When people talk about the desire to obtain a second citizenship, they often mean the citizenship of the United States or the EU countries. However, these countries are in no hurry to hand out passports. The procedure for obtaining citizenship through naturalization lasts 10-15 years.

Wealthy people who participate in residence permit investment programs sometimes have an advantage – they are allowed to obtain citizenship faster than by other options.

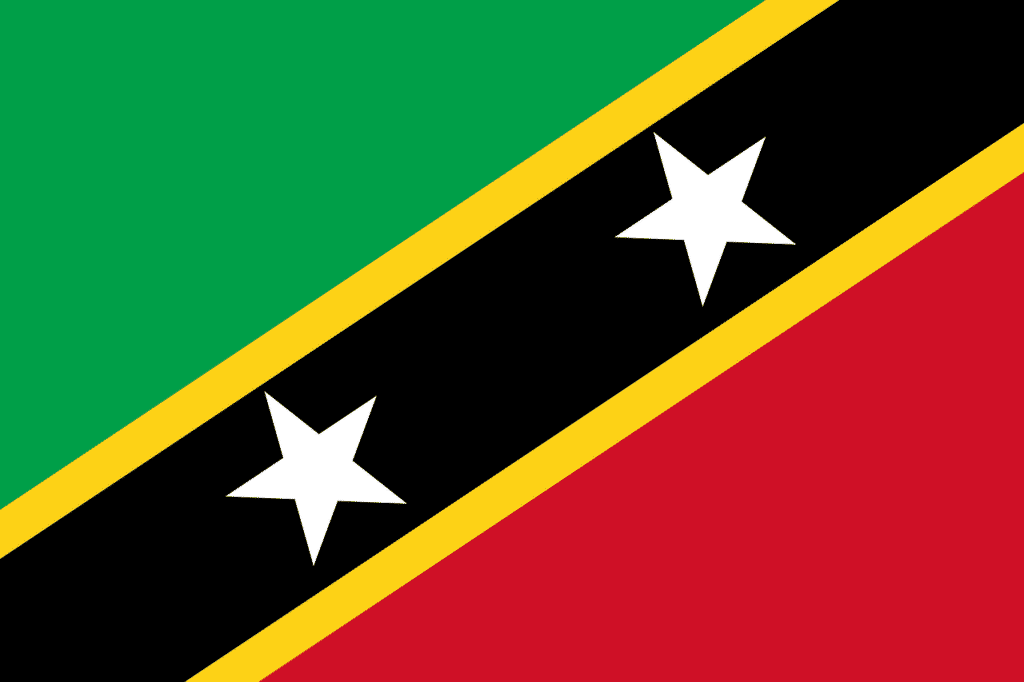

Therefore, in this article we will discuss the whole process of obtaining residency or citizenship in St Kitts and Nevis, which is also a popular expat place. We have talked a lot about how to get citizenship in different countries, some of the options are naturalization or marriage, but we will be mainly focused on one of the most possible options – investments.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions. Often the best time to consider your investment situation is when you are changing your overall financial plans.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

Interesting facts about Saint Kitts and Nevis

Only 51,000 people live on the two islands of Saint Kitts and Nevis. The state is located east of Cuba and the Dominican Republic.

Saint Kitts and Nevis was a British colony until 1983. The country’s legal system is based on English law. The taxation system allows you to optimize tax payments. There are no taxes on gift, inheritance, capital gains, and dividends in the country.

The country is part of the British Commonwealth, and its formal ruler is the British Queen. Communicate in the country in English, and the main currency is the East Caribbean dollar. For reference, 1 USD = 2.7 East Caribbean dollars.

Saint Kitts and Nevis is a combination of tropical nature, beautiful beaches and respectability. The capital Basseterre is the center of business, culture and fashion. Many Hollywood stars come here to relax and go shopping.

The country’s economy is based on tourism and agriculture. There are many fashionable hotels and a well-developed tourist infrastructure. The islands cultivate mainly sugar cane, coffee, and cotton.

Opportunities you will get from Saint Kitts and Nevis passport

The Saint Kitts and Nevis Citizenship Investment Program is one of the most reputable in the world. It has been in operation since 1984 and is the oldest program in the Caribbean. The Saint Kitts and Nevis passport is highly regarded among entrepreneurs and wealthy people.

Citizenship of Saint Kitts and Nevis allows you to visit more than 150 countries without a visa, including the countries of the Schengen area, Great Britain. A citizen of Saint Kitts and Nevis can get a tourist visa to the United States for 10 years in 2 – 3 weeks.

The quickest and easiest way to obtain citizenship of Saint Kitts and Nevis by investment is a special state program. An investor invests from $ 150,000 in the country’s economy and, on average, gets a passport in 4 months.

Obtaining a residence permit and citizenship in the state of Saint Kitts and Nevis by investment is the oldest, simplest and most pleasant passport program in the world. It is over 30 years old (created in 1984). Its effectiveness has been proven many times over.

Over the years of the investment program, the country has developed a strong and stable economy, which has become an excellent platform for international business. Saint Kitts and Nevis has a number of important advantages:

- It is not necessary to visit Saint Kitts and Nevis to obtain a passport and residence permit. Documents are simply sent by mail. There is also no need to reside in this country.

- You can visit the countries of the Schengen Union, as well as Switzerland, Great Britain, Ireland and Cyprus without a visa. In total, there are more than 120 states.

- Visas to the United States and Canada for citizens of Saint Kitts and Nevis are issued immediately for ten years. A visa to Australia is issued online.

- You can get a Saint Kitts and Nevis passport in just six months.

- The island nation is known for its low tax rates, stable economy and politics. All transactions are performed with minimal risks. The income of foreign companies is not taxed.

- The state guarantees confidentiality to the recipients of the second citizenship and does not disclose the real place of residence of the resident.

- Citizenship is issued for life, and the passport is changed every ten years. A small state fee is required to change the document.

- The right to conduct business and work in the country is granted. However, holders of second citizenship cannot vote in local parliamentary and other elections.

- Saint Kitts and Nevis is one of the offshore jurisdictions that provides very favorable conditions for doing business.

There are no restrictions to obtain citizenship of Saint Kitts and Nevis: residents of any country and representatives of any nationality can use the investment program.

Two investment ways to get St Kitts and Nevis passport

The government of the country freely issues residence permits to residents of other countries and their families in exchange for investments in the economy of Saint Kitts and Nevis. Family members are spouses, minor children (joint or from previous marriages), elderly parents over the age of 65, adult children under 25, provided that they are unmarried and do not have employment (usually students).

There are two ways to get a residence permit in Saint Kitts and Nevis for investments:

Non-refundable donation to the Sugar Industry Diversification Fund

To boost the economy, the government established the Sugar Industry Diversification Foundation (SIDF) in 2006. Initial goals: to support sugar plantation workers who are out of work, and to research and fund other industries that may replace sugar production. For a long time, the processing of cane was the only source of income for the state.

The fund’s budget is formed from investments that are paid by persons wishing to obtain citizenship:

- $ 250,000 – the amount of investment for one applicant.

- $ 300,000 for a family of up to four people (including spouses and minor children).

- $ 350,000 – for five family members.

- $ 450,000 – for seven people.

- $ 50,000 for each additional family member, as well as for each dependent over the age of 18.

Additionally, a state fee is charged for verifying the authenticity of documents and the reliability of recipients of citizenship: $ 7,500 for the applicant and $ 4000 for each member of his family. A licensed government agency and an independent international college of detectives carry out verification.

Investments are transferred to the Diversification Fund after verification of documents and approval of the application. In this case, the applicant receives a letter confirming that the government of the country is ready to accept new citizens.

Citizenship to property owners

According to the country’s parliament, tourism is the main hope of the economy of the two exotic islands. Now this industry is actively developing: an excellent infrastructure is being created, a high level of service is maintained, and the coast is being built up.

Tourism in the country can be supported by investing in luxury resort real estate (there is practically no other one there). For a contribution of $ 400,000, the applicant receives citizenship and real estate on the coast, which can be rented to tourists or used as a summer residence.

By the way, the Sugar Industry Diversification Fund also supports tourism: a third of its budget is spent on these purposes. Most of it goes to construction, the rest is spent on the international promotion of the islands (advertising in airports, airplanes, on other sites). The emphasis is on excellent conditions for golf and ecotourism.

An additional government fee is paid for the consideration of the application:

- $ 50,000 per applicant.

- $ 25,000 for a spouse and each of the children (siblings or adoptive) under the age of 18.

- $ 50,000 for each unmarried and unemployed child over 18 and for parents over 65.

The last part of the amount will go to pay the state fee: $ 7,500 for the applicant and $ 4,000 for each family member over 16 years old.

$ 400,000 is the minimum donation. Few people manage to keep within this framework, because real estate on the island is much more expensive. However, you can find partners with whom you can actually make a joint contribution and enter into fractional ownership of real estate. Most of the island’s developers offer this service and allocate the “presence” time between the owners according to the size of the share.

Before sending an application for a second citizenship, the investor must conclude an agreement with the developer and transfer to his account a first installment of at least 10% of the total value of the property. Next, the application is sent for verification. If approved, the applicant must transfer the remaining amount to the developer’s account.

It is important to take into account the fact that the purchase of land will not be considered an investment. The only exception to this rule is the Christophe Harbor coastal area, where the minimum land value is $ 700,000.

Since 2012, amendments have appeared in the law on citizenship by investment: after five years from the date of construction, the property can be sold, the second owner can also apply for a second citizenship. Previously, spa houses could be used to obtain a residence permit only once. In this way, the first owner can retain citizenship and get his investment back.

Please note: the purchase of real estate includes its full service over the next five years. This includes the following: insurance, property taxes, resort club memberships. You can delegate these payments to a developer company: most organizations provide property management services (rent a house and provide it with proper care). However, the built housing cannot be launched. This requirement is specified in the contract.

In addition to real estate, a state fee is paid:

- USD 35,000 for the main applicant;

- USD 20,000 per spouse;

- USD 40,000 for a brother / sister;

- USD 10,000 for each dependent applicant.

The price of Saint Kitts and Nevis citizenship depends on the number of family members included in the application, as well as on the choice of investment path. The procedure for obtaining citizenship is simple and transparent. The terms for consideration of documents are on average 3-4 months.

Required documents

To speed up obtaining citizenship for the applicant and each family member, you need to collect the following package of documents:

- Citizenship Application.

- Photo, signature and certificate for her.

- Medical certificates with HIV test results. The test must be carried out no earlier than three months before the submission of documents.

- Notary-certified copies of all pages of internal and foreign passports (for adults) or birth certificates (for children).

- Notarized copies of certificates of marriage or divorce, certificates of name change, military cards.

- Six standard color passport photographs taken no earlier than six months prior to application.

- Police clearance certificates (Ministry of Internal Affairs) of the country in which the applicant and his family live.

The main applicant is required to present an extended package of documents:

- For SIDF (Diversification Fund) investors, a deposit application form and a copy of the escrow agreement are required.

- Real estate owners need an original purchase agreement, a copy of the escrow agreement, proof of transfer of title to the property and transfer of funds to the developer’s escrow account.

- Original letter of recommendation from the bank, received no earlier than a month ago.

- Original letter of recommendation from the applicant’s last place of work, written no earlier than six months ago.

- Confirmation of residence at the address indicated in the application (utility bills are suitable).

Taxation in Saint Kitts and Nevis

Taxation of individuals

Saint Kitts and Nevis has no direct taxes, income tax, capital gains tax, inheritance and gift taxes. Capital gains tax of 20% is imposed only on profits derived from transactions with assets located in Saint Kitts and Nevis less than 1 year from the date of acquisition.

To work in Saint Kitts and Nevis, foreign nationals need to obtain a permit, the annual cost of which is XCD 1,500 (USD 635). Employees and their employers must pay social security contributions to the state budget. Since January 2011, employees with an annual income from XCD 1,000 to XCD 6,500 pay 3.5%, from XCD 6,500 to XCD 8,000 – 10% and over XCD 8,000 – 12%.

Real estate taxation

When buying real estate, 0.2% of the value of the property is paid to the Assurance Fund to ensure the transfer of ownership. About 2.5% must be paid to a lawyer for the certification of documents on the transfer of ownership. Preparation of a plot plan costs about USD 300. Stamp duty is 12% of the contract value of the property.

The annual property tax in Saint Kitts and Nevis is 0.2% of the market value. Any rental income from real estate is tax deductible. No capital gains tax is levied on the sale of real estate. When buying land by foreigners, there is a fee of 10% of the value of the acquired land.

Preguntas frecuentes

Question: Which option is better? Real estate investment or fund donation?

Answer: It is better to invest in a fund, as it is faster and in the end it may turn out to be cheaper. By law, the option of a non-returnable investment in the fund requires a minimum of USD 150,000, and the option through real estate – a minimum of USD 400,000.

Please note that regardless of price ranges, all properties in this state are slightly overvalued compared to similar properties in other Caribbean countries. This is due to the Citizenship by Investment program, which artificially inflated real estate prices in Saint Kitts and Nevis.

You need to understand that with an average cost per square meter of about 10,000, you will not spend 400,000, but much more. If we are talking about good villas, then the prices start from 2 million and more. If you apply for citizenship through the option of buying real estate, then another 10% of the cost of servicing the transaction and taxes on the purchase are added.

Also in the real estate option, a non-refundable government registration fee of USD 35,000 for the main applicant, 20,000 for the spouse and 10,000 for each family member is added to the total cost. The cost of legal services for obtaining citizenship when buying real estate is the same as for the donation option to the Sugar Fund, but the total costs of the program when buying real estate will be higher.

Moreover, the property cannot be resold for 5 years. Taking into account the combination of all these factors, the majority of clients for obtaining citizenship of Saint Kitts and Nevis choose the option of donating money to the Fund for Sustainable Development. Additionally, it makes sense to mention that since April 2018, legislative amendments have come into force, which allow you to obtain citizenship of Saint Kitts and Nevis when buying real estate in the amount of 200,000 USD, but it will need to be saved not 5, but already 7 years.

Question: Will citizenship in Saint Kitts allow you to live in England? Can I sell my property in five years? Will the passport be canceled?

Answer: Citizenship of Saint Kitts and Nevis does not give the right to live in the UK all year round (this requires a residence permit), but allows you to visit this country for 180 days without a visa.

If the real estate is sold after 5 years, the passport will not be canceled, but as mentioned above, the option of investing in the Fund, and not in real estate is more recommended.

Question: For how long is a Saint Kitts passport issued? Do I need to update it? Can I buy a business for citizenship purposes?

Answer: The Saint Kitts passport is issued for 10 years for adults and for 5 years for minors. In addition to the passport, an unlimited citizen registration certificate is issued. It is he who is the main document confirming citizenship.

For the purposes of obtaining citizenship, only a business such as a hotel (commercial real estate) is suitable. You can buy a business, but the market of the Federation of Saint Kitts and Nevis is quite narrow, and without having lived for some time on the islands, it will be difficult to assess the liquidity of a business.

Question: I would like to renounce the citizenship of Saint Kitts and Nevis, as I plan to enter the state where dual citizenship is not permitted. How to do this and how much does the escort service cost? A passing question: I would like my wife and child, who at one time received citizenship with me, to keep it. Will my refusal affect them?

Answer: You must submit a formal (notarized) application that you renounce citizenship, as well as submit a certificate and passport. This will not affect the citizenship of the spouse and the child. The cost of the process will start from $ 4000.

Question: What other countries, except for the Federation of Saint Kitts and Nevis, provide citizenship by investment?

Answer: From European countries, citizenship by investment is offered by Bulgaria, Cyprus and Malta. The level of investments required to obtain an EU passport under the official programs of these countries is on average about 1 – 2 million euros.

In some countries, for example, in Austria, it is possible to obtain citizenship for merit in the field of economics, which should be expressed in investments of about 10 million euros, but the selection criteria are subjective (priority sector of the economy, job creation, new technologies), and not so clear like the first three countries mentioned.

Therefore, if there is no compelling reason to choose Austria, this passport program is not recommended. In the Caribbean, citizenship by investment can be obtained in Dominica, Grenada or the islands of Antigua and Barbuda.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.

I’m want to have your WhatsApp line

It is all here – https://adamfayed.com/contact