International dividend tax for expats refers to the taxes imposed on dividend income earned from foreign investments while living in another country.

It typically includes dividend withholding tax in the source country and possible additional tax in the expat’s country of tax residence.

Este artículo trata:

- How are overseas dividends taxed?

- Do I have to pay taxes on foreign dividends?

- Is there withholding tax on foreign dividends?

- Is there double taxation on dividends?

Principales conclusiones:

- Foreign dividends are often taxed at the source before you receive them.

- Your tax residency usually determines if additional tax is owed.

- Tax treaties can significantly reduce or eliminate double taxation.

- Proper investment and residency planning can lower dividend taxes legally.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

What exactly is a dividend tax?

A dividend tax is a tax on income received when a company distributes profits to its shareholders.

Dividendos are commonly paid by publicly traded stocks, exchange-traded funds (ETFs), mutual funds, and real estate investment trusts (REITs).

Dividend taxes apply to the cash or equivalent value received by the investor and are calculated separately from capital gains.

The applicable tax rate and treatment vary based on the tax rules governing dividend income in the relevant jurisdiction.

What is a preferential rate?

A preferential rate is a lower tax rate applied to certain types of dividend income instead of the standard ordinary income rate.

Many countries offer preferential rates for qualified dividends or dividends meeting specific criteria, such as being paid by publicly listed companies, held for a minimum period, or coming from certain jurisdictions.

For expats, dividends taxed at a preferential rate can significantly reduce overall tax liability compared with ordinary income taxation.

What is original income?

Ordinary income refers to dividends that are taxed at the same rate as regular income, such as salaries, business profits, or interest income.

These dividends do not qualify for any special reduced rates and are typically subject to the full progressive tax rates of the country of tax residence.

Classifying dividends as ordinary income can result in a higher tax burden compared with preferentially taxed dividends.

Who is exempt from dividend tax?

Investors are exempt from dividend tax if their income, residency status, or investment structure falls under specific legal exemptions.

Dividend tax exemptions may apply to:

- Investors whose income is below taxable thresholds

- Residents of territorial-tax countries that do not tax foreign dividends

- Dividends held within qualifying retirement or pension accounts

- Investors protected by favorable tax treaty provisions

How are international dividends taxed?

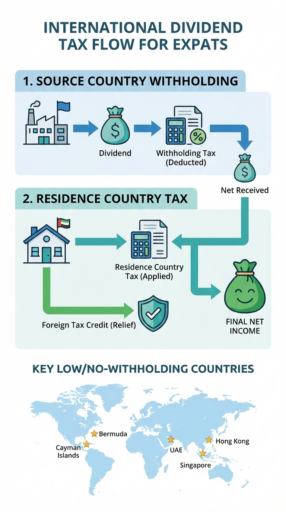

International dividends are typically taxed by both the country where the dividend originates and the country where the investor is tax resident.

1. Source-country taxation

The country where the company, fund, or ETF is incorporated usually taxes dividends at the point of payment.

This tax is applied automatically as withholding tax, meaning it is deducted before the dividend reaches the investor.

Withholding tax rates vary widely by country and are often reduced when a tax treaty exists between the source country and the investor’s country of residence.

2. Residence-country taxation

Your country of tax residence may also tax dividend income as part of your worldwide income, even if tax was already withheld at the source.

This second layer of taxation depends on local tax laws and how dividends are classified (ordinary income vs. preferential rates).

Para evitar doble imposición, many countries allow foreign tax credits, exemptions, or exclusions, provided the dividend income is properly reported.

Most countries rely on double tax treaties to coordinate these two layers of taxation, ensuring dividends are not taxed twice at full rates while still preserving each country’s taxing rights.

What is the tax rate for foreign dividends?

Source‑country withholding tax rates alone can range from 0% up to about 44% before treaty relief, and even after treaties are applied many rates still fall between roughly 5% and 15%.

Tax on foreign dividends often varies widely.

Source‑country withholding tax examples

Different countries impose different standard withholding tax rates on dividends paid to non‑residents before any treaty reduction:

- Reino Unido: often 0% (no withholding tax)

- Grecia: about 5%

- Irlanda: around 25%

- Suiza: around 35%

- Many jurisdictions: typically ~10%–20%

- At the high end: some places can exceed typical ranges (e.g., up to ~44% in specific jurisdictions) before treaty relief

Tax treaties between countries often reduce these standard rates for residents of treaty partners to lower levels, commonly in the ~5%–15% range, if you submit the proper documentation.

Residence‑country dividend tax and credits

Even after source withholding, your country of tax residence might tax the same dividend as part of your worldwide income, with rates that depend on local laws.

Many jurisdictions grant foreign tax credits for withholding paid abroad, which can offset or eliminate the additional residence tax owed.

Because both source withholding and residence taxation can apply, expats may end up paying only one, the other, or both taxes with credits reducing the overall burden.

How to avoid dividend withholding tax legally

You can reduce dividend withholding tax by investing in treaty-friendly countries or using accumulation funds that reinvest dividends instead of distributing them.

Strategies include:

1. Invest in countries with favorable tax treaties: This can lower source-country withholding rates for residents of treaty partners.

2. Use tax-efficient ETFs domiciled in treaty-friendly jurisdictions: These funds often minimize withholding at the source.

3. Claim treaty reductions through proper documentation: Submit the required forms to the source country to benefit from reduced rates.

4. Choose accumulation funds instead of distributing funds: Dividends are reinvested automatically, potentially avoiding immediate withholding.

5. Relocate to a low- or no-tax country: Some jurisdictions do not tax foreign-sourced dividends, reducing overall tax liability.

Tax avoidance is illegal, but legally minimizing taxes through planning, treaty use, and investment structuring is a lawful and widely accepted part of professional gestión de patrimonios.

Which countries have no withholding tax on dividends?

Singapore is among the list of countries with no withholding tax on dividends paid to foreign investors.

Other countries included are:

- Hong Kong

- Emiratos Árabes Unidos

- Islas Caimán

- Bermudas

- Bahréin

However, even if the source country does not withhold tax, your country of tax residence may still tax the dividends according to its local rules.

Dividend Tax vs Capital Gains Tax for Expats

For expats, dividends are generally taxed when received, whereas capital gains are taxed only when the underlying assets are sold.

Las principales diferencias son:

- Dividends taxed immediately: Most countries treat dividend income as taxable in the year it is paid, even if the cash is reinvested.

- Capital gains taxed on realization: Taxes on profits from the sale of assets typically apply only when the investment is sold, not while it grows.

- Rates often differ: Many jurisdictions tax dividends at higher rates than long-term capital gains, making growth-focused investments (like accumulation ETFs) more tax-efficient for expats.

- Possible exemptions: Some countries fully exempt capital gains on foreign assets, offering additional planificación fiscal opportunities.

Conclusión

International dividend tax can feel complex, but it’s also an opportunity.

By understanding how different countries tax dividends, using treaties wisely, and structuring inversiones strategically, expats can turn cross-border challenges into advantages.

Ultimately, the key is not just minimizing taxes, but aligning your investment strategy with your lifestyle and residency choices, creating a system where your wealth grows efficiently across borders.

Preguntas frecuentes

Do US expats get double taxed?

Yes, US expats are taxed on worldwide income, including dividends, but foreign tax credits and tax treaties usually prevent them from paying tax twice.

Are US dividends taxable to non-residents?

Yes. US dividends are generally taxable to non-residents through withholding tax, typically at 30%, unless reduced by a tax treaty.

Do expats pay capital gains tax?

Expats pay capital gains tax if their country of tax residence taxes worldwide gains; some countries tax only local gains, while others do not tax capital gains at all.

How to declare foreign dividend income?

To declare foreign dividend income, report it on your annual tax return in your country of tax residence, provide documentation of any withholding tax paid abroad, and complete any required foreign income schedules or disclosures.

Ensure all dividends are included to avoid penalties, even if taxes were already withheld in the source country.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.