Los mejores gestores de patrimonios para extranjeros: Opciones alternativas

The best wealth managers for expats in 2026 are firms and advisors with proven experience in international investing, cross-jurisdiction tax planning, regulatory compliance, and serving clients living overseas. This list highlights expat-relevant wealth managers and advisory firms selected based on: For transparency, our list includes Adam Fayed, who works in conjunction with fully licensed partners […]

Ethical Investing vs Greenwashing: Are ESG investments legit?

ESG investments aim to align capital with values, but many funds labeled ethical or sustainable may still support harmful practices. Understanding how ESG works and when it can mask poor behavior is essential for investors seeking truly responsible portfolios. This article covers: Key Takeaways: My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have […]

Liechtenstein Zombie Trust Apocalipsis Explicado: Causas, Riesgos e Impacto para el Inversor Offshore

A Liechtenstein zombie trust is a legally valid offshore trust that has become non-functional because its trustee has resigned and no replacement is willing to act, leaving assets effectively frozen. This issue has escalated into a broader zombie trust crisis, primarily affecting Liechtenstein-based trusts linked to sanctioned or high-risk jurisdictions. As trustees withdraw to avoid […]

Privacy Coins Explained: A Guide for Investors and Crypto Users

Privacy coins are at the helm of digital privacy and regulatory oversight debate. They offer enhanced anonymity in financial deals, raising important questions for investors, regulators, and exchanges. While their technology promises discretion and security, their legal status and adoption vary across jurisdictions, creating a complex landscape for anyone looking to understand or invest in […]

Crypto-Asset Reporting Framework (CARF): Non-CARF Countries Guide

Only a handful of countries, including India and Vietnam, are not yet participating in CARF, making country selection increasingly important for crypto investors. The Crypto-Asset Reporting Framework (CARF) is an international initiative designed to improve reporting and compliance of crypto-asset holdings across jurisdictions. For expats, investors, and financial institutions, understanding CARF and which countries participate—or […]

Financial Advisor for Income-Generating Investments for Expats

A financial advisor helping expats with income-generating investments focuses on creating stable, globally diversified income streams that support your lifestyle abroad while keeping overseas risks under control. Expats often earn in one currency, spend in another, and face unfamiliar tax rules while aiming for consistent income rather than growth alone. We provide custom strategies for […]

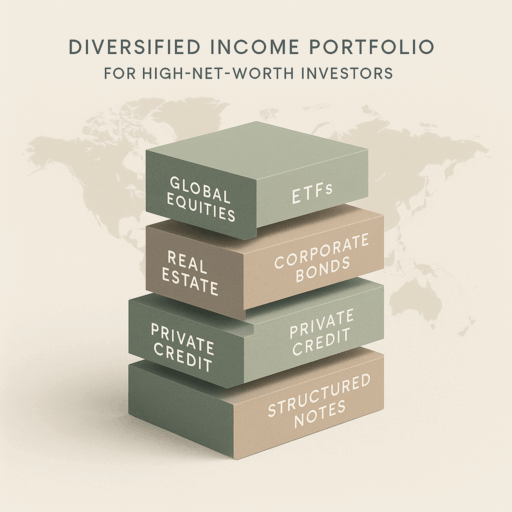

Income Options for Expats and High-Net-Worth Individuals

Expats and high-net-worth individuals have several income options than just cash and government bonds. Modern portfolios mix dividend-paying global stocks, income-focused funds and ETFs, and high-quality corporate or emerging-market bonds. In addition, many investors add real estate, REITs, private credit, structured notes, and multi-asset income solutions for diversification. HNWIs and expats face a unique challenge: […]

How the UK Budget Will Impact Expats

Offshoring assets will become more attractive. Rachel Reeves announced tax increases in her recent budget. Perhaps unsurprising when she wrote a book titled The Women Who Made Modern Economics, in which she praised Joan Robinson. Joan Robinson praised the brutal communist leader Mao Zedong and the even more brutish North Korean regime in her book “Korean […]

Are Offshore Bonds a Good Investment?

Offshore bonds offer tax-deferral, flexible withdrawal options, and estate planning benefits. They are investment wrappers issued outside an investor’s home country, typically via life-insurance style contracts. This article explores: Key Takeaways: My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions. The information in this article is for general guidance only. It […]

UK Tax Benefits of Offshore Bonds (And Cons to Watch Out For)

Offshore bonds give UK residents and returning expats powerful tax benefits by allowing investment growth to roll up tax-deferred and enabling 5% tax-advantaged withdrawals. They also offer strategic options for gifting, trusts, and inheritance tax planning. This article covers: Key Takeaways: My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions. The […]

Will and Estate Planning in Spain for Expats

Estate planning in Spain is more complex than in many other European countries because of forced heirship rules, regional tax differences, and separate inheritance laws for non-residents. Having a Spanish will and a clear cross-border plan reduces tax and prevents family disputes. This article explores: Key Takeaways: My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 […]

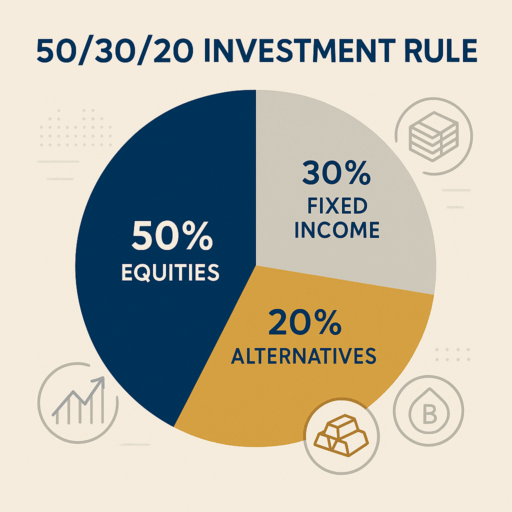

Cartera 50/30/20 vs 60/40: ¿Qué asignación de activos es mejor?

The 50/30/20 rule for allocating assets offers better diversification, downside protection, and risk-adjusted returns than a traditional 60/40 portfolio. By slightly reducing equities, keeping a solid fixed-income base, and adding alternatives like structured notes, real estate, or private credit, this strategy balances growth with defense. How you split your portfolio can significantly impact returns, risk, […]

Fiscalidad mundial y estructuras más inteligentes: Lo que dice Mark Morris, asesor de la OCDE, sobre FATCA, CRS y CARF

Adam recently spoke with Mark Morris, who has advised the OECD (Organisation for Economic Co-operation and Development), and EU and German Parliaments, among many other global organizations. In this Youtube video, Mark shared insights on: The conversation covers highly technical and specialized topics. If you believe you could benefit from personalized tax or structuring advice […]

Invertir Offshore desde EEUU: Guía de cuentas, opciones y banca

Offshore investing from the US allows investors to diversify portfolios, access international markets, and potentially optimize returns. Popular offshore investment options include offshore mutual funds, offshore investment bonds, and other global financial vehicles. In this guide, we answer the most common questions US investors have about investing offshore, moving money, and managing offshore accounts: My […]

Visado de Inversor Comercial de Nueva Zelanda: Invierta $1M-$2M para obtener la residencia por vía rápida

The New Zealand Government has closed the Entrepreneur Work Visa and introduced the Business Investor Visa, opening in November 2025. Applicants can invest NZD $1M (3-year residence pathway) or NZD $2M (12-month fast-track) in an existing business. This new visa aims to attract serious investors while boosting New Zealand’s economy and labor market. This guide […]

How Indians Invest Abroad Under the LRS or Liberalised Remittance Scheme

The Liberalised Remittance Scheme (LRS) provides Indian residents with a structured yet flexible pathway to invest abroad. Families can pool their individual limits for joint ventures, while each member retains independent accountability. There is no restriction on the number of remittances, provided the annual ceiling of USD 250,000 is respected. A valid PAN is mandatory […]

Ciudadanía por méritos en Malta: El camino hacia la nacionalidad maltesa excepcional

The Maltese government introduced a new pathway to citizenship, known as Citizenship by Merit, a selective naturalization route that’s not open to everyone. Unlike traditional investment-based naturalization schemes, this program is not primarily about financial donations or real estate purchases. Instead, it provides recognition to individuals who have rendered exceptional contributions or services to Malta […]

Actualización del visado de administrador de empresas para Japón: explicación de las nuevas normas y requisitos

Japan is implementing significant changes to its Business Manager Visa system, effective mid-October 2025. The minimum investment requirement has increased sixfold from ¥5 million to ¥30 million (approximately $204,000). Additionally, new mandatory employment and professional qualification requirements have been introduced. These changes aim to attract more substantial businesses while curbing shell company abuse, fundamentally shifting Japan’s approach from accessibility to selective high-value entrepreneurship. The reforms affect both new applicants and potentially existing visa holders during renewal periods, […]

How Much Money Can You Send Abroad from India? RBI LRS Rules

India allows resident individuals to remit up to USD 250,000 per financial year under the RBI’s Liberalised Remittance Scheme (LRS). This is subject to purpose restrictions and Know Your Customer (KYC) compliance requirements. From April 1, 2025, Tax Collected at Source (TCS) applies only after combined LRS remittances cross ₹10 lakh in a financial year. […]

Can Foreigners Buy Property in New Zealand? Rules and Exceptions

Foreigners generally cannot buy existing homes in New Zealand under the Overseas Investment Amendment Act 2018, except for Australians, Singaporeans, and certain eligible visa holders. Recent 2025 changes also allow Active Investor Plus and Investor 1 or 2 visa holders to purchase or build homes worth NZD $5 million or more. This guide brings together […]

LRS Limit for Buying Property Abroad from India: A Guide

Indian residents can legally purchase property abroad using the Liberalised Remittance Scheme (LRS). This permits remittances up to USD 250,000 per financial year for capital account transactions, including immovable property acquisition. This guide consists of several important aspects of purchasing property abroad under LRS, such as: Furthermore, all the essential rules and regulations regarding Reserve […]