Private banks usually charge around 2% per year in total costs, layered across custody fees, advisory fees, transaction charges, and investment products rather than as a single transparent fee.

Even conservatively managed portfolios can see costs add up.

Lower-cost private banks and smarter strategies can materially reduce these fees—and we have access to both.

Este artículo trata:

- How much do private banks charge?

- Are there cheap private banks?

- Can you reduce private banking cost?

- Low Cost vs Traditional Private Banks

- Private bank vs wealth management fees

Principales conclusiones:

- Private banking offers personalized service and exclusive access, but fees can be high.

- Fees can be reduced through negotiation and product review.

- Diversify deposits to manage safety and insurance limits.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

What is the downside of private banking?

Private banking often involves high fees, potential conflicts of interest, and limited transparency on returns.

While it provides convenience and exclusivity, the main downsides include:

- High management fees: Many banks charge 1–2% annually on assets under management, plus hidden product fees.

- Limited product independence: Bank advisors may prioritize proprietary products, which can affect returns.

- Requisitos de saldo mínimo: Some services require $500,000–$1 million or more, locking away liquidity.

- Overlapping services: Multiple fees for planificación patrimonial, investment advice, and credit can stack.

Despite these downsides, many clients value the access, advice, and concierge services offered.

Is it worth it to have a private banker?

Private banking could be worth it if you need personalized investment advice, gestión de carteras, and exclusive access to financial opportunities, but not all clients benefit equally.

Consider the following:

- Net wealth level: Clients with over $1 million typically extract the most value from holistic portfolio management.

- Complexity of finances: If you have multiple income streams, international accounts, or business ownership, private bankers can save time and mitigate risks.

- Access to opportunities: Certain structured products, private equity deals, or lending options are often reserved for private bank clients.

- Time value: Convenience and relationship management may justify the fees for busy clients.

For smaller portfolios, the cost-benefit ratio may favor independent advisors or fee-only planners.

How are private banking fees structured?

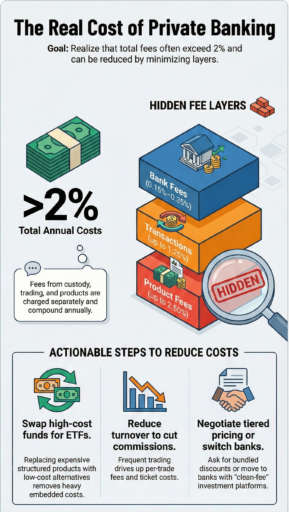

Private banking fees are structured across custody and advisory fees, transaction fees, and investment product fees.

Each fee category is charged separately and compounds annually. Total costs often exceed the headline rate quoted to clients.

What are private bank custody and advisory fees?

Private banks may charge 0.15%–0.35% per year in custody and advisory fees based on portfolio size.

These figures are illustrative examples in Swiss francs (CHF) and may vary by bank or region:

- 0.35% annually on portfolios up to ~CHF 5 million

- 0.25% annually on portfolios between CHF 5–10 million

- 0.15% annually on portfolios above CHF 10 million

These sample rates are charged quarterly and calculated on the gross value of securities, covering safekeeping, reporting, and advisory services.

What transaction fees do private banks charge?

Private banks charge per-trade fees each time investments are bought or sold. Transaction fees may start at 0.25%–1.25% per trade, but they can add up with frequent trading.

Common transaction costs include:

- Renta variable: ~0.5%–1.25% per trade, with minimum fees per transaction

- Bonds and structured products: ~0.25%–1.00% per transaction depending on size

Higher portfolio turnover leads to higher annual costs.

What investment product fees apply in private banking?

Investment product fees typically add 0.25%–2.50% per year on top of bank fees.

Entre ellas figuran:

- Mutual fund and hedge fund management fees

- Additional annual fees for private equity and certain alternatives

- Embedded product costs deducted automatically

These charges are separate from custody and transaction fees.

What is the total cost of private banking?

The total cost of private banking commonly reaches 2% or more per year once all fees are combined.

Esto incluye:

- Custody and advisory fees

- Trading and transaction charges

- Fund and product-level fees

The total is indirect and spread across statements rather than shown as a single line item.

Are private bank all-in fees truly all-inclusive?

No. Private bank all-in fees usually exclude external fund fees, taxes, and third-party charges.

Some structures also apply:

- Per-trade ticket fees

- Additional costs for specific investment products

As a result, total costs can still exceed the quoted all-in rate.

How to reduce private banking fees

You can lower private banking costs by negotiating fees, avoiding high-cost products, reducing portfolio turnover, separating advice from custody, and reviewing total charges annually.

1. Negotiate Fees

• Ask for tiered pricing or reduced management fees on larger balances.

• Explore bundled service discounts if you hold multiple accounts or products with the same bank.

• Some private banks offer cleaner pricing models or lower advisory and custody fees—consider switching if costs are high.

2. Avoid High-Fee Investment Products

• Replace expensive structured products and high-fee funds with low-cost alternatives such as ETFs, clean-fee funds, or transparent bond allocations

• This reduces embedded costs while maintaining portfolio exposure

3. Reduce Portfolio Turnover

• Frequent trading drives up transaction commissions, ticket fees, and product switching costs

• Maintaining a lower-turnover portfolio can significantly cut annual fees

4. Separate Advice from Custody

• Using an independent advisor while holding assets with a custodian bank removes product-driven incentives, improves fee transparency, and often lowers total costs

• This hybrid approach is common among fee-sensitive high-net-worth investors

5. Review Total Costs Annually

• Private banking fees are rarely consolidated in one place

• Conduct an annual review of custody and advisory fees, transaction charges, and fund/product fees

• This gives a full picture of true costs and highlights areas to reduce expenses

Are there lower-cost private banks?

Yes. Some private banks could offer materially lower total costs through reduced custody fees, fewer transaction charges, and clean-fee investment platforms.

Access to these banks can significantly lower annual private banking costs compared to traditional fee structures.

We can connect clients to these cheaper banks, enabling significant fee savings and more transparent pricing.

Traditional vs Low Cost Private Banks

Traditional private banks typically charge 1–2% of assets annually, while lower-cost alternatives can reduce fees to 0.3–0.8% with similar services.

High-net-worth clients often overpay in management fees without realizing it. The difference compounds significantly over time, affecting long-term wealth growth.

| Feature / Cost | Traditional Private Bank | Lower-Cost Private Bank |

| Management Fee | 1–2% of assets/year | 0.3–0.8% of assets/year |

| Account Minimum | $1M+ | $250K+ |

| Advisory Access | Gestor de relaciones dedicado | Digital + optional advisor |

| Opciones de inversión | Full range, often in-house products | Broad, including ETFs, mutual funds |

| Performance Reporting | Estándar | Real-time, digital dashboards |

| Additional Fees | Transaction fees, fund fees, exit fees | Minimal or transparent fees |

Private bank fees vs wealth management fees

Private bank fees are typically higher than independent wealth management fees, mainly due to custody charges, transaction commissions, and embedded product costs.

Private bank fees

Private banks usually charge:

- 0.15%–0.35% custody and advisory fees

- Per-transaction trading commissions

- Embedded fund and structured product fees

Total costs often reach around 2% per year when all layers are included.

Wealth management fees

Independent wealth managers typically charge:

- A single advisory or management fee, often 0.5%–1.0% per year

- Lower or pass-through custody fees via third-party banks

- Fewer embedded product commissions

Total costs are usually lower and more transparent than traditional private banking structures.

Preguntas frecuentes

Is it safe to have $500,000 in one bank?

Yes, generally. Most banks insure deposits up to regulatory limits ($250,000 in the US under FDIC, higher in some jurisdictions).

Amounts above insured limits carry credit risk unless diversified across multiple banks.

What is the minimum wealth for private banking?

Typically, $500,000 to $1 million, though some banks offer entry-level private banking at $250,000.

The threshold varies by institution and region.

Who qualifies for private banking?

Eligibility usually requires:

• High net worth (generally $500k+)

• Complex financial needs (multi-currency, international exposure, business ownership)

• Interest in bespoke wealth management solutions

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.