The inheritance law in Germany for foreigners allows non-citizens to inherit German assets under the same legal framework as German nationals.

German succession rules apply to estates involving German property or qualifying connections to Germany, regardless of the heir’s nationality or residency.

Este artículo trata:

- What is the German law on inheritance?

- How much inheritance is tax free in Germany?

- Does inheritance tax apply to non-residents?

- Who comes first in inheritance?

- What is a Certificate of Inheritance in Germany?

Principales conclusiones:

- Foreigners can inherit German assets without citizenship or residency.

- Statutory heir classes determine inheritance if no will exists.

- Non-residents may still be subject to German inheritance tax.

- An Erbschein or equivalent certificate is often required to access assets.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

What Are the Inheritance Laws in Germany?

German inheritance laws are based on universal succession, meaning that all assets and liabilities of the deceased pass automatically to the heirs at the moment of death.

If there is no valid will, statutory inheritance rules apply, determining heirs based on family order and degree of relationship.

Los puntos clave son:

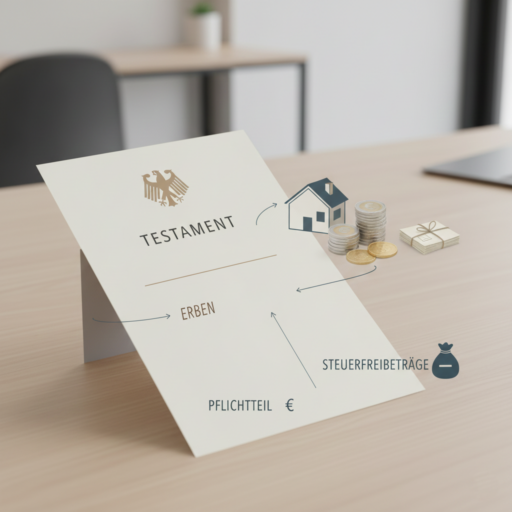

- Mandatory shares (Pflichtteil): Close relatives such as spouses and children are guaranteed a minimum portion even if excluded from a will.

- Heir classes and order: German law specifies the hierarchy of heirs, starting with children, then spouses, parents, and more distant relatives.

- Wills and testamentary freedom: While individuals can write a will to allocate their assets, compulsory shares for protected heirs cannot be fully overridden.

- Herederos extranjeros: Non-citizens have the same inheritance rights as German nationals but must follow German procedural requirements. If the estate involves multiple countries, international private law or EU succession regulations may also apply.

This framework ensures clarity and fairness, protecting close family members while allowing flexibility for asset distribution through a valid will.

Can a Non-Citizen Inherit in Germany?

Yes, a non-citizen can inherit in Germany. German inheritance law does not restrict inheritance based on nationality.

Foreigners may inherit German property, bank accounts, inversiones, and other assets on the same legal basis as German citizens.

However, foreign heirs may face additional administrative steps, such as proving identity, relationship to the deceased, and compliance with international private law rules that determine which country’s succession law applies.

Can Non-Residents Own Property in Germany?

Yes, non-residents can own German property.

There are no restrictions preventing foreigners from inheriting or owning real estate, regardless of residency or citizenship status.

Inherited property passes automatically to heirs, but registration in the German land registry must be updated.

This often requires notarized documents and certified translations for foreign heirs.

Who Is First in Line for Inheritance?

The deceased’s children and their descendants are first in line to inherit under German law.

If children are alive, they inherit before parents, siblings, or more distant relatives. If there are no children, the surviving spouse and parents inherit instead.

The spouse’s share depends on the marital property regime and whether children exist.

Who Is Not Allowed to Inherit From Parents?

Individuals may be excluded from inheriting if they have been legally disinherited through a valid will, although compulsory shares may still apply.

A person can also lose inheritance rights if they are declared unworthy to inherit, for example due to serious wrongdoing against the deceased, such as intentional harm or coercion.

Nationality or residency alone does not disqualify someone from inheriting from parents under German law.

Do Non-Residents Pay Inheritance Tax?

Yes, non-residents may have to pay German inheritance tax.

Inheritance tax in Germany applies if either the deceased or the heir had a connection to the country, or if German-situated assets, such as property, are inherited.

The scope of taxation depends on residency status, asset location, and applicable tax treaties between Germany and the heir’s home country.

How Much Inheritance Is Tax Free in Germany?

Inheritance in Germany is tax free up to €500,000 for spouses, €400,000 for children, €200,000 for grandchildren (or €100,000 if their parent is still alive), and €100,000 for parents and grandparents, while siblings and unrelated heirs receive only €20,000.

These tax-free allowances depend on the relationship to the deceased, not nationality.

Foreign heirs generally qualify for the same exemptions as German residents, provided the inheritance falls within German tax jurisdiction.

What Is the Inheritance Document in Germany?

The primary inheritance document in Germany is the Erbschein, or certificate of inheritance. This official court-issued document proves who the legal heirs are and the extent of their shares.

Foreign heirs often need an Erbschein to access cuentas bancarias, sell property, or transfer ownership of assets.

In some cases, a notarized will combined with a European Certificate of Succession may replace the Erbschein.

Comparing Germany’s Inheritance Law to Other Key Jurisdictions

Germany’s inheritance law is highly structured, with compulsory shares for spouses and children, universal succession principles, and formal documentation requirements.

Comparing it to other key jurisdictions highlights where it stands out and where foreign heirs might face different rules.

Germany vs. Portugal

- Forced heirship: Germany protects spouses and children through Pflichtteil; Portugal extends mandatory portions to children, spouses, and parents (legítima).

- Taxation: Germany uses inheritance tax with exemptions based on the heir’s relationship; Portugal applies 10% stamp duty to non-family heirs.

- Herederos extranjeros: Germany applies its law to assets in Germany, while Portugal allows foreigners to elect their nationality’s succession law if stated in a will.

Germany vs. United States

- Compulsory shares: Germany enforces minimum shares for spouses and children; most US states allow full disinheritance with a valid will.

- Probate process: Germany requires an Erbschein (Certificate of Inheritance); US probate varies by state and can be more flexible but also more fragmented.

- Tratamiento fiscal: Germany levies inheritance tax with thresholds by relationship; the US imposes federal estate tax for high-value estates, plus varying state taxes.

Germany vs. France

- Mandatory heirs: France has strict forced heirship protecting children; Germany’s Pflichtteil is similar but somewhat narrower in scope.

- Documentation: France relies heavily on notarial deeds; Germany primarily uses the Erbschein for proof of inheritance.

- Cross-border considerations: French succession rules may automatically apply to property in France, whereas Germany applies its law to German-situated assets, regardless of heir nationality.

Why It Matters for Foreign Heirs

Understanding these differences helps foreign beneficiaries plan effectively across borders, choose wills carefully, manage tax exposure, and navigate probate requirements. Cross-border families should pay attention to:

- Which country’s law governs which assets

- How compulsory shares differ

- Tax exemptions and liabilities for non-residents

Conclusión

Inheritance law in Germany offers a structured and highly regulated system that applies equally to citizens and foreigners.

While the rules provide clarity and protection for close relatives, foreign heirs must navigate tax obligations, documentation requirements, and cross-border legal considerations.

Proper planning and early understanding of German inheritance law can significantly reduce delays, disputes, and unexpected tax exposure for international families.

Preguntas frecuentes

How Long Does Inheritance Take in Germany?

Inheritance proceedings in Germany typically take several months.

Straightforward cases may be resolved within three to six months, while complex estates involving foreign heirs, property, or disputes can take significantly longer.

How to Claim Inheritance in Germany?

To claim inheritance in Germany, heirs must provide proof of death, establish their legal status as heirs, and apply for an Erbschein if required.

Foreign heirs often need notarized documents, apostilles, and certified translations.

How Much Tax Do You Pay on Foreign Inheritance?

German tax on foreign inheritance ranges from 7% to 50% when Germany has taxing rights over the assets.

Close family members such as spouses and children generally pay 7% to 30%, while more distant relatives face 15% to 43%, and unrelated heirs may be taxed at 30% to 50%, depending on the value of the inheritance after allowances.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.