Junk bonds, or high-yield bonds, are a financing tool for companies with lower credit ratings. These bonds offer investors higher returns than investment-grade bonds but come with increased risk.

Companies issue junk bonds to attract investors willing to take on more risk in exchange for potentially higher yields.

Credit rating agencies play a significant role in categorizing bonds. They evaluate the financial health of the issuing company and assign a rating.

Junk bonds usually receive ratings below ‘BBB’ from agencies like Standard & Poor’s and below ‘Baa’ from Moody’s.

The allure of junk bonds lies in their high yield. However, this high yield compensates for the increased risk of default. Investors need to weigh the potential returns against the risks involved carefully.

Si desea invertir como expatriado o particular con un elevado patrimonio neto, puede enviarme un correo electrónico (advice@adamfayed.com) o utilizar estas opciones de contacto.

Why the Spotlight on Junk Bonds in 2023?

The year 2023 has set the stage for a significant reckoning in the junk bond market. Interest rates began to surge in late 2021, affecting companies that had previously benefited from low rates during the early years of the COVID-19 pandemic.

According to Bloomberg data, all-in yields on high-yield debt currently sit around 8.67%, far above the average rates from 2017 to 2021.

The Wall of Maturities

One of the looming challenges for companies issuing junk bonds is the “wall of maturities” expected in 2024. Companies will need to start refinancing their debt well in advance, and the cost of borrowing is likely to rise. This situation could make it difficult for companies with weaker business models to survive.

Economic Indicators and Junk Bonds

A Bloomberg survey of economists puts the probability of a 2023 recession at 70%. This economic downturn could significantly impact junk bonds, as credit spreads could widen, making it more expensive for companies to refinance their debt.

Defaults and Bankruptcies

Defaults and bankruptcies have increased, albeit from extraordinarily low levels. Companies like Revlon Inc. and Endo International Plc have already faced financial struggles, leading to bankruptcy proceedings. These events serve as a cautionary tale for investors in junk bonds.

The Advantages of Junk Bonds

High Yield Potential

Junk bonds, also known as high-yield bonds, have captivated the attention of investors due to their potential for delivering higher returns than most traditional investment-grade bonds.

These bonds are issued by companies that might be financially struggling or are perceived to have a higher risk of default. However, this inherent risk is what drives the higher yield, making it an enticing option for those who are willing to take on that risk.

When juxtaposed with investment-grade bonds, junk bonds stand out primarily because of their yield.

An investment-grade bond might have a credit rating that signals stability and a lower likelihood of default. In contrast, with its lower credit rating, a junk bond signals higher risk but also promises a higher return.

Diversification Benefits

Diversification is a strategy that every astute investor employs to spread and mitigate risks.

Incorporating junk bonds into an investment portfolio can offer a unique diversification avenue, distinct from traditional bonds or other asset classes. Junk bonds often exhibit a different behavior pattern compared to other assets.

For instance, while certain market conditions might adversely affect stocks or investment-grade bonds, junk bonds might remain unaffected or even thrive. This unique behavior makes them an excellent tool for hedging against market volatility.

The buying patterns of junk bonds can serve as a market risk indicator. An uptick in junk bond investments might signal increased market optimism, suggesting that investors expect economic improvements and are thus willing to take on more risk.

Conversely, a decline in junk bond investments might indicate a more risk-averse sentiment among investors.

Credit Ratings and Junk Bonds

Credit ratings play a pivotal role in the world of junk bonds. These ratings, provided by agencies like Standard & Poor’s, give investors insights into the risk levels of different bonds.

For instance, bonds rated lower than BB by Standard & Poor’s fall into the junk bond category. While these ratings offer a glimpse into the bond’s risk, they also impact its market price and interest rate.

A bond with a higher credit rating will typically have a lower yield, while a junk bond with a lower rating will offer a higher yield to entice investors.

Top 5 Junk Bond Investment Opportunities in 2023

Emerging Market Junk Bonds

With their rapid economic growth and development, emerging markets have become hotbeds for junk bond investments. As these markets mature, local companies frequently issue junk bonds, eager to capitalize on growth opportunities.

Countries like India, Brazil, and South Africa are leading the charge in 2023, with their companies actively issuing junk bonds. With their expanding middle class and increasing consumer demand, these nations offer a promising backdrop for junk bond investments.

While the potential for high returns exists, investors must also be wary of the political and economic instability that can sometimes plague emerging markets. Proper research and due diligence become paramount.

Distressed Industries Making a Comeback

The cyclical nature of industries means that downturns are often followed by periods of growth and recovery. In 2023, sectors like travel, hospitality, and energy, which faced challenges in the past, are witnessing a resurgence.

Companies that have managed to weather past storms, streamline operations, and adapt to changing market conditions are most likely to offer lucrative junk bond oportunidades de inversión.

While the path to recovery might differ across industries, the overarching theme remains consistent: companies that innovate and adapt thrive.

Corporate Junk Bonds with Strong Fundamentals

Despite their lower credit ratings, several corporations in 2023 stand out due to their robust business models and growth trajectories. These companies, while categorized under junk bonds, show immense promise.

Look for companies with low debt-to-equity ratios, consistent revenue growth, and a clear competitive advantage in their respective markets.

While specifics might vary, companies in the tech sector, renewable energy, and e-commerce have been particularly noteworthy in their junk bond offerings.

Convertible Junk Bonds

Convertible junk bonds serve a dual purpose. Given their convertibility feature, they offer the stability of bonds and the potential upside of equities.

Investors can convert these bonds into shares of the issuing company at predetermined rates, potentially allowing them to benefit from stock price appreciation.

The increasing volatility in equity markets has made convertible junk bonds attractive, as they offer a hedge against market downturns while still providing an upside.

Short-Term Junk Bonds

Short-term junk bonds offer an enticing opportunity for investors with a shorter investment horizon. These bonds, with their shorter maturities, allow for quicker capital turnover.

Short-term junk bonds allow investors to reinvest their capital more frequently, adapting to changing market conditions and seizing new opportunities.

While the allure of quick returns is undeniable, investors must also know the heightened risks associated with short-term investments. A keen eye on market trends and timely decision-making is crucial.

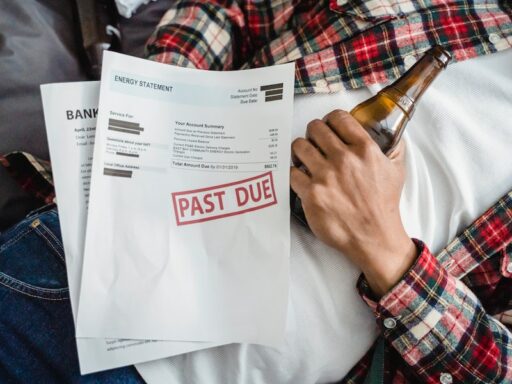

Risks and Considerations

Default Risk

By their very nature, Junk bonds carry a higher risk of default than most other bonds. A default occurs when a bond issuer fails to make the promised interest payments or repay the principal at maturity.

Companies that issue junk bonds often have lower credit ratings, indicating a higher likelihood of default. This is because these companies might be financially struggling or are in industries facing economic challenges.

When a bond misses a principal and interest payment, it’s considered to be in default. Junk bonds have a higher risk of default due to uncertain revenue streams or insufficient collateral. This risk intensifies during economic downturns, making these bonds even riskier.

For instance, Tesla Inc.’s bond, rated B- in 2014, was still in the junk bond territory in 2020 with a BB- rating despite the company’s significant growth.

Interest Rate Sensitivity

All bonds, including junk bonds, are sensitive to interest rate changes. When interest rates rise, bond prices typically fall, and vice versa. This inverse relationship is crucial for investors to understand, especially when navigating the volatile landscape of junk bonds.

Higher interest rates can make new bonds more attractive, pushing the prices of existing bonds down. This effect can be more pronounced for junk bonds due to their inherent risk.

As rates rise, the higher yields offered by junk bonds might not be enough to compensate for their increased risk, leading to potential price decreases.

Economic Factors and Junk Bonds

Junk bonds are closely tied to broader economic factors. From global events to economic booms and recessions, various elements can influence the performance of junk bonds.

Increased buying interest in junk bonds can serve as a market risk indicator.

If investors actively purchase junk bonds, it might suggest a willingness to take on more risk, possibly due to a perceived improving economy. Conversely, a sell-off in junk bonds could indicate a more risk-averse sentiment.

From geopolitical tensions to global health crises, various events can impact the performance of junk bonds. Such events can influence investor sentiment, economic growth, and, by extension, the creditworthiness of companies issuing junk bonds.

Diversifying Within the Junk Bond Space

Diversification is a fundamental principle of investing, and it’s especially crucial when dealing with assets like junk bonds.

By diversifying your investments across a range of junk bonds, you can spread and reduce the risk associated with any single issuer defaulting.

Understanding the Issuers

Some junk bonds are different. Startups issue some, while others come from established companies facing temporary challenges. Research the companies behind the bonds to understand their business models and financial health.

Geographic Diversification

Junk bonds from emerging markets might offer higher yields but also have geopolitical risks. Balancing your portfolio with bonds from different regions can help mitigate these risks.

Sectoral Diversification

Different sectors react differently to economic changes. You can shield your portfolio from industry-specific downturns by holding junk bonds from diverse sectors.

Monitoring and Rebalancing

Active portfolio management is crucial when investing in junk bonds. Their volatile nature means that the market dynamics can change rapidly, affecting your investments’ value and risk profile.

Setting Clear Benchmarks

Define what success looks like for your junk bond investments. Whether achieving a specific yield or capital appreciation, having clear benchmarks helps assess performance.

Regular Reviews

Given the higher risk of default associated with junk bonds, reviewing your portfolio regularly is essential. This not only helps in identifying underperforming bonds but also in spotting opportunities for better returns.

Rebalancing Based on Market Conditions

Economic factors can significantly impact the junk bond market. For instance, during economic downturns, the risk of bond defaults increases, making these investments even riskier. Being proactive in rebalancing your portfolio based on prevailing market conditions is crucial.

Seeking Expert Advice

The junk bond market can be intricate, with various factors influencing bond prices and yields. While individual research is valuable, seeking expert advice can provide deeper insights and more nuanced strategies.

Leveraging Credit Ratings

Credit rating agencies, such as Standard & Poor’s, assign ratings to bonds based on their assessment of the issuer’s creditworthiness.

For instance, bonds rated lower than BB by S&P fall into the junk bond category.

These ratings can serve as a guide for investors, but it’s essential to understand the criteria behind these ratings and their implications.

Staying Updated with Market Research

Various macroeconomic and company-specific factors influence the junk bond market. Regularly reviewing market research can provide insights into the junk bond space’s trends, risks, and opportunities.

Consulting Financial Advisors

Financial advisors with expertise in junk bonds can offer personalized advice tailored to your financial goals and risk tolerance.

They can help in portfolio construction, risk management, and identifying potential investment opportunities.

The Future of Junk Bonds Beyond 2023

The market for junk bonds in 2023 is vibrant and full of opportunities. However, like all investments, they come with risks. By staying informed, diversifying, and seeking expert advice, investors can navigate the world of junk bonds and potentially reap significant rewards.

As we look beyond 2023, the future of junk bonds remains bright, with endless possibilities on the horizon.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.