many of these smart beta ETFs still use a fund manager.

Evaluating BlackRock’s Risk Management Strategies

Investing in BlackRock Funds involves understanding their approach to risk management. This section explores how BlackRock Funds navigate the complexities of the financial markets, ensuring investor assets are managed with a keen eye on risk and reward.

The Foundation of BlackRock’s Risk Management

Emphasizing Diversification

Diversification is a cornerstone of risk management in BlackRock Funds. By spreading investments across various asset classes, BlackRock Funds aim to mitigate risks associated with market volatility.

Utilizing Advanced Analytics

BlackRock Funds leverage advanced analytics to assess and manage risk. This proactive approach allows for a comprehensive understanding of potential market shifts, crucial for effective risk management.

Responding to Market Volatility

Adaptive Investment Strategies

BlackRock Funds are known for their adaptive investment strategies. In response to market volatility, these funds adjust their asset allocations to balance risk and return effectively.

Real-Time Risk Assessment

Continuous monitoring of market conditions allows BlackRock Funds to perform real-time risk assessments, a critical aspect of their risk management strategy.

Risk Management in Specialized Markets

Dealing with Emerging Markets

BlackRock Funds’ approach to emerging markets involves a careful analysis of political, economic, and currency risks, ensuring informed investment decisions.

Technology Sector Investments

In the rapidly evolving technology sector, BlackRock Funds employ specialized risk management strategies to navigate the unique challenges and opportunities this sector presents.

Regulatory Compliance and Ethical Standards

Adhering to Global Regulations

BlackRock Funds strictly adhere to global financial regulations, an essential part of their risk management framework.

Ethical Investment Practices

BlackRock Funds incorporate ethical investment practices in their risk management strategies, aligning with ESG (Environmental, Social, and Governance) principles.

How does BlackRock compare to Vanguard?

Most of BlackRock’s index funds are just as good as any other index provider, including Vanguard. It is a misconception that Vanguard only does index investing. Like BlackRock, they also have managed and passive funds.

Vanguard was the first company to offer index funds so they have more of a brand name in their niche, but that doesn’t make them better.

The key difference between BlackRock and Vanguard is the fees they charge for their investment products. While both companies offer low-cost index funds and ETFs, Vanguard is generally known for having some of the lowest fees in the industry, while BlackRock’s fees can vary depending on the specific product and investment strategy.

However, BlackRock’s iShares ETFs are known for their low fees and broad range of offerings.

These days, they both offer almost identical funds and that is the same when it comes to Blackrock’s MyMap funds which are very similar to Vanguard LifeStrategy funds in terms of costs and performance.

MyMap and LifeStrategy funds are both target-date fund offerings designed to provide investors with a diversified portfolio that automatically adjusts over time to become more conservative as the target date approaches.

One key difference between these products is their investment philosophy. BlackRock’s MyMap funds are actively managed and focus on constructing a portfolio that seeks to outperform a benchmark index over time, while Vanguard’s LifeStrategy funds are passively managed and seek to track a specific index.

How the assets are allocated between bonds and stocks also vary between MyMap and LifeStrategy funds. The asset manager decides how to change the asset allocation, as conditions change.

It is too soon to tell which fund will perform better long term.

Revenue Model and Reports

How do they generate revenue?

Fees that are charged for BlackRock’s investment management services are the primary source of the company’s revenue. The business provides customers with access to a comprehensive selection of investment products and services, some of which include index and active management strategies, ETFs, mutual funds, and alternative investments.

BlackRock’s investment products and services are subject to a variety of fees, such as management fees, performance fees, and advisory fees, depending on the type of fee.

Fees for management are typically calculated as a percentage of assets under management, whereas fees for performance are typically calculated according to how well an investment fund or account performed in comparison to a benchmark or another measure. The provision of individualized investment guidance to institutional customers typically results in the charging of advisory fees.

In addition to the fees that are charged for investment management, BlackRock generates revenue from the services that it provides in the areas of technology and risk management, as well as from securities lending and other activities. BlackRock’s clientele can take advantage of a range of risk management and analytical services. The company’s technology platform, known as Aladdin, is a leading investment management system that is used by institutional investors all over the world.

BlackRock’s revenue model is designed to provide a diversified stream of income across its various business lines. This allows the company to generate revenue from a wide range of sources, helping to reduce its dependence on any single product or business line.

How does BlackRock’s latest financial performance look like?

BlackRock reported revenue of about $4.34 billion in the fourth quarter (Q4) of 2022, a 15% drop year over year from roughly $5.11 billion in Q4 2021. Net income attributable to BlackRock also fell in Q4 2022 to $1.26 billion from $1.64 billion in the same quarter of 2021.

For full-year 2022, revenue slid 8% year over year to $17.87 billion while net income attributable to BlackRock decreased 12% to $5.18 billion.

The company delivered net inflows worth $146 billion for Q4 and $393 billion for the full year. Net inflow is the amount of money received by the company into its investments.

Before we move on, let’s look at the firm’s revenue in detail.

Revenue from Investment Advisory, Securities Lending, and Administration Fees

It is clear that BlackRock generates the majority of its revenue from investment advisory, administration fees, and security lending. In particular, revenue from investment advisory and administration fees declined year over year to $3.26 billion in Q4 2022 from $3.83 billion. Meanwhile, Q4 securities lending revenue edged up to $139 million year over year from $136 million.

The common types of fees included in this business category are the firm’s equity fees, fixed-income fees, multi-asset alternative fees, as well as fees for cash management services.

Revenue from Distribution Fees

This includes the fees involved with the distribution and service of different products. It also includes fees associated with support services related to investment portfolios.

For the reported quarter, revenue from distribution fees plunged year over year to $314 million from $411 million.

Revenue from Technology Services

This business category of BlackRock includes investment management technology systems, risk management services, wealth management tools, and digital distribution tools.

The tools for wealth management and digital distribution get offered to insurance companies, banks, pension fund managers, and asset managers.

Revenue from technology services climbed year over year during the reported quarter to $353 million from $339 million.

Revenue from Investment Advisory Performance Fees

Certain BlackRock accounts get charged with performance fees. This is when the performance exceeds a certain threshold.

BlackRock earned $228 million through this category of business in Q4 2022, down from $329 million in the same quarter in 2021.

Advisory and Other Revenue

This business category of BlackRock includes advisory services for global financial institutions, for regulators, and for government clients. These fees charged by BlackRock are on a fixed-rate basis.

Advisory and other revenue also shrank to $43 million year over year for the reported quarter from $59 million.

The Role of Technology in BlackRock’s Investment Approach

BlackRock Funds consistently leverage cutting-edge technology to enhance their investment strategies. This section explores how technology plays a pivotal role in BlackRock’s approach to managing investments.

Advanced Analytics in Investment Decision-Making

Real-Time Market Analysis

Real-time market analysis is a cornerstone of BlackRock Funds’ technology use. By analyzing market data as it happens, BlackRock can make timely and informed decisions, a crucial advantage in today’s fast-paced financial environment.

Predictive Analytics

Predictive analytics allow BlackRock Funds to forecast market trends and potential risks. This proactive approach is integral to maintaining a strong investment portfolio and mitigating potential losses.

Automation and Efficiency in Portfolio Management

Algorithm-Driven Trading

Algorithm-driven trading is a key feature in BlackRock Funds’ technology arsenal. These algorithms execute trades at optimal times, maximizing returns and minimizing costs.

Risk Assessment Tools

Automated risk assessment tools play a critical role in BlackRock Funds’ investment approach. These tools continuously monitor and evaluate investment risks, ensuring that portfolios maintain a balanced risk profile.

Integration of Artificial Intelligence and Machine Learning

AI in Market Research

AI-driven market research offers BlackRock Funds a competitive edge. AI algorithms analyze vast amounts of data to uncover hidden market trends and investment opportunities.

Machine Learning in Risk Management

Machine learning algorithms are employed by BlackRock Funds for dynamic risk management. These algorithms adapt and learn from new data, continuously refining risk assessment strategies.

Blockchain and Cryptocurrency Ventures

Blockchain for Enhanced Security

Blockchain technology is being evaluated by BlackRock Funds for its potential to enhance transaction security and transparency.

Cryptocurrency Investment Strategies

BlackRock Funds are developing strategies for cryptocurrency investment, recognizing the growing importance of digital assets in the global financial landscape.

Involvement with Cryptocurrencies

There are some aspects of BlackRock which prove its connection to the crypto realm. Looks as if Blackrock is enthusiastic about the crypto investment realm.

Why? Because it is showing a lot of interest in the crypto market. This is even when things went south for cryptocurrencies.

Well, the scenario of investments in cryptocurrencies is not limited to BlackRock. Most major companies are also seen among the companies investing in cryptocurrencies. These include Alphabet, Morgan Stanley, Goldman Sachs, Samsung, etc.

In 2022, BlackRock launched their blockchain ETF called iShares Blockchain and Tech ETF (IBLC), which aims to monitor the investment results of an index that is made up of firms based in the US as well as those based outside that are engaged in the creation, advancement, and usage of blockchain and cryptocurrency tech. The holdings of this ETF are:

• Coinbase Global

• Marathon Digital Holdings

• USD Cash

• Galaxy Digital Holdings

• International Business Machines

• Hive Blockchain Technologies

• Bitfarms

• PayPal Holdings

• Canaan

• Nvidia

• Advanced Micro Devices

• Block Inc.

• Hut Mining

• CleanSpark

Nonetheless, this ETF doesn’t get involved with cryptocurrency investments directly.

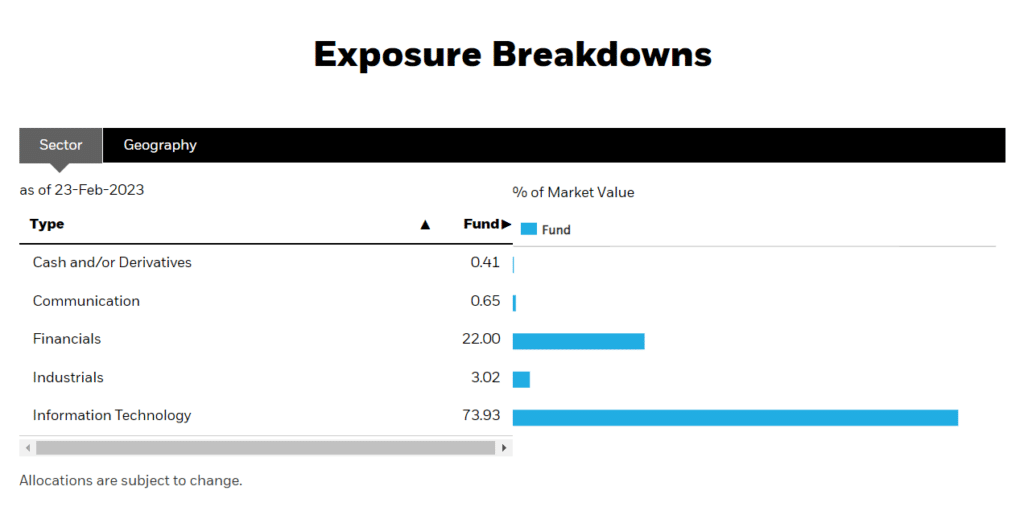

Below is a graph that shows the exposure of iShares Blockchain and Tech ETF (IBLC):

BlackRock-Coinbase Tie-Up

BlackRock’s institutional clients seem to be positive about the digital asset market. Even when things aren’t progressive for the crypto market.

Because of that, BlackRock in 2022 announced a partnership with Coinbase, one of the best global cryptocurrency exchanges that got listed on NASDAQ in 2021.

This cooperationwas for concentrating on Bitcoin, or at least for now. There is a possibility to see involvement in other cryptos in the future.

BlackRock seems to be positive on blockchains, stablecoins, crypto assets, and tokenization. Furthermore, it started with Bitcoin because institutional clients are enthusiastic about it.

Why Bitcoin? Well, it is obvious. Bitcoin is the old-school cryptocurrency responsible for the crypto explosion. It is also the biggest and the most liquid crypto asset compared to any other cryptocurrency.

With the Aladdin software suite, individuals can track and manage their Bitcoin holdings. This software also offers access to conduct a risk analysis of clients’ holdings. People who opt for this get access to various features and tools via Coinbase Prime.

How does a Bitcoin Trust work?

Most of you may not be familiar with the term Bitcoin Trust and it’s okay. Bitcoin Trust or Bitcoin Investment Trust is an investment vehicle like stocks. This is also good for exposure to Bitcoin instead of futures contracts.

Understanding BlackRock’s Asset Allocation and Diversification Techniques

Investing in BlackRock Funds involves understanding their sophisticated asset allocation and diversification strategies. These techniques are key to managing risk and optimizing returns, especially in the dynamic financial landscape of 2023.

Core Principles of BlackRock’s Asset Allocation

Balancing Risk and Reward

BlackRock Funds prioritize a balance between risk and reward. This involves analyzing market trends and adjusting asset allocations to optimize investment portfolios. Their approach ensures that investors in BlackRock Funds are positioned to capitalize on market opportunities while mitigating potential risks.

Responsive Asset Allocation

BlackRock Funds employ a responsive asset allocation strategy. This means they continuously monitor global economic indicators and adjust their investment strategies accordingly. This dynamic approach helps BlackRock Funds stay ahead in rapidly changing markets.

Diversification Strategies in BlackRock Funds

Geographic Diversification

BlackRock Funds understand the importance of geographic diversification. By investing across various global markets, they spread risk and tap into different economic growth patterns. This strategy is crucial for investors in BlackRock Funds seeking global exposure.

Sector Diversification

Sector diversification is another cornerstone of BlackRock Funds’ strategy. They allocate assets across multiple sectors, from technology to healthcare, ensuring that portfolios are not overly dependent on any single industry’s performance.

Adapting to 2023’s Market Conditions

Embracing Technological Advancements

In 2023, BlackRock Funds are increasingly leveraging technology to enhance their asset allocation and diversification strategies. They use advanced analytics and machine learning to identify investment opportunities and risks, making BlackRock Funds well-equipped for modern investing challenges.

Responding to Global Economic Shifts

BlackRock Funds are adept at responding to global economic shifts. With the ongoing changes in the global economy, including inflation trends and geopolitical tensions, BlackRock Funds adjust their strategies to safeguard investments and explore growth avenues.

Scrutinization over ESG investments

In August 2022, BlackRock was reported to be under scrutiny from attorneys general (AGs) of 19 states, according to the New York Post. This is due to the aggressive impact of BlackRock’s ESG investments.

These attorneys general wrote to the SEC to supervise BlackRock’s dealing with China. The letter also asked for BlackRock’s fiduciary responsibility to investors.

The AGs said that BlackRock has been defeating the whole purpose of ESG. BlackRock stresses that US companies follow a policy of zero-carbon emissions. Yet, BlackRock is said to maintain relations with Chinese companies which do not follow ESG policies at all.

The AGs asking BlackRock to reveal its investment policies could lead to issues. This may lead to treasurers in most states to remove their funds from BlackRock.

BlackRock and the Chinese Property Market

How has the real estate industry crisis in China affected BlackRock funds?

In an August 2022 report from financial services firm Morningstar, it said that Asia’s bond funds were moving away from the Chinese real estate market. These were not just any bond funds but Asia’s largest high-yield bond funds.

The scenario was because of a drastic liquidity crisis in the Chinese property sector impacting debt investments.

The weighting of Chinese property bonds in Asian junk funds was around 28% by the end of 2021. This slid to 16% in June 2022, especially because of the clampdown on borrowing and housing sales decline.

Many funds from leading asset managers reported double-digit losses by July 2022. BlackRock reduced its Chinese property market exposure by about half in June 2022 from December 2021. BlackRock cut its investments in the Chinese real estate sector to roughly 15% of the portfolio, Bloomberg said.

In December 2022, the dim situation has somehow eased with appetite for junk-bonds starting to rebound, according to fund managers cited in a report by The South China Morning Post (SCMP).

“There is room for optimism as some high-yield bonds are ‘over-penalised’, according to JPMorgan Chase,” SCMP said.

Additionally, the government has recently made a number of policy announcements that, when taken together, should provide a significant boost to the Chinese real estate industry in terms of its short-term funding requirements.

Gordon Tsui, who is based in Hong Kong and is the head of fixed income at Ping An of China Asset Management, stated in an interview with SCMP that bond investors, particularly those in Asia, are heading back to Chinese property credits and that those interested are looking at the sector once more.

However, substantial uncertainties remain in the Chinese property sector.

Nomura desk analysts headed by Nicholas Yap stated that “the turnaround in China’s property market is likely to be slow, notwithstanding Beijing’s recent policy pivot,” SCMP said, citing a November 2022 report from Nomura.

What about the Ukraine-Russia war and its effects on BlackRock funds?

You most probably are aware of the recent events that took place between Russia and Ukraine. Based on this, most countries and financial institutions paused their dealings with Russia. BlackRock has also become a part of this and initiated the process of liquidating its Russia ETF.

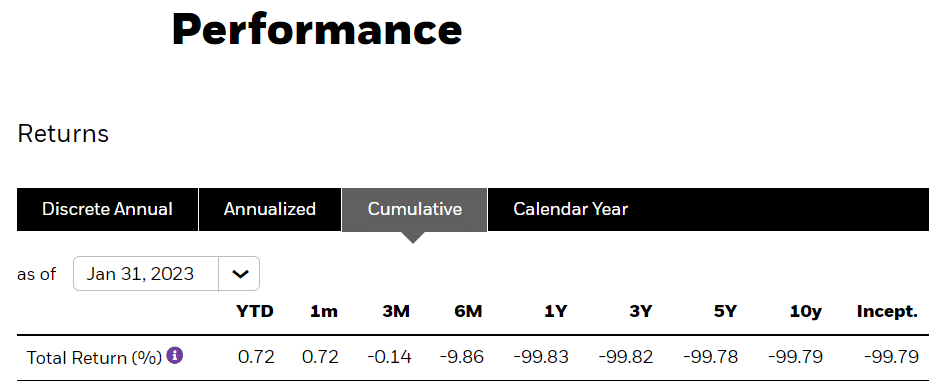

The Russia ETF of BlackRock is iShares MSCI Russia ETF (ERUS), which is a US-listed ETF. This replicates the MSCI Russia Index, which consists of large and mid-cap stocks.

ERUS’ net assets as of Feb. 24, 2023 stood at $484,028.

This ETF is said to be the first Russia ETF of BlackRock to be officially liquidated in the US. The process of liquidation began on Aug. 17, 2022. The fund managers started the liquidation and started paying their investors. Most of ERUS’ holdings aren’t yet sellable. Based on this, the liquidation process would still continue until the end of 2023.

Nonetheless, if BlackRock isn’t able to sell them by then, they might terminate the fund. This will lead to a scenario where the investors might lose their assets. These sorts of issues tend to reduce customers’ belief in the financial institution.

BlackRock’s Approach to Global Economic Trends and Market Analysis

BlackRock Funds consistently demonstrate a keen understanding of global economic trends and market analysis. In 2023, this insight is more crucial than ever, as investors navigate through a landscape marked by volatility and new opportunities.

Responding to Economic Volatility in 2023

Navigating Market Fluctuations

In 2023, BlackRock Funds have been actively navigating the heightened market fluctuations. With a strategic approach, they aim to leverage these conditions, turning potential challenges into opportunities for growth and stability.

Investment Strategies Amidst Economic Uncertainty

BlackRock Funds’ investment strategies in 2023 are tailored to address the economic uncertainties. By diversifying portfolios and focusing on long-term growth, they provide a buffer against short-term market shocks.

BlackRock’s Investment Themes for 2023

Pricing the Damage

One of the key themes BlackRock Funds are focusing on in 2023 is ‘Pricing the Damage.’ This involves a careful analysis of the economic impact of recent global events and adjusting investment strategies accordingly.

Rethinking Bonds

‘Rethinking Bonds’ is another theme for BlackRock Funds in 2023. In a changing economic landscape, they are re-evaluating the role of bonds in investment portfolios, ensuring they meet the evolving needs of investors.

Living with Inflation

‘Living with Inflation’ is a critical theme for BlackRock Funds. In 2023, they are developing strategies to help investors navigate the complexities of an inflationary environment, focusing on investments that can potentially offer inflation protection.

BlackRock’s Proactive Approach to Global Economic Changes

Embracing Technological Advancements

BlackRock Funds are embracing technological advancements to enhance their market analysis and investment strategies. In 2023, they are utilizing cutting-edge tools to better predict market trends and make informed investment decisions.

Sustainable Investment Solutions

Sustainability remains a key focus for BlackRock Funds in 2023. They are actively seeking investment solutions that not only offer financial returns but also contribute positively to environmental and social goals.

Is BlackRock a broker-dealer? Otherwise, is it affiliated with a broker-dealer? Are there any drawbacks because of this?

BlackRock is a broker-dealer, and it may also be affiliated/associated with another.

When a financial institution is dual-registered as a broker-dealer, there are some drawbacks. The main disadvantage is compensation-related conflicts of interest.

Registered investment advisers should focus on clients’ interests rather than their own. But when they are dual-registered, the situation leads to conflicts of interest. These conflicts include profit sharing from funds, collecting fees, commissions, and so on.

Such conflicts result in hidden fees as well as higher overall costs.

Are the investment funds of BlackRock involved with 12b-1 fees?

12b-1 fees are a type of fee that mutual funds charge to cover the cost of marketing and distribution. These fees are typically a percentage of the fund’s assets and are included in the fund’s expense ratio.

Mutual funds involving 12b-1 fees are associated with higher expense ratios. There is no guarantee for higher returns even though firms’ pay is associated with these fees.

Some financial institutions receive 12b-1 fees in the mode of payments. This makes them look like incentives to promote their businesses. According to SEC reports, BlackRock doesn’t have 12b-1 fees.

Does BlackRock recommend proprietary investments and products?

Yes, BlackRock does recommend proprietary investments and products. These financial products generate more commissions for the firm compared to non-proprietary products.

Aside from iShares ETFs, BlackRock mutual funds, and tech platform Aladdin, here are some other examples:

The Impact of Regulatory Changes on BlackRock’s Investment Strategies

The investment landscape for BlackRock Funds continually evolves, significantly influenced by regulatory changes. Understanding these changes is crucial for investors considering BlackRock Funds.

This section explores how recent regulatory developments have impacted BlackRock’s investment strategies.

Navigating Financial Market Transparency Regulations

Enhanced Disclosure Requirements

Recent regulatory shifts have placed a greater emphasis on transparency in financial markets. BlackRock Funds now operate under stricter disclosure requirements, ensuring investors have comprehensive access to fund information.

This change aims to protect investors and enhance their understanding of where their money is invested.

Impact on Investor Confidence

Increased transparency regulations have bolstered investor confidence in BlackRock Funds. By providing clearer insights into fund operations and holdings, investors can make more informed decisions, a key factor when investing in BlackRock Funds.

Adapting to Environmental, Social, and Governance (ESG) Regulations

Embracing Sustainable Investment Strategies

Regulatory changes around ESG criteria have led BlackRock Funds to adapt their investment strategies. BlackRock has increasingly focused on sustainable investment options, aligning with global trends and regulatory expectations.

This shift not only reflects regulatory compliance but also caters to the growing demand for socially responsible investing.

ESG Reporting and Performance

With these regulatory changes, BlackRock Funds have enhanced their ESG reporting mechanisms. This ensures that the funds not only comply with new standards but also demonstrate their performance in sustainable investing, an increasingly important aspect for investors in BlackRock Funds.

Responding to Global Economic Shifts and Regulatory Trends

Adjusting to Market Volatility and Regulatory Dynamics

BlackRock Funds continuously adjust their strategies to align with global economic shifts and regulatory changes. This includes adapting to market volatility and changing financial regulations, ensuring that BlackRock Funds remain resilient and responsive to the dynamic investment environment.

Proactive Approach to Regulatory Compliance

BlackRock Funds take a proactive stance in responding to regulatory changes. By anticipating and adapting to new regulations, BlackRock ensures that its funds are not only compliant but also positioned to capitalize on emerging opportunities.

BlackRock Solutions

BlackRock Solutions is a consulting arm of BlackRock that provides investment and risk management services to institutional investors. The group works with clients to develop customized investment strategies and risk management solutions.

BlackRock Private Equity Partners

BlackRock Private Equity Partners is a private equity platform that invests in a wide range of private equity strategies, including buyout, growth equity, and special situations. The platform invests on behalf of institutional investors, including pension funds and endowments.

BlackRock Real Assets

BlackRock Real Assets is a platform that invests in real estate, infrastructure, and renewable power projects. The platform invests on behalf of institutional investors, including pension funds and sovereign wealth funds.

These recommendations could limit the diversity of clients’ investments. Anyhow, the choice depends on the client. This may also lead to an impact on the transferability of the investment assets.

You can ask them directly how much the firm is earning from the investment products. You can also enquire about the availability of non-proprietary products.

Does BlackRock accept performance-based fees? Are clients’ assets invested into products with performance-based fees?

Technically, as a registered investment advisor in the US, BlackRock is subject to regulations that restrict its ability to accept performance-based fees.

Under the Investment Advisers Act of 1940, registered investment advisors are generally prohibited from charging performance-based fees for managing assets of registered investment companies, such as mutual funds, unless the fees meet certain conditions. These conditions include meeting specific requirements regarding the calculation and payment of performance fees, as well as the disclosure of the fees to investors.

In the case of BlackRock, the vast majority of its mutual funds charge a fixed management fee that is based on a percentage of assets under management, rather than a performance-based fee. BlackRock’s exchange-traded funds (ETFs) also charge a fixed management fee, but this fee is typically lower than the fees charged by actively managed mutual funds.

Nevertheless, it’s worth noting that BlackRock does offer some products and investment strategies that may have performance-based fees, such as hedge funds and private equity funds. These products are typically only available to institutional investors and high-net-worth individuals, and may have different fee structures than BlackRock’s mutual funds and ETFs.

Since the performance-based fees are paid when an asset outperforms the index it tracks, it creates a somewhat unhealthy scenario for the investors. Usually, the financial adviser gets paid these fees for outperforming the index. This breeds a sense among the advisers that they must beat the performance of the index at any cost.

When this happens, managers of those products will take higher risks. Research shows that fund managers take an immense amount of risk in such situations. They double down on the risk and eventually end up with a poor performance than usual. This is not good, especially for the investors.

For strategic investors, it is suggested to avoid the funds having performance-based fees.

Does BlackRock recommend securities underwritten by it or its affiliates?

As a registered investment adviser, BlackRock is subject to regulations that require it to act in the best interests of its clients and avoid conflicts of interest. To comply with these regulations, BlackRock has policies and procedures in place to manage potential conflicts of interest, including those that may arise from recommending securities underwritten by BlackRock or its affiliates.

In general, BlackRock’s policies prohibit its investment professionals from recommending securities underwritten by BlackRock or its affiliates solely because of their affiliation with BlackRock. Instead, BlackRock’s investment professionals are required to consider a range of factors, including the investment objectives and risk tolerance of their clients, when making investment recommendations.

That being said, BlackRock’s policies do allow for investment professionals to recommend securities underwritten by BlackRock or its affiliates if they believe that the securities are in the best interests of their clients and meet their investment objectives. However, any such recommendations must be based on a thorough analysis of the security’s merits and risks, and must be made with the client’s best interests in mind.

To ensure that its investment professionals are acting in the best interests of their clients, BlackRock has a range of oversight and compliance mechanisms in place. These mechanisms include regular reviews of investment recommendations, training and education programs for investment professionals, and ongoing monitoring of potential conflicts of interest.

Still, endorsing securities underwritten by the firm itself or its partners builds a greater tendency for the firm to be biased on these products more than those that aren’t affiliated.

How can you buy BlackRock funds?

You can buy BlackRock funds through a variety of channels, including:

- Online brokerage accounts: You can purchase BlackRock funds through most online brokerage accounts. Examples of online brokerage platforms that offer BlackRock funds include Fidelity, Schwab, and Vanguard.

- Financial advisors: If you work with a financial advisor, they can help you purchase BlackRock funds through their brokerage platform or directly from BlackRock.

- BlackRock’s website: You can purchase BlackRock funds directly through the company’s website. To do so, you’ll need to create an account and complete the necessary paperwork.

- Retirement accounts: BlackRock funds may also be available through employer-sponsored retirement plans, such as 401(k) plans and IRAs.

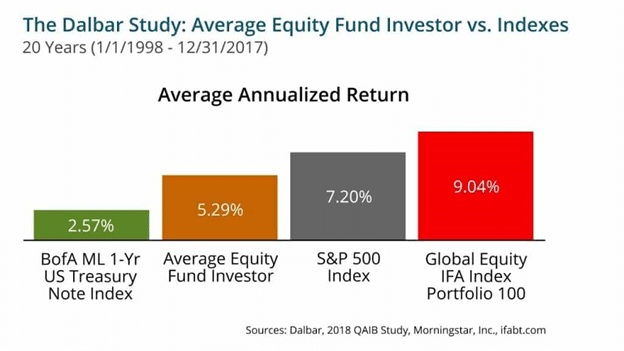

The statistics show that the average investor putting money themselves (so-called DIY) are likely to lose by at least 2% per year to the actual index.

In other words, if the S&P500 does an average of 8% in the next 20 years, the average investor might get 5% to 6% at most as the statistics from Morningstar show:

It is obvious to see why. During periods like the coronavirus and the 2008 to 2009 financial crisis, many investors panic sell and take a wait-and-see approach.

They only get back in once the dust has settled and markets have recovered. Investors generally love to buy during periods like 1999, when markets are increasing in value.

In other words, too many people buy high and sell low and thus lose their money.

What are the biggest mistakes people make when buying BlackRock Funds?

The biggest mistake investors tend to make in general (and not just related to these funds) are:

- Being reassured by past performance. Emerging markets, as an example, have had a very bad period, compared to US markets. That will change though. Just as emerging markets outperformed in the early-mid 2000s, they will once again have their period in the sun someday.

- Only being in your home country’s index. This is called “home country bias”.

- Only investing in things you are familiar with. This is linked to point 2, but goes further. For example, numerous studies show people are more likely to buy a technology stock if they work at Facebook, or invest in Amazon if they live near the warehouse.

- Only investing in funds like BlackRock through well-known DIY brokerages. In reality, well-known often means “one size fits all” and not in a specific niche like ultra-high-net-worth or the expat niche.

- Not being long-term oriented. The longer you invest usually equals the lower the risk, and the better the returns due to compound interest. Time is one of the only free lunches in investing.

- Trying to time the best opportunity to enter markets (market timing) and stock picking with a majority of your portfolio. Having 10% in individual stocks won’t hurt but anything else is very risky as the airlines are currently showing. The banks have gone through a very slow recovery process since the 2008 financial crisis and some are faced with continued challenges.

- Not taking the media with a pinch of salt. The financial and general media exists to make fortune tellers look good with their forecasts, to paraphrase Warren Buffett, they exist to fear monger and sensationalize.

- Overreacting to short-term market volatility. BlackRock funds, like all investments, are subject to market volatility. Overreacting to short-term market movements can lead to poor investment outcomes, as it may cause you to buy and sell at inopportune times.

- Not monitoring their investments: Even after you’ve purchased a BlackRock fund, it’s important to monitor your investment and periodically review its performance and suitability for your investment objectives and risk tolerance. Failing to do so can lead to missed opportunities or suboptimal investment outcomes.

- Forgetting the basics – investment objectives and risk tolerance. Before investing in any BlackRock funds, it’s important to consider your investment objectives and risk tolerance. Investing in a fund that doesn’t align with your investment goals or that is too risky for your risk tolerance can lead to poor investment outcomes.

Are BlackRock funds available in the expat market?

Yes, they are on many expat-related platforms. In fact, most platforms, including some of the expensive options I have reviewed before have access to BlackRock Funds.

Their more expensive actively managed index funds are also on Platform Securities International in Jersey and countless other private banking platforms.

Non-US investors can invest in BlackRock with the help of their range of offshore funds. Some examples include:

• BlackRock Global Funds (BGF)

• BlackRock Strategic Funds (BSF)

• BlackRock Global Investment Series (GIS)

• BlackRock Global Index Funds (BGIF)

• iShares Exchange Traded Funds (ETF)

Nowadays, various online brokers offer exceptional services on a global basis. Hence, you can find an online broker who can offer iShares ETFs. This will reduce a lot of problems while investing as an expat.

Is now a good time to buy BlackRock funds?

Now is always the right time to invest if:

- You are long-term oriented.

- You own both stocks and bonds. Bonds tend to go up as stocks go down, and vice versa. So as an example, in recent times, short-term government treasury notes have outperformed intermediate and long-term bonds and stock markets. That won’t be the case forever though.

- You rebalance and reinvest dividends. In other words, as one asset does well relative to the other, you adjust your allocations accordingly.

- You never panic when markets slump.

We just want to say what we always say, i.e., most investment assets are best for the long term. BlackRock funds also fall under the same category. They provide exposure to stocks and bonds, which leads to a diversified portfolio.

Just be attentive to what to avoid and you also can find a few based on the information in this post. Don’t panic when your investment doesn’t perform as you expected.

Remember that we don’t endorse any products in this article. Adding to that, we don’t suggest any of the products as bad for you. You must hold yourself responsible for the investment decisions you make.

With that being said, investor behavior is far more important than the actual funds you invest in for total returns.

Investor A could invest in BlackRock Funds short term and get much lower returns than the second investor in the same funds who is very disciplined and in for the long term.

Creating a diversified portfolio is very important. Yet, you must remember that investments are complex. Unless you have enough experience, it is wise to take the help of a financial expert.

BlackRock Funds: Final Thoughts

BlackRock is an industry-leading fund manager, which happens to be the best in its sector. Before investing, it is wise to note various aspects that determine its performance.

Nonetheless, it seems positive as a stock, especially for investors looking for diversification. It is a massive asset management company deemed to be more reliable than others.

The investment strategy implemented by BlackRock is a trending passive investment strategy. It also profits from increasing value to its shareholders with buybacks.

Yes, there are various political and regulatory risks involved. But they can’t be considered hard-hitting factors over the long term.

Some of BlackRock funds are excellent. Most of their index funds are just as good as Vanguard or any of the competitors. Meanwhile, their managed index funds aren’t bad per see, but cost 5x more than the basic index funds.

BlackRock has been in a few situations where it got forced to pay fines. Most factors for this include violating whistle-blower protections, improper filings, etc.

Remember that BlackRock earns a lot of its revenue through various types of fees.

This also means that the company may endorse affiliated securities, recommend products in their own interest, as well as force advisers/managers to get involved with an immense amount of risk.

This leads to a conflict of interest because BlackRock is a fiduciary. All fiduciaries should act in the best interests of their clients.

There are various alternatives, not just to BlackRock, but to the asset class of mutual funds as well.

Are you an expat? Are you trying to find a financial expert to take care of your investment goals? If so, you’ve come to the right place.

We offer top-notch financial services to our clients. This allows them to get rid of their financial difficulties as well.

Don’t believe us? Well, you can check the client testimonials received by us. They demonstrate our expertise.

To get access to the best-in-class services offered by us, you can click on the link provided below.

Adam Fayed – Expat Wealth Management Services

Hoping that the information provided in this article was helpful for you. Have a great time ahead!

Further Reading

The article below reviews some funds which have been getting a lot of press in recent times.

Are they better as a fund provider and asset manager compared to Vanguard and BlackRock?

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.