What are the easiest places to get residency? That will be the topic of today’s article.

This list might change over time as more countries open up nomad visas in the wake of the global pandemic.

If you are looking to invest in expat-specialised solutions or have any questions, don’t hesitate to póngase en contacto conmigo o utiliza la función WhatsApp que aparece a continuación.

It is usually better to sort out residencies and tax-efficient investments at the same time, because many of the opportunities available in your home country or current jurisdiction won’t be available in the next destination.

Setting up something which is internationally portable makes sense.

Introducción

The unstable economic and political situation in different countries forces people to look for ways to protect their families and savings.

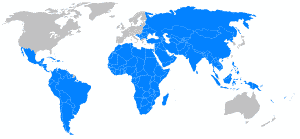

One of them is to obtain citizenship or a residence permit (residence permit) in another country. In response to the growing demand, governments are developing programs for obtaining a residence permit or citizenship by investment. We have researched and created a list of the leader countries of the 2020, where getting residency is relatively easy.

The leader in the ranking is Malta with the Individual Investor Program. It allows you to obtain European citizenship for investments of EUR 1 million. The second place is shared by the programs of Cyprus and Austria. Citizenship of these three states gives the right to live and work in any EU country. In third place is the new program of Montenegro.

The low cost of participation and the ability to travel without a visa in the Schengen area, Great Britain, China and other countries are an advantage for investor programs.

The programs were analyzed in 13 countries according to the following criteria: reputation, quality of life, visa-free entry, application processing time and quality of information processing, compliance, investment requirements, the need to live in the country, the possibility of moving to other countries, the need to visit the country, the transparency of the procedure.

Global ranking of residence permit programs by investment 2020

The leaders of the rating of residence permits for investments, like a year ago, were Portugal and Italy. All three countries received top marks in terms of visa-free travel to other countries and good scores for the quality of life and the country’s reputation.

In terms of investment requirements, the best indicators are in Austria and Hong Kong. As for the total cost of participation in the program, the most favorable conditions are offered by programs in Thailand, Malaysia, Greece and Latvia.

The 2020 study assessed 23 countries on 10 indicators: reputation, quality of life, taxation, visa-free travel to other countries, application processing time and quality of information processing, compliance, investment requirements, total costs, timing of citizenship, and requirements for obtaining citizenship.

Countries such as Portugal, Greece, Spain do not require investors to permanently reside in their territory, or they impose small requirements for visiting. Others – Austria, Switzerland or the United Kingdom – are strictly committed to meeting participants’ residency requirements. Each program has its own terms of consideration of applications – from several weeks to several years and different conditions for obtaining citizenship.

This was a short introduction for you, to have a general imagination about the countries that allow you to easily become their citizen and what you have to do for that.

So, to get residence in a very fast way there are two options, now let’s discuss these main options, which can be done by origin and by investment.

Where is the easiest place to obtain citizenship by origin in 2020?

A number of countries like the USA issue a passport at birth (Jus soli / soil right). Others, like most of Europe, allow parents to inherit their citizenship status if they were citizens of where you were born (Jus sanguinis / blood law). And some of them apply both principles. This is true, for example, in Australia.

There are several states in the world that go even further and allow you to inherit through your grandparents or even great-grandfathers. As a result, after consulting with an immigration agent, many people find themselves pleasantly surprised to be able to obtain a second passport in this way. Here are some examples:

Citizenship by origin in Ireland

You can get it through your (great) grandmother / (great) grandfather who was born in Ireland. This right does not depend on when or where you were born. The presence of such ancestors allows you to get an Irish passport almost instantly, saving yourself from many years of naturalization after obtaining a residence permit in Ireland, for example, through a subsidy of 500,000 euros.

Citizenship by origin in Italy

Italy is unique in that its status is passed down from ancestor to child with no limit on the number of generations separating them, provided that none of the ancestors ever gave up their Italian passport.

This means that you can inherit it from your grandparents, great-grandfathers or great-grandmothers, or even more distant ancestors who lived 5 generations ago – as long as none of the ancestors along the way gave up their Italian passport.

In this context, it should be remembered that some of them only allow one (that is, prohibit dual citizenship), which could have forced one of the candidate’s ancestors to renounce his Italian. Therefore, thorough research should be carried out before submitting an application in order to avoid unpleasant surprises.

Citizenship by origin in Poland

If any of your ancestors lived in Poland after it became independent in 1918, with Polish citizenship, you have the right to Polish. As with Italy, if any of your ancestors in the family abandoned their Polish, you will no longer be eligible.

Citizenship by descent in Hungary

In 2011, the Hungarian authorities passed a new Hungarian Citizenship Act, allowing the descendants of any person who was a Hungarian citizen before 1920 or between 1941 and 1945 to exercise the right of descent. This is true for residents of areas that were once part of Hungary, but are now part of neighbors such as Slovakia and Romania.

But before applying for a passport, you should make sure of your ability to demonstrate a high level of proficiency in the Hungarian language, without which Hungarian citizenship cannot be obtained. The same is true for persons undergoing naturalization after obtaining a residence permit in Hungary on one basis or another, for example, after opening a local business.

Citizenship by descent for the descendants of persecuted persons

People with Jewish roots from the Sephardic diaspora can quickly and easily obtain Spanish citizenship. She offered her descendants to the Jews expelled from Spain in 1492.

According to experts, 2.2 million people will be able to take advantage of this opportunity. To become one of them, you will need to prove your connection with the Sephardic community. Portugal has a similar program, where applicants are required to prove a link with the Portuguese Sephardic diaspora.

A number of European states offer the descendants of victims of state repression and other persecution. Examples are:

- If you can prove that you are descended from the Sephardic Jewish communities expelled from Spain in 1492, then you are eligible for Spanish citizenship.

- Likewise, if you prove that you are a descendant of the Portuguese Sephardic Jewish community expelled by the Portuguese Inquisition, then you are entitled to Portuguese citizenship and a very valuable EU passport.

- Descendants of those who were persecuted by the Nazis for political, racial, sexual or religious reasons during Hitler’s dictatorship may be eligible for German citizenship.

Where is the easiest place to get citizenship by investment in 2020?

Many jurisdictions these days offer legal and very fast citizenship (in some cases, the speed of its registration reaches only one and a half months) in exchange for investment in their economy.

These investments range from returnable investments in local businesses and real estate purchases to making a contribution to a government fund without a right of repayment. Below is a small list of options for issuing an investment passport.

Cyprus Citizenship by Investment

When considering applying for citizenship by investment in Cyprus, remember that this jurisdiction has set the highest starting level for investment in a passport. The minimum investment amount is € 2 million.

The huge advantage of this program is that you can invest the required total amount in a wide variety of assets (or a combination of them) at your discretion. The main thing is that the funds are invested in the Cyprus economy.

It is available when buying real estate, bonds or stocks, as well as when starting a business. These investments can provide income for living as well as capital gains. No donation is required to participate in this program.

Antigua and Barbuda Citizenship by Investment

A one-time non-refundable endowment donation to the Antigua National Development Fund for a minimum amount of US $ 100,000 allows a law-abiding foreigner to qualify for a Caribbean passport.

The donation amount for a family of five or more is $125,000. You will also need to pay a processing fee of $25,000 for a family of four and an additional $15,000 for each dependent on top of that.

This program gives you and your family full status. An Antigua and Barbuda passport offers visa-free travel to nearly 13 dozen destinations, including all Schengen members, the UK and most of South America.

At the same time, it should soon be possible to obtain a passport for a subsidy to the University Development Fund with a bonus in the form of one year of free university studies.

Citizenship by Investment Saint Kitts and Nevis

Participants in this program are encouraged to invest in real estate in Saint Kitts and Nevis. To obtain a passport, you need to invest in a pre-approved development project of more than $200,000 (with the option to sell the asset after 7 years) or more than $400,000 (with the option to sell the asset after 5 years) for each main applicant.

You also need to pay a processing fee of $7,500 for the main applicant and $4,000 for each dependent over 16. There is also a one-time post-approval government fee of $35,047 for the main applicant, $20,047 for the spouse and $10,047 for all other dependents of the main applicant, regardless of age.

Where is the easiest place to get citizenship in 2020? – Residency of the country, and a few years later

Without the required background or the large investment required for the first two options described above, post-residency naturalization is the easiest way to become a citizen.

Residency is generally much easier to obtain than citizenship, and in many cases it can be converted to citizen status after a certain period (each has different requirements) of maintaining the residency.

In addition to living for a certain period, there may be other requirements, such as taking a local language proficiency test. But first you need to figure out how to get a residence. Below are some options to consider.

Intercountry agreements

These are agreements between states that allow citizens of several of them to live and work freely or more easily on each other’s territory. After a certain period of residence, you can become a citizen. Examples of such agreements are:

- Scandinavian agreement between Denmark, Finland, Iceland, Norway and Sweden.

- The European Economic Agreement (EEA) is an agreement between all 27 EU countries, Switzerland, Iceland, Liechtenstein and Norway. Citizens can live, work and move freely in the EEA area.

- Trans-Tasmanian Agreement between Australia and New Zealand that allows citizens to live and work freely in each other’s territory.

- MERCOSUR Agreement (Mercado Comu’n del Cono Sur – MERCOSUR), which makes it easier for citizens of South American states to obtain residency.

Residence by investment

Governments around the world offer “golden visas” to foreigners who invest in their economies. Here is a selection of such proposals.

Visado de oro para Portugal

Invest over 350,000 euros in old Portuguese real estate (over 3 decades) or research activities, visit Portugal once a year for several weeks for 5 years, take Portuguese lessons and a beautiful Portuguese passport can be yours.

Spain Golden Visa

Invest 500,000 euros in real estate in Spain and you will be able to apply for a Spanish residence permit. After 10 years of residence and proof of knowledge of basic Spanish, you can apply for a passport and obtain Spanish citizenship. There are also other alternatives for investors in Spanish “golden visas” such as buying shares or making a bank deposit of € 1,000,000 or more or investing in government bonds for € 2,000,000.

Cyprus Golden Visa

Purchase property in Cyprus for € 300,000 or more, transfer € 30,000 to a local bank account and be able to apply for Cyprus Investor Residency. The process is very simple and fast (it takes about 1 month to obtain a residence permit) and all procedures can be arranged from your country of residence. Once you have a Cyprus Golden Visa, you will need to visit Cyprus for one day, every two years, to maintain your residence permit.

Grecia Golden Visa

It is possible to obtain a “golden visa” for Greece through investments in real estate in Greece in the amount of 250 thousand euros or more. This is one of the lowest investment requirements for an investment residence in Europe. Acquisition of one or several assets at once is allowed.

Visas for financially self-sufficient persons

Many countries offer residence permits if the applicant can prove that they have a source of income to cover the costs of living in the host country. Your income can be, for example, from investments, offshore business or pension.

Residence permits for financially self-sufficient residents from this group have many different names, and often obtaining them requires the fulfillment of a number of non-standard requirements and compliance with unique restrictions. Here are some examples:

- Proof of monthly income from reliable sources of 750 for the main applicant and 150 for each family member is sufficient to qualify for a residence permit in Nicaragua.

- Spain offers residency if you can show an annual income of € 25,920 plus € 6,480 for each dependent. The applicant is issued a renewable visa for one year. At the same time, by extending the visa for five years, you can apply for a permanent residence permit in Spain.

- By earning at least € 800 a month as a freelancer, you might be eligible for a Freiberufler visa, which gives you the right to live and work in Germany.

- Having a stable source of income in the amount of 2 thousand euros per month and providing proof of no previous convictions, you can apply for a residence permit in Greece for financially independent persons.

Retirement visas

Many countries around the world are opening their doors to retirees, and often the minimum age for retirement is quite low there. For example, in some countries, foreigners can retire at the age of over 45.

To be eligible for a retiree visa, you usually must prove that you have regular income from a pension or investment, or other type of passive income. Here are examples of retirement visas available to you:

- Nicaragua – Proof of $ 600 monthly income (and $ 150 per household member) will be required. In this case, your age must be over 45 years old.

- Honduras – 600 monthly income will suffice.

- Costa Rica – You will need to prove that you have a monthly income of 1,000 (you must prove that this income will come on a monthly basis throughout your life).

- Guatemala – An income of 1,000 per month will be sufficient to obtain a retiree visa.

- Thailand – You will need to prove that you have a monthly income of 2,000 (or you have a deposit account with an amount of 25,000). Applicants must be over 50 years old. At the same time, the country has another interesting alternative in the form of an “elite visa”.

- Aruba – Applicants must be over 55 years of age and have a monthly income of 2,300.

- Malaysia – Prove income of 2,500 or more per month, show assets of around 83,000 and Malaysian retirement visa is yours. And yes, the applicant must be over 50 years old. Wealthy pensioners and workers approaching retirement age are advised to wait for the launch of the program in the country.

- Spain – Proof of a monthly income of 2,600 (and 650 for each additional family member) is required to obtain a retiree visa.

- Vanuatu – Applicants must have a monthly income of over 2,800 (this amount must be transferred to a commercial bank in Vanuatu).

- UK – Proof of 2,900 monthly income is required. Applicants must be over 60 years of age and nationals of a country that has a valid pension agreement with the UK.

Visas for talented athletes or artists, experienced professionals and businessmen creating innovative startups

Many countries have immigration schemes aimed at highly qualified specialists in certain areas of IT, science and medicine. At the same time, in a number of countries, such as Australia, there is even a list of skills in demand.

If your profession is on this list and you meet other requirements (for example, knowledge of English), you are eligible for a resident visa. The professions required range from bakers to botanists and architects.

Residency for talented athletes or artists is issued by the authorities of the Principality of Andorra. Read about how to apply for Andorra Passive Residency, if you are one of those talented people, in our guide.

Experienced professionals and businessmen creating innovative startups are also welcome in Cyprus, where they can apply for a startup visa.

Conclusión

As you can conclude from the information presented above, there are many easy and fast ways to obtain citizenship status. Family ties, investment and naturalization through long-term residence are three of the easiest ways to achieve this goal.

However, the article describes only a few immigration schemes. In case you are intended to get another citizenship, it’s better to contact experts for advice to see additional options. Professionals will effectively help you find the best route based on your needs and capabilities.

Lecturas complementarias

The article below speaks about:

- Is $1m enough to retire in the UK, the US, Canada and most developed countries these days?

- How about if you have $5m or $10m invested or saved up – is it enough for a luxury retirement?

- Is $300,000 enough to retire in a place like Thailand, Cambodia and other countries in South East Asia?

- How much do you need to retire early and is it a good idea to begin with?

Click below to read more.