As some of my more frequent readers know, I have spent more time in Japan and China, than any other country apart from the UK. After 9 years vivir en el extranjero, what are the key mistakes I see expats make when it comes to financial planning, investing and business?

The information below are the most common mistakes I have seen in the expat community in Japan, and how you can mitigate them, alongside answering some FAQs.

Those FAQs include Japanese inheritance tax issues, which concern countless expats living in Japan, and deductions.

This article is long and covers many issues. For those that are time-poor and want to invest in a portable and efficient manner as an expat, please contact me. My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

1. Keeping up with the Jones’

Japan isn’t as obsessed with consumption as Singapore, Hong Kong or Dubai. Despite having more millionaires than any other city on some metrics (although not on a per capita basis), Japanese people aren’t flashy as a generalization.

That doesn’t mean a minority aren’t, or your fellow expats aren’t. Many expats are on big packages, but remember that Tokyo is an expensive city, if you factor in the tax and rents.

$200,000-$500,000 a year might sound like a lot of money to most people, but once you adjust for the taxes, cost of accommodation and sometimes international schooling, it can go quickly if you put your mind to it.

I have seen expats on 250,000-350,000 yen a month ($2,300-$3,300 or so) gradually increase their wealth, and others on $500,000 a year, who are in debt or have zero wealth!

Remember wealth is net income – expenditure x compounded returns. If you spend more than you make, to impress people you don’t even like, you will get into trouble.

So your spending and investment habits make a bigger difference to wealth than your income.

Just ask Mike Tyson, Boris Becker or Michael Jackson- having a super-high salary isn’t an automatic passport to riches!

So use your expat package wisely!

2. Not reviewing inheritance and estate planning

The Japanese Government can potentially tax you significantly if you die. So planning is key if you are going to be a long-term Japanese expat.

This is especially the case considering these rules are always changing.

3. Focusing on local real estate

Real estate doesn’t outperform markets long-term, in most cities and situations. The biggest advantages of real estate are leverage and rental yields, but that has become harder to profit from in Japan.

There used to be a time when capital values were stagnant, but using Airbnb was a simple way to get good rental yields in Tokyo and beyond.

That has gotten harder with new government rules and restrictions. In general, unless you are a professional real estate investor, it is best to use real estate as a home or just rent.

If you are in Japan on a short-term contract, renting makes sense. If you plan to stay for 20-30 years, then buying on a mortgage can be cheaper.

4. Not reviewing your existing investments

Most expats in Japan have expat investments held offshore. Some people are getting good returns, and some are not.

Markets have performed well for 10 years or longer, so your portfolio should be performing well as well.

You should also review your pension situation in your home country, to see if you can limit tax.

For British people, and some other nationalities, there can be significant tax benefits to transferring a pension overseas. This is especially the case for larger pension pots.

At the bottom of this article, I review some of the most popularly sold expat products in the expat community.

Many people make the mistake of never reviewing these policies.

5. Focusing on local solutions for your investments

As somebody who has lived in Japan, I can say that it makes no difference where your advisors lives, in this day and age.

What matters is things like fees, how long you invest for, what you are invested in and how easily you can communicate with your advisor.

Some expats tend to localize too much and get used to overly conservative business norms, like focusing on face-to-face communication.

They meet an advisor at an event, or get recommended to use X and Y company, and don’t consider the alternatives such as an online advisor.

Ultimately an online advisor can do things more quickly, efficiently and cheaply compared to somebody with a big flash $30,000 a month office in Roppongi.

That money comes from clients money. If they are wasting time with endless chit chat, which tends to come hand-in-hand with face-to-face meetings, I doubt they can respond as quickly to your emails and inquiries as somebody who is using the latest technology remotely.

I should know. I used to do things the old-fashioned way and know how inefficient it is compared to the alternative where clients can flick me a message on WhatsApp and I can reply within hours at most.

It also needs to be remembered that local solutions are often more heavily taxes.

6. Giving money to a partner

Speaking about localization, unless your wife (or indeed husband) is financially qualified, there is no reason for them to look after the money.

It makes sense for decisions to be jointly made, or for the wage earner to make those decisions with the help of an advisor.

Giving money to a partner seldom works out well, and causes untold complications if you get divorced.

Many expats, especially men, tend to justify this norm as being a Japanese traditional. It may be a tradition to give money to your wife….that doesn’t make it rational.

7. Leaving money in the bank

The bank pays people 0% interest in Japan. This is lower than inflation and even lower than the US and some other countries.

Most developed countries now have negative real interest rates according to the Economist Magazine’s stats below;

So you are guaranteed to lose money with this tactic. Investing, as opposed to saving money, makes the most sense.

Don’t get me wrong, markets go up and down. However, the long-term has always been good.

As Buffett pointed out 1-2 years ago, $10,000 invested in the S&P in 1941, would be worth around $52m today!

For that matter, $10,000 invested in the early 1990s, would be worth $100,000 today. There is no reason to be afraid of short-term fluctuations in the market, especially if you have government bonds in your portfolio.

8. For business owners – not focusing beyond Japan

As mentioned before, your wealth is net income – expenditure x compounded returns. For business owners, you have a great chance to increase your wealth, compared to a salaried employee.

It isn’t easy in a stagnant market, however, so many Japan-based business-owners need to be enterprising. Many fail in this regard and become insular.

In Singapore and various places in SE Asia, it is normal for people to use their locations as a hub. Business owners, who just live in location A, but target location B or indeed the world, from their laptops.

In Japan, 95%+ of expats seem to be either salaried employees, businesses focused on Japan or those focused on things like inbound tourism – Chinese and other foreign tourists who are coming to Japan on holiday.

What I seldom see in Japan is enterprising people who use Japan as a base for global business.

I have met a few. I met one man who only came to Japan due to his wife being a local. He uses Japan merely as a home – a nice and comfortable place to live.

He works from work, on his laptop, and doesn’t target the local market any more than any other market. Only 2% of his revenue comes from the local market.

Likewise, for me, my location is irrelevant. That isn’t just words, I have gained clients in 27 countries (and 5 continents) in the last 12 months alone, and I haven’t focused on local markets since 2014.

Not since 2014 have I gained the majority of my clients in the country where I was resident. The fact is, we live in completely different times now with the digital age.

This isn’t just affecting business. Even 5-10 years ago, people would have found it incredible, to think that a man relying on Twitter, and being outspent by his political rival 2:1-3:1, could beat his political opponent in the Presidential Elections of 2016!

And then barely a few months ago, an enterprising 28-year-old Democrat, Alexandria Ocasio-Cortez, beat the 4th highest ranking Democrat by using online tools.

That could never have happened in the 1950s, 1980s, 1990s or even 10 years ago when this digital revolution was just getting started.

The digital age is affecting business as much as politics. The business practices from the last 200-300 years are changing. We are in the middle of different age, a digital revolution.

The internet has been around for decades, but only in the last 5-10 years, are we doing more and more things online.

What is the first thing you do now? You Google probably, just as I do! And unlike 15 years ago when we only trusted Amazon and eBay and big companies, these days people rely on online recommendations and the authenticity of a personal brand/relationship.

When I am the buyer, the LAST thing I want to do, is takethe subway and meet you face-to-face. I want credibility through online recommendations.

I want speed and accuracy. 20 online recommendations on LinkedIn matter 10x more to me than how you are dressed, or which office you work from.

Many people feel the same. And yet, perhaps due to Japan’s old-school culture, many long-term expats in Japan still focus on business cards, face-to-face communication, outdated rituals and only focusing on the local market.

I remember I had a chat with a country manager of a major MNC in Japan a few years ago. He told me he doesn’t like to hire expats who have lived in Japan for more than 5 years, or especially 7 years.

The reason? They become less enterprising. More conservative and localized. Try to avoid this trap.

So If you have a business in Japan, focus on the world from your fingertips, not one market with stagnant growth!

Of course, not all businesses can be scaled online. Many can though.

9. Underestimating certain things

Underestimating the cost of living, how much you need to save for retirement and how many years you will live in retirement, are mistakes made by expats in Japan and beyond.

It is easy to get into the habit of wishful thinking, but just remember we are also in changing times when it comes to medical technology.

You may easily have 45 years+ in retirement!

10. Getting stuck in a rut

Especially if you own your own business, executing ideas can be key. Ideas in isolation are irrelevant. Execution matters.

Effective execution becomes harder when you associate with negative and toxic people or get into regular habits.

I found moving from country to country every 2-3 years, and regularly speaking to people in different industries online, can help keep my brain fresh.

Of course, this option isn’t available to everybody, but I have found some expats come to Japan full of energy and vigour, and soon become negative after 3-7 years.

That negativity can indirectly affect sales, business and even spending habits – a lot of the aforementioned bad spending habits is caused by boredom.

11. Putting all your eggs in one basket – especially illiquid assets

Too many expats in Japan, or indeed globally, just invest in their business. Or just in property locally or back home. Or just in stocks.

Realistically, you can’t rely on an illiquid asset in retirement. If you get sick tomorrow, could you sell your house or business?

Especially if your business is highly related to your personal brand, contacts and skills, why would somebody want to buy that business, if you aren’t going to be around?

I have met countless people who have boasted to me about land, property or business valuations but have failed to sell those assets when they most need to.

It makes sense to have assets in relatively liquid stock and bond market portfolios, to limit the risks, whilst still gaining from rising markets long-term.

That doesn’t mean you shouldn’t invest in your business. Reinvesting money into your business can have a great return on investment, especially when your business is small and growing fast.

But again, we are in changing times. So cheap and free techniques can be more effective in 2019, than expensive options.

I know countless people today making more money from cheap Facebook ads than they do from $10,000 promotions.

I also know many people who are able to make more money from writing articles, than they do going to events.

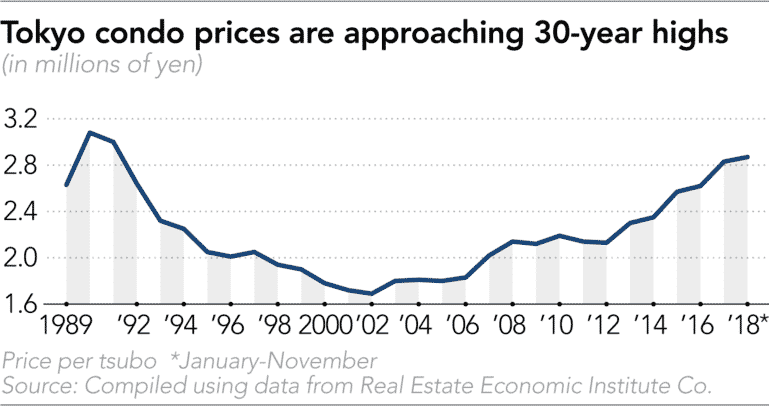

Finally, let’s not forget that illiquid investments like property are amongst the most expensive in the world in Japan.

They are now fast approaching the levels last seen during the Bubble Economy:

12. Comparing yourself to people back home

You probably know people who are earning $40,000 or 40,000GBP in retirement.

I am from the UK, and I personally know countless people who have the Old Age Pension + rental income + a company pension in retirement.

Most people consider such people merely comfortable at best, and certainly not rich.

And yet, $40,000 is the equivalent to $1m benefit, if you were to invest for yourself.

The reason is simple. If you are drawing down a retirement pot, it is only safe to withdraw 4% of a portfolio.

Why do I mention this? Well, many expats console themselves that “I am saving and investing more than my friends back at home”.

That might be true, but remember, they have additional social security benefits.

That isn’t to mention other benefits like healthcare. Many expats have higher cost of living in retirement, due to not paying into the healthcare system.

So investing for expats is more of a necessity, rather than an added bonus. So don’t delude yourself that saving just a bit more than your peers back home, is enough.

13. Not learning the lessons from covid

We have been progressively doing more things online for over two decades now.

“High trust” services like legal and financial services saw a huge growth in online advisors from 2010 until 2019.

Despite this, there are still those people who clung to outdated business ideas.

The pandemic just forced the world to press the fast forward button in more ways than one.

Covid showed that online businesses with quicker and cheaper processes are better able to adapt to unexpected events.

They are also safer because traditional businesses are more likely to go bust due to cashflow-related reasons.

All those fancy office spaces comes out of your portfolio, increases your risks.

Moreover, one day you will leave Japan. So, where your advisor or advisory company is based is irrelevant.

I personally have clients in over 100 countries for this very reason.

Frequently asked questions (FAQS)

This section will answer some FAQs I am asked by expats – especially those which weren’t addressed above:

Should you invest in Japanese Yen?

Unless you are actually going to jubilarse en Japón, saving and investing in Yen doesn’t always make sense.

The Japanese Stock Market is, on many measures, riskier than US markets and something more diversified like MSCI World.

If you don’t know where you want to retire, focusing on USD- based investments can make sense.

If I invest overseas, whilst living in Japan, what if I leave?

Most of the investments that can be utilized are portable and thus can be transferred.

Do most DIY platforms accept for Japan?

Some do, and some don’t, and the rules are always changing. It is always best to check with the platforms you are interested in setting up.

Otherwise, ask your advisor for help

Do you have clients in Japan?

Of course.

What about inheritance tax in Japan?

Inheritance taxes can be high in Japan – up to 55% in fact! So if you die whilst living in Japan, this can hit you hard.

The rules are currently being reviewed, but you shouldn’t rely on changing rules.

You should always “plan for the worst, but hope for the best”. A good advisor can help you set up quality options for estate planning and inheritance tax reductions.

How to calculate inheritance tax, is complicated, as it depends on several factors including what visa you are on, how many years you have lived in Japan and the location of your assets.

What is Judsho?

It is understood to be the place where you are resident for tax purposes. Before 2013, if a person’s “judsho” was outside of Japan, they were only liable for inheritance tax on assets held inside Japan.

That has changed, which means that there is a “worldwide inheritance tax” system in Japan.

Those laws were changed in 2017, to ensure that only those that have lived in Japan for more than 10 years would be hit by this worldwide inheritance tax rate.

In 2018, that was further changed to 5 years, as a trail.

What are the inheritance tax rates in Japan?

The rates son:

• Up to ¥10 million ………………… 10%

• ¥10 million – ¥30 million ……… 15%

• ¥30 million – ¥50 million ……… 20%

• ¥50 million – ¥100 million ……. 30%

• ¥100 million – ¥200 million ….. 40%

• ¥200 million – ¥300 million ….. 45%

• ¥300 million – ¥600 million ….. 50%

• Over ¥600 million ……………….. 55%

Are there many exemptions from inheritance tax?

The following exemptions apply:

- ¥5 million retirement allowance per each heir

- ¥5 million life insurance proceeds per each heir

- Various non profit exemptions

- Foreign tax credits

There are other possible exemptions as well, including if the heir has disabilities.

Real estate and local businesses also have deductions.

When do people need to pay these taxes?

You need to pay these taxes within 10 months of the death.

What things are never likely to change?

Japanese-sourced assets are always likely to be taxed. As Japan tries to attract more foreign talent, due to the falling population, foreign investments may continue to be liberalized.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.