In this article Dominion Capital Strategies Review, we will look into Dominion Capital Strategies (Guernsey), its products and other offerings, as well as the positives and negatives of investing with it.

Our view about this product is that it is great in limited situations. For the majority of people, we can usually offer better options.

Who is Dominion Capital Strategies and where is it sold?

Dominion is an investment management company based out of Guernsey with offices in Uruguay and beyond. The company is subject to regulation and licensing by the Guernsey Financial Services Commission.

They are sold globally but are especially strong in Latin America – including Uruguay, Brazil and Chile. Both local and expat clients can take part.

Dominion Capital Strategies Products

They offer a lump sum and regular opción de inversión. They are called the My: Savings Strategy (MSS) and My: Investment Strategy (MIS).

The savings plans are designed for people that want to invest for a period of five to 20 years, whereas the investment lump sums can be used for a five-year period.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use Whatsapp (+44-7393-450-837).

Let’s look at the features of each product in more detail.

My: Savings Strategy

This product is intended for individuals who want to save regularly in order to meet future financial obligations such as funding education for their children or relatives, providing for healthcare expenses, creating a retirement fund, or achieving other medium- to long-term financial goals.

The solution offers actively managed global investment strategies that are customized based on the individual’s risk tolerance.

My: Savings Strategy is available in web and mobile versions, and can be accessed in English, Spanish, Japanese, Portuguese, and Chinese.

Is there a minimum contribution for My Savings Strategy?

In order to participate in this option, a minimum monthly contribution of 250 USD or its equivalent is required.

Additionally, the minimum additional single contribution is set at 1,500 USD. This is the minimum amount of money that you can add to the cuenta de ahorro in a single transaction, in addition to any regular contributions.

Contributions can be made on a monthly, quarterly, semi-annual, or annual basis. It can also be adjusted at any time during the selected term of the plan. If needed, contributions can also be temporarily paused until circumstances improve. Such level of flexibility allows investors to adapt their savings plan to meet their changing financial needs over time.

This indicates that you have the option to halt contributions at any point without incurring any charges or expenses. Additionally, the investment plan allows for adjustments to contributions – they can be raised or lowered – and it permits one-off payments, known as “lump sums,” to be made during the plan’s term in order to increase investment returns.

Debit and credit card payments, plus wire transfers are accepted.

What fees are charged for My Savings Strategy?

You will be charged 25 USD to set up an account. There is also a yearly cost that gets lesser if the term chosen is longer. For a term of five years, an annual charge of 2.65% will be assessed. This cost will go down to 1.15% if the term is 15 to 20 years.

My: Investment Strategy

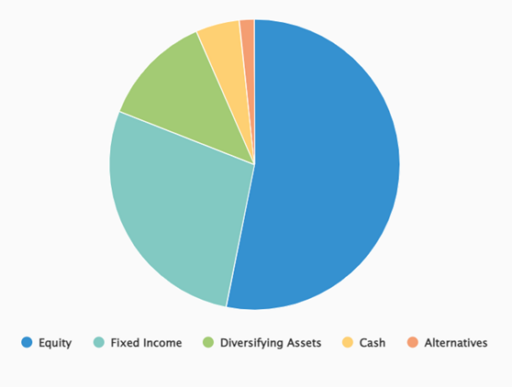

This is an investment account that offers flexibility. It provides access to a selection of fund managers who offer portfolios with varying levels of risk, categorized as Cautious, Balanced, or Aggressive. In addition to these risk-graded portfolios, there are also specialist funds available.

This investment plan offers the flexibility to adjust investment choices as frequently as needed, allowing investors to adapt to changing market conditions or personal circumstances.

The goal of this account is to provide long-term capital appreciation. It provides globally diversified investment strategies that are actively managed and tailored to the investor’s comfort level with risk.

This investing account is not only easy to open and administer, but also offers you the benefit of doing it fully online. Your portfolio may be tracked, changes made, and account details accessed from any location with an internet connection.

What is the minimum contribution for My Investment Strategy?

To open this investment account, you will need to make a minimum initial contribution of USD 10,000. After the account is established, you may make additional contributions of at least USD 1,500 per transaction.

Furthermore, this investment account accepts wire transfer only.

What are the costs?

To create this investment account, there is a one-time setup fee of 25 USD.

In addition, an annual administration fee will be charged based on your contribution amount for the first five years. The fee is 1.6% of your contributions each year during this period. After the first five years, the administration fee will decrease to 1% of the account’s value.

Bear in mind that that there are no penalties for making withdrawals from this investment account. However, if you withdraw all of the funds before the end of the fifth year, administration charges will apply.

Protected Investment Portfolio

Dominion clients who invest in the two products mentioned above have the option of investing in the Protected Investment Portfolio. This enables them to get both development and protection from a single investment.

¿Cómo funciona?

When the market is doing well, the whole portfolio is allocated to the growth asset. If market circumstances worsen and there is a possibility of losses, assets will be progressively shifted into the safe asset to safeguard the portfolio’s value.

The Volatility Index (VIX) is an essential consideration when allocating assets inside the Protected Investment Portfolio. In general, when market volatility rises, a larger portion of the portfolio is allocated to the safe asset.

This strategy enables investors to participate in the market’s upside potential while simultaneously limiting negative risk.

What are the main features of the Protected Investment Portfolio?

One notable feature of this portfolio is the 80% Protection Lock-In, which is available from day one. Each individual account is re-balanced daily to align with market performance and volatility. Should the value of the Protected Investment Portfolio slip under the protected value, a gap payment in cash is made to the account the following day. The protected value for each individual investor is always 80% of the highest ever fund units value of the account.

The product also offers the potential for unlimited upside from stock market exposure. This means that investors have the opportunity to benefit from market growth and achieve potentially higher returns.

Another distinguishing aspect is asset segregation, since all accounts are maintained in custody by the Bank of New York Mellon. This adds another degree of protection for investors by keeping their money apart from other funds and assets.

Protected Investment Portfolio offers high levels of liquidity, making it simple for investors to manage their assets. The product is daily liquid, which means investors may purchase or sell portfolio units on any business day. Investors may swap in and out of the product and other funds, as well as invest in or redeem their account, at any time.

Are there charges for getting out of the products?

There are charges for getting out of the regular investment, but that depends on how long you have been in the product, and how much longer you have committed to pay.

In other words, if you invest for 10 years, after 5 years, your surrender value will be relatively high, as compared to in year 2.

Dominion Capital Strategies Funds

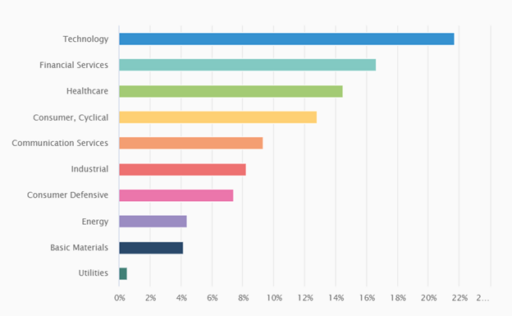

The funds on offer depend on how “aggressive” the investor is. They offer aggressive, balanced, and cautious funds with this in mind.

The performances of the funds are not all positive. Some returns since launch are in the negative territory as of the time of writing. So far, year-to-date performances of the funds are positive.

All the funds we will discuss below are denominated in US dollar.

DCS Global Equities

DCS Global Equities, which was rolled out in May 2018, aims to increase investment returns in the long term. The fund targets global ETFs and mutual funds which are primarily focused on offering exposure to global stocks, particularly “mature” European markets.

The main part of the fund’s estrategia de inversión targets medium- to long-term growth, so it invests in global firms that are concentrated on luxury or discretionary spending. The fund’s primary assets are highly correlated with global stock indexes.

Moreover, the DCS Global Equities fund also invests in an array of global and regional stock funds that deal with small and medium cap investments. These satellite assets have lower correlation with the main stock indexes, providing added diversification to the fund’s portfolio.

The fund has performed well, with a year-to-date (YTD) return of 9.76% and a return of 13.11% since its launch.

DCS Global Bonds

This fund was also launched in May 2018 and has a similar goal with DCS Global Equities, only that this one invests in instruments (ETFS and mutual funds) in Europe that provide exposure to global bonds.

The primary asset management group funds invest in worldwide corporate and government bonds. Global bond funds and top-ranked ETFs focused on investment-grade government and corporate debt instruments make up its core assets.

Satellite assets are global bond fund managers with good risk and performance indexes.

YTD, the fund has performed at 1.74%, while its performance since launch is -18.91%.

DCS Cautious

Launched in May 2018, the fund invests in mature European markets, offering exposure to both global bonds and stocks (so it’s a combination of the first two funds).

The DCS Cautious fund is designed to allocate 10% to 30% to funds exposed with global stocks and 70% to 90% to investment funds exposed with global bonds. It invests on main asset management group funds like global corporate and government bonds, plus small, medium, and large cap stocks.

The fund has delivered a return of 2.25% YTD, and a negative return of 13.23% since its rollout.

DCS Balanced

The same with DCS Cautious, this fund also provides global bonds and stock exposure. The difference is that DCS Balanced is designed to allocate 50% to 70% of investments in funds with global stocks exposure and 30% to 50% in investment funds with global bonds exposure.

The fund had a YTD performance of 4.14% and a performance since launch of -2.00%.

DCS Aggressive

Also rolled out in May 2018, this fund has similar objectives as DCS Cautious and Balanced funds. The main difference lies in the allocation strategies employed.

DCS Aggressive’s allocation is between 70% and 90% to funds with global stocks exposure and between 10% and 30% to investment funds with global bonds exposure.

In addition, the fund invests in main asset management fund groups that focus on emerging and frontier markets.

YTD, the fund has returned 5.11%, and since launch, it has returned 2.31%.

DCS Emerging Market Equities

DCS Emerging Market Equities is a feeder fund that puts money into the Pacific North of South EM All Cap Equity sub-fund. Its investment objective is to maximize long-term capital appreciation through investments in EM stock funds and ETFs, mainly selecting high-quality companies with exposure to emerging economies and mega companies such as Samsung and Tencent.

The fund also puts money into experienced managers of stock funds who specialize in investing in emerging markets and have a strategy that gives them more exposure to medium-sized businesses and emerging markets.

Since its launch in May 2018, the fund has had a negative return of -21.28%. Meanwhile, it has a YTD performance of 6.39%.

DCS New Technologies

DCS New Technologies is an investment fund set up to target the growing technology sector. High-performing technology funds with a focus on large, well-known firms make up the bulk of the fund’s holdings.

The fund’s ancillary assets are made up of investments that favor both those with a track record of success and those that are innovative and disruptive. Robotics, online commerce, artificial intelligence, and fast-growing startups are the primary investments of these funds.

The fund has performed well since its launch, with a YTD performance of 15.74% and a performance of 29.41% since May 2018.

DCS Global Growth

The fund, which debuted in May 2018, focuses on issues related to health, environment, demography, and sustainability. The main assets are funds with exposure to specific issues through big companies with large cap. Meanwhile, the satellite assets are funds dedicated for small and medium cap firms.

YTD, the fund’s performance was 6.63%, and since launch, it has returned 14.28%.

DCS Cash

The DCS Cash fund was introduced in May 2018 to invest in instruments that offer exposure to cash. The main assets of the fund are selected from the main money market funds that allocate cash or cash alternatives. The DCS Cash fund does not contain any satellite assets.

YTD, the fund has generated a performance of 1.17%, while the performance since its inception has been 1.20%.

DGT E-Commerce Fund

Since its inception in June 2014, the DGT E-Commerce Fund has sought to capitalize on the rising popularity of online shopping by investing in firms with worldwide reach. Companies with a worldwide presence whose business models align with or promote the growth of Ecommerce make up the bulk of the Fund’s holdings. The goal of the Fund is to provide investors with optimal returns by taking advantage of this expanding market.

Its performance YTD is 11.20% and since its debut, it has delivered a return of 37.70%.

DGT Luxury Fund

Launched in August 2012, the Global Trends Luxury Consumer Fund targets worldwide firms in the luxury or discretionary spending industry to provide investors with medium- to long-term profitability. The fund’s holdings often include some of the most recognizable names in international high-end retail, catering to affluent shoppers everywhere and the rising demand for luxury goods in emerging nations.

Its performance YTD is 13.54% and since launch is 38.75%.

DGT Managed Fund

The Global Trends Managed Fund is a type of managed fund solution that follows the Global Trends investment philosophy, seeking to achieve medium to long-term growth by actively managing investment strategies and selecting exposure to Global Trends with the greatest opportunity and risk return ratio at any given time.

The fund, which was launched in September 2012, has achieved a YTD performance of 11.47% and a performance of 66.24% since its rollout.

Opportunities Plus

The primary goal of the Opportunities Plus fund, introduced in June 2021, is to achieve growth over the medium to long term via a mix of capital appreciation and income accrual. This is executed through investments in a diversified global equity funds portfolio.

The fund’s performance YTD is 8.70%, but since its launch, the performance has been -23.25%.

DCS Longevity and Social Change

This fund just recently debuted in March 2023. The majority of the fund’s assets are invested in equities and equities-related instruments of firms with products or services relevant to the world’s aging population and rising life expectancy. Environmental, social, and governance considerations are also taken into account.

It has yielded a return of 6.81% since inception.

DCS G10 Macro Rates

Since its launch in March 2023, the fund has achieved a performance of 0.43%. Its investment objective is to increase investors’ profit by making investments in the Pacific G10 Macro Rates.

The fund’s investments include a mix of debt securities and currencies, and it takes exposure to interest rates and inflation rates indirectly through financial derivative instruments on both long and short bases.

DCS G10 Marco Rates has produced a performance of 1.8% since launch.

DCS Multi Asset Sustainable – Balanced

Also rolled out in March 2023, this fund’s portfolio primarily consists of open-ended ETFs that invest in stocks and bonds, as well as direct stocks that fulfill certain sustainable investment standards.

DCS Multi Asset Sustainable Balanced fund’s performance since launch has been 1.02%

DCS S&P 500 Tracker

The DCS S&P 500 Tracker has generated a return of 3.01% since its debut in Feb 2023.

How to invest in Dominion Capital Strategies

You can invest through independent investment platforms. Please get in touch with your asesor financiero to open an account with Dominion.

What are the tax considerations of investing in Dominion Capital Strategies?

The investor’s home nation, the nature of the investment, and local tax legislation all play a role in determining how much of an impact taxes have on a Dominion Capital Strategies portfolio investment. To further understand the tax consequences of your assets, it is always wise to contact with a certified tax adviser or expert before making any choices.

There are no sales taxes or capital gains taxes in Guernsey. However, its inhabitants are subject to taxation on their global income under its personal income tax system. After claiming any applicable exemptions, residents of Guernsey have a personal income tax rate of 20%. A person is exempt from paying income tax on the first portion of their income up to their personal allowance.

What are the pros and cons of investing with Dominion Capital Strategies?

Pros

- The charging structure is better than some available in the market – just $25 at the beginning + ongoing fees. Those ongoing fees, however, depend on the charging structure your broker puts in place on day one.

- It is quite a transparent structure.

- They can accept clients in most locations with some exceptions. So, they are more flexible than some investment providers in this regard.

- It is efficient from a time perspective. Everything can be done online.

- They are regulated by Guernsey. The asset manager is also regulated by the Financial Conduct Authority in the UK.

- A good, tax efficient, structure.

- It is available in Portuguese, Spanish and various other languages.

- They have bought in an excellent feature which allows for downside-protection for more cautious investors.

Contras

- Dominion doesn’t have as many opciones de inversión as opposed to some other options. That includes less passive investment options. This indirectly increases the costs and the client pays more money. The performance of these funds they offer, however, hasn’t been bad at all. With the right fund selection, this point could be negated.

- As they are selling their own funds on the platform, this is potentially a conflict of interest.

- The investment performance in the first few years, is often not as good as in the years after that, due to the initial charges.

- You are depending on your broker to a large extent. Broker A might get you higher returns than broker B, depending on several factors including the investment choices and initial charging structure. If you go through a professional advisor, your returns are likely to be much higher.

- It is a flexible solution; however, it is still better to pay in every month until the end on the monthly savings side. So, it is best to pick a premium which is comfortable for you and continue to invest on a monthly basis.

Dominion Capital Strategies Review: Final Thoughts

Dominion Capital is a good company, and when used correctly, can yield good returns, especially with the downside-protected option.

However, you should consider second options and also look at the charging structure proposed. For many clients, better options exist.

If you have been proposed this product and want a second opinion or cheaper charges within Dominion, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

¿Le duele la indecisión financiera? ¿Quiere invertir con Adam?

Adam is an internationally recognised author on financial matters, with over 655 million answers views on Quora.com and a widely sold book on Amazon.

Lecturas complementarias

A revise of some of the “old school” expat savings plans.