Negociación, compensación, informes y facturación son sólo algunos de los muchos servicios de corretaje que ofrece Interactive Brokers Hong Kong Limited, y lo hacen todo sin exigir a los clientes que firmen compromisos anuales o incluso semestrales.

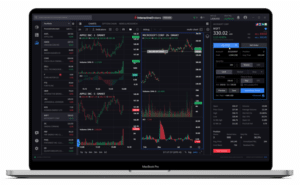

La plataforma ofrece servicios de correduría de primera clase y facilita una administración empresarial y una atención al cliente eficaces mediante un potente sistema de gestión de las relaciones con los clientes (CRM) diseñado específicamente para los corredores.

Al transmitir las mejores ofertas y demandas de los mercados electrónicos disponibles sin ampliar los diferenciales, añadir comisiones ocultas ni aumentar las cotizaciones, Interactive Brokers Hong Kong Limited demuestra su dedicación a ofrecer a los clientes las mejores ofertas de bonos posibles.

Interactive Brokers Hong Kong Limited está regulada por la Comisión del Mercado de Valores de EE.UU. y la Commodity Futures Trading Commission. Quienes abran cuentas en Asia, excluidos India, Hong Kong, Japón, Australia y Singapur, utilizarán Interactive Brokers LLC en EE.UU.

La apertura electrónica de cuentas es posible a través de la plataforma, y los corredores de bolsa que están dispuestos a hacer pública su información prestan servicio y asistencia comercial a los usuarios. Los clientes tienen la opción de operar en línea ellos mismos o de que lo haga su corredor.

Interactive Brokers Hong Kong Ltd amplía los horizontes de los inversores proporcionando acceso a datos de mercado las 24 horas del día y operando con acciones, opciones, futuros, divisas, bonos y fondos.

Las comisiones sobre operaciones con acciones en Hong Kong oscilan entre 0,0151 HKDTP3T y 0,051 HKDTP3T del valor de la operación, y no existen diferenciales, mínimos de cuenta ni comisiones de plataforma para estas operaciones. Además de su cómoda accesibilidad, las baratas tasas de margen (tan bajas como 1,501 HKDTP3T), la integración con el sistema IB SmartRoutingSM y la oportunidad de ganar dinero extra prestando acciones totalmente pagadas hacen que esta plataforma de intermediación sea muy atractiva.

Si desea invertir como expatriado o particular con un alto patrimonio neto, que es en lo que estoy especializado, puede enviarme un correo electrónico (advice@adamfayed.com) o utilizar WhatsApp (+44-7393-450-837).

Interactive Brokers Hong Kong Cuenta e Inversión

¿Cuáles son las opciones de inversión disponibles con Interactive Brokers Hong Kong?

- Acciones: Interactive Brokers Hong Kong permite a los clientes negociar acciones en la Bolsa de Hong Kong, la Bolsa de Nueva York y el NASDAQ, lo que ofrece una gran variedad de opciones de inversión.

- Opciones: Interactive Brokers Hong Kong permite a los clientes operar con acciones e índices en opciones, lo que les permite explorar diferentes tácticas.

- Futuros: Los clientes pueden operar con acciones, índices y materias primas. Los clientes tienen más opciones de inversión con esta función.

- Negociación de divisas: Interactive Brokers Hong Kong ofrece operaciones de divisas al contado en dólares estadounidenses, euros, libras esterlinas y dólares de Hong Kong. Esta función ofrece más flexibilidad a los operadores de divisas.

- Bonos: En la plataforma se pueden negociar bonos del Estado y de empresas. Este producto diversifica las carteras con valores de renta fija.

- Fondos de inversión: Interactive Brokers Hong Kong ofrece más de 7.000 fondos de inversión de varias familias, como BlackRock y Vanguard, sin comisiones por transacción.

- Fondos cotizados: Los clientes pueden negociar fácilmente con una amplia gama de fondos cotizados en bolsa de distintas clases de activos e industrias. Esta característica hace que la plataforma sea más flexible para diferentes estilos de inversión.

- SSFs y EFPs: Interactive Brokers Hong Kong ofrece una variedad de productos de inversión a través de Single Stock Futures y Exchange for Physicals. Esta inclusividad permite la personalización de la cartera.

- Warrants: La plataforma permite a los inversores negociar warrants, que les otorgan el derecho pero no la obligación de comprar o vender un activo subyacente a un precio concreto antes de una fecha determinada. Las herramientas de inversión disponibles con esta función se amplían.

Cómo comprar acciones de Hong Kong en Interactive Brokers

Cree una cuenta con Interactive Brokers Hong Kong Limited para empezar. Esto implica revelar datos personales sensibles y someterse a procedimientos de verificación de identidad y dirección.

Una vez creada una cuenta, es necesario depositar fondos en ella para que el cliente tenga acceso a los fondos para operar. Las transferencias bancarias y las transferencias electrónicas de dinero (TEF) son solo dos de las muchas alternativas de financiación que ofrece Interactive Brokers Hong Kong.

Los clientes pueden realizar una orden de compra de acciones de Hong Kong una vez que su cuenta haya recibido fondos. Interactive Brokers plataforma de negociación permite a los usuarios colocar órdenes de mercado simplemente tecleando el símbolo del valor negociado y pulsando el botón correspondiente.

Al cursar una orden de mercado, los clientes designan “MKT” como tipo de orden e indican la cantidad de acciones que desean comprar o vender. Este sencillo método les facilita la realización de las operaciones financieras previstas.

Los clientes pueden obtener el mejor precio posible especificando “SMART” como destino de la orden y beneficiándose de un enrutamiento inteligente. Esto activa el enrutamiento SMART, que envía la orden a todas las bolsas accesibles en busca del mejor precio posible.

El último paso en la colocación de una orden utilizando el broker de inversión es la revisión de la información para comprobar su exactitud antes de enviarla para que se lleve a cabo. Esta última comprobación verifica el propósito del cliente y evita que se cometan errores antes de que se realice realmente la operación.

Interactive Brokers Hong Kong elegibilidad

Interactive Brokers Hong Kong Limited requiere ciertos requisitos previos y documentación para abrir una cuenta. La apertura de una cuenta con Interactive Brokers Hong Kong Ltd requiere:

- Criterios de residencia: Los residentes en Hong Kong deben cumplir determinados requisitos de documentación.

- Identificación: Los clientes deben mostrar un pasaporte, documento nacional de identidad o permiso de conducir para demostrar su identidad y fecha de nacimiento.

- Justificante de domicilio: El proceso de apertura de la cuenta requiere un extracto bancario o una factura de servicios públicos como prueba de la dirección residencial.

- Empleo: Los clientes deben facilitar el nombre, la dirección y el número de teléfono de su empleador.

- Cuenta bancaria: El proceso de apertura de la cuenta requiere que los clientes faciliten los datos de su cuenta bancaria para la financiación.

- Para cumplir los requisitos reglamentarios, los ciudadanos no estadounidenses deben facilitar su SSN o número de identificación.

¿Cuáles son los tipos de cuenta disponibles en Interactive Brokers Hong Kong?

Interactive Brokers Hong Kong Limited ofrece una amplia variedad de opciones de cuenta. La plataforma de trading online ofrece diferentes tipos de cuentas, entre las que se incluyen:

Sólo para uso personal o familiar; diseñado para que una persona lo utilice para operar o invertir.

Las dos personas que utilizan la cuenta son los “copropietarios”, como su nombre indica. Las cuentas conjuntas pueden ser de arrendatarios con derechos de supervivencia, de arrendatarios en común o de bienes gananciales, según las leyes del estado en el que residan los titulares de la cuenta.

En beneficio de un beneficiario designado, un fideicomisario gestiona estos fondos en una cuenta fiduciaria.

Puede configurar una Cuenta de Asesor Familiar para que actúe como centro de todas las cuentas independientes de sus clientes. Un único inicio de sesión en Interactive Brokers Hong Kong facilita a los operadores profesionales el seguimiento de todas sus cuentas.

Las Cuentas de Inversión para Asesores, Asesores Familiares, Asesores No Profesionales, Family Offices y Hedge Funds están diseñadas pensando en clientes institucionales como RIAs, FOs y HFs. Se tienen en cuenta sus necesidades organizativas específicas y se diseñan en consecuencia.

¿Cuáles son los mínimos de cuenta para Interactive Brokers Hong Kong?

Los depósitos mínimos exigidos por Interactive Brokers Hong Kong Limited son los siguientes:

Es obligatorio realizar un depósito inicial de 10.000 USD (o su equivalente en otra divisa) para las cuentas de corredor, y esta cantidad se abona contra las comisiones durante los 8 meses iniciales.

No se requiere un depósito mínimo para las Cuentas Cliente, lo que da a los particulares la libertad de empezar a operar inmediatamente sin incurrir en ningún coste.

Comisiones de inactividad: Si, después de los 8 meses iniciales, el total de comisiones pagadas en un mes determinado cae por debajo del mínimo mensual, se aplicará un coste de mantenimiento igual a la diferencia. Con un mínimo de 2.000 USD y un total de 1.400 USD en comisiones, la comisión de mantenimiento sería de 600 USD.

Aunque no hay un mínimo fijo para registrar una cuenta Family Advisor, la creación de una cuenta de margen requiere una comisión de 2.000 USD.

¿Cuáles son las comisiones de Interactive Brokers Hong Kong por operar?

Las comisiones de negociación son bajas en todos los mercados de Interactive Brokers Hong Kong.

Las comisiones por operar con acciones de Hong Kong oscilan entre 0,0151 HKDTP3T y 0,051 HKDTP3T del valor de la operación. Es importante señalar que no hay costes adicionales por realizar estas operaciones en la plataforma en línea, incluidos los diferenciales, los mínimos de cuenta o las comisiones de plataforma.

Las comisiones mínimas para las operaciones con futuros y opciones son de 18 HKD para las acciones de la Bolsa de Hong Kong y de 15 yuanes chinos para las acciones de Shanghai-Hong Kong Connect y Shenzhen-Hong Kong Connect.

IB SmartRoutingSM y tipos de margen tan bajos como 1,501 HKDTP3T también están disponibles para los clientes. Esta tecnología le ayuda a obtener la mejor ejecución posible mediante la búsqueda en múltiples bolsas y dark pools de los precios más bajos posibles de acciones, opciones y combinados.

Las comisiones mínimas para las acciones de la Bolsa de Singapur (SGX) se basan en el valor total de todas las operaciones ejecutadas en un mes determinado. La comisión mínima para operaciones con un valor mensual de 2,5 millones de SGD es de 0,08% por valor de operación (mínimo de 2,50 SGD). En cambio, el coste más bajo es de 0,005% por valor de operación (mínimo de 0,15 SGD) para un valor de operación mensual de hasta 50 millones, y viceversa.

Operar con acciones o ETF cotizados en una bolsa estadounidense es ventajoso porque no cobra comisiones a sus clientes. Esto hace que negociar en el mercado estadounidense sea una opción más asequible.

¿Cuál es el proceso para abrir una cuenta con Interactive Brokers Hong Kong?

Los usuarios pueden abrir cuentas de Interactive Brokers de Hong Kong siguiendo estos pasos:

- Los clientes pueden visitar Interactive Brokers Hong Kong y hacer clic en “Abrir una cuenta” en el sitio web.

- Elija el tipo de cuenta: Los clientes deben elegir el tipo de cuenta que se ajuste a sus exigencias. Existen cuentas individuales, conjuntas, fiduciarias, de asesor familiar e institucionales.

- Proporcionar información personal: Los clientes deben facilitar su nombre, dirección, fecha de nacimiento e información de contacto.

- Facilitar información laboral: Los clientes deben facilitar el nombre, la dirección y el número de teléfono de su empleador.

- Para ingresar fondos en la cuenta, los clientes deben facilitar los datos de su cuenta bancaria.

- Justificante de identidad y dirección: Los clientes deben presentar un pasaporte, documento nacional de identidad o permiso de conducir con su nombre y fecha de nacimiento. Los extractos bancarios y las facturas de servicios públicos son necesarios para demostrar la dirección residencial.

- Los clientes deben llenar sus cuentas después de abrirlas para garantizar que tienen fondos suficientes para operar. Interactive Brokers acepta transferencias bancarias y pagos electrónicos.

¿Cuáles son las ventajas de utilizar Interactive Brokers Hong Kong frente a otros brokers de la región?

Con una gran cantidad de funciones útiles, Interactive Brokers Hong Kong es un claro favorito entre las plataformas de inversión de Hong Kong. No hay diferenciales, mínimos de cuenta ni comisiones de plataforma, además de las comisiones increíblemente bajas sobre acciones de Hong Kong que se ofrecen a los clientes.

En este sitio puede invertir en acciones, índices, metales, ETF, opciones, futuros, bonos, divisas al contado, fondos de inversión y mucho más. Los inversores pueden estar al tanto de los movimientos del mercado y hacer apuestas con conocimiento de causa gracias a la disponibilidad de datos de mercado las 24 horas del día de Interactive Brokers Hong Kong.

La accesibilidad de la plataforma a la herramienta IBKR BestX, desarrollada para maximizar la ejecución, y sus tipos de financiación transparentes y asequibles no hacen sino aumentar su atractivo.

Además de sus ofertas estándar, Interactive Brokers Hong Kong también actúa como broker principal, proporcionando servicios como un sólido sistema CRM diseñado específicamente para brokers. Esto ayuda tanto en la gestión del negocio como en la atención al cliente.

Los inversores que utilizan los servicios de Interactive Brokers Hong Kong pueden estar tranquilos sabiendo que están cubiertos por la sólida infraestructura de protección del inversor de la ciudad gracias al Fondo de Compensación del Inversor de la ciudad.

¿Cuáles son las desventajas de utilizar Interactive Brokers Hong Kong?

Aunque las complejas características de Interactive Brokers son atractivas, la plataforma puede crear algunos obstáculos, especialmente para los operadores sin experiencia. Los recién llegados al mundo del trading pueden sentirse desanimados por la curva de aprendizaje de la plataforma debido a su aparente complejidad.

Además, algunos consideran que el proceso de apertura de cuentas con Interactive Brokers HK es lento y engorroso en comparación con otras alternativas. plataformas de corretaje. Esto podría dificultar el proceso de incorporación de nuevos clientes.

La posibilidad de que el servicio de atención al cliente de Interactive Brokers esté sobrecargado es otro factor en el que hay que pensar, ya que podría repercutir en la capacidad de respuesta de la empresa y en la disponibilidad de asistencia para los clientes. En momentos de demanda extrema, las respuestas a las preguntas e inquietudes de los clientes pueden tardar más de lo habitual en procesarse.

Además, pueden surgir problemas tecnológicos en la plataforma, como problemas para mostrar un gran número de plazas ordenadas. Los operadores que navegan por el sitio pueden encontrarse con cierta frustración como resultado de estos problemas técnicos. Los usuarios, especialmente los recién llegados, deben tener estas cosas en cuenta cuando interactúen con Interactive Brokers Hong Kong.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.