Can a Foreigner Buy Land in China Now?

Si desea invertir como expatriado o particular con un elevado patrimonio neto, que es en lo que estoy especializado, puede enviarme un correo electrónico (advice@adamfayed.com) o WhatsApp (+44-7393-450-837).

Introducción

Yes – it’s the shortest and most direct answer to the question can a foreigner buy land in China? However, there are other important things to look into before you make this bold move.

The Property Law of the People’s Republic of China now allows that after having undergone various amendments across the years. There is no longer a requirement for foreigners who want to acquire inmobiliario in the country to first spend at least a year there for studies or a job.

Additionally, foreigners were formerly restricted from purchasing more than one property in China, but those limits were eliminated thanks to a legal reform. Foreigners are now free to buy as many houses in the País asiático as they wish. At the same time, the law relating to the required minimum amount of time spent residing in China has also been repealed.

Essentially, foreigners cannot own a land in China because every land in the country is owned by the state. However, foreigners who are working in China and those who wish to move to the country can acquire a property based on their needs and financially capacity, albeit with certain limitations imposed.

Can a Foreigner Buy Land in China: Requirement Guidelines

Despite the fact that the overall standards have changed, variations very much still exist in certain Chinese territories, such as in Shanghai and Beijing, where there are additional conditions.

In Shanghai, for example, foreigners who wish to buy real estate must provide proof of their marital status. The law that is in effect in Shanghai additionally specifies that a foreigner who does not have a household registration is only permitted to acquire one land.

In Beijing, on the other hand, foreigners would be allowed to acquire a home if they have been making contributions to social security and settling their taxes for five years prior to the acquisition.

Also due to the revisions of law, there is no longer a cap on the number of homes that can be bought by a foreigner. The only caveat is that the property or properties must only be used for residential purposes; the foreigners cannot rent it out or use it to engage in any other activities.

Do note that such amendments to the original law provisions are applicable to mainland China.

Can a Foreigner Buy Land in China: The Case of Foreign Investors

It is necessary to first establish a company in China for international businesses and foreign individuals who wish to use the real estate for other purposes. When looking to buy a home in China, the following conditions must be taken into account:

- Supporting information attesting to a foreign corporation’s legal status is required for those seeking to establish outlets or subsidiaries in China;

- There ought to be a written assurance that the property will only be used for business reasons;

- The purchase of a property classified as a housing unit is now permitted for foreign investors with business operations in China;

- Before buying a home in China, foreigners must reside in the country for a minimum of a year.

Can a Foreigner Buy Land in China: A Step-by-Step Guide

Foreigners who have already lived in China for a while must have seen the standard of homes in the country. As a general rule, below are some information foreigners looking to purchase a home in China should take note of:

- Proof of residency. A foreigner must first present documentation proving their residency in China, which can be received from the Municipal Bureau of Public Security in their community;

- Secure a property for sale. A foreigner looking to buy property in the country can contact a property for sale for which they’ll have the option of hiring a real estate broker or handling the task on their own.

- Prepare a bid and draft an initial deal. The buyer must submit an offer to the seller after locating a piece of inmobiliario up for sale. The buyer and seller will both execute a provisional acquisition deal, and the buyer will give the seller 1% of the purchase cost if the seller accepts such proposal;

- Sales and purchase contract. A sales and purchase agreement (SPA), which must be prepared, must include the sales price, taxes to be paid, terms of payment and installments, repercussions if a party breaks the agreement, and any additional conditions that both parties may demand;

- Sign a legally enforceable agreement. Following the initial agreement, the purchaser and the seller will sign a legally binding contract for sale that should be notarized (since the buyer is a foreign national). It is necessary to file the official contract with the local registry;

- Title transfer. Transferring the title of the land to one’s name is the final stage in compra de inmuebles in China. A foreign buyer must go to the Deed and Title Transferring Office to complete this task. Ensure that there are no further liens related to the property by carefully inspecting the title.

The local Foreign Office must also approve the purchase before it can be made by foreigners, which is a requirement in order for the gobierno to acknowledge the acquisition in full.

Can a Foreigner Buy Land in China: Land-use Rights Lease to Foreigners

By setting up arrangements with the government, foreign investors who are interested in immigrating to China can have access to land-use rights that have been provided by the government. The Chinese government or the Land and Resource Bureau at the municipal level will then execute a deal with these international investors.

In this way, they are given land-use rights over a specific area of land that the state holds, valid for a set amount of time. The duration of the lease can exceed 70 years if it is for residential use by a foreigner.

A land leased for commercial or recreational reasons has 40 years max before the lease is terminated. A cap of 40 years will pass before the lease expires whether the land is leased for business or enjoyment. The concession of such land-use will not exceed 50 years if the land is leased by a foreigner for industrial, scientific, health, cultural, athletic, or educational uses.

Although it is not common and is only being tested in specific locations of China, some local governments let foreigners to benefit from land-use leasing rights for construction purposes. Usually, domestic businesses that have previously received the land-use rights from the government lease such rights to foreign investors.

Only the uses specified in the original master agreement may be carried out by a foreigner on the property. A new leased land-use right must be registered with the land administration body.

Can a Foreigner Buy Land in China: The Constraints

There usually is a limitation to everything and acquiring land in China as a foreigner is no exception. Bear in mind that foreigners are only permitted to possess residential real estate; meaning, if they wish to own commercial property, they must incorporate it in China.

The seller must receive an upfront payment from the foreign buyer that’s worth 30% of the purchase price in Chinese yuan, in addition to a 1% deposit if the buyer secures a mortgage. Foreigners are not allowed to be landlords in China as well.

Can a Foreigner Buy Land in China: Rules for Natural Persons

Those who are residing in China are only permitted to buy homes in the country provided they can demonstrate that they have been residents for at least a year and that they have paid the local impuestos.

Can a Foreigner Buy Land in China: The Price of Acquiring Real Estate

China’s territories all have different average land prices. The property prices per square meter in central Beijing from January 2003 to August 2022 stood at 39,167 yuan (about $5,407) on average per month, according to Hong Kong-based data insights provider CEIC Data, a unit of macroeconomic, business and industry intelligence company ISI Emerging Markets Group.

During the same period, prices per square meter in the municipality of Chongqing in China’s Sichuan province reached 6,857.124 yuan on average per month, CEIC said. On the other hand, per-square-meter prices in Chinese province Anhui hit 7,206.542 yuan, according to the data insights provider.

The average price of land in Shenzhen, one of the largest property markets in mainland China, was 31,861 yuan per square meter for the quarter ended September 2021, based on CEIC data. Land prices per square meter in China’s port hub Guangzhou, meanwhile, stood at 19,065 yuan on average for the same period.

Land Acquisition-Related Costs

Among the expenses associated with purchasing real estate in China are the notarized contract including details about the property acquisition, home insurance, the 0.5% transfer tax, the 7% construction tax, the 3% property tax, as well as the notary fees.

Can a Foreigner Buy Land in China: Property Due Diligence

It is important to verify precise details about the property before signing any final acquisition deals. Verification of numerous issues is a part of the due diligence process for Chinese real estate properties. Among the information you need to check are those of the tenant, operations/finances, building structure, plus other relevant data.

Looking into the financial statements of the property is an important step so as to ensure that there are no mortgages linked to it. Meanwhile, the building information will focus on particular data, such as reports on the building’s safety, seismic risk, environmental studies, or mechanical system.

Property Due Diligence for Investors

Investors who are interested in conducting business in China need to execute a more thorough due diligence, which may involve the determination of whether the building’s market value accurately represents its underlying costs, a whole set of records pertaining to the building’s ownership, the details of the lease, the legal protections outlined by the law, as well as internal regulations.

Can a Foreigner Buy Land in China: On Taxes

Due to taxes imposed by Chinese law, selling a property in China may be difficult for the seller. Of course, the actual taxes will depend on the sale you are interested in, but you should be aware that the following taxes might be applicable:

- Enterprise impuesto sobre la renta, which is solely applicable to the sale of commercial real estate. The seller is required to pay a 5% business tax, as well as a rate of 25% of the enterprise impuesto sobre la renta, which is applied to the sale’s profit.

- Land value appreciation tax, which is applied at the time of the transfer of real estate and can range from 30% to 60% of the property’s appreciation or the asset’s rise in value over time. The GuoShuiFa Circular, which went into effect in May 2010, specifies the tax.

- Deed tax, which is levied against the purchaser at the time of the transaction and is valued in the range of 3% to 5% of the property’s transfer value;

- Stamp duty, which is levied when a property’s title is changed.

Can a Foreigner Buy Land in China: The Property Market Crisis

China is facing property woes partially as a result of purposeful policy choices, independent news organization Al Jazeera said in a report. Beijing announced a strategy, dubbed Three Red Lines, in August 2020, with the intention of gradually deflating a significant property bubble that had been building for decades.

Both reducing the economy’s over-reliance on real estate and reining in the speculation that had driven up housing prices beyond the means of many Chinese middle-class families were objectives of the strategy. As per the policy, developers couldn’t borrow money from banks and other financial institutions unless they met stringent criteria for financial soundness, such as a maximum of 100% on net debt to equity.

It turned out that several developers were burdened with massive debts and had been operating outside of the so-called Three Red Lines. The sector was faced with a significant financial shortage as a result of being abruptly unable to borrow under the new restrictions, according to Al Jazeera.

Evergrande Group, one of China’s largest developers, fell behind on interest payments owed to its offshore bonds in December 2021. Kaisa Group Holdings, another urban developer and operator, did the same shortly after. With this backdrop, the industry’s problems have gotten worse as debt-laden and broke developers have battled to finish projects on time.

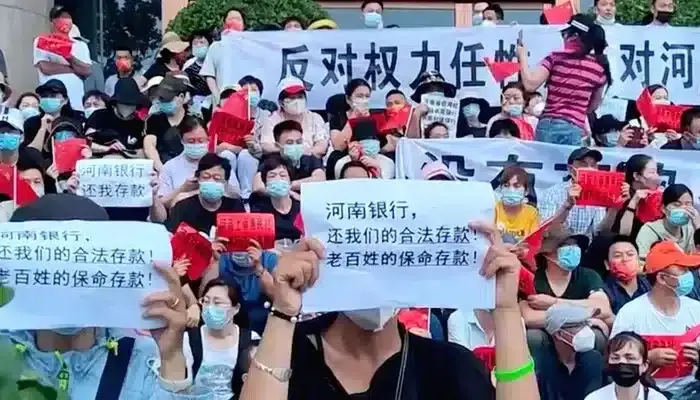

Pre-sale property purchaser demonstrations, which started in the southeasterly city of Jingdezhen earlier in 2022, have expanded to about 100 cities and involve some 300 homeowner associations, Al Jazeera said.

According to a calculation by Deutsche Bank, the value of the mortgages impacted by the boycotts is between 1.8 and 2 trillion Chinese yuan ($248.5 billion to $276.10 billion), or around 5% of all mortgage lending.

China’s property crisis is a serious threat to its economy. Although some observers think the market has bottomed out, the industry’s problems are anticipated to last for some time. A worse decrease than that saw during the 2008 financial crisis was predicted by S&P Global Ratings in July for a 30 percent decline in real estate values this year.

Protests of homeowners amid the property crisis in China. Image credit to BBC

So, What Now?

“What is currently needed is a backstop to the self-fulfilling crisis: the belief that property developers will be insolvent impels buyers to hold off their purchases and financing to dry up,” London School of Economics and Political Science’s economics professor Keyu Jin said in an article for British daily newspaper The Guardian.

According to Keyu Jin, a planned bailout program is unlikely to make a difference, and some monetary easing and relaxation in the mortgage industry are insufficient to spur demand.

The issue, she said, cannot be resolved by reducing mortgage lending standards. Instead, property developers would require considerably greater assistance from the government notwithstanding their prior dishonest behavior. The government will need to convey a much stronger message and foster trust in order to break the pattern.

Can a Foreigner Buy Land in China: Property Market Outlook

The residential real estate market in China is projected to continue to struggle this year as buyers exercise caution, news agency Reuters said in a report. Economists now predict that home prices will fall this year and that real estate sales will decline more quickly than previously anticipated, the report said.

According to a Reuters poll of more than 10 analysts and economists conducted between August 29 and September 2, new home prices are deemed to drop 1.4% within this year.

“Uncertainty over China’s growth prospects and concerns about project incompletion will largely drive weak homebuyer demand over the next 6-12 months,” Daniel Zhou, an analyst for bond credit rating business Moody’s, said in a research note, as per Reuters.

Authorities have implemented a number of strategies to support the industry in 2022. However, according to the analysts surveyed by Reuters more is still required, which complements Keyu Jin’s sentiment that was mentioned earlier.

The outlook for sales continue to be dim amid economists’ projections for an improvement in property prices in 2023. According to the poll Reuters conducted, new home prices were predicted to increase by 2% year over year in the first half of 2023, but sales were predicted to decline by 15% as a result of persistently weak demand.

Should You Buy Land in China?

So you’re interested in buying land in China, but given the current conditions, it seems like acquiring property in the country only means trouble. However, Keyu Jin gives a less dim outlook on China’s property market.

Although there is immediate pressure on the Chinese economy, a catastrophic housing crisis is not imminent in China, according to the LSE professor. For starters, Chinese households have historically had quite high savings rates, so they should be able to handle interest payments very easily. There were no severely indebted homeowners unable to make their minimum payments, such as the case in the US and Europe in 2008.

Additionally, Keyu Jin pointed to the stifled demand for housing due to factors like rising urbanization and the fact that bachelors are deemed more eligible to marry in a society where marriage is fiercely competitive for men.

A full-scale financial crisis is also unlikely since major banks are owned by the government and thus cannot fail. Foreign creditors to Chinese real estate developers will have to take a significant reduction applied to the value of an asset, but the impact on the global economy is probably not as substantial.

Can a Foreigner Buy Land in China: The Bottom Line

Asia offers many nations with relatively lower financial risk, where you can own freehold property and pay less per square meter and hold a permanent residence visa as well. There could be better locations to buy land in Asia as a foreigner, such as in Malasia, Cambodia, or Vietnam, depending on your individual needs.

In the end, there are many factors to consider if you’re set on purchasing land in China. Yes, you can definitely acquire one if you want to, but do make sure to evaluate your personal needs and weigh the pros and cons of your prospect before committing. Think also of the capability of foreign banks to provide a variety of loans to foreigners in China before making a final leap.

If you’re buying land in China specifically for investment reasons, the Chinese property market can be quite appealing for you, especially if you are an aggressive type of investor with a very high risk tolerance and one who goes against crowd mentality. Also, remember the investing rule buy low, sell high? Well, prices of real estate in China are down so, intuitively, it’s a great market to capitalize on.

Working with financial and legal advisers can help you with the processes of buying land in China as a foreigner. We can work together regarding this.

¿Le duele la indecisión financiera? ¿Quiere invertir con Adam?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.