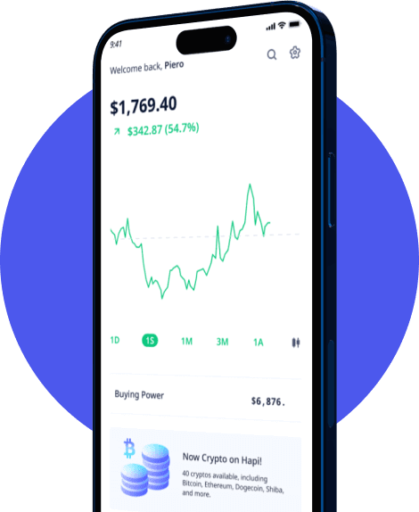

Let’s talk about US-based Hapi App, an investment application that’s designed for trading of stock and exchange-traded funds (ETFs) for clients in Latin America.

By focusing on the Latin American market, the platform aims to provide localized support, understand the unique characteristics of the region’s financial landscape, and offer investment options that are relevant to Latin American users.

If you’re interested to know more about this platform, I’ll provide you with a detailed walk-through. So read on.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

What is Hapi?

The stock-and-ETF-trading app was established in 2020 by economist Dusko Kelez. It’s a do-it-yourself (DIY) platform that gives you access to equity markets in the US.

In a previous interview with Forbes, Kelez expressed his motivation for starting Hapi. He said that he started the company because he wanted to buy shares of Tesla several years ago but found it difficult as a Peruvian. He searched for various trading apps like Robinhood but couldn’t find an apt solution.

Hapi is now gaining recognition as the “Robinhood” of Latin America. It aims to cater to the increasing demand in this region for buying and selling US stocks and cryptocurrencies. As a result, the business expects its managed assets to expand.

Currently, Hapi operates in several Latin American countries including Peru, Colombia, Mexico, and Chile. It has established a presence in these countries to serve the growing market of individuals who are eager to participate in US stock and crypto trading.

Hapi may be a good fit if you’re comfortable making all of your own investment decisions and have the knowledge to do so, including selecting holdings, figuring out investment approaches, timing placing buy and sell orders, and restricting your trading to cash accounts with only US-listed stocks, ETFs, exchange-traded notes (ETNs), and American Depositary Receipts (ADRs).

The fact that Hapi allows investors to buy a share in increments smaller than a complete share is a major plus. This is a useful option for people who have a restricted budget but yet wish to spread their investing dollars elsewhere.

The Hapi app does not provide any kind of advice, direction, or oversight in any form. You’ll be better off looking into other platforms that can give the necessary degree of aid and support if you find or need such services in managing your assets.

Hapi is registered as a broker-dealer under the Securities and Exchange Commission (SEC).

Account Setup, Access, Funding, and Withdrawals

Requirements to Create an Account

To be eligible for a Hapi App account, you must be at least 18 years old and have a valid ID. You must also be a resident of any of the following countries:

- Argentina

- Bolivia

- Brazil

- Chile

- Costa Rica

- Colombia

- El Salvador

- Ecuador

- Spain

- Guatemala

- Honduras

- Jamaica

- Mexico

- Paraguay

- Peru

- Dominican Republic

- Venezuela

- Uruguay

- Trinidad and Tobago

How can I access my account?

It requires an iPhone or iPad running iOS 15.0 or later and an Apple Watch running iOS 8.0 or above. For those who use Macs, the Hapi platform is compatible with versions of Mac OS 11.0 and later, and it works particularly well on Macs that have Apple Silicon chips. Hapi is compatible with Android Marshmallow 9.0 and later versions on mobile phones and tablet computers. Web browsers like Safari, Brave, Chrome, and Firefox can be used to access the Hapi platform too.

How do I fund my Hapi account?

There are three different methods available to fund your account: direct deposit, wire transfer, and crypto deposit.

Direct Deposit

The first option through Direct Deposit can be done directly within the app. You may transfer money to Hapi by opening the app’s banking menu and then selecting the option “Transfer to Hapi.” Click the name of the bank you use. Simply enter the amount you want to transfer in US Dollars and hit “Transfer.”

Funds will be accessible instantaneously if deposit is made prior to 3:55 p.m. New York time. Deposits made after that time will be accessible at 7:05 a.m. New York time on the next business day.

Wire Transfers

Another option is to make a Wire Transfer from your bank account. The process is similar to that of the first option, except this time you’ll choose wire transfer. Note that ACH transfers are not supported for this method.

Wire transfers need to be conducted in USD, and the processing times and fees will depend on your bank and country. It’s essential to check with your bank regarding any potential intermediary banks that may charge additional fees. Hapi only receives the funds and is not involved in the wire process or associated fees.

Crypto Deposit

The third funding option is through Crypto Deposit. Go to Banking, pick “Transfer Crypto,” then hit “Deposit” to move crypto from other wallets or exchanges to your Hapi account. Copy or scan your Hapi wallet address. Then, go to your crypto wallet or exchange and initiate the transfer using the compatible wallet address and network for that particular crypto.

Crypto transactions typically take around 60 to 120 minutes to reach your Hapi app account, but the duration may vary based on the crypto’s value.

How can I cash out money from my account?

To initiate a bank transfer through the Hapi app, follow these steps. Firstly, go to the banking section within your app. Then, select the option for transferring funds to your bank. The subsequent steps will vary based on your country of residence:

For those in Peru, Colombia, Chile, or the United States, click on “Crossborder transfer” specific to your country. Enter the desired withdrawal amount, taking into account any transfer fees and available purchasing power. Provide your bank details and identification document. Verify that the information and withdrawal amount are accurate before confirming.

For those in Argentina, Bolivia, Brazil, Costa Rica, El Salvador, Guatemala, Honduras, Jamaica, Mexico, Paraguay, Dominican Republic, Venezuela, and Trinidad and Tobago, you’ll need to complete and submit a form – now you’re good to go!

When making a withdrawal from your Hapi account, it’s essential to ensure that the funds come from settled transactions. After selling an asset, there is a two-day trading settlement period during which the transaction is completed. It is only after this period that the funds become available for withdrawal. On the third day following the transaction, you will see the funds reflected in your purchasing power and can proceed to withdraw them.

To avoid any issues, it’s important to confirm with your bank that they can receive funds from abroad without any complications or bounced transactions. Make sure to also inquire whether your bank assesses any costs for receiving money from the US.

Note that withdrawals can only be made to an account held by the same individual as the Hapi account. By regulatory requirements, funds from a user’s account cannot be sent to a third party.

Investing with the Hapi App

Hapi allows you to invest in more than 9,000 different securities, including major equities and ETFs traded on US markets. In addition, they have more than 40 other crypto available for purchase.

Is there a minimum amount to invest with the Hapi app?

The platform has an entry point of 1 USD. You can build your investment portfolio with the flexibility to choose your desired amount. Hapi allows you to invest in fractional shares and ETFs starting from as low as 5 USD.

Do I have ownership of my stocks?

Shares purchased in the Hapi App are owned outright by the platform’s investors. Hapi functions as a broker-dealer, meaning that it acts as a go-between when its customers want to make a purchase or sale. So, the shares will be the your property once the transaction is executed.

As a shareholder, you’ll have the chance to have your voice heard in corporate decisions, collect dividends, and use other legal protections. Your monies are held in a trust account that is not linked to Hapi’s general operating finances. As a result, none of the business’ obligations place a risk on them or utilize them as collateral.

Contracts for Difference (CFDs) are often utilized by market makers to trade with themselves and involve margins or spreads; Hapi does not participate in such activities. The US, where Hapi is based and authorized to do business, prohibits firms from serving in dual capacities as market makers and broker-dealers. Such tasks need the involvement of several organizations.

Hapi follows the National Best Bid Offer (NBBO) price while making deals. When you submit a market order, Hapi is bound by law to obtain the best possible price in the market to accomplish the intended transaction. This guarantees the best potential transaction execution price for you.

How can I acquire or dispose stocks through the platform?

Visit the stock’s detail page for vital details before buying or selling on Hapi. The stock’s historical performance, important ratios, and news are on this page. These insights may help you invest wisely.

To purchase or offload a stock you don’t own, go to the bottom of its detail page. A default “Buy” or “Sell” button will display. Click the button that’s applicable. Next, specify the number of shares you want. Tap the option in the upper right corner to specify your order in dollars rather than shares. Choose “Buy (or Sell) in Dollars.”

Before placing your order, check the information. Verify everything. Edit your order if necessary. Then, confirm your order and submit it.

What options are available when placing an order?

To purchase or sell stocks, you may use a variety of order types. You may make some orders expire at the end of the trading day, while others will stay active until you cancel them. It’s crucial to weigh the repercussions of every potential course of action.

Market Order

You may purchase or sell shares of stock at the current market price using a market order. During normal market hours or extended hours, market orders are executed instantly. While they might be helpful for making rapid stock trades, it’s important to remember that the execution price is not guaranteed.

Limit Order

If you’d rather purchase or sell a stock at a certain price, you may do it using a limit order. You’ll have greater say over the final cost of execution as a result. Limit orders may or may not be executed, so keep that in mind. Your order may be partly or not performed at all if there are insufficient buyers or sellers at the price you set.

How to determine the acquisition or sale price

The limit price is the specific price you choose for acquiring or offloading a security. It lets you select a maximum or minimum share price for purchase or sell orders.

For a buy limit order, you specify the maximum price you’re willing to pay for each share. When the market price reaches your limit price or goes below it, the order is executed, and you buy the shares at that price or a lower price.

For a sell limit order, you set the minimum price you want to receive for each share. When the market price reaches your limit price or goes above it, the order is executed, and you sell the shares at that price or a higher price.

In both cases, the limit price gives you to more command over your order’s execution price. It ensures that you buy or sell the shares at the desired price or a better price.

Just to reiterate a previous point, do remember that if the market price does not reach your limit price, the order may not be executed.

By setting a limit price, you can make strategic decisions based on your desired buying or selling price for the asset.

What becomes of my stocks in the event of delisting?

En New York Stock Exchange and NASDAQ have given Hapi clearance to act as an intermediary in the trading of securities listed on their respective exchanges. However, Hapi cannot authorize trading in equities that are only available via the over-the-counter (OTC) market.

The thing is, stocks that get delisted from the said major stock exchanges become available only on OTC markets.

Hapi will be able to liquidate a user’s stake in a delisted stock after it has received the user’s written consent to do so. Although the stock can never be repurchased on the Hapi App.

What are the tax considerations?

Hapi, as a US company, operates in accordance with US laws and regulations. When you engage in trading activities on the Hapi App, you are subject to these laws and regulations. Where you live plus your citizenship status, among other things, will determine whether taxes apply to your transactions. You should learn about and follow all relevant tax regulations on your own initiative.

When it comes to dividends, Hapi follows the practice of withholding US taxes associated with these dividends. These withheld levies are paid directly to the Internal Revenue Service, the US tax authority.

Is investing with Hapi safe?

Risks are inherent in all equity investments particularly penny stocks, which are further amplified for various reasons.

Penny stocks generally refer to stocks that trade for under 5 USD, and they tend to exhibit higher volatility compared to most stocks. These stocks often experience fractional cent movements frequently, with even small price variations representing a significant percentage of their value. Because many investors buy a lot of penny stocks, even a little price movement may have a big effect.

Furthermore, penny stocks may not have a consistent market, and there might be limited trading activity for extended periods. Penny stocks are also more susceptible to manipulation versus larger and more established firms. Their lower price and infrequent trading make them easier targets for manipulation.

The bid-ask spread, which is the difference between a stock’s selling price and its buying price, is also bigger for penny stocks than for higher-priced equities.

What do Hapi App fees look like?

Trading US-Listed Securities

Hapi trading app offers a fee structure that is advantageous for users. The platform does not assess fees or commissions related to acquiring or selling stocks and ETFs, making it a cost-effective option for investors.

So, if you deposit 10,000 USD into your Hapi account, you will have the full amount available for investment in any US national exchange-traded stock of your choice. This allows you to utilize the entire deposited amount for acquiring stocks to maximize your investment potential within the Hapi platform.

Custodial costs may apply to some ADRs; you may learn more about the fees connected with a particular ADR by contacting the bank acting as custodian for that security. You could be charged a minimum fee of 0.06 USD per share for trading ADRs, which translates to 0.25 USD per transaction.

Account Maintenance and Transactions

Additionally, there are no annual account fees, ensuring that users can keep their investment accounts open without incurring any recurring charges.

In terms of transaction minimums, Hapi sets the bar quite low, with a minimum requirement of just 2 USD. This means that even individuals with smaller investment amounts can participate in trading activities through the app.

When it comes to funding your Hapi App account, the platform itself does not charge any fees. However, your bank or an intermediary bank could apply transaction and foreign currency conversion fees for fund transfers. The Hapi app does not offer refunds for these charges, as they are external to their service.

Withdrawals

Colombia and Chile’s withdrawal cost is 4.99 USD, with a 25 USD minimum. The same fee is assessed for withdrawals in Argentina, Brazil, Ecuador, Peru, and Uruguay, although Hapi doesn’t state if there’s a minimum amount required too. Meanwhile, Mexico and other countries charge 10 USD per cash out, with the same minimum of 25 USD.

Wire withdrawals inside the US cost 4.99 USD.

Regulatory Trading Fees

Besides, it’s worth mentioning that there may be a small regulatory fee imposed on sales. The principal value determines such fees.

Sells cost 5.10 USD per 1 million USD principal, rounded up to the nearest cent. The Trading Activity Fee (TAF), meanwhile, is 0.06 USD and 0.002 USD for equity and options sales, respectively. These fees are rounded up to the nearest penny and capped at 5.95 USD.

Other Services

Hapi offers various services with associated fees. Electronic Statements & Confirms are provided at no cost, allowing users to access their account statements and confirmations electronically. However, if users prefer receiving paper statements, there is a fee of 5 USD. Additionally, paper confirms are available for 2 USD per request. On the other hand, paper Form CRS (Customer Relationship Summary) is provided free of charge.

In terms of miscellaneous charges, there is an inactivity fee of 1.99 USD, which applies when an account remains inactive for a certain period. Voluntary corporate actions or elections, such as participating in shareholder votes or exercising rights, do not incur any charges.

The Hapi App also offers a Prime subscription for 9.99 USD. This subscription likely provides users with additional benefits or features, although specific details would be outlined in the terms and conditions.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.