Anuncio de Reuters sobre el impulso a África y Singapur

SINGAPUR, 9 de junio de 2025 (EZ Newswire) - El empresario financiero británico Adam Fayed, abre nueva pestaña ha anunciado un impulso a través de África oriental y occidental, con planes de

SINGAPUR, 9 de junio de 2025 (EZ Newswire) - El empresario financiero británico Adam Fayed, abre nueva pestaña ha anunciado un impulso a través de África oriental y occidental, con planes de

Buscamos empresas para comprar, en el sector de los servicios financieros.

¡Estoy encantado de anunciar que he vuelto a publicar mi libro de Amazon 2018.....completamente gratis! La versión actualizada de 2024 incluye responder a preguntas como: El

Nuestros últimos reportajes

¿Qué me hace diferente y en qué le beneficia?

Obtenga hoy mismo sus guías financieras y de inversión gratuitas para expatriados

¿Cuáles son las 6 principales razones para que los expatriados y los HNWI tengan un asesor?

Casos prácticos de clientes recientes

Me complace anunciar mi 34ª reseña en LinkedIn

adamfayed.com en Forbes - Me complace anunciar que pronto seré colaborador habitual de Forbes.com

As digital nomad visas spread across Europe, two models have emerged: high-visibility, lifestyle-driven programs designed to attract attention, and quieter, legislated residencies built for structural

The OECD real estate reporting framework represents a structural expansion of global tax transparency, bringing immovable property into automatic cross-border information exchange. Through the Multilateral

Panama is highly attractive for retirees because it doesn’t tax retirement income, allowing expats to enjoy their pensions, savings, or social security without heavy deductions.

Adamfayed.com has been recognized as Best Expat Wealth Advisory Firm – Global 2026 by International Business Magazine, as part of the publication’s annual awards program.

You can hold USD in an Indian account, but only through specific account structures and regulatory conditions set by the Reserve Bank of India (RBI).

An external asset manager is a professional or firm that manages investment portfolios independently of banks, offering tailored wealth management solutions. This independence enables a

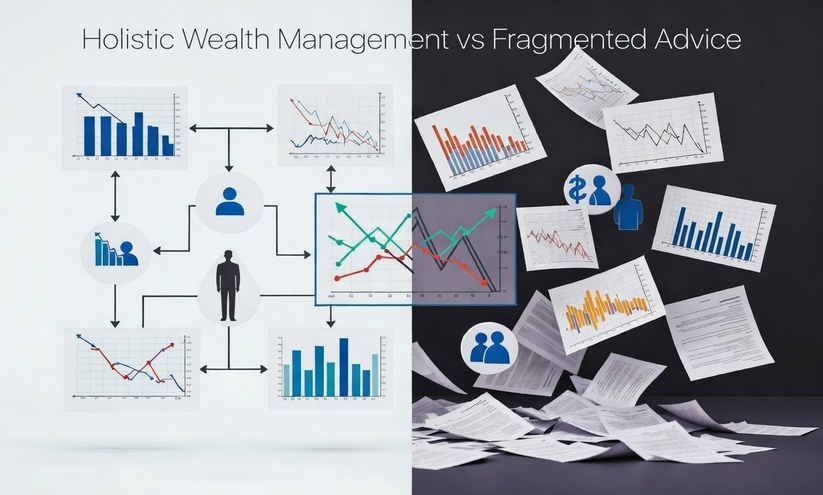

Most investors rely on siloed financial advice—separate advisors for investments, tax, estate, or insurance. Holistic wealth management, in contrast, integrates all aspects of a client’s

For high-net-worth investors, FATCA, CRS, and CARF compliance isn’t just mandatory—it can be leveraged strategically for structuring investments efficiently. This involves designing entities and beneficiary

Cross-border wealth management has entered a new era where optional compliance no longer exists. CRS, FATCA, and CARF make transparency mandatory for high-net-worth individuals. Beyond

A growing number of expats move abroad chasing higher income, better lifestyles, or a sense of adventure—only to discover that the emotional and financial realities

Recent US immigration policies have tightened visa screening, expanded enforcement, and altered how legal residency is granted, directly affecting travelers, workers, and families. These immigration

Recently, countries like Sweden and Canada have updated their citizenship laws, reshaping how individuals can gain, change, or maintain nationality. These changes reflect global trends

Mauritius hosts a thriving private banking sector, with institutions like Mauritius Commercial Bank (MCB) Private Banking and Barclays Bank Mauritius Private Banking commonly used by

In Portugal, non-residents pay flat tax rates of 25–28%, while residents face progressive rates from 12.50% up to 48%, based on income. Tax in Portugal

Getting dual citizenship in countries like Ireland and Dominica can be surprisingly easy for many people. These nations offer clear paths through ancestry or investment,

Bulgaria officially launched its Digital Nomad Visa, a dedicated long-stay residence permit for remote workers earning income from abroad. The visa is valid for one

PPLI can hold property exposure, but typically not through direct real estate ownership inside the policy. In most jurisdictions, real estate must be structured indirectly

Inheritance in Thailand is governed by strict local laws that affect property, marital assets, and foreign ownership. Expat wills in Thailand ensure your Thai-based assets

Bolivia does not tax most foreign-sourced income for residents under its territorial tax system. This means expats earning income abroad may legally pay 0% income

Japan’s debt has long been massive yet manageable—until 2026. Recent shifts in interest rates, political policy, and global capital flows are exposing vulnerabilities that could

Expat wills in Japan are governed by Japanese inheritance law, which imposes fixed statutory heir shares and inheritance tax rules even on foreign nationals. Because

SUSCRÍBETE A ADAM FAYED ÚNASE A INMENSA ABONADOS DE ALTO PODER ADQUISITIVO

SUSCRÍBETE A ADAM FAYED ÚNASE A INMENSA ABONADOS DE ALTO PODER ADQUISITIVO

Acceda gratuitamente a los dos libros de Adam sobre expatriación.

Acceda gratuitamente a los dos libros de Adam sobre expatriación.

Obtenga más estrategias cada semana sobre cómo ser más productivo con sus finanzas.