There is so many options out there in the investing world. This article will discuss 10 such options.

Si quieres invertir y estás confuso con todas las opciones que hay, puedes ponerte en contacto conmigo utilizando este formulario, o utilice la función de chat que aparece a continuación.

1 Invest in yourself!

Investing in yourself pays out dividends, if you do it in the right way.

Formal and self education can offer a great return on investment, if you are focused.

There is almost every tool you need to become stronger with a little effort on the web.

Learn a language, get certified, become a translator and double your money as a freelancer, or study a highly important programming language that you know most companies would need, then take a book on investments, read this article or find a consultant that can teach you the basics in a short time.

When there is no money to invest, your ideas are money, and your time to make them become reality is also an investment. Do take into consideration that the average investor makes just 2.5% annually on his/her capital.

Therefore just by being more productive or frugal, you can achieve to make 100% to infinite more income than previously. By being more productive, by becoming more efficient in what you know how to do, the money will come to you, you won’t need to chase it.

And it doesn’t if you learn it in a school, in a learning centre or by yourself, if you really commit to getting how something works and you manage to make it work, for sure it will work.

There’s no other option, ever heard of all the businessmen that read several books per week?

Reading different books may give you different impressions and make you absorb some important ideas and concepts through its pages, but if you learn one single book sufficiently and you apply it, you made it!

2 Invest in your business

Many wealthy people keep wealth invested in their companies or other more profitable companies, such as private investments or listed companies on the stock market.

Of course though, most people fail in starting their own business. One tried and tested way is to get a job first, get good at something, and then start a business in that niche.

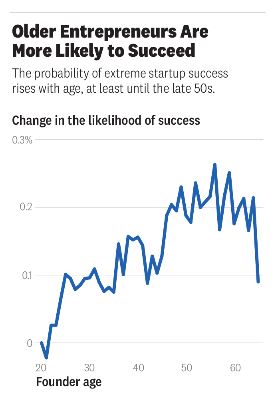

The statistics show those with experience are more likely to succeed in starting their own business – although it starts to even out above 55 or 60:

That doesn’t mean that you need to wait until you are 60 to start a business, but merely that you are more likely to succeed after your late 20s and 30.

3 The Stock Market

We have already spoken about investing in our own businesses. Rationally speaking then, surely we would want to invest in the cream of the crop – those few firms that manage to IPO and get onto the stock exchange?

There are numerous ways to get access to the stock market. This includes investing in individuals stocks, which is riskier than investing in the whole market or index like the S&P500 or Dow Jones.

There are other ways to invest in stocks:

Shares: You can purchase the shares of the companies you believe that will grow the most in the future, taking advantage of the compound growth that, as a snowball, just continues to become bigger and bigger. However, stock pickers often don’t beat the market long-term.

ETFs: Do you want to buy the shares of multiple companies at once belonging to the same sector? ETFs might be for you. There are index-linked ETFs, which are similar to index funds practically speaking, and sector specific ETFs like technology as an example.

There are hundreds of options to choose from depending on your needs.

4 Cash bank deposit

A cash bank deposit is one of the simplest investments you can think of.

The problem is, these days you face the following risks:

- Inflation risk. Is the interest rates offered lower than inflation? In which case you are guaranteed to lose money

- Currency risk. Do you live in an emerging market? You could lose a lot relative to the USD, Pound and Euro. In the last 10 years, many South African and other investors have lost a lot of cash in hard currency, despite the high interest rates

- Relative risk. Cash has never beaten stocks or even bonds long-term.

- Ruin risk. In very severe situations like in some Latin American countries and Zimbabwe in recent times, you can lose almost all your money to hyperinflation.

5 Buy lands or properties

There are many ways you can buy property. This includes:

- Your own home

- Rental properties

- REITS y pagarés de préstamo

- Alternative ways you can own property as we will discuss more below

In general property yields are more important than capital growth prospects for real estate investors.

Depending on a property to depreciate, in other words that a person will spend more money than you did for the same asset, is a form of speculation.

In comparison, one of the “Warren Buffett rules of investing” is that you should always focus on what an asset can yield you.

Otherwise, if you didn’t like this ‘’passive’’ approach, you could opt for an active one, for:

- Orchards.

- Vegetable farmland.

- Row cropland.

- Livestock-raising land.

- Timberland.

- Residential development land

- Commercial development land

- Mineral production land

- Vineyards

- Recreational land.

Most of the time, though, most lands cannot be both for agriculture and residential or commercial use at the same time. In fact, due to several geological causes, building houses on an improper solid could lead to the collapse of it and sinking, like what is happening with today’s Jakarta, in Indonesia, as the soil cannot withstand all the weight above it.

A downside to consider is that if you want to buy lands, as a citizen in your country, or investing in other countries, you could face numerous complicated issues fiscally as you result from being the owner of it.

In any case, it is a huge misconception to suggest that “renting is dead money”.

Renting vs buying (so your primary residence)is a whole different ball game to considering rental properties.

I even know some professional real estate investors that rent their own home, but own several rental properties, for this reason.

5 Commodities and collection

Many people assume commodities are good investments. The oil is ending! The water is ending! Minerals are limited! We have heard them all.

However, long-term. commodities have been very poor investments – including gold.

Commodities do have time in the sun. Gold and silver did well from 2000-2011. Diamonds, oil and copper have also done well during numerous periods in the past.

No doubt they will have other good periods in the future. However, the fundamental problem with commodities is the same as your primary residency:

- They don’t produce a coupon or yield unless you buy oil producing company stocks like BP or Shell

- They don’t pay a dividend unless they are a stock

Do again, we are back in the position where we are hoping that the person coming after us, will pay more for the same asset.

6 Investing in REITs

We have already spoken about real estate, but a whole section should be focused on real estate investment trusts (REITS).

A REIT is a company that focuses on buying income-producing real estate.

Typical assets include apartment buildings, office space, shopping malls, student housing, storage space and other properties that could be rented to tenants. They typically don’t own a lot of raw lands, for example.

Some of the largest and most acclaimed real estate in the world has been, or is currently, owned by REITs, for instance, the Empire State Building.

REITs distribute most of their net income to the investors. In Canada it is done monthly, it’s quarterly in the USA, that makes them popular producing assets.

Many REITs are easily accessible and can be purchased through an online brokerage account. Investors can thus gain exposure to real estate for just a couple of hundreds of dollars.

There are risks. The most well-known risk is that they are susceptible to interest rate hikes.

Since they own property, they have enormous debts in the form of mortgages and lines of credit, etc. If interest rates rise quickly, it could cause problems for them. A well-managed REIT will strive to mitigate that risk accordingly.

A lesser-known hazard is that large REITs often overpay for real estate.

They need to deploy enormous sums of cash quickly to generate a return for investors. For example, a REIT might have $100.000.000 in the bank that it needs to put somewhere. There aren’t that many properties that sell for $100.000.000, so its options are limited.

It might look for 2 properties for $50.000.000 each to open up choices, but still, there’s not too much to work with. Big REITs have big money and not much time to invest it, so they’re sometimes forced to make relatively inefficient purchases. They can, therefore, be subjected to steep price declines if property markets fall.

Some people prefer small REITs for that reason, but still, REITs are generally loved by income-oriented investors.

They can also be a good way to participate in real estate, without actually buying property. And just like any investment, doing your research before buying is key.

Good quality REITS can be excellent investments that add diversification to a portfolio.

7 Structured notes

Structured notes can be risky forms of investments as I have mentioned before.

If used correctly, structured notes offer investors a wide array of opportunities despite the risks.

Structured notes are a debt obligation issued by financial institutions, that also contains an embedded derivative component that adjusts the security’s risk-return profile. With structured notes, you can invest in several asset classes, regions or sectors that may not be easily accessible for private investors.

Their yield depends on several underlying assets, like an equity index, a basket of individual equities or a credit index. If the underlying asset performs as expected, the return will be positive. Therefore, the return performance of a structured note will track both the underlying debt obligation and the derivative embedded within it.

An example of a structured note would be a three-year bond cooped with a futures contract on peanuts. Common structured notes include principal-protected notes, reverse convertible notes, and leveraged notes. More frequently, a structured note will offer limited losses in exchange for limited gains compared to other assets.

A big downside is that derivatives are always complicated, even more, when they are combined with other financial products.

That makes a structured note a very complex product, as the investor has to understand perfectly the product he or she is buying, and as it works both as a debt instrument and as a derivative.

Therefore, they should only be used by professional investors, and as a small percentage of a portfolio.

8 Crowdfunding

Crowdfunding is when individuals or startups use an online platform to get funding for a project globally.

It makes use of the easy accessibility of vast networks of people through social media to bring investors and entrepreneurs together, with the potential to increase entrepreneurship by expanding the pool of investors beyond the traditional circle of owners, relatives and venture capitalists.

The global crowdfunding raised 16$ billion dollars from 2000 to 2005 and it’s projected to reach 100$ billion by 2025.

There are 4 kinds of crowdfunding, debt, equity, rewards and donation.

- Debt-based: This is when contributors receive an interest rate in exchange for their contribution, examples include platforms like FundedHere, CROWDO and MoolahSense.

- Equity-based: Where contributors receive shares in exchange for their contributions, examples include AngelList, FUNDNEL, SEEDRS and CAPBRIDGE.

- Rewards-based: Where contributors are promised rewards in exchange for their contribution, like first-priority access to a product once it is on the market, examples include KICKSTARTER, Indiegogo and Ulule.

- Donation-based: Where donations are charitable and usually tax-deductible, examples include, Indiegogo, Patreon, YOUCARING and FriendFund.

Before investing in a crowdfunding platform it’s better to consider it’s the age of existence. In fact, most of them are new to the market and crowdfunding platforms need a lot of cash upfront in their first years of business.

One funny case of crowdfunding was from an individual who wanted to create a new potato salad recipe. His goal was to raise $10, but he raised more than $55,000 from 7,000 backers. Investors can select from hundreds of projects and invest as little as $10.

Again, crowdfunding is a very risky investment compared to some of the alternatives.

9 Car sharing

The environment and “green issues” is becoming more important for younger people.

The attention to our environment made new trend lines and economic opportunities to arise and others to sink.

Now you can generate income from an extra car by renting it out on a daily basis. If you keep it in a garage it will just depreciate in value up to 60% in 5 years from the time of purchase.

So, why not keep it active all the time when you don’t need it? Not everybody owns a car like in the USA.

Therefore, if you live in a populated city, mainly in Western Countries, you could offer your car for a reasonable price on the market and keep it active and create a good stream of income. Surely you will have some costs behind it, such as insurance, to fix it and maybe drunk-irresponsible people.

Car sharing isn’t a proven long-term investment for the vast majority of people.

10 Discontinued Consumer Products.

If you buy consumer goods in bulk when there is a sale or discount, you can save 6%-10%.

It also happens that a big global brand files for bankruptcy, it could be a big deal to grab everything you can, wait some years, and sell them at a higher price to nostalgic people.

This happens every time a new product is released in limited quantity.

Big investors or also individuals who have some spared money, will start buying hundreds of Supreme t-shirts or iPhones in order to sell them at 3-4 times more than their beginning price, either physically or on eBay/Amazon.

This happened quite recently with the COVID outbreak when some individuals stockpiled flat masks and 3D masks and sold them at 10-20 times the original price and became rich on other people’s sufferings and panic.

It is not uncommon to see that still today, there are some collectors that would pay millions just to have the object they need in their collection to feel satisfied, be it a painting, a bottle or a postage stamp.

In general though, this kind of thing is more for a hobby, and for saving money, rather than as an investment.

Conclusión

In general, index and bond funds and other kinds of long-term investing, offer the best risk adjusted investment opportunity, assuming you can be long-term.

Other kinds of investments can give you diversification. If used in moderation, they can be good alternative investments.

A key mistake to avoid is hoping that the person coming after you, will pay more for the same asset that you paid for it.

That is the biggest reason why gold, most commodities and several assets have simply maintained their value after inflation for 2,000 years or so – they don’t offer a coupon, yield or dividend.

Therefore, the only thing holding up the price, is the hope that the person coming after you will pay more for it.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.

I like the “invest in yourself’ if you do not have enough capital to start up a business.

thanks glad you like it

it does take a lot of work!