In today’s modern world, there is increased global mobility of people and a consequent need for different countries to offer various types of visas in order to attract the best talent from around the world. To compete for this highly-skilled global talent, many countries have introduced what is known as “golden visas.”

A golden visa is a type of residency permit that offers certain benefits and advantages to the visa holder, such as expedited citizenship, access to certain public services, a reduction in tax rates, and many other things, to mention a few.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

There are many different golden visas available worldwide, but some countries offer more advantageous visas than others. Moreover, you don’t have to worry about the legalities and costs of applying for a golden visa, as many reputable and accredited firms offer free consultations.

So, if you’re looking to relocate to a new country and want to take advantage of a golden visa program, check out the list of the best golden visas in Europe we’ve compiled here. That being said, we will proceed to take a detailed look at each of these visas so that you can make an informed decision.

In addition, we will also provide a list of some of the best golden visa firms that can help you get started. Are you ready to check it out? Without further ado, let’s look at the best golden visas in Europe!

Benefits of Obtaining Golden Visa

As of today’s 21st century, people are now more mobile than ever before. With technological advances and globalization, people can travel and work in different countries. Consequently, the number of people who own dual citizenship has been rising in recent years.

One option for obtaining a second citizenship is through Golden Visa programs. These programs offer foreign investors the opportunity to obtain a visa or residency permit in exchange for investing in a certain country. However, there are many benefits of obtaining a Golden Visa. Here are seven of the most notable!

Opportunity to Live In a Vibrant Country

This is one of the most important benefits that a Golden Visa holder can enjoy. With a Golden Visa, you will be able to live in a country that is not only beautiful and exotic but also offers a great quality of life. In addition, you will have the opportunity to experience the culture and lifestyle of the country firsthand.

Access to a Wide Range of Investment Opportunities

Another important benefit of having a Golden Visa is accessing a wide range of investment opportunities. This means that you can invest in businesses, real estate, and other investments in the country where your Golden Visa is valid.

Freedom to Travel without Restrictions

As a Golden Visa holder, you will have the freedom to travel without restrictions. This means that you can travel to any country in the Schengen Area without obtaining a visa first. In addition, you will also be able to travel to other countries outside of the Schengen Area without any problems.

No Need to Obtain a Work Permit

If you are a Golden Visa holder, you will not need to obtain a work permit to work in the country where your visa is valid. This makes it much easier for you to find a job in the country of your choice. Also, you will not have to go through the hassle of applying for a work permit every time you want to change jobs.

Enjoy Tax Benefits

Last but not least, you will also be able to enjoy many tax benefits if you are a Golden Visa holder. This is because the tax laws in most countries favor investors who have a Golden Visa. Therefore, you will be able to save a lot of money on your taxes if you invest in the country where your Golden Visa is valid.

Golden Visa Holders Are Eligible For Citizenship

Another great benefit of having a Golden Visa is that you will be eligible for citizenship in the country where your visa is valid. This means that you will be able to live and work in the country of your choice without any restrictions. Also, you will be able to enjoy all the benefits that come with being a citizen of the country, such as the right to vote and own property.

Golden Visas Can Be Passed On To Future Generations

Finally, one of the best benefits of having a Golden Visa is that it can be passed on to future generations. This means that your children and grandchildren will be able to live and work in the country of your choice without any problems. In addition, they will also be able to enjoy all the benefits that come with being a Golden Visa holder.

Best Golden Visas in Europe

When it comes to golden visas, Europe is a great place to be. There are many different options available, each with its own unique benefits. In this section, we will walk you through the best golden visas in Europe. Without further ado, here are the best golden visas in Europe.

Portugal’s Golden Visa Program (ARI)

Portugal’s golden visa program is one of the most popular in Europe. It offers several benefits, including residency and a visa for the investor’s spouse and children. Investors can also apply for citizenship after six years of residency. Also, Portugal is a beautiful country with a rich culture, making it a great place to live.

Ireland Investment Visa

If you’re looking to invest in a European country, Ireland may be the best option for you. The Irish government offers a number of golden visa options, including the immigration investor program and the start-up entrepreneurs program.

Greece’s Golden Visa Program

Greece’s golden visa program offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after seven years of residency. Greece is a beautiful country with a rich culture and history. It is also a great place to do business.

Spain’s Golden Visa Program

Spain’s golden visa program offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after ten years of residency. Spain is a beautiful country with a rich culture and history. It is also a great place to do business.

Italy’s Golden Visa Program

Italy’s golden visa program offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after ten years of residency. Italy is a beautiful country with a rich culture and history. It is also a great place to do business. Besides, Italy has a great climate and lifestyle.

United Kingdom’s Tier 1 Investor Visa

The United Kingdom’s Tier 1 investor visa is one of the most popular golden visas in Europe. It offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after five years of residency. The UK is a great place to do business, and it also has a great climate and lifestyle.

Malta’s Individual Investor Program

Malta’s investor program is one of the most popular golden visas in Europe. It offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after five years of residency. Malta is a beautiful country with a rich culture and history. It is also a great place to do business. Besides, Malta has a great climate and lifestyle.

Bulgaria’s Golden Visa Program

Bulgaria’s golden visa program offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after five years of residency. Bulgaria is a beautiful country with a rich culture and history. It is also a great place to do business.

Czech Republic’s Golden Visa Program

Czech Republic’s golden visa program offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after five years of residency. The Czech Republic is a beautiful country with a rich culture and history. It is also a great place to do business.

Romania’s Golden Visa Program

Romania’s golden visa program offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after five years of residency. Romania is a beautiful country with a rich culture and history. It is also a great place to do business. Also, Romania has a great climate and lifestyle.

Austria’s Golden Visa Program

Austria’s golden visa program offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after eight years of residency. Austria is a beautiful country with a rich culture and history. It is also a great place to do business.

Switzerland’s Golden Visa Program

Switzerland’s golden visa program offers investors residency and a visa for their spouses and children. Investors can also apply for citizenship after eight years of residency. Switzerland is a beautiful country with a rich culture and history. It is also a great place to do business. Besides, Switzerland has a great climate and lifestyle.

Overview of the Best Tourist Attractions in Europe

Europe is a vast continent with plenty of tourist attractions to offer visitors. From historical landmarks and stunning natural scenery to vibrant city life and world-famous cultural events, there’s something for everyone in Europe. Here is an overview of some of the best tourist attractions on the continent.

Barcelona, Spain

Barcelona is a city with a rich history and culture. It’s home to some of the most famous tourist attractions in Europe, including the Gothic cathedral La Sagrada Familia, the Gaudi Park, and the Barcelona harbor. In fact, Barcelona was listed as the fifth most popular tourist destination in 2017.

Rome, Italy

Rome is another iconic European city with a wealth of history and culture. From the Colosseum to Vatican City, there are plenty of tourist attractions in Rome. The city also has lively nightlife and is home to some of the best restaurants in Europe. Also, Rome was ranked as the second most popular tourist destination in 2017.

Paris, France

Paris is one of the most popular tourist destinations in the world, and it’s easy to see why. The city is home to iconic landmarks like the Eiffel Tower, Notre Dame Cathedral, and the Louvre Museum. In addition, Paris is known for its lively nightlife, world-class restaurants, and stunning architecture.

Edinburgh, Scotland

Edinburgh is a city with a rich history and culture. It’s home to many famous tourist attractions, including Edinburgh Castle, the Royal Mile, and the Scott Monument. Edinburgh is also known for its lively nightlife and its many festivals, celebrating everything from comedy to science.

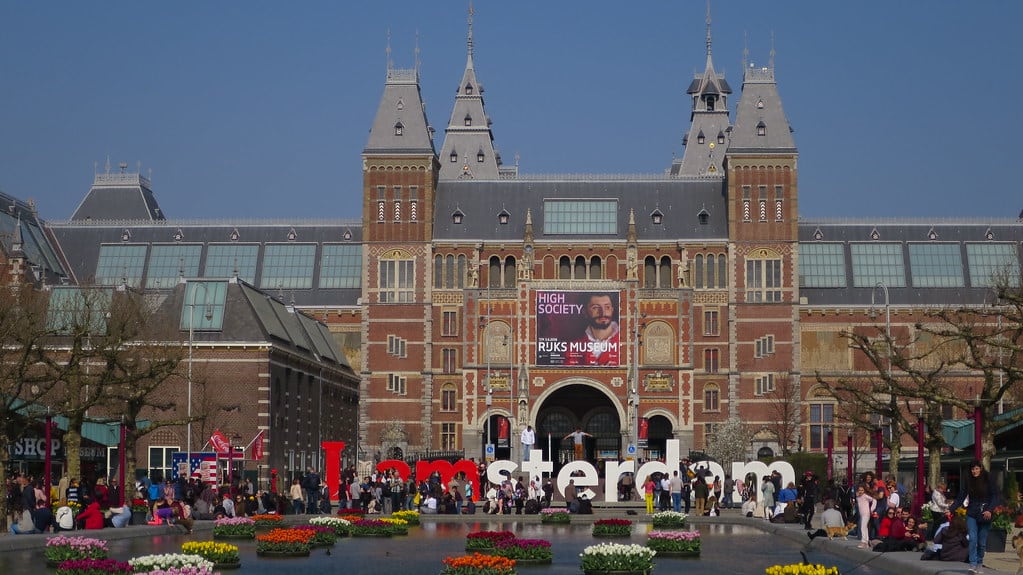

Amsterdam, Netherlands

Amsterdam is a city known for its canals, its vibrant nightlife, and its many museums. The city is home to iconic tourist attractions like the Rijksmuseum and the Anne Frank House. Amsterdam is also a great place to shop, with many world-famous stores and boutiques located in the city center.

London, England

London is one of the most popular tourist destinations in the world, and for a good reason. The city is home to many famous landmarks, including Buckingham Palace, Big Ben, and Westminster Abbey. In addition, London has a lively nightlife scene and is home to some of the best restaurants in Europe.

Vienna, Austria

Vienna is a city with a rich history and culture. It’s known for its many museums, including the Albertina Museum and the Hofburg Palace. Vienna is also home to famous landmarks like the Stephansdom Cathedral and the Schönbrunn Palace. And, of course, Vienna is known for its world-famous symphony orchestra, the Wiener Philharmoniker.

Istanbul, Turkey

Istanbul is a city with a rich history and culture. It’s home to many famous tourist attractions, including the Hagia Sophia Museum, the Blue Mosque, and the Topkapi Palace. Istanbul is also known for its vibrant nightlife, with many clubs and bars located in the city center.

Prague, Czech Republic

Prague is a city with a rich history and culture. It’s home to many famous tourist attractions, including the Charles Bridge, the Old Town Square, and the Jewish Quarter. Prague is also known for its many festivals, including the Prague Spring Music Festival and the Prague International Film Festival.

Bruges, Belgium

Bruges is a city with a rich history and culture. It’s home to many famous tourist attractions, including the Belfry of Bruges, the Market Square, and the Basilica of the Holy Blood. Bruges is also known for its many canals, making the city a popular destination for tourists looking for a romantic getaway.

Who Can Obtain Golden Visas?

There are many different ways to obtain a Golden Visa, depending on your nationality and purpose for wanting one. This article will explore who can obtain Golden Visas and the different routes you can take.

Nationals of certain countries can apply for a Golden Visa through investment. For example, nationals of Portugal can obtain a Golden Visa by investing in Portuguese property or businesses. Other investment options include government bonds or shares in Portuguese companies.

If you are not a national of one country that offers a Golden Visa through investment, there are other ways to obtain one. Some countries offer Golden Visas for entrepreneurs who want to set up a business.

For example, the United Kingdom offers a Golden Visa for entrepreneurs who want to set up a business. The United States also offers a Golden Visa for entrepreneurs, but this is only available to those from certain countries.

Some countries also offer Golden Visas to people who have a job offer. For example, Australia offers a Golden Visa to people who have a job offer from an Australian company. Many countries offer Golden Visas to students. For example, the United States offers a Golden Visa to international students who want to study at an American university.

Benefits of Different Investment Options

Investing is a great way to grow your money over time. But with so many different investment options available, it can be tough to know which one is right for you. Here’s a look at some of the most popular investment options and their potential benefits.

Stocks

Investing in stocks can offer the potential for high returns, but it also comes with a higher level of risk. If you’re comfortable with taking on some risk, stocks could be a good investment for you. Also, keep in mind that you don’t have to invest all of your money in stocks. You can diversify your investment portfolio by including other asset classes, such as bonds and real estate.

Bonos

Bonds are often considered less risky than stocks since they typically offer fixed payments. The return on your investment may be lower than if you had invested in stocks. Bonds can be a good option for investors looking for stability and predictable income.

Real Estate

Real estate is a popular investment option, and for a good reason: it can offer the potential for high returns while also being relatively low risk. However, real estate investments can be complex, so it’s important to do your research before getting involved.

Mutual Funds

Mutual funds are a type of investment that pools money from many different investors and invests it in various assets, such as stocks, bonds, and real estate. Mutual funds can offer diversification and professional management, making them a good option for many investors.

Exchange-Traded Funds (Etfs)

ETFs are similar to mutual funds, but they’re traded on stock exchanges like individual stocks. This means that you can buy and sell ETFs throughout the day, just as you would with stocks. ETFs offer the same benefits as mutual funds, but they may be more volatile than traditional ones.

Annuities

Annuities are investments that provide regular payments to the investor, typically for life. Annuities can be a good option for retirees looking for guaranteed income. However, annuities can be complex and expensive, so it’s important to do your research before investing in one.

Certificates Of Deposit (Cds)

CDs are a type of investment that offers a fixed rate of return over a specific period. They’re typically considered low-risk investments since the federal government backs them. However, the return on your investment may be lower than with other investment options.

Treasury Bills, Notes, and Bonds

Treasury bills, notes, and bonds are all government debt considered low-risk investments. They typically offer higher returns than CDs, but they also have longer terms. For example, a treasury bond may have a term of 10 years or more.

Frequently Asked Questions about Golden Visa

What is a Golden Visa?

A Golden Visa is a passport-free visa that allows people from outside the European Union to live in a member state of the EU for five years. The visa is renewable, and after five years, the holder can apply for permanent residency. Also, the visa holder and their family are allowed to travel within the Schengen Area without a visa.

What are the benefits of a Golden Visa?

The main benefits of a Golden Visa are that it allows people to live in the European Union for five years, and it allows them and their families to travel within the Schengen Area without a visa. Moreover, the visa is renewable, and after five years, the holder can apply for permanent residency.

Conclusión

Europe is a continent with a rich history and diverse cultures. It is also home to some of the world’s most powerful economies. For these reasons, many people want to live and work in Europe. If you think Golden Visa is the best option for relocating to this part of the world, refer to this ultimate to get the concept right.

¿Le duele la indecisión financiera? ¿Quiere invertir con Adam?

Adam is an internationally recognised author on financial matters, with over 383.2 million answers views on Quora.com and a widely sold book on Amazon.