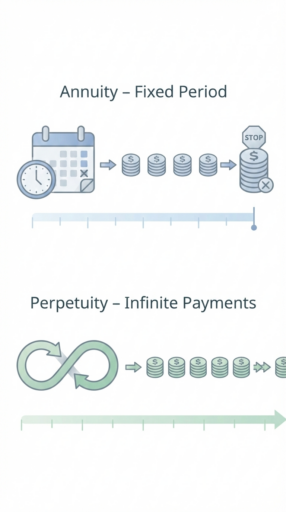

An annuity pays income for a defined period or lifetime, while a perpetuity pays income indefinitely with no end date.

Understanding annuity vs perpetuity clarifies how long payments last, how value is calculated, and when each concept is used in finance and retirement planning.

Este artículo trata:

- What is the main difference between an annuity and a perpetuity?

- What is an example of a perpetuity and annuity?

- What are the advantages and disadvantages of an annuity vs perpetuity?

- How do I know when to use an annuity or perpetuity?

Principales conclusiones:

- Annuities have a defined payment period; perpetuities do not end.

- Perpetuities are theoretical or financial constructs, not typical retirement products.

- Annuities are practical income tools used in retirement and insurance planning.

- Choosing between them is driven by time horizon, purpose, and risk assumptions.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

What Is the Difference Between Perpetuity and Annuity?

The main difference is that an anualidad pays for a fixed period or lifetime, while a perpetuity pays indefinitely with no end date.

An annuity is commonly used in retirement income planning, loans, and insurance products.

A perpetuity is primarily a financial concept used in valuation models, where payments continue forever and value is calculated using a constant discount rate.

Can an Annuity Be a Perpetuity?

An annuity cannot be a true perpetuity because its payments always have a defined end, even for lifetime annuities.

Unlike a perpetuity, which continues indefinitely, annuity payments stop when the recipient dies.

While some long-term annuities may seem perpetual, they do not meet the strict financial definition of a perpetuity.

What Is the Formula for Annuity and Perpetuity?

En annuity formula calculates the present value of a series of payments made over a fixed period, while a perpetuity formula calculates the present value of payments that continue indefinitely.

For an ordinary annuity, the present value formula is:

PV = PMT × [1 − (1 + r)⁻ⁿ] ÷ r

where PMT is the periodic payment, r is the discount rate per period, and n is the total number of payments.

For a perpetuity, the present value formula is:

PV = PMT ÷ r

because the payments never end and there is no fixed number of periods. This simplified formula reflects the infinite duration of cash flows in a perpetuity.

What Is a Real Life Example of a Perpetuity?

A classic real-life example of a perpetuity is preferred stock that pays fixed dividends forever.

As long as the issuing company exists and continues paying dividends, the income stream does not end.

Another example is government-issued perpetual bonds, which pay interest indefinitely without returning the principal.

These instruments are rare and mainly used for financial modeling rather than personal income planning.

Can a Perpetuity Be Passed to Beneficiaries?

Yes, a perpetuity can theoretically be passed to beneficiaries.

In practice, whether heirs receive payments depends on the legal and contractual terms of the instrument, such as perpetual bonds or preferred stock.

Unlike typical lifetime annuities, which usually stop at death unless a guaranteed period is selected, a true perpetuity can continue providing income to heirs or successors.

What Is an Example of an Annuity?

A common example of an annuity is monthly retirement income purchased from an insurance company, where an individual invests a lump sum and receives regular payments over a fixed period or lifetime.

Other examples include mortgage payments and structured settlement payments, which are paid in regular intervals for a defined term.

Unlike a perpetuity, payments from an annuity always end after a set period or at the end of the annuitant’s life, ensuring a finite duration.

What Are the Benefits of Perpetuity vs Annuity?

The main benefit of a perpetuity is that it provides infinite, predictable cash flows for valuation, while an annuity offers practical, structured income over a defined period.

Perpetuities also allow investors to easily calculate theoretical returns, compare long-term investment options, and model perpetual income streams.

Annuities provide additional benefits such as flexible payout options, protection against outliving savings, and the ability to tailor payments to specific financial targets.

What Is the Biggest Disadvantage of an Annuity vs Perpetuity?

The biggest disadvantage of an annuity compared to a perpetuity is that payments eventually stop.

Whether due to a fixed term ending or the death of the annuitant, annuities do not provide infinite income.

Perpetuities, however, are largely impractical for individuals, as they assume endless payments and constant conditions.

This makes them unsuitable for real-world retirement income needs despite their theoretical appeal.

When to Use Perpetuity vs Annuity?

Use a perpetuity when you need theoretical or infinite cash flow modeling, such as in corporate finance, valuation of perpetual bonds, or academic analysis.

Perpetuities are ideal for estimating long-term asset value and are useful if you are an investor or analyst focusing on long-term income assumptions, but they are rarely practical for individual financial planning.

Use an annuity when you need predictable, structured income over a defined period or lifetime, such as for retirement, insurance payouts, or income replacement strategies.

Annuities are well-suited for clients who need steady cash flow to cover living expenses, protect against longevity risk, or ensure reliable income throughout retirement.

Annuity vs Perpetuity in Corporate Valuation

Annuities are used to value finite cash flows, while perpetuities are used to value income streams that continue indefinitely.

Beyond personal finance, these concepts also provide a foundation for assessing long-term cash flows in corporate valuation.

A perpetuity models income such as dividends from stable companies or perpetual bonds, allowing analysts to estimate long-term value using a simple formula.

An annuity, by contrast, applies when cash flows are limited to a fixed period, like loan repayments, project revenues, or finite investment payouts.

Present value calculations for annuities enable precise assessment of the worth of these scheduled cash inflows over a set number of periods.

Choosing between them ensures accurate financial modeling: perpetuities simplify long-term valuations, while annuities provide precise estimates for finite, predictable cash flows, helping businesses make informed investment and financing decisions.

Conclusión

Annuities and perpetuities serve very different purposes: one is practical for meeting real income needs, while the other is a tool for modeling and long-term valuation.

Understanding both concepts allows investors and planners to apply the right instrument to the right situation, whether structuring payments, evaluating assets, or designing financial strategies.

Knowing when to leverage each can improve decision-making and help align financial outcomes with specific goals.

Preguntas frecuentes

How Do an Ordinary Annuity, an Annuity Due, and a Perpetuity Differ?

An ordinary annuity pays at the end of each period, an annuity due pays at the beginning, and a perpetuity pays forever.

The key difference lies in timing and whether payments ever end.

What Is an Example of a Perpetuity Annuity?

There is no true perpetuity annuity. The term is sometimes used informally to describe very long-lasting income streams, but all annuities have an endpoint, even lifetime annuities.

How Much Will a $100,000 Annuity Pay Monthly?

A $100,000 annuity pays roughly $400 to $600 per month.

The exact amount depends on factors such as age, interest rates, payout type, and contract terms.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.