This article will review Lendahand, a crowdfunding platform that was founded in the Netherlands in 2013.

If you have been proposed this option and want a second opinion, you can email me (advice@adamfayed.com) or póngase en contacto conmigo aquí.

Lendahand History

Lendahand’s mission is to support entrepreneurs and businesses in emerging economies by providing them with access to capital.

Peter Heijen, the founder of the company, made a decision in 2010 to leave his job as an equity analyst manager in Amsterdam and backpack through Asia. It was during this trip that he encountered individuals who led him to believe that there needed to be a change in the world. Peter recognized that creating employment opportunities could help alleviate poverty and that small- and medium-sized enterprises (SMEs) could be instrumental in achieving this goal.

This is how he came up with the concept for Lendahand, which provides start-up capital to businesses in developing countries by soliciting contributions from investors in Europe in exchange for a low rate of interest.

Lendahand works by connecting investors with businesses that need funding. Investors can choose to invest in a particular project or business on the platform and receive returns on their investment over time. The platform offers a range of opciones de inversión, including loans and equity investments.

Lendahand focuses on providing financing to businesses in sectors such as agriculture, energy, and SMEs in Africa and Asia. The company aims to promote sustainable economic growth in these regions by supporting businesses that have a positive impact on local communities and the environment.

The Lendahand platform may be accessed in several nations, including India, Indonesia, Kenya, Kyrgyzstan, Mexico, Moldova, Mongolia, and Peru, to mention just a few. Each year, the firm expands its offering to include other territories.

Lendahand receives an annualized interest rate payment from its borrowers (the issuers) that averages 7.8 percent. Because of this, it pays an average interest rate of 4.25 percent to its funders (investors). The gross margin is somewhere around 3 percent and may go as high as 4 percent.

Lendahand Investments

Let’s look into the status of investments on the Lendahand platform.

Outstanding Investments

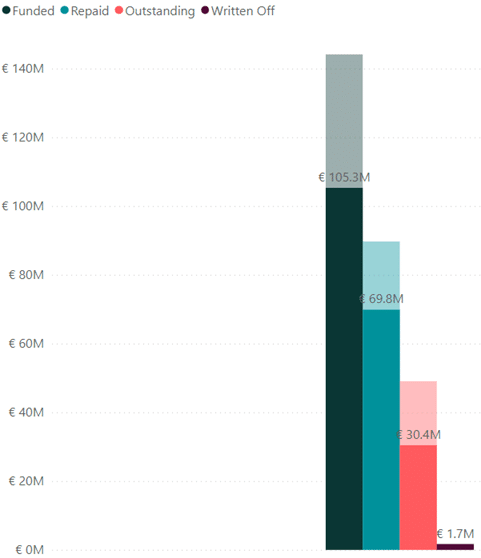

All investments made via Lendahand, Energise Africa, and PlusPlus as of September 30, 2022 are shown in the graph above.

Outstanding Investments by Repayment Status

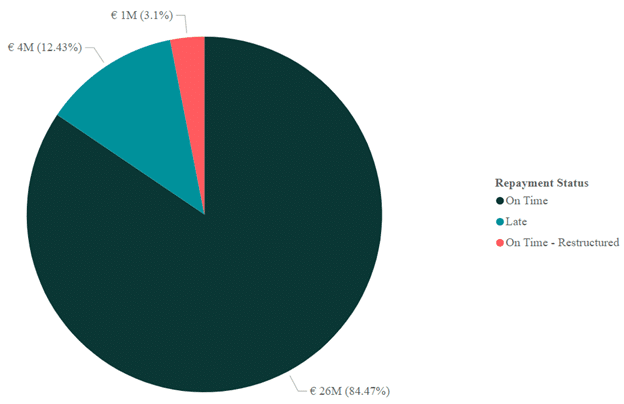

All outstanding loans are assigned a repayment status at the project level. The graph above shows that most loan repayments were completed on time, as of September 2022.

What types of investments are offered on Lendahand?

Investing via local partners

Energise Africa’s approach to financing entrepreneurs in emerging markets involves partnering with local financial institutions. By investing through a local partner, you provide growth capital to a selected enterprise while assuming some risk related to the financial institution’s performance.

The local partners are mainly responsible for covering the risk of nonpayment and exchange rate fluctuations. These partners have set aside funds for this reason. Additionally, in case of need, it is possible to claim their equity.

What are the perks of this investment option?

- New employment opportunities are one of the factors considered when vetting an entrepreneur.

- The interest rates offered range from 2% to 5% per annum.

- The risks associated with currency fluctuations and defaults are mostly covered by the local partners.

Inversiones directas

Aiming to finance entrepreneurs and SMEs in emerging markets, Energise Africa offers a direct investment option where the enterprise itself is the counterparty without the involvement of any third party. Typically, the enterprises involved are active in the renewable energy sector. Although tipos de interés are higher than investments via a local partner, the risks are also higher. Unlike the investment via local partner, default risks are not covered in this type of investment.

Unlike local partners that are able to mitigate their risks through diversification of their investments and operations in various regions, a single company typically has a higher concentration of risk as it operates in a single industry and offers limited products.

What are the benefits of this investment option?

- The focus is on delivering basic necessities like clean energy to households and businesses.

- The interest rates offered for this type of investment range from 4% to 7% per year.

- By supporting this initiative, investors can make a significant contribution to reducing CO2 emissions in emerging economies.

Co-Financing

This investment option involves Lendahand partnering with established social or professional institutional investors to provide financing for entrepreneurs in emerging countries. These experienced partners, who often have a long-standing presence in the targeted country, identify the projects. On the Lendahand platform, investors have the chance to invest alongside these co-financing parties in the selected projects.

What makes this investment opportunity advantageous?

- Generate positive impact in agriculture, housing, and access to clean water.

- Earn an annual interest of 2% to 6% while contributing to sustainable development goals.

- Highly reputable organizations in the Netherlands are responsible for selecting and monitoring the local partners involved in the investment process.

What investment opportunities are currently available?

Impact+

Impact+ is an investment opportunity for individuals and companies seeking to invest at least 25,000 euros in impact investing initiatives. It allows them to contribute their funds to assist diligent entrepreneurs and expanding SMEs that require capital in emerging markets worldwide. This investment product allows private investors to have an active role in making a positive impact in the world by supporting local businesses.

This private investing product is accessible in more than 10 countries in the form of fixed-maturity debt instruments, providing interest rates of between 2% and 7%. The investments mature within six to 48 months, and within two years on average. Investors receive principal plus interest payments on a semi-annual basis.

Impact+ provides investors with complete autonomy in choosing the investment opportunities they wish to invest in. Lendahand will keep investors informed of new investment rounds and provide details such as country, maturity date, interest rate, and the expected impact of the investment.

HUMO

Currently, Lendahand’s local partner, HUMO, is open for interested investors. HUMO is looking for a loan worth 200,000 pounds to back 150 entrepreneurs in Tajikistan who operate in rural areas, including farmers and women-owned businesses.

The loan, which bears an annual coupon of 4%, will mature in two years. It is currently 58% funded.

HUMO is just one among five local partners of Lendahand that are looking for investors.

Sistema.bio 31

The last active project that needs funding on Lendahand’s platform is from Mexico-based social enterprise Sistema.bio 31, which aims to raise 150,000 euros. The fund will be used to back the small farms of 375 families in Kenya.

This investment offers a yearly interest of 5.50%. The maturity is 12 months. Unfortunately, only individuals who are tax residents of the Netherlands are eligible to participate.

Lendahand has funded more than 3,000 projects to date.

¿Quién puede invertir?

Investment is possible for individuals with an EU, Schengen or UK Identification document. However, if you are from a country outside these regions, kindly send an email to info@lendahand.com.

What documents must be submitted?

For personal account

To register as an investor, you will be required to provide a clear image of your passport, EU ID card, or EU driver’s license containing your personal information and citizen service number. Please ensure that the uploaded file is in JPG or JPEG format, as PDFs are not accepted.

If you decide to scan your ID using a smartphone, kindly ensure that there are no glares on the image. Additionally, you will be required to upload a photo of yourself or take a selfie using your smartphone.

For business account

Each co-owner of the company who has more than 25% ownership is required to provide an ID document. For Foundations and Associations, all members of the board of directors must provide an ID. Additionally, an abstract of the Chamber of Commerce is also required, and it should not be older than three months.

What are the investment minimums and maximums at Lendahand?

Compared with the other crowdfunding platforms that we reviewed that had relatively low investments, Lendahand by far has the lowest minimum investment at only 10 euros. This sum can be raised in increments of 10.

On the other hand, Lendahand did not specify a maximum investment allowed on the platform. It cautioned investors to invest responsibly and not risk more than they can justify.

En Dutch Authority for the Financial Markets (AFM) advises against investing more than 10% of your available funds in crowdfunding.

Are there investment fees?

Joining the platform and investing through Lendahand is completely free of charge, regardless of whether you choose to pay via iDeal or credit card. Additionally, there are no fees associated with the repayment process.

How to pay for investment

Lendahand offers several payment options to make investing accessible to different investors. You can pay using iDeal, which is available for Dutch bank account holders, and Bancontact, which is available for Belgian bank account holders. You can also choose to pay via bank transfer.

What currencies are allowed?

Currently, Lendahand provides investment opportunities in two currencies, namely euros (EUR) and US dollars (USD).

For investments in euros, you invest and receive repayments in euros. Any risks related to currency exchange rate fluctuations are covered by the local partners or entrepreneurs associated with the project.

When investing in US dollars with Lendahand, you will make your payment in euros and receive your repayment in euros as well. However, once a project is fully funded, the sum in euros from the project will be converted to US dollars at the rate that was earlier determined by IbanFirst. Repayments will be converted back from US dollars to euros on the repayment date.

IbanFirst serves as Lendahand’s exchange rate partner.

When do I receive my repayments?

Lendahand follows a repayment schedule of every 6 months. This means that investors can expect to receive their repayments on or around the 10th working day of the month every 7th month, following the initial investment. For instance, if you invested in a project that reached its funding target on January 30th, you can expect to receive your first repayment on or around August 10th.

Companies also have the option to repay investments earlier than the scheduled date. This may happen if the business has been performing well and wants to pay off its debt ahead of time. If an investment is repaid early, investors will receive the remaining amount of the investment along with the accrued interest. Additionally, investors will receive a 1.5% interest payment on the early repayment amount.

This provides an incentive for companies to repay early and benefits investors by allowing them to reinvest their money sooner than anticipated.

Note that the option of early repayment is not available during the project’s first year.

What happens if a project does not receive funding?

If a crowdfunding project fails to reach its funding goal within 60 days, Lendahand will return your committed investment. This means that you will not lose any money if a project is not fully funded. However, Lendahand has had a 100% funding rate so far, which means that all of the projects listed on the platform have been successfully funded.

Can I cancel my investment?

Yes. If you change your mind after making an investment, you can cancel it by contacting Lendahand through email at info@lendahand.com within four days from the moment you receive the confirmation email. Once the cancellation request is approved, the investment amount will be refunded to your Lendahand wallet, and you will have the option to either keep it there for future investments or transfer it to your cuenta bancaria.

Does Lendahand offer a guarantee?

For local partners

Lendahand does not offer a guarantee, but it selects financially solid local partners based on strict criteria to minimize the risk of loss for investors. The local partners are responsible for the repayment of the loans, even if some of the entrepreneurs are unable to repay.

However, if the local partner is unable to repay for any reason, there is a chance of partial or full loss of the invested money. Therefore, Lendahand advises investors to spread their investments over multiple projects to further mitigate the risk.

For direct investments

In general, there is no guarantee for direct investments. Nevertheless, the local partners and companies take on the exchange rate risks. All investments, redemptions, and interest payments are processed in euros by Lendahand.

Lendahand partner Sida, which is part of the Swedish government, may offer a guarantee for some direct investments in Africa. However, this guarantee is only applicable to specific projects that are indicated explicitly on the project page. The guarantee covers a maximum of 50% of the investment amount.

What are the benefits of investing on Lendahand?

Lendahand offers several benefits to investors looking to make a social impact through their investments.

The minimum investment amount is low, making it accessible to a wide range of investors. Additionally, investors can increase their investment in increments of 10, providing flexibility and control over their investment amount. In terms of additional costs, Lendahand does not charge any fees for investors to join or invest, and the repayment process is also free of charge.

The firm carefully selects financially solid local partners who are responsible for repayment, reducing the risk for investors. These local partners also spread their risks by having many customers, operating in different regions and sectors, and having projects with varying maturities.

Lendahand also provides opportunities for investors to make a social impact through their investments. By investing in SMEs in emerging markets, investors can support job creation and economic growth in these regions. Some projects even have a focus on renewable energy, contributing to sustainable development.

¿Cuáles son los riesgos?

Lendahand’s local partners may face a range of risks that could impact their ability to secure investments, including bankruptcy, currency exchange rate fluctuations, fraud, operational risks, political and regulatory changes, and natural disasters or epidemics. It’s important to note that risks of default are not covered with direct investments.

Additionally, there is some operational risk associated with Lendahand itself. For instance, there could be a scenario in which Lendahand is unable to find shareholders to finance its activities.

Lendahand will do its utmost to manage any outstanding investments in this situation. Nevertheless, if local partners delay or refuse to pay, it naturally becomes more difficult for the crowdfunding firm to legally handle the issue.

If a local partner goes bankrupt, investors run the risk of losing some or all of their invested money. While Lendahand will attempt to recover outstanding payments, the success rate in such situations is restricted. Unfortunately, as an investor, you cannot take action against the financial institution. Therefore, it is advisable to spread the investment across several different projects to minimize the risk.

Also bear in mind that investments in crowdfunding are not guaranteed by the Dutch deposit guarantee scheme, which protects savings up to a certain amount in the event of a bank’s insolvency.

For a different take on managed investments, consider the Cuenta de capital gestionada Utmost International.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.