In previous articles I have spoken about the best investments for expats, y how to get rich from investing.

But what options exist for your investments and what are the positives and negatives of each?

That is the subject of this article. At the bottom of the article, we conclude with a simple question – what’s the bottom line and does DIY investing work?

If you want to invest and are confused by all the options out there, you can contact me using this form, or use the chat function below.

Investment:

Definition – The process of putting money to work in order to gain profits from it would be known as an ‘Investment’.

Investments can be made in business projects, purchasing different types of assets, etc. Investment can also be referred to as putting money into something now so that it can be beneficial in the future.

In the terminology related to finance, Investment would be considered as purchasing an asset which would create profits in the future, generally by selling the acquired asset at a higher price.

Since Investment is an act that generates profits, in many instances there is an amount of risk involved in it as well. There are different types of investment opportunities available to individuals nowadays. A few examples of general types of investments are:

- Cash

- Bonos

- Stocks

- Mutual Funds

- Index Funds

- Exchange Traded Funds

- Real Estate

Cash – Cash can be invested in a bank as a deposit and profits can be earned in the form of interest. Interest earned from banks can be of two types, namely, simple interest and compound interest.

However, cash has significant currency and inflation risks. Indeed, you are guaranteed to lose money with cash now, in most countries.

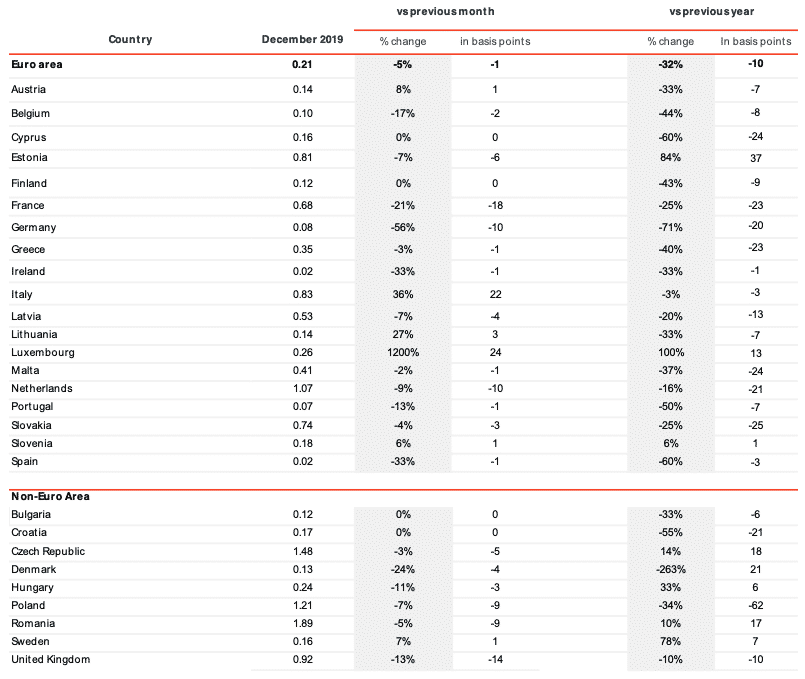

The graph below shows bank interest rates are below inflation in most developed countries.

In emerging markets, currency devaluations have been a big issue, with most depositors getting negative interest rates in USD terms in the last 10 years.

Real Estate – Buying a real estate property for own use would be considered a purchase for own benefits, whereas, buying a real estate property in order to sell it for a higher price or rent it would be considered as an investment. Real Estate investments can be considered as one of the highly advantageous methods of investment.

Real estate has several disadvantages though, such as:

- It is an illiquid asset which can’t be sold easily

- It is now highly taxed in many countries

- The leverage (debt/mortgage) is a double edged sword. It is risky but also gives you the potential for upside

- With the exception of a few professional real estate investors, most do it yourself landlords struggle to beat stock markets long-term

For many people, investing in REITS and loan notes makes more sense.

It takes away a lot of the hassles and risks of investing in real estate, if you do it right.

Stocks – Stocks, also known as Equities, are a fraction of ownership of a company. The units of stocks are called Shares. When a person buys/invests in a company’s stock, they are investing/buying a small proportion of that country. People who buy stocks are paid in the form of dividends when the company gains profits. If the value of the stock increases the person who owns the stock can be able to sell it and make a profit from it known as a Capital Gain.

If the company goes bankrupt and tries to liquidate the funds, the shareholder (person who owns a stock) would get the amount that would be equal to his share, after the company has paid the debts off (if any). Stocks involve risk as the price can either go up or down.

Individual stocks are risky as even big firms like Lehman can go bust.

However, buying the overall market (index funds as an example), or a collection of stocks (like mutual funds) isn’t risky if you hold them long-term. We will discuss these investments more below.

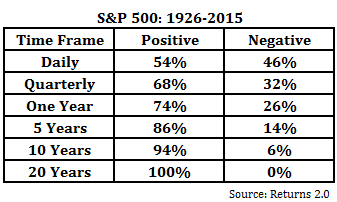

A long-term investor has never lost money in the S&P500 as an example:

Bonds – Bonds are the financial instruments of debt, which are generally issued by a government or a corporation to an individual. Bonds usually fetch a fixed interest on the investment made. Variable and floating interests are also available nowadays. Funds gathered with the help of bonds are often used by governments or companies for carrying out financial operations, covering expenditures, running various projects, etc.

The rates of Bonds depend on the interest rates and because of this reason, many people can be seen investing in the bonds during the times when banks raise the interest rates.

Mutual Funds – Mutual Funds are the types of investment funds that gather funds from many investors and pool the funds in order to purchase securities. Mutual Funds are managed by portfolio managers who allocate and distribute the funds into various stocks, bonds, and securities. Individuals can be able to invest an amount as low as $1,000 and yet be able to diversify their investment where it is invested 100 different stocks that are present within a portfolio.

Mutual Funds are designed in such a way that they replicate the performance of underlying indexes such as the S&P 500. Some mutual funds can be actively managed where the portfolio managers carefully check and allocate the funds.

Mutual Funds are known to have greater costs involved such as annual management fees, charges, etc. This usually reduces the number of returns that have been earned. Buy and Sell operations are often carried out after the market closes as they are valued at the end of a trading day.

Exchange-Traded Funds – Exchange Traded Funds, also known as ETFs, are the types of financial instruments that can be traded throughout the day, everything else is almost similar to that of mutual funds. ETFs can be traded on a stock exchange. Due to the broad coverage offered by them and the easiness of trading, ETFs are one of the most popular investment opportunities.

Along with these, there are some other types of investment opportunities such as commodities, futures, options, cryptocurrencies, hedge funds, etc.

Index-linked ETFs are very similar to index funds, but they are just more liquid.

Where to make an investment of $100,000 or £100,000:

If you are a person who had earned a handsome amount of money and want to invest and gain more profits from it, you would have often thought about “where to invest a $100,000 or £100,000?”. This is the most common question that will arise in people’s minds if they want to make profits from their hard-earned money.

If not invested properly, there is also a chance that an individual might lose the money that they have earned, and anybody wouldn’t be happy over having losses over a big amount of money like that. There is even a chance of losing most of the money invested, if possible, even all the money, if not done in a proper way.

So, let us take a look at the highly beneficial investment opportunities, with the help of which any person can be able to maximize their profits.

Investing in the Stock Market:

The most important investment option that needs to be taken into consideration, while investing such a huge amount of money is ‘Investing in Stock Market’. With such kind of money, a person can be able to diversify their portfolio, by getting exposure to almost every sector/industry in the world. Stocks are also known to be one of the best investment opportunities to provide better returns to an individual.

The process of investing in stocks can be quite complex and needs a lot of attention from the investor. The best process for making an investment in stocks is as follows:

Buying Individual Stocks – This is one of the riskiest methods.

If you are an aggressive investor, and willing to take a risk along with some necessary precautions, then investing in individual stocks might be advantageous for you.

For doing so, the investor should have a perfect idea about what they are doing, or else they are going to end up investing in thousands of individual stocks making their level of diversification low.

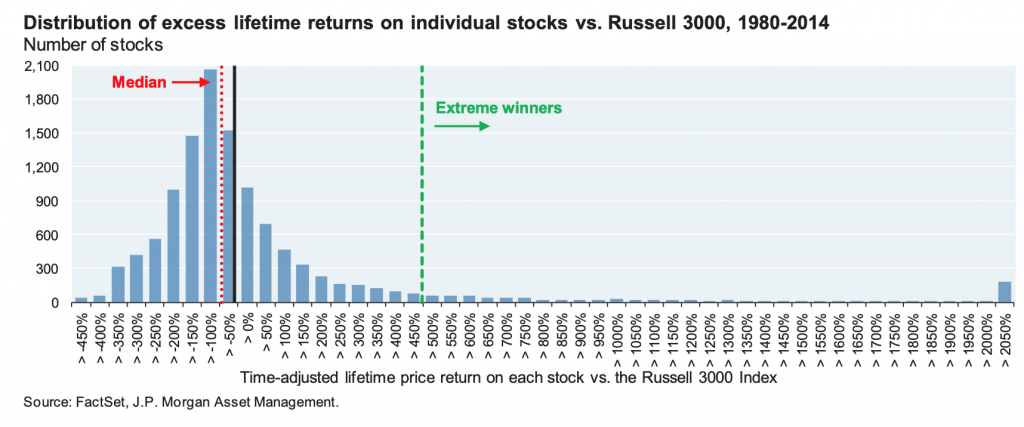

In reality very few do. Less than 2% beat the market long-term with stock picking.

The reasons are simple. Nobody has a crystal ball and a few extreme winners (like Amazon and Netflix recently) are a small minority of stocks:

Added to that, if you try to beat the market for 2 years, or even 5 years, you have a chance.

But your chances of beating the S&P500 over 40 years as a DIY investor is close to 0%.

Making Investments in ETFs and Mutual Funds – Mutual Funds and ETFs are also advantageous financial instruments. These are nothing but already diversified stocks available in a bundle that a person can be able to make an investment in.

Buying an ETF or a mutual fund will grant instant diversification. The fact that how they are combined, managed, and sold makes the difference.

ETFs are generally passively managed funds, which means the investor wouldn’t have to bother wasting their time in order to manage these.

ETFs generally follow and match the performance of an Index. For example, Stocks investing in Gold, the S&P 500, etc. People can even choose the type of investment they want to make with the help of these. For example, if a person wishes to make an investment in socially responsible companies only, they can be able to do so with the help of ETFs.

Mutual Funds, even though being actively managed funds, which are diversified by portfolio managers. Mutual Funds often have more charges involved as another person has to manage the funds. The stocks that are chosen might be based on the fund manager’s personal investment choices.

Mutual Funds’ performance is known to be less when compared to that of the ETFs. A strategy can be made with mutual funds. however, the options are limited.

It does not mean that mutual funds are worse when compared to that of ETFs, they come with some exquisite benefits as well. The general ideology here is to keep the fees as low as possible and mutual funds involve more costs.

Peer-to-Peer lending (P2P lending):

Investments made in P2P lending can achieve highly profitable returns but it is too risky for most investors.

They are a form of passive investment and can be helpful for other people as well. Returns earned with the help of P2P investing can range between 5% – 10%. In some cases, the person might even be able to generate returns up to 12%.

P2P lending platforms offer loans to people while imposing a certain amount of interest on the money that they have taken. Generally, this amount is collected on a weekly, monthly, or quarterly basis depending on the platform.

However, the thing that needs to be taken into consideration is “where there is demand, there is a supply required.”, similarly, where there is money being lent, there is a requirement for borrowing money as well.

This creates an opportunity for the investors to lend money to the people who need it (with the help of these P2P lending platforms). By loaning the necessary amount, investors get monthly and quarterly deposits depending on the platform’s method of collecting the funds.

For example, if you make an investment of $100,000 by loaning it to 100 people in the form of $1,000 for a three-month period. Let us say the interest is 5%. Then you can be able to earn an amount of $5,000 over 3 months. This could become $10,000 if the interest rate is 10%. Adding to this, you will also be left with personal satisfaction that you were able to use that money to help someone.

Some of the best P2P lending platforms available in the world are ‘Prosper’ and ‘Lending Club’.

Due to the risks involved, most people shouldn’t invest a high percentage of their money into real estate.

Investing in Real Estate:

Like we have discussed earlier at the beginning of the article, investing in Real Estate can be quite beneficial, especially if a person applies a buy-and-hold strategy on the property owned by them. There are three types of real estate investment opportunities that can be highly beneficial to an individual. They are ‘Traditional Real Estate’, ‘REITs’, and ‘Crowdfunding’.

Traditional Real Estate – Traditional Real Estate is the general form of investing in Real Estate, where a person purchases a property and makes profits from it by selling after renovation, selling after holding on to it for a certain period of time or renting it. The process of flipping (making renovations and selling) would not be considered as beneficial as the other two options. Especially, buying a property and renting it out can be more beneficial to an individual.

Investing in the home-town of a person can be good as they can buy an excellent property with $100,000 or £100,000. If the property value exceeds, buy a property by paying the down-payment. The rental income over that property should suffice for the loan installments and once completed with the loan the person owns a property in which they can reside. If the property value goes up, they can sell it; if the property value remains the same or goes down, that can rent it or reside over there.

Investments made in international real estate property can also gain profits. However, the person would either have travel frequently to the location of their property or hire a local property manager. International real estate investments are known to have returns of up to 8% – 12%.

REITs – Real Estate Investment Trusts (REITs) ate the ETFs of the Real Estate. These provide a diversified Real Estate portfolio, meaning different types of property in different areas. The control over the assets might be limited, but over the long term, they are prone to provide more profits. However, there is an availability of selling the person’s respective stake whenever they want.

Crowdfunding – Also known as Property Crowdfunding, Crowdfunding is raising money for a commercial real estate project by approaching a pool of investors. This is usually done small scale investors to fund bigger projects. Investments can be done in this for as low as $5,000. With an amount as high as $100,000 or £100,000, exposure among the biggest real estate deals can be accessed.

Before making an investment in Property Crowdfunding, it is better to have a good amount of knowledge about real estate investing, or else it can become a complex situation for an individual.

Retirement Accounts:

Making an investment in retirement accounts can be highly beneficial for individuals when they grow old. Having some money at the safe side can be advantageous for a person if they wish to have a better life after they retire. It is actually a necessity rather than a choice.

People can be able to save money by depositing in various types of retirement accounts such as ‘401(k)’ account’, ‘Individual Retirement Account (IRA)’, etc. Retirement accounts come with a lot of benefits for the individuals these days.

If you already have a retirement account and it is a tax-efficient one, you can start investing a part of the amount of $100,000 or £100,000 or all of it depending on your retirement strategy. Many accounts such as ‘401 (k)’, ‘403 (b)’, ‘Roth’, ‘IRA’, etc., are tax-efficient and help individuals in saving their money from taxes (which may amount up to thousands of dollars).

Other notable investment options:

There are some other types of lucrative investment opportunities along with these, which help an individual gain more returns on their investments. Some of the honorable mentions are:

- Making an investment in a college savings plan so that your kids wouldn’t have to worry about getting into a college in order to pursue education. Accounts are available that have lucrative offers and are tax-efficient.

- Private investments

Conclusion – what’s the bottom line?

For most people, if they are long-term orientated enough, having a liquid buy and hold stock market strategy works.

Apart from that:

- If you are an investor who has a subsequent amount of knowledge in stock markets and is an experienced investor, you can invest on your own. However, this only applies to 2%-10% of people maximum. As per the article below, most people fail in DIY investing due to lack of knowledge and failing to control emotions.

- If you are an investor with a minimum experience on the stock market to no experience at all, you can take the help of a good financial advisor.

- Even if you have a lot of knowledge, but you are busy, it makes sense to outsource your investments.

What do you offer investors?

- We make investments and allocate assets by creating a diversified portfolio

- We offer investment opportunities you can’t get access too yourself unless you are a multi-millionaire, at discounted prices

- All our investments are portable

- We are strong in the expat niche.

Further Reading

Does do it yourself (DIY) investing really work?