If you’re considering buying a property in Greece, you’re embarking on an exciting journey that can lead to a lifetime of enjoyment and potential financial rewards.

However, as with any major investment, it’s important to be well-informed about the process and all the factors involved.

This article will help you navigate the ins and outs of buying a property in Greece, whether you’re looking for a vacation home, an investment property, or a permanent residence.

Si desea invertir como expatriado o particular con un elevado patrimonio neto, que es en lo que estoy especializado, puede enviarme un correo electrónico (advice@adamfayed.com) o WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some of the facts might change from the time of writing, and nothing written here is financial, legal, tax or any kind of individual advice, nor a solicitation to invest.

Why would you buy property in Greece?

There are many reasons why buying a property in Greece can be a wise and rewarding investment.

Greece has long been a sought-after destination for tourists and expats alike, thanks to its rich history, stunning natural beauty, and welcoming culture.

The country offers a warm climate, beautiful beaches, crystal-clear waters, and a relaxed way of life that can be difficult to find elsewhere.

Additionally, Greece has a relatively low cost of living, making it an affordable place to own a property.

From an investment perspective, Greece’s real estate market has shown steady growth in recent years, making it an attractive option for those looking to buy property for financial gain.

The country’s government has also implemented policies to encourage foreign investment, such as granting residence permits to non-EU citizens who invest in real estate.

Finally, owning a property in Greece can offer an opportunity to connect with the country’s rich cultural heritage. From ancient ruins to traditional villages, Greece is full of history and tradition that can be explored and enjoyed by property owners.

What are the legal requirements for buying a property in Greece?

If you’re considering buying a property in Greece, it’s important to understand the legal requirements involved. Here are some key steps you’ll need to follow:

Obtain a Greek tax registry number

This is a unique number that identifies you to the Greek tax authorities. You can obtain one by applying in person at a tax office in Greece or by appointing a representative to do so on your behalf.

Open a Greek bank account

You’ll need to have a Greek bank account to pay for the property and related expenses. You can open an account in person at a Greek bank or through an online banking service.

Hire a lawyer

It’s highly recommended to hire a lawyer who specializes in Greek property law. Your lawyer will help you navigate the legal process, revise contracts, and ensure that all necessary permits and documentation are obtained.

Sign a purchase agreement

Once you’ve found a property and negotiated the price, you’ll need to sign a purchase agreement (synallagma). This document outlines the terms of the sale, including the purchase price, payment schedule, and any conditions or contingencies.

Obtain a property tax clearance certificate

Before the sale can be finalized, you’ll need to obtain a property tax clearance certificate (fiche) from the local tax office. This certifies that all property taxes have been paid up to date.

Register the property

The final step is to register the property with the Greek land registry. This is done by submitting the purchase agreement, property tax clearance certificate, and other relevant documents to the land registry office

Buying a property in Greece can be a wise and rewarding investment. Photo by Tirachard Kumtanom

What are the steps involved in buying a property in Greece?

Buying a property in Greece can be a complex process, but here are the general steps involved:

1. Research

Start by researching the real estate market in Greece, including the different regions and types of properties available. Determine your budget and priorities, such as location, size, and amenities.

2. Find a property

Once you’ve narrowed down your search, begin viewing properties that meet your criteria. It’s a good idea to work with a reputable real estate agent who can help you find suitable options and negotiate on your behalf.

3. Make an offer

Once you’ve found a property you’re interested in, you’ll need to make an offer. This can be done verbally or in writing, and should include the purchase price and any conditions or contingencies.

4. Conduct due diligence

Before finalizing the sale, it’s important to conduct due diligence on the property. This may include obtaining a property survey, checking for liens or other encumbrances, and reviewing the property’s legal status and ownership.

5. Sign a purchase agreement

Once you’re satisfied with the due diligence, you’ll need to sign a purchase agreement (synallagma) with the seller. This outlines the terms of the sale and any conditions or contingencies.

6. Pay a deposit

You’ll typically need to pay a deposit (e.g. 10%) to secure the property and show your commitment to the sale.

7. Obtain a property tax clearance certificate

Before the sale can be finalized, you’ll need to obtain a property tax clearance certificate (fiche) from the local tax office. This certifies that all property taxes have been paid up to date.

8. Finalize the sale

Once all conditions have been met, the sale can be finalized. This involves signing the final purchase contract (apografi), paying the remaining balance, and registering the property with the Greek land registry.

9. Obtain a residence permit (if applicable)

If you’re a non-EU citizen, you may be eligible for a residence permit if you invest a certain amount in Greek real estate. This can be obtained through the Greek consulate or embassy in your home country.

What are the costs associated with buying a property in Greece?

Buying a property in Greece involves a number of costs beyond the purchase price. Here are some of the main expenses to consider:

- Property transfer tax: This is a tax paid to the Greek government for transferring the property’s ownership. The rate is currently set at 3% of the property’s assessed value.

- Notary and lawyer fees: You’ll need to hire a notary (notarios) and a lawyer (dikigoros) to help with the legal aspects of the transaction. Their fees typically range from 1-2% of the property’s value.

- Real estate agent commission: If you use a real estate agent to help you find and purchase the property, you’ll typically need to pay a commission of 2-3% of the purchase price.

- Property survey fees: You may want to hire a surveyor to inspect the property and provide a report on its condition. The cost of this service varies depending on the size and complexity of the property.

- Property tax: As the new owner of the property, you’ll be responsible for paying property tax to the Greek government. This is based on the assessed value of the property and can vary depending on the region.

- Utility connections and fees: You’ll need to set up accounts for electricity, water, and other utilities. There may be connection fees and ongoing service fees to consider.

- Homeowners association fees: If you purchase a property in a complex or development with shared amenities, you may need to pay monthly or annual fees to the homeowners association.

How can I find a reliable real estate agent in Greece?

Finding a reliable real estate agent in Greece is an important step in the process of buying a property.

Ask friends, family members, or colleagues who have purchased property in Greece for their recommendations. Personal referrals can be a great way to find an agent who has a proven track record.

Check online reviews and ratings of real estate agents in Greece. Look for agents who have positive reviews and a high rating.

Look for agents who are members of industry associations, such as the Hellenic Association of Realtors (HAR). These associations often have a code of ethics and standards that members must adhere to.

Look for agents who have experience in the specific area and type of property you’re interested in. An agent who specializes in the region or type of property you’re interested in can offer valuable insights and guidance.

Choose an agent who communicates clearly and effectively. You want an agent who will keep you informed throughout the process and be available to answer your questions and concerns.

Look for agents who are licensed and registered with the Greek Real Estate Registry. This can provide assurance that they have the required training and qualifications to practice real estate in Greece.

Arrange to meet with potential agents in person. This can give you a sense of their professionalism, knowledge, and communication style.

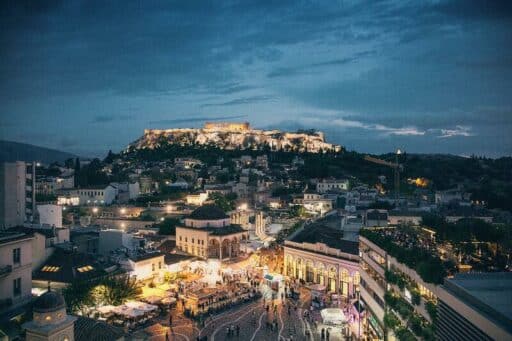

Athens is a great option for those who want to be close to amenities and attractions. Photo by jimmy teoh

Are there any restrictions on foreign ownership of property in Greece?

Foreigners are generally allowed to own property in Greece without significant restrictions.

Non-EU citizens may need to obtain approval from the Greek Ministry of Defense for properties in certain areas near military bases or borders, but this is a relatively straightforward process.

However, it’s important to note that there are some restrictions on property ownership in certain areas for both Greeks and non-Greeks, such as areas designated as protected natural reserves or archaeological sites.

In these cases, special permits may be required for property ownership or development.

Additionally, non-EU citizens who purchase property in Greece may be subject to certain conditions, such as a minimum investment amount, in order to obtain a residence permit.

It’s always a good idea to work with a qualified lawyer or real estate agent who can help you navigate any potential restrictions or requirements related to foreign ownership of property in Greece.

What are the best areas in Greece to buy property?

Greece offers a wide range of regions and locations to buy property, each with its own unique features and attractions. Here are some of the most popular areas:

Athens

Greece’s capital city offers a bustling urban lifestyle with a rich history and culture. It’s a great option for those who want to be close to amenities and attractions, such as museums, restaurants, and nightlife.

Crete

Greece’s largest island, Crete, offers a mix of stunning beaches, rugged mountains, and charming villages. It’s a popular tourist destination, but also offers plenty of opportunities for peaceful living.

Mykonos and Santorini

These two islands are famous for their white-washed buildings, blue-domed churches, and stunning views of the Aegean Sea. They’re popular with tourists and second-home owners, but can be expensive.

Halkidiki

This peninsula in northern Greece offers a laid-back lifestyle with beautiful beaches and lush forests. It’s a popular destination for Greeks and foreigners alike.

Peloponnese

This region in southern Greece offers a mix of rugged coastline, historic sites, and traditional villages. It’s a great option for those who want a quieter, more rural lifestyle.

Thessaloniki

Greece’s second-largest city offers a vibrant cultural scene and a mix of historic and modern architecture. It’s a popular destination for students and young professionals.

What are the tax implications of buying a property in Greece?

Buying a property in Greece can have several tax implications that buyers should be aware of. Here are some of the main taxes you may need to pay:

Property transfer tax

This is a tax paid to the Greek government for transferring the property’s ownership. The rate is currently set at 3% of the property’s assessed value.

Value-added tax (VAT)

VAT is generally not applicable to residential property sales in Greece, but it may be applicable to commercial properties or new-build properties.

Property tax

Once you become the owner of the property, you’ll need to pay an annual property tax. The amount is based on the assessed value of the property and can vary depending on the region.

Income tax

If you decide to rent out your property, you’ll need to pay income tax on the rental income. The rate varies depending on the amount of rental income you earn.

Capital gains tax

If you sell your property in the future, you may be subject to capital gains tax on any profit you make. The rate is currently set at 15%, but may vary depending on the length of time you’ve owned the property and other factors.

Buying a property in Greece can have several tax implications that buyers should be aware of. Photo by Nataliya Vaitkevich

How do I ensure that buying a property in Greece is a good investment?

Ensuring that buying a property in Greece is a good investment involves careful research, due diligence, and working with qualified professionals.

Start by researching the real estate market in Greece, including the different regions and types of properties available. Look for trends in pricing and demand, as well as any risks or opportunities in the market.

Before finalizing the purchase, make sure the property has a clear legal status and that all necessary permits and documentation are in order. Hire a lawyer who specializes in Greek property law to help you with this step.

Conduct due diligence. This involves inspecting the property thoroughly to ensure that it’s in good condition and has no major issues. Hire a surveyor to inspect the property and provide a report on its condition.

Look for properties in desirable locations with access to amenities such as transportation, shopping, and entertainment. Properties in areas with good potential for growth or development can also be a good inversión.

Determine the potential rental income or resale value of the property to ensure that it’s a sound investment. Look at comparable properties in the area to get an idea of pricing and demand.

Choose a real estate agent who has experience and knowledge of the local market. They can offer valuable insights and guidance on making a smart investment.

Conclusión

Buying a property in Greece can be a rewarding experience for those who approach it with the right mindset and preparation.

Whether you’re looking for a second home, a rental property, or a permanent residence, Greece offers a wealth of options to suit your needs and preferences.

With careful consideration, research, and guidance, you can find the perfect property to meet your goals and make a successful investment in one of Europe’s most beautiful and vibrant countries.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.