Updated April 16, 2020

Countless investors are interested in real estate, without the extra hassle of finding tenants, paying taxes and maintaining the place.

This is especially the case in the era of close to 0% interest rates, and with speculation that central banks around the world might further lower rates in 2019 and 2020.

Some other people just want access to real estate, but don’t have $200,000+ to invest. What can these investors do?

This article will discuss some options and answers some frequently asked questions, and also look at options for expats who want to invest in direct property but are struggling to get a mortgage.

I will also leave my contact details at the end of the article, for anybody interested in investing in real estate online and without the time and other hassles of being a landlord.

What are the main options besides direct property?

This article will discuss three of the main options for gaining exposure to property without extra hassles; REITS, property funds and loan notes.

What are real estate investment trusts (REITS)?

REITS are real estate companies that invest in income producing property such as hospitals.

Many REITs have performed well, over long periods of time, especially the more diverisifed ones.

An $100,000 investment in a Vanguard REIT index in 1996, would have grown to over $740,000 by the end of 2015, producing a 10.8% annual return, assuming dividends were reinvested.

This is slightly higher than the S&P. REITS come with some of the benefits of physical real estate, without the hassle of finding tenants and the other high costs.

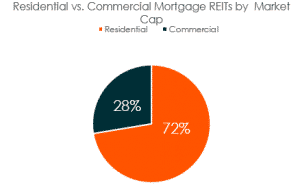

REITS can be both commercial and residential focused, although residential dominates the market.

How to invest in commercial real estate through REITS?

Some REITS, like the aforementioned Vanguard REITS Index, tries to capture the whole market, like an index fund.

Other REITS are focused on specific segments, like commercial real estate, or countries like the UK, Australia or any number of other sectors.

Either way, the process for investing in REITS is simple, because both commercial and residential REITS are usually available on the same investment platforms used for index funds and other forms of investments.

So is the easiest way to invest in REITS within an online investment account?

Yes, in general, the easiest way to invest in REITS is to open up an online brokerage account, which allows you to invest in stocks, bonds and REITS within the same portfolio.

This has the added benefit of allowing you to “rebalance” when one is doing better than the other.

Can you invest in specific markets through REITS?

Some REITS do focus on specific market. Either country, region or indeed industry.

In general, however, the more broadly diversified ones, are safer.

How often do REITS pay out income and dividends?

It depends on the REIT. Most are monthly, quarterly, semi annually or annually.

What types of properties do REITS own and manage?

Typically, it is shopping centers, health care facilities, family homes, office buildings and hotels.

Are REITS taxes more heavily than stock indexes?

That depends on where you live. In some countries, they are, as they are considered ordinary income.

In some other countries, they aren’t tax disadvantageous.

What are property loan notes?

Property Loan Notes are financial instruments that are typically used to raise development capital for developers.

These loan notes have been particularly popular with regards to UK property in recent times.

They allow individual investors to invest, sometimes alongside institutional investors, in a development.

These developments can be commercial, or residential property. As an example, a project I have access to in the UK focuses on commercial developments near motorways.

Clients include Starbucks, Lidl, Aldi and some other big names, that rent out the sites. Clients invest for a period of 2 years, with income payments made every 6 months.

These payments can either be withdrawn as income or reinvested into a wider portfolio.

It is also common for some loan notes to offer higher deferred payments, for clients that can wait 2-3 years for a pay out.

Like REITS, loan notes can sometimes be held within a wider stock and bond portfolio.

This diversifies the portfolio during periods of turbulence.

Are loan notes regulated?

Like REITS and funds, the regulation depends on several factors, including where you live.

Some are regulated and some are less heavily regulated.

Ultimately, investing in loan notes always carries big risks, and you could lose all your money.

Do loan notes qualify for Entrepreneurs Relief?

No they don’t.

What are property funds and property index funds/tracker funds?

There are different types of property fund. One kind is fairly simple; some funds merely buy many construction and property companies or even merely just try to track the performance of a property index.

An example of this, would be some funds buy the shares of the top 100-200 property firms in the world.

Two examples would be the iShares Global Property Securities Equity Index Fund and the Vanguard Australian property Securities Index Fund.

Some property funds, in comparison, make more direct investments into the real estate.

Are these kinds of investments usually liquid?

Property index funds are almost always liquid, and you can take the money when you want. Most REITS are also liquid.

In the case of property loan notes, they often have a certain commitment period 2-3 years is a typical commitment period.

What are the risks?

All kinds of property have certain risks; political, social and otherwise. One of the bigger risks is the liquidity issue.

If a fund has too many people redeeming their investment, and too few new investors, they can get suspended.

This has happened with some huge funds, such as The M&G UK Property Income Fund , one of the largest of its kind.

This isn’t a big risk with a property index fund.

How can you invest in real estate for small amounts like 10k?

The easiest ways to gain exposure to real estate for small amounts of money, like 10k, is to have a 10%-15% allocation to something like REITS, within a broader portfolio.

The reason why this is effective, is many direct investments into REITS or property loan notes, have investment minimums.

In comparison, if you already have 100k-200k in an existing portfolio, it is fairly easy to start small with property investments.

Why don’t you personally invest much into direct real estate?

Many of my readers have asked me why I don’t own property, or at least direct property.

I do have a 10% allocation to REITS in my portfolio, and of course, index funds indirectly gives me access to property and construction related stocks without trying to pick winners.

However, the biggest reasons why I personally don’t invest in (direct) real estate directly is:

- The time costs – real estate is less of an investment, and more like running your own business. You can’t rely on capital values most of the time, so need to focus on yield and leverage. So you have revenues from rent, and sometimes from the capital values once you sell, but you also have costs for taxes, maintenance and so on. You also have the time costs of being a landlord, especially if you go down the Airbnb route, which means checking in many tenants.

- It isn’t easy to beat markets long-term – beating markets short-term, can and does happen, but over 40-50 years, it isn’t easy. What has made this situation harder, is that it is getting harder and harder to get 95%-100% mortgages, so leverage is getting harder in most markets. Given the time costs and direct costs of owning property, moreover, beating markets by 0.1% by year isn’t enough to mitigate for the costs

- It is an illiquid asset – unlike REITS or index funds, you can’t easily sell direct real estate. That also makes you vulnerable to tax changes – you can’t simply sell your property if a new radical government comes to power

- There has been a populist backlash – previously one of the biggest positives about property has been that it has been tax advantageous in most countries and you can use real estate investments to get second residencies and even passports. So many investors could “kill two birds with one stone” by getting an overseas residency and property. That is still possible in some places, but it is much harder than before, with many countries closing schemes or raising requirements. Likewise, many of the tax advantages of property have been closed down in numerous countries. If we take the UK as an example, the British Government has dramatically increased taxes on second homeowners.

- The tax rules and general rules are always changing – it seems with ever budget, brings a new tax or change. The direction of travel seems to be towards more tax and regulation.

- High valuations or high risk – most markets are either very risky or have high valuations. Some of the cheap emerging market opportunities, like in Georgia, are risky. Some of the safer options are overvalued.

- REITS have often outperformed direct real estate – the very best markets might have regularly beaten REITS, but most don’t, at least if you calculate the net returns.

- The risk – is higher in buying just 1-3 houses, than holding a diversiifed global index or REITs.

- Rentals and tenants – once you buy a rental property, you might not find somebody to rent it easily or quickly. Or you might end up with bad tenants

- There are a lot of hidden risks – with liquid investments, I know most of the risks and how to reduce them. Property has some obvious and direct risks. It also has many hidden and unforeseen risks.

- Fewer opportunities compared to the past- than in previous years and decades. Gone are the days when you could invest in many safe areas, around the world, which have excellent rental yields and a lot of home for capital appreciation. Sure a few areas might exist. In general, however, a lot of the better opportunities exist in high-risk countries.

- It is a cult – in many countries, property ownership has become a cult. That is always a bad sign. To paraphrase Buffett, “when there are too many people on one side of the boat, or argument, you should be careful”. A lot of peer pressure ensures people are obsessed with properrty ownership.

- I would prefer to run my own business – property is like running your own business in many ways. There are costs, indirect and direct. There are revenues and potential liabilities. If I am going to spend that much time on something, even 10% net per year isn’t enough, to justify that kind of hassle and time pressures.

- It is outside my area of expertise – I have seen some people, who do very well buying properties at auction. They get a cheap price. They then redo the properties and resell them, for a huge profit. They can only do this, however, due to specific expertise they have. Often they can do the electrics, plumbing or other tasks themselves or at a cut-price. I am not in this situation. Often real estate professionals, know ways to make profits. For most people, they aren’t in that situation.

- Renting isn’t dead money – it is a huge misconception.

For those that do want direct property, how easy is it to get mortgages for expats?

Over the years, it has gotten harder for expats, and indeed foreign buyers, to get mortgages.

In the UK, Australia and countless European markets, most lenders perceive expats as higher risk than people living locally.

That is because many expats are earning in foreign currency, and are on 2-3 year contracts, or are self-employed.

So you can get a UK mortgage as a non-resident, but the process is often more time-consuming, and you often have to put down a bigger deposit on day 1, compared to people living locally.

Where can I go for expat mortgages?

Many online websites have expat mortgage calculators, which show that the interest rates are typically higher for expats.

Some of the most famous banks, including HSBC expat, offer buy-to-let mortgages to UK and other expats, but the exchange rates aren’t always competitive.

This can also be an issue for people living in the UK, and other countries, that have overseas income.

There are countless British people, and indeed foreign-nationals, living in the UK, who have overseas income and are paid in Euros and USD.

Beyond the UK, countless countries such as Australia and especially New Zealand, have put restrictions on overseas property buyers, after a backlash against rising property prices.

What are some of the cheapest property markets right now?

Some up-and-coming markets include Georgia and Bulgaria, in Europe. Beyond that, many parts of the UK are increasingly being seen as cheaper than comparative markets.

With the whole “Northern Powerhouse” project, countless people are seeing Manchester, Liverpool and other parts of the North of England, as good options for real estate.

Typically speaking, the North and Midlands have better property yields, than London and the South East.

How about property tax?

This depends on the country again. If we tax the UK as an example again, there is a buying tax, called stamp duty. This ranges from 0% on cheaper houses, through to 12% on houses worth over 1.5M Pounds.

People who are buying property as a second home, have to pay an additional 3%, meaning an effective rate of 3%-15%.

It isn’t easy to negate this fee, although you can sometimes transfer a property’s deeds as a gift or put it in a will.

In addition to that, any income from property, will also be included towards UK Income Tax.

Below 11,851GBP a year, you don’t have to pay UK income tax. Above this threshold, and until 46,350GBP, a 20% rate is applied.

Above 46,350GBP, a 40% rate is applied. So people with multiple properties in the UK, often face an income tax increase, regardless of where they live, and they also face the hassles of needing to self-assess their own taxes.

Finally, you have capital gains tax. This didn’t used to apply to non-residents, including British expats and foreign buyers, but it now does.

You are generally taxed at 18%-28%, depending on many factors. Trusts are taxed at 28%.

The point is, property isn’t always tax advantageous. It can be high-tax, in certain situations, and the rules are complex and ever-changing.

Can you easily reduce your tax bill on direct property?

There are ways you can use deductions to reduce your tax bill. Expenses from insurance and maintenance bills are just two examples of allowable expenses.

These rules are always changing, and indeed the UK Government is currently making changes to the mortgage interest cost element of allowable expenses.

One of the advantages of loan notes and REITS, is that they can be put into more tax efficient structures – sometimes even 0% rate structures.

This is especially the case for expats, and others, who have access to low or no tax structures, due to their residency.

How about for Americans and Australians?

Americans need to pay tax on overseas income beyond a certain threshold and need to declare any overseas assets, even if the threshold has not been breached.

This is regardless of whether the investment is in direct real estate, REITs or any other kind of investment.

For Australians, expat mortgages are possible to get, but like for Brits, tend to be a bit harder than for local residents.

How about fast growing markets like China and India?

When I first visited Shenzhen in 2007, one of my friends said “real estate seems cheap here”. And he was right, however, the same thing has been said about all countries.

Look at some of the “darlings” of emerging market property in recent years, such as Egypt and Tunisia.

Political and other risks, have affected the property market. That doesn’t mean you should never consider emerging market property, it just means that risk should be managed.

A globally diversified REITS, as an example, is much less risky than buying just one property in an emerging market.

It is also important to note, that many of these markets have already inflated. Real estate yields are very low in India and China, which means that renting is relatively cheaper than buying right now.

That doesn’t mean that China’s property market will automatically collapse this year or in 2020, it just means that risks are relatively high right now.

Can REITS and property notes be used for residency and passports?

Unlike something like government bonds or direct real estate, REITS and property note can’t usually be used to get second residencies and passports.

How about peer to peer lending?

I have dealt with this issue on another topic. I have listed the article at the bottom of the page.

Do you advise on real estate?

My specialism is portfolios which compromise of stocks, bonds and something REITS and loan notes, as opposed to direct real estate.

My portfolio minimums are $75,000, or currency equivalent, for such services.

I can take clients from everywhere in the world, except those living in the US. American expats are sometimes OK, but investment options can be more limited, due to US tax rules.

However, I do have access to several property companies, if my clients ask for an introduction.

Typically, they have a specialism, such as expat mortgages and property. The majority of them are focusing on the UK, Australian, Canadian, US and Hong Kong Markets.

A few do have access to some emerging markets, such as Bulgaria.

What are your contact details?

adamfayed@hotmail.co.uk and I am also available on a range of apps

Further reading

For further reading on real estate, the revise article below, written in September 2019, would be useful.

It focuses on two of the most popular property websites.

https://adamfayed.com/realityshares-and-partner-property-review-are-they-good-investments

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.