This article will focus on a review of Maydan Capital, doing business as WahedX, to help prospective investors who are eyeing an investment with the platform.

If you have been proposed this option and want a second opinion, you can email me (advice@adamfayed.com) or póngase en contacto conmigo aquí.

We can sometimes offer discounts, and other benefits, if you want to invest in it, compared to many other providers, or introduce alternatives which might be better for your situation.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

What is Maydan Capital?

Maydan Capital is a global equity funding platform that is flexible and transparent. It gives investors access to pre-screened startups and growing businesses in a variety of international markets, such as real estate and tech. Such portfolios are all screened according to Islamic principles.

WahedX also offers a user-friendly and accessible platform that allows investors to manage their portfolios online. The company’s use of technology and robo-advisory platform, combined with its focus on long-term investing and risk management, make it a popular choice among Muslim investors in the UK.

One of the key benefits of using WahedX is that it provides investors with access to halal investment options that are typically not available through traditional investment channels. This can be particularly important for Muslim investors who want to ensure that their investments are aligned with their religious beliefs.

What is halal investing?

Inversión halal refers to investment activities that are in compliance with the principles of Islamic finance. In Islamic finance, the investment must adhere to the Shariah law, which is the Islamic law derived from the Quran and the teachings of the Prophet Muhammad.

Halal investment prohibits investments in industries that are considered haram or forbidden in Islam, such as alcohol, gambling, tobacco, and pornography.

Halal investment opportunities can include investments in businesses that provide halal products and services, such as halal food, Islamic finance, and healthcare, among others. Some common examples of halal investment vehicles include Shariah-compliant stocks, Islamic bonds (Sukuk), and real estate investment trusts (REITs).

Halal investments aim to provide a way for Muslims to invest their money in a socially responsible and ethical manner while still earning a return on their investments. They are becoming increasingly popular around the world, and many financial institutions now offer specialized products and services that cater to the needs of halal investors just like what Maydan Capital is doing.

Maydan Capital Investment Opportunities

¿Cómo funciona?

Explore the investment options on Maydan Capital’s platform and register as an investor. Once you are signed up, you will be privy to information and access all offerings that need funding. When you are ready to invest, make sure to distribute your risk by choosing a mix of offerings.

Investing in businesses on the WahedX platform involves selecting early stage and growth-focused enterprises that are believed to have the potential to expand their operations. By investing money in such businesses, you obtain a proportionate stake in their equity, represented by shares in their company. The value of these shares may increase over time, especially if the business experiences success, and you may be able to sell them at a profit or receive dividend payments at a later date.

It’s important to note, however, that investing in early stage firms on the platform can be risky. Many startups and small enterprises fail to achieve success, resulting in the loss of some or all of your investment. Therefore, it is crucial to conduct due diligence and research to ensure that the business you are considering investing in has a sound business model, experienced management team, and a clear plan for growth.

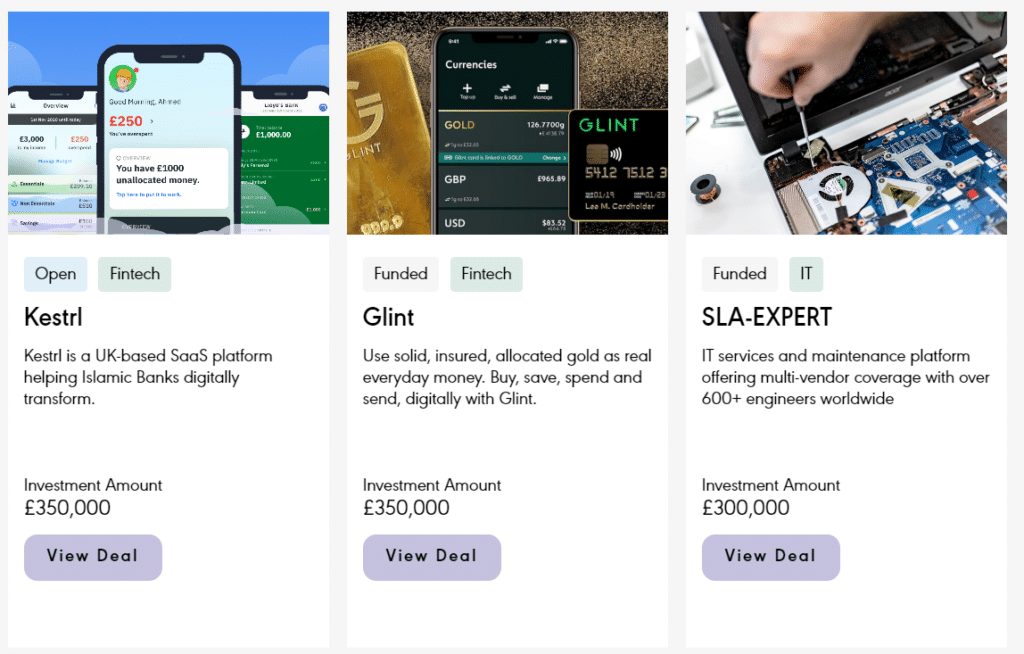

There are seven investment options on Maydan Capital’s website with target funds that range from 135,000 pounds to 350,000 pounds, but six of them are all closed for new investments. The closed offerings are those for UK firms Glint and Zenpulsar, Pakistani company Lokal, UAE business SLA-Expert, Canadian firm Econommi, as well as Dutch company Fairnance.

Let’s look into the details for the investment opportunity on Kestrl that currently still accepts new investors.

Who is Kestrl?

Kestrl is a UK-based Islamic fintech company that provides digital banking solutions and services for Islamic banks and financial institutions. The company aims to bridge the gap between traditional Islamic finance and modern digital technology by offering Shariah-compliant products and services that meet the needs of the modern banking industry.

Kestrl’s business can be divided into two main segments: business-to-business (B2B) and business-to-consumer (B2C).

The B2B segment involves offering digital banking solutions to Islamic banks and financial institutions. This includes providing digital banking platforms and tools that these institutions can use to offer their customers banking products and services that adhere to the Shariah law.

Meanwhile, Kestrl’s B2C segment involves offering digital banking services directly to customers. The B2C solutions are designed to provide a seamless and user-friendly experience for customers while ensuring compliance with Islamic finance principles.

What makes this a potentially profitable investment?

Islamic finance is a rapidly growing segment of the financial industry, and there is a significant demand for Shariah-compliant banking products and services. Kestrl’s digital banking solutions can help Islamic banks and financial institutions provide these services to their customers, while also providing a range of innovative solutions for individuals and businesses.

Kestrl is well positioned to benefit from the projected growth of the global Islamic fintech market, which is expected to reach a size of $179 billion USD by 2026, with a compound annual growth rate of 17.9%. This growth reflects a strong demand for digital solutions that cater to underserved Islamic banks. Kestrl’s unique offerings in this space make it a promising player in the market.

The global Islamic banking industry is growing rapidly, with around 250 Islamic banks in operation and more being established each year. Assuming that approximately 50% of these banks are looking to digitize their operations, it translates to a potential market of 125 Islamic banks that Kestrl could target as clients.

Based on its current business model, the company’s total addressable market in this space could be at least 45 million pounds per annum. With Islamic banks located across different regions such as the Middle East, Southeast Asia, Central Asia, and Africa, Kestrl has a vast market opportunity and the potential for geographical buildout.

Furthermore, the fintech industry as a whole has seen significant growth in recent years, and digital banking solutions are becoming increasingly popular around the world. Kestrl’s focus on the Islamic finance sector provides a unique niche that could be an advantage.

The Islamic fintech ecosystem presents limited direct competition in this area. Expertise is required to navigate this niche market, which can pose a challenge for new entrants. Kestrl has a distinct advantage in this space, thanks to its position as a UK-based Islamic fintech with a thriving community of over 6,000 active members. Building an engaged community is crucial for any new entrant, and Kestrl’s established community represents a significant barrier to competition.

Moreover, the stringent Shariah compliance vetting process poses a challenge for non-Islamic software providers seeking to cater to the needs of Islamic banks.

The target funding for this investment option is 350,000 pounds.

Who can invest on Maydan Capital’s investment opportunities?

Residents of the UK and member-states of the European Union (EU) can become investors.

If you are located outside of the UK and Europe and wish to invest in the company’s platform, you will need to self-certify as an accredited investor in your local area. This is a requirement intended to demonstrate that you possess the professional knowledge and understanding necessary to appreciate the risks involved in investing in private firms.

It is important for Maydan Capital to ensure that investors have the expertise to make informed investment decisions. By self-certifying as an accredited investor, you acknowledge that you are capable of evaluating the merits and risks of investing.

It is important to note that the firm does not accept investors from certain jurisdictions due to regulatory and compliance considerations. To know if your jurisdiction is qualified, you can reach out to the company directly.

¿Hay mínimos de inversión?

The minimum investment amount for each offer is determined by Maydan Capital and depends on various factors such as the investee company’s funding requirements and the type and number of potential investors. The current investment option on the company’s website has set 1,000 pounds as minimum investment.

You can pay for your investment via a bank transfer. You will receive instructions on your screen, along with a Unique Bank Transfer Reference Number. This number will be utilized to link your investment to your funds. Additionally, you will receive this information via email.

Do remember that you must send your investment money to ShareIn Ltd, which acts as WahedX’s custodian and holds all client funds in segregated accounts. ShareIn is authorized and regulated by the Financial Conduct Authority.

To obtain more information about the specific terms of the offers, we suggest reviewing the live details provided on the website.

Does Maydan Capital execute due diligence to secure investors’ interests?

Yes, WahedX makes sure that all information and claims included in a business’ pitch are thoroughly checked and verified before the offer is opened to investors. This includes verifying the accuracy, fairness, clarity, and non-misleading nature of each statement made. If a company makes material statements of fact, they are required to provide evidence to substantiate the claim or amend or remove the statement altogether.

Before closing an investment, Maydan Capital conducts due diligence on the company, its legal structure, and its directors. The investment team conducts a thorough revise of every company that raises funds on the platform. This involves conducting a range of key checks and searches using a combination of public registers, third-party sources, and information requested directly from the company.

The due diligence process is designed to protect investors by identifying potential risks and ensuring that the companies listed on the WahedX platform meet rigorous standards. By conducting comprehensive due diligence, we investors can enjoy greater transparency, confidence, and peace of mind when making investment decisions.

Are there other services?

Raising Capital

Before you can use WahedX’s platform to raise capital, you have to submit a pre-qualification form and wait for the firm’s response within three days.

Maydan Capital seeks firms that have upcoming public or private funding round, high quality investors, as well as supporting due diligence information like financial model and cap table. If possible, the firms must have also reached the post-product and post-revenue stages.

What are the fees for raising capital on WahedX?

The firm will not charge you for submitting a pre-qualification form, as no fee is assessed on application review.

In the event that the company is successful in its efforts to gather funds, they reserve the right to assess a fee on the total amount of money raised. Such fee will be subtracted from the total amount of money raised before it is distributed to investors.

You could also incur certain costs for rolling out your fundraising offer. These are payable to third-party service providers. You will be informed of any such fees before you initiate the capital raise.

What are the pros and cons of investing with Maydan Capital?

Investing on WahedX comes with several advantages that make it a popular choice for investors. First and foremost, the company offers a fully digital platform that enables investors to invest in Shariah-compliant assets with ease. This makes it accessible for investors who may not have the time or expertise to manage their investments directly, allowing them to access a diversified portfolio of assets managed by experts.

Besides, the firm focuses on socially responsible investing as well as ethical startups. This approach ensures that investors can make investments that align with their values and principles.

WahedX also prides itself on offering low fees, which means that investors can keep more of their investment returns. The platform offers competitive pricing and has no hidden fees or charges. This makes it a cost-effective option for investors who are looking to maximize their returns without incurring excessive fees.

Another benefit of investing on WahedX is the peace of mind that comes with investing in a regulated platform. WahedX is regulated by the Financial Conduct Authority, which provides a level of security and assurance for investors. Furthermore, WahedX uses ShareIn as its custodian, which holds all client monies in segregated accounts, ensuring that investor funds are protected.

However, investing in businesses that are featured on the WahedX platform comes with a number of risks. Your funds are not protected by the deposit insurance offered by the Financial Services Compensation Scheme, so you cannot file a claim in the event of a loss.

There is also no assurance that you will be repaid the cash that you have invested. There is a possibility that if the firm in which you have invested goes out of business, you may suffer a loss of part or all of the money that you have put in.

Moreover, the investments on the platform are illiquid. Many of the investments listed on WahedX are in early stages, which may not have a well-established market for their shares. This can make it difficult to sell shares if an investor needs to access their funds quickly.

Investing in startups are much like any other kind of investment in that they come with their own unique set of challenges and perils. They can be more challenging to evaluate since they may have limited financial data or operating history. A relatively high percentage of firms that are still in their infancy end up failing.

Maydan Capital Review: Final Thoughts

Investing in equity involves certain risks and may not be easily convertible to cash. These risks include the possibility of losing some or all of the capital invested, limited ability to sell the investment quickly, lack of regular income in the form of dividends, and the possibility of dilution of ownership. Therefore, equity investments should be made as a part of a diversified investment portfolio and only by investors who understand and accept the associated risks and think long term.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.