This article will talk about LEOcrowdfunding Review. So, let’s look into a brief background of the company as well as the services it offers.

If you have been proposed this option and want a second opinion, you can email me (advice@adamfayed.com) or póngase en contacto conmigo aquí.

Who is LEOcrowdfunding?

Based in London, LEOcrowdfunding is a crowdfunding platform that was originally known as LEOpropcrowd when it launched in November 2018. The platform’s goal is to facilitate a win-win partnership between developers, landlords and investors by providing the latter with opportunities to invest in inmobiliario projects.

Crowdfunding refers to the practice of raising funds for a project or venture from a large number of people, typically through online platforms. It has emerged as a new and increasingly popular source of alternative finance, which means funding options that exist outside of traditional sources like banks, venture capital firms, and angel investors.

Rather than relying on a small group of investors to provide large amounts of capital, LEOcrowdfunding allows individuals to contribute smaller amounts of money to collectively fund a project. This democratization of finance has made it easier for entrepreneurs, artists, and other creators to bring their ideas to life, while also providing investors with access to new and exciting oportunidades de inversión.

Moreover, crowdfunding platforms like LEOcrowdfunding offer several advantages over traditional funding sources, including the ability to reach a wider audience, greater transparency, and more flexibility in terms of funding goals and timelines. As a result, crowdfunding has become an increasingly important source of alternative finance for startups, small businesses, and creative projects around the world.

LEOcrowdfunding Investments

When investing in crowdfunding, there are several possible outcomes depending on the amount of investor interest and the amount of funding raised:

- Zero investors: If a crowdfunding campaign fails to attract any investors, then the project creator will not receive any funding. In this case, the project may be cancelled, or the project creator may choose to relaunch the campaign with a revised strategy to attract more interest.

- Fund pledges: If a crowdfunding campaign attracts some investors but fails to meet its minimum funding target, then the pledges made by investors are usually cancelled, and the funds are not collected. In some cases, the project creator may be able to relaunch the campaign with a lower funding target or seek alternative sources of funding.

- Fully funded: If a crowdfunding campaign meets its minimum funding target, then the project creator will receive the funds raised from investors. The funds can be used to bring the project to life, and investors may receive equity in the company or a promise of future returns on their investment.

What investments are offered?

Explore LEOcrowdfunding’s offerings alongside the comprehensive review of Cartera Investors Trust Access.

The property investment opportunities on LEOcrowdfunding’s platform can also be categorized based on the abovementioned outcomes. Let’s look at some examples:

Investments with no investors

There are two property investment offerings on the LEOcrowdfunding platform that closed with no investors, including the Stafford Gardens. It was a planning uplift project, and the goal was to submit an application for authorization to build 42 flats and four townhouses.

Canceled offering

There were a total of 51 investors who pledged a total of 136,700 pounds to this project dubbed Oak Gardens in Essex. The project was funded to the tune of 78,700 pounds. The Fundraising ran into issues with its senior loan supplier, however, and ultimately chose to cancel the raise to keep the investors safe.

Investments that surpassed targets

There are also many opportunities on the platform that topped their minimum target funding, such as the redevelopment of an old woolen mill in North Tawton, Devon.

The uplift project has set a minimum funding goal of 25,000 pounds and has closed with 42,000 pounds from 23 investors. The project has a term of one year to two years, with projected return of 50% per annum.

Is there a project that’s still open for investments?

Yes, there is one available as of the time of writing.

LEOcrowdfunding gives investors access to a construction project of new flats that will be located in Central Point in Liverpool City. The project is from promotor inmobiliario Integritas Property Group.

The entire Naylor Street project in Liverpool will consist of many phases, the second of which will be the construction of Central Point. Integritas Property Company will be responsible for the construction of 69 residential flats over seven stories on the property, which is now a brownfield site.

The location also has a sizable retail and leisure square, which is equipped with room for six separate business establishments. It is a short walk to both the city center of Liverpool as well as the World Heritage site of the Albert Docks from these flats, which come with either one or two bedrooms. The location has been granted full planning authority and work has already begun in earnest. The agreed-upon construction timeline is shooting for completion in the fourth quarter of 2024.

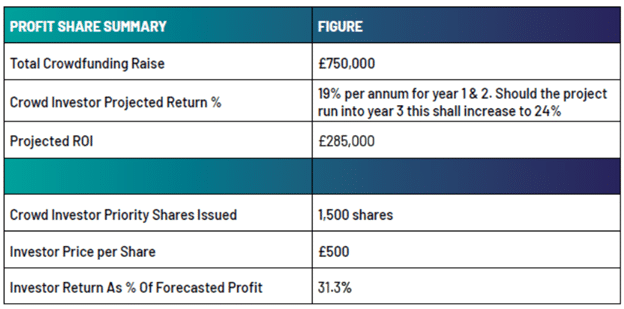

The least amount targeted to be raised for the project is 250,000 pounds, and the highest amount that is aimed to be pooled is 750,000 pounds. Integritas Property has determined that it would provide investors with a return of around 19% per year in exchange for their equity investment. This is going to be a project that takes 24 months.

Below is a summary table of the profit share for the project:

There is also a project that LEOcrowdfunding tagged as “coming soon.”

The Dunlichity House project in Inverness, Scotland, is a serviced accommodation project with additional development opportunities from experienced property developer Forget Me Not Properties.

The target fund for this investment opportunity sits at 550,000 pounds.

What if a project fails?

LEOcrowdfunding typically operates an investment-based crowdfunding model, where investors provide funds in exchange for equity in the company or a promise of future returns. In this model, if the crowdfunding project fails to meet its minimum target, then the project is usually cancelled, and the investors’ funds are returned to them.

However, the company does not explicitly explain if it offers refunds to its investors once the target isn’t reached and an offer has closed. They did warn that “if the business you invest in fails, you are likely to lose 100% of the money you invested.”

To be fair, there was a planning uplift project offering called Barn Hill View Estate Limited. It was able to secure 102,900 pounds from 37 investors after a successful crowdfunding effort. The Fundraiser, nevertheless, made the decision to not continue with the raise.

They made it clear that the money was returned to the investors in addition to a goodwill payment of 2%, which served as an acknowledgment of their contribution.

So, if you plan on joining their crowdfund opportunities, just make sure to clarify this vital detail to the company directly.

¿Quién puede invertir?

The investment opportunities offered by LEOcrowdfunding are available to residents of the United Kingdom who meet certain financial criteria. Specifically, individuals who are classified as Certified High Net Worth Individuals or Self-Certified Sophisticated Investors are eligible to invest. Additionally, those who confirm that they will invest less than 10% of their net assets in certain types of investments can invest as restricted investors.

LEOcrowdfunding is open to discussing potential opciones de inversión for individuals located outside the UK who possess a significant amount of investment capital. However, the viability of such opportunities will depend on the specific circumstances of the prospective investor and the regulatory framework in their country of residence.

If you are interested in exploring these possibilities as an overseas investor, just send an email to Support@LEOcrowdfunding.com.

Cómo invertir

Investments made on the LEOcrowdfunding platform are held in separate client bank accounts managed by ShareIn, a third-party provider.

There are multiple payment options available to investors, including:

- Pre-funding the wallet associated with your account and using the balance to pay for your investment.

- Notifying the firm that you will be making payment via bank transfer after placing your order.

How does return on investments look like?

You can earn up to 30% returns, but this aspect will be determined by the specific real estate venture that you will finance. The particulars for each investment return will vary. They are posted on the company’s platform.

Investing in a firm such as those that are listed on the LEOcrowdfunding platform comes with a significant risk, but it also comes with the prospect of a huge payoff. Should the company in which you invested is not successful, it is quite possible that you will lose all of the money that you put into it. Even in the event that the company in which you invest proves to be profitable, it can take a number of years before you see a return on your investment.

What are the investment fees?

Using LEOcrowdfunding to make an investment does not cost you anything extra. The business will bear the expenses of fundraising that are linked with this investment round.

Are there minimums?

You can infuse funds worth as little as 100 pounds for your chosen property project.

LEOcrowdfunding Fundraisers

If you are interested in the company’s fundraising initiative, you only have to fill out a simple form on the firm’s website that asks for your complete name, email address, contact number, message to the company, and project details.

What are the fees for fundraisers?

LEOcrowdfunding has the following fee structure in place:

- A fee of 750 pounds for onboarding and rolling out a project on the platform.

- A 5% fee for successful fundraising campaigns.

What are the pros and cons of crowdfunding using the platform?

LEOcrowdfunding, like any other crowdfunding platform, has both upsides and downsides.

Here are some of the benefits associated with LEOcrowdfunding:

- Access to capital: LEOcrowdfunding provides SMEs with an opportunity to access capital that they may not be able to secure through traditional funding sources such as banks or venture capitalists.

- Investor engagement: LEOcrowdfunding allows SMEs to engage with potential investors and build a community of supporters around their projects, which can help to increase brand awareness and customer loyalty.

- Cost-effective: Crowdfunding can be a cost-effective way to raise funds, as it eliminates the need for expensive legal and financial services that are typically required for traditional fundraising methods.

- Innovation: Crowdfunding platforms like LEOcrowdfunding encourage innovation by providing a platform for new and creative ideas to be developed and funded.

Meanwhile, here are some drawbacks with LEOcrowdfunding:

- Failure to reach funding targets: If a crowdfunding campaign fails to meet its funding target, then the project creator will not receive any funding, and the investors’ pledges will be cancelled.

- Lack of control: When investors participate in a crowdfunding campaign, they typically have little to no control over the project’s management or decision-making processes.

- Unproven business model: Many of the companies that seek funding on LEOcrowdfunding are start-ups or early-stage businesses, which may not have a proven business model or track record of success.

- Limited investor protection: Unlike traditional investment options such as stocks and bonds, crowdfunding investments are not typically regulated by financial authorities and may not offer the same level of investor protection.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.