Retiring in Singapore in 2022 as an Expat

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introducción

Here are important information about retiring in Singapore – dubbed the Lion City, the Garden City, and Instant Asia – including visa requirements, costs, and best spots.

Singapore is a small country comprising 64 islands huddled close to the end of the Malay Peninsula. It is a city with a large English-speaking population and several man-made wonders, such as the largest artificial waterfall in the world, famous structures, and what is frequently referred to as the best international airport in the entire world.

Retiring in Singapore: Visas

Singapore is not included in the list of countries that offer benefit-based retirement visas in an effort to attract expat retirees to their country. Although no such retirement visa is offered in the Asian country, you can still be allowed to retire there — you merely have to undergo a lengthier process and bear more costs.

You must first obtain permanent residency if you’re eventually retiring in Singapore. There are three main ways to achieve this: (a) the Foreign Artistic Talent, (b) Investment, (c) and the Professional, Technical Personnel and Skilled Worker programs.

Foreign Artistic Talent Scheme for Permanent Residence

In an effort to entice overseas artists with extraordinary skill to move to Singapore, the National Arts Council (NAC) and Immigration and Checkpoints Authority of Singapore (ICA) rolled out the Foreign Artistic Talent program. These artists ought to have proper training and a solid track record in their field, such as the performing and visual arts, literary and creative arts, design, and/or media.

Eligibility

- Had formal or pertinent training in the specialization

- Considerable expertise in the specialty

- A well-known status both domestically and internationally

Investment Program for Permanent Residence

Two investment programs are currently offered to aid international investors in moving to Singapore. Through the Global Investor Program or Financial Investor Scheme, foreign investors may get permanent residency status for their spouses and unmarried children who are below 21 years old.

The Singapore Economic Development Board (SEDB) is in charge of managing the Global Investor program. Entrepreneurs and potential investors are eligible to apply for Singapore Permanent Residence through the Global Investor scheme.

Under the program, you may opt to either:

- Make an investment worth a minimum of 2.5 million Singapore dollars in a new business entity or the build out of an already operational business in permitted business industries (option A); or

- Invest at least 2.5 million dollars into a fund that has been approved under the Global Investor program and invests in Singapore-based firms (option B).

Eligibility

- Evidence of at least three years of successful entrepreneurship and business operations. You must also provide your company’s three years’ worth of audited financial accounts.

- In addition to a 5-year business proposal or investment plan, an employment forecast and annual financial estimate are required for option A.

- Businesses in the real estate or construction industries: The most recent annual revenue must be a minimum of 200 million dollars, and the past three years’ average annual turnover must be 200 million dollars.

- Other sectors: The most recent annual revenue must be a minimum of 50 million dollars, and the previous three years’ average annual turnover must be 50 million dollars. To achieve the minimum turnover requirement, you could submit the financial statements of the business with the biggest turnover or combine the financial accounts of several different companies.

- Businesses that are privately held: Minimum 30% ownership. Additionally, you must illustrate your position inside the organization as well as the expansion and success of your company or businesses.

Professionals, Technical Personnel & Skilled Workers Scheme for Permanent Residence

Professionals from across the globe with great abilities and experiences are welcome in Singapore thanks to its open immigration policy.

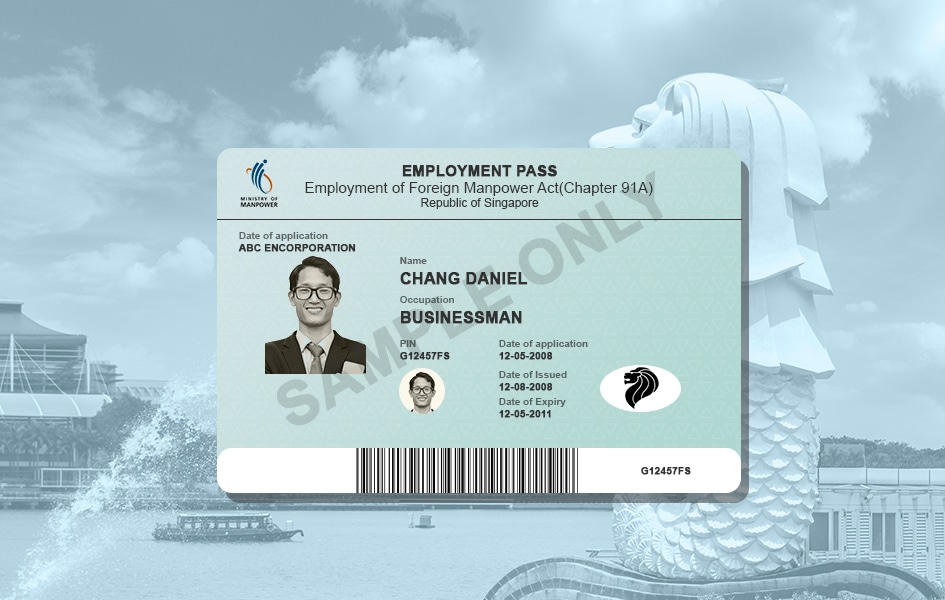

The Professional, Technical Personnel and Skilled Worker (PTS) program is the most popular way to obtain permanent residency in Singapore. With the help of this program, foreign workers in Singapore with an Employment Pass (EP), Entrepreneur Pass (EntrePass), Skilled Worker Pass (or S Pass) can apply for permanent residency.

The spouse and minor children of the applicant, if any, are also eligible to apply for permanent residency under the PTS scheme.

Eligibility

- Younger than 50 years old is preferred

- Current occupation and employment record

- Present employer information and its credentials

- Education credentials and record

- Salary and financial background

- Family ties in Singapore

- Personal interests and pursuits

Required Documents

Below are the requirements you need to submit as part of your residency application:

- Original passport

- Original employment pass

- Original academic certificate

- Original birth certificate

- Income tax (notice of evaluation)

- Pay slips for 6 months’ worth of your salary

- Original marriage certificate (if applicable)

- Two colored, passport-size pictures

- Complete and signed application Form 4A from the ICA

Note that an accredited translation service must convert any non-English documents into English.

Retiring in Singapore: Cost of Living and Housing

Retiring in Singapore would in general cost you less than if you would do so in large US cities like New York. For comparison, global cost of living data aggregator Numbeo estimated that you must have about $6,580 in Singaporean capital Singapore city (as of the time of writing) so as to maintain the same standard of life that you can have with $6,900 in Washington, DC, or even $9,100 in New York. These figures assume that you are renting in these cities.

Singapore was listed as the 8th most expensive city in the world for expats, just behind New York which took the number 7 spot, based on the 2022 Cost of Living City Ranking by asset management firm Mercer. For comparison, fellow Asian city Hong Kong comes in at number 1, while European city London was at number 15.

When retiring in Singapore, do note that real estate in the country is certainly expensive; that much is certain. The cost per square meter for buying an apartment within the city center is at 26,889 dollars, while that outside of the area is at 12,521 dollars.

Although expensive, rentals are still affordable compared to many major American cities. Rent for one-bedroom apartments inside and outside Singapore’s city center cost 3,112 dollars and 2,241.5 dollars on average per month, respectively. Rent prices in Singapore are 36.8% lower than in New York City and 10.8% less than in Los Angeles, Calif.

The overall monthly cost of living in Singapore for one person can hit 1,332 dollars on average, while it can cost about 4,841.5 dollars for a family of four, both excluding rent.

Retiring in Singapore: Healthcare

Some of Asia’s best medical systems are found in Singapore. The healthcare system in the country ranked second in the world in 2021 according to Bloomberg, with an efficiency score that came in close behind that of Hong Kong. Singapore also took the same ranking based on the Healthcare Efficiency Index of global healthcare data platform Knoema. This is a major plus points if you’re retiring in Singapore.

Under the purview of the Ministry of Health of the Government of Singapore, citizens and legal residents in the country have access to universal healthcare with advanced technology along with a highly competent team of doctors and nurses.

Singapore has a wide range of medicine prices. Following a consultation with a physician, general practitioners and specialists frequently prescribe medication. The cost of drugs is typically covered by private insurance, so it’s better to have one ready when retiring in Singapore.

You can pick from a variety of health plans if you wish to secure health insurance. The most common choices are:

- MediShield Life – Regardless of age or medical conditions, this is a basic health insurance program that offers lifetime protection against medical expenses. MediShield Life assists citizens of Singapore in paying for substantial hospital fees as well as some outpatient procedures, including cancer chemotherapy and dialysis.

- Integrated Shield Plan – this option costs more, but it offers greater coverage than MediShield Life. An Integrated Shield Plan should be chosen as an upgrade if you desire extra coverage. The coverage offered by various insurance provider types varies. Since the premiums increase with age, you should take your budget into account if you want to subscribe to the Integrated Shield Plan.

Even with insurance, some costs, including as deductibles and elective procedures, may still need to be covered by the patient out of pocket. Expats can expect to pay higher rates.

Retiring in Singapore: Taxes

The Central Provident Fund is a mandatory contribution for all Singapore residents and citizens who work in the nation. Even though they are residents, foreign nationals who do not work in Singapore are exempt from paying into the Central Provident Fund. Meanwhile, your pension income may be subject to tax depending on how much you get.

Singapore imposes a tax of up to 22% on income.

If you are a US citizen who eyes retiring in Singapore, note that the Internal Revenue Service follows you no matter where you live and that you must generally file a tax return every year. However, if you manage your finances well, you could be able to benefit from the Foreign Earned Income Exclusion. You can read our earlier article titled 24 Important Things about American Expat Tax You Should Note to have more information on this.

Retiring in Singapore: Safety

Thanks to Singapore’s reputation as one of the safest nations in the world, retiring there shouldn’t present any security concerns. In fact, the country took the top spot in terms of countries/areas where people feel safest walking alone, particularly at night, as per the 2019 Law and Order informe of analytics and advisory firm Gallup that was based on a 2018 global survey for perceptions of law and order. The country also ranked first in Gallup’s Law and Order Index, with a score of 97.

Non-violent petty crime can still happen in popular tourist locations, just like in other big or even small cities. Pick-pocketing, abandoned property theft, and pocketbook snatching are crimes you need to be on the lookout for.

The fact that crimes can occur, whether you’re retiring in Singapore or elsewhere, must always be kept in mind, though.

Retiring in Singapore: Best Places

Safety, cleanliness, and a good standard of living are all features of life in Singapore. You can live a comfortable retirement in some of the nicest neighborhoods in the nation. Below is a list of the top retirement communities for expats once you’re set about retiring in Singapore:

Holland Village

Holland Village is not a typical rural suburb, despite its name, so do not be misled by it. This community situated in the central region of Singapore is commonly known as Holland V. Young people and expats enjoy dining and shopping in this area. Holland Village is also home to a lot of culinary chains in Singapore. Ethnic restaurants and franchises like Tapas Bar are prevalent in the neighborhood, which offers more upscale dining alternatives. If you’re a foodie, this should definitely be on top of the places to check out when retiring in Singapore.

Tiong Bahru

The oldest housing estate in Singapore is Tiong Bahru, which is also one of the most interesting residential areas due to its eclectic combination of distinctive architecture, boutiques, traditional customs, and delectable cuisine. Living in Tiong Bahru has many advantages, such as its handy location. You will find it simple to go around the area, whether you use the bus or train, regardless of where in the neighborhood you reside. If you hate transit hassles, do examine this spot when retiring in Singapore.

Tanjong Pagar

When retiring in Singapore as a foodie, Tanjong Pagar is another haven you should consider. This location is a historic area within the Central Business District that also offers nightlife choices. Some of the country’s most delicious cuisines could be found at Tanjong Pagar. There are lots of posh restaurants where you can eat one or even two meals every day because the food is so good – just make sure to ready your wallet.

Sentosa

Sentosa is the finest choice if your idea of retiring in Singapore is to spend most of your days in an island resort. The island of Sentosa is situated just south of the main island of Singapore. Beautiful beaches and the S.E.A. Aquarium, one of the largest oceanariums in the world, can be found on the island. Every attraction on the island is accessible to you via the country’s bus services.

Woodlands

Woodlands is a planning area and residential town nestled in the North Region of Singapore. The name Woodlands is derived from the area’s abundance of foliage, rubber trees, parks, and other natural features. Because of the Singapore American School’s location in Woodlands, this neighborhood is primarily favored by American expats. Look into this area if you’re retiring in Singapore with your children.

Woodlands is a terrific place to consider when retiring in Singapore as it offers a wide variety of recreational amenities, retail establishments, and medical care facilities.

Retiring in Singapore: In a Nutshell

A lot of expats move to Singapore each year due to its beauty. American citizens can feel safe in the country, and the living conditions and pricing are comparable to the US. There won’t be a linguistic barrier because English is one of the country’s four official languages, along with Mandarin, Malay, and Tamil. While it would be challenging for the majority of Americans to live comfortably while retiring in Singapore on Social Security benefits alone, someone with a pension or other retirement assets may be able to do so.

¿Le duele la indecisión financiera? ¿Quiere invertir con Adam?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.