(This article was last updated on February 3, 2023.)

Quilter Cheviot Review – is it a good option this year? That will be the topic of today’s article.

Quilter Cheviot, also known as Quilter Cheviot Investment Management, is a Discretionary Fund Manager (DFM). It is currently owned by one of the largest players in both the UK and offshore expat financial arena (Old Mutual), and also have its own fund ranges.

Quilter Cheviot has 24.9 billion pounds or around 30 billion US dollars assets under management as of September 30, 2022, and this number keeps increasing.

The discretionary fund manager has offices located in 13 different areas around the United Kingdom, in addition to having an international footprint in Jersey and Dubai. The firm provides a wide array of investment services and has a comprehensive offering. It is also used by some advisors in the expat arena.

In order to cater to more than 36,000 customers, Quilter Cheviot has designed investment solutions that are particularly suited to the client’s needs as well as their risk profile.

We will discuss the services offered by the firm and give our review alongside suggesting what you can do if you have a portfolio with the company.

If you are looking to invest, you can contact me on advice@adamfayed.com or use the WhatsApp function below.

Table of Contents

What are Discretionary Fund Managers and how are they used?

Increasingly, many expat financial companies are outsourcing the financial management to Discretionary Fund Managers (DFMs). So, the financial advisor is selecting the DFMs they recommend and then using them to select investments.

In this model, the advisor is simply doing the financial planning part of the operation, such as finding out how much money the client can afford to invest, but then is outsourcing the investment management part of the puzzle.

What are the options available with Quilter Cheviot?

Discretionary Portfolio Service

It is intended for people who would like to invest more than 250,000 pounds (300,452.5 dollars). With this account, an investment manager will have control over your holdings, will determine what you buy, sell, and when to take action based on their best judgment.

They will construct a portfolio for you that corresponds to your goals and will manage it actively, so they will make appropriate modifications according to changes in your tolerance to risks and investment time frame, as well as fluctuations in the market and the economy, plus other variables.

Your dedicated Investment Manager will not only manage your investment portfolio but will also serve as your point of contact and be available to answer any questions you might have. You will have regular scheduled meetings with them, but in addition to that, you will also have the ability to talk to them whenever you want.

Managed Portfolio Service

Individuals with an investment budget of more than 40,000 pounds (48,072 dollars) can take advantage of Quilter Cheviot’s Managed Portfolio Service (MPS).

You will have access to the following under this service:

- a local investment manager who is dedicated to addressing any concerns you may have regarding your portfolio

- a complete custody, portfolio administration, as well as detailed reporting services, such as valuation, capital gains tax report, tax-year end, plus online reporting

- the firm’s equity and fund research teams will provide you with factsheets per month on top of regular investment editorials.

Climate Assets Funds

Both the Climate Assets Balanced Fund and the Climate Assets Growth Fund make investments in businesses that are actively working to improve the state of the world while adhering to a set of core moral principles.

Investing in businesses that are dedicated to finding long-term solutions to some of the problems facing the world is a primary focus of this investment service. It also offers a solution to potential investors who are interested in investing in the expanding markets for sustainable practices and environmental technologies and those who possessed a balanced or growth risk appetite.

To guarantee that the firms is making well-informed decisions on its investments, the Climate Assets investing process takes into account a number of important aspects of sustainability and conducts data analysis.

Specifically, the focus for most of the investments are in these three areas:

- businesses that share the firm’s commitment to ethical principles

- government bonds that assist in providing portfolio protection

- non-traditional assets such as the infrastructure for renewable energy sources

This service also focuses on medium and large enterprises of high caliber, which have the potential to minimize the cyclical nature of returns and safeguard investments.

The investments made are solely in businesses that can provide answers to persistent problems within the following industries: water, food, clean energy, health, and resource efficiency industries.

Companies that make their money from dubious areas of the economy are not eligible for investment in the funds.

Climate Assets Balanced Fund

This fund was rolled out in 2010 as part of Quilter Cheviot’s Climate Assets Funds service.

The equity content under this fund is between 60% and 75%.

Climate Assets Growth Fund

This was recently rolled out, in 2022, and contains equity of between 75% to 95%.

You have the option of directly investing in the Climate Assets Balanced and Growth Funds, as well as investing through one of the following platforms: AJ Bell, Hargreaves Lansdown, Interactive Investor, and The Big Exchange.

AIM Strategy

Individuals who would like to invest more than 100,000 pounds can take advantage of Quilter Cheviot’s Alternative Investment Market (AIM) Strategy, which was developed with estate and inheritance tax (IHT) preparation in mind. Clients who have been introduced to the Quilter Cheviot AIM Strategy by a professional adviser are eligible to invest in the strategy.

The Quilter Cheviot AIM approach prioritizes the protection of capital while minimizing the impact of inheritance taxes. Investors have the opportunity to acquire access to a broad portfolio of companies that are listed on the Alternative Investment Market by participating in a tax-efficient elective approach.

Because it is anticipated that these enterprises will be eligible for Business Relief, the investor’s prospective inheritance tax liability may be reduced as a result of the investment in such businesses.

What are some of the benefits of utilizing the AIM Strategy?

Possible decreases in inheritance taxes

After two years, assets that have been invested in the AIM service will no longer be considered part of the investor’s estate and will therefore no longer be subject to inheritance tax. In other words, the beneficiaries are exempt from paying an inheritance tax of up to 40 percent of the fortune they received.

Wrappers for Individual Savings Accounts (ISA) can accommodate portfolios

Putting those assets inside of an ISA wrapper not only removes them from the reach of the Inheritance Tax, but it also protects them from the Income Tax and the Capital Gains Tax.

Management that is active

The investments of customers are actively managed within the AIM portfolio, and Business Relief is incorporated as an integral component of the approach.

Quilter Cheviot enjoys the benefits of having an in-house Small Cap expert that works to choose equities that generate cash, are profitable, and have healthy balance books. The company must take an active role in managing the portfolio to ensure that the stocks continue to satisfy the requirements that have been set.

Additionally, the company has access to both small and worldwide large cap corporations, which, along with the assistance of the company’s in-house specialized equities and funds analysts, provides a substantial amount of information.

What criteria are used to select companies?

The research department at Quilter Cheviot conducts a check on AIM-listed stocks that have a market cap of at least 250 million pounds and a free float that sits at a minimum of 50 percent. The percentage of a company’s shares that are freely tradable on the stock market is referred to as the “free float.

After that, this list is narrowed down to include only the stocks that are eligible for business relief. Due to these criteria, the list of stocks can be narrowed down to approximately 100. After compiling this prospective buy list, the team will perform in-depth research on the qualities of individual equities that are being considered for inclusion in the portfolio.

Considerations pertaining to the environment, society, and governance are completely incorporated into the research procedure, which assists in the identification and awareness of potential prospects and risks involved.

Business Relief was first implemented in the United Kingdom in 1976 with the intention of shielding certain qualifying business assets from inheritance taxes. This protection extends to a relief of one hundred percent for shares held in eligible unquoted trading enterprises. For the purposes of these considerations, unquoted shares include those quoted on AIM.

If the firm is eligible for relief and the asset is retained for a minimum of two years, the asset’s value is free from IHT upon the death of the investor, subject to possible constraints where the firm owns any excepted assets. Such excepted assets mean investment assets that are not considered necessary for the company’s operations.

The investee firms that are chosen to be included in your Discretionary Managed AIM Strategy will be under a recurring and independent assessment per year that will be conducted by tax specialists that Quilter Cheviot has retained.

During this assessment, the financial records of each investee firm are analyzed, and a description of the scope of the business relief that is likely to be made accessible to investors in that business is provided.

Investors ought to be aware that the final decision regarding whether or not the stocks meet the criteria for Business Relief will still be made by HM Revenue and Customs (HMRC) during probate and will be dependent on the particular situations of the investee firm during the time of the investor’s passing.

Are there risk controls implemented?

- Get to know the management before any investments are made.

- Steer clear of companies that consistently lose money.

- Steer clear of so-called blue sky firms

- at least 250 million pounds worth of market cap

- ownership of a firm’s free float should not exceed 3%

What about service costs?

The initial fee is 1% plus VAT, up to a maximum of 5,000 pounds.

This is calculated based on the total worth of the monies that were initially put into the strategy.

There is also a management charge of 1.25% per year plus VAT. The value of your portfolio at the conclusion of each month is used to calculate the yearly management fee, and this value is then averaged throughout the course of the charging period.

Within the context of the AIM Strategy, Quilter Cheviot does not impose any dealing charges on its customers. Because of this, clients can benefit from more accurate and open information regarding pricing.

What should you keep an eye out for?

When investing in smaller businesses, you must keep in mind that the risk involved is far higher than with investing in larger organizations.

Because there is a limited market for investments in smaller businesses, it may be more challenging to sell stakes in those companies.

The benefits of investing in this portfolio are contingent upon the regulations concerning taxes that are now in effect. Any potential future modifications to those rules could have an impact on any benefits obtained from holding onto AIM stocks.

It should be noted that the service is not suggested for any reason other than shielding assets from inheritance tax, and the only investors who stand to gain from it are those whose estates have a value that is more than the present level of IHT-free allowances, which is at 325,000 pounds.

Because the regulations governing business relief necessitates investments to be kept for a minimum of two years, in order to be eligible for inheritance tax relief, you should have kept investments in an eligible portfolio for a minimum of two years prior to your passing.

Advice & Dealing Service

Quilter Cheviot provides clients with access to a customized dealing facility that includes foreign stocks, fixed interest assets, and collective investments like unit trusts.

Through their Advice and Dealing Service, they are able to provide you with a significant amount of help even if you choose to take a more hands-on approach to the decisions regarding your investments.

What do you get when you use the Advice & Dealing Service?

- A devoted investment manager who is able to provide guidance, talk about specific investment concepts, and provide overall market summaries.

- Access studies on markets, economies, and currencies both in the UK and overseas.

- The services are provided by a stockbroking team.

If you would rather exercise your own investment choices and would like to be active in the everyday administration of your investment portfolio, there is a straightforward and commission-only method of trading that you may take advantage of too.

You will get contact to a dedicated investment manager as a feature of the service. This manager will be able to discuss specific investment ideas on top of more broad market observations, and there will be no additional management costs associated with this discussion.

Cash Management Service

Quilter Cheviot investors are urged to take a long-term strategy to investing, but it is also acknowledged that you might wish to retain funds for an emergency, a future plan, or just for convenience of access if you invest in the company. Therefore, in order to provide you with the opportunity to handle your financial matters online, they have formed a partnership with Flagstone.

What exactly is flagstone, then?

Flagstone is a web-based cash management platform that provides competitive interest rates available on a broad range of bank deposit accounts. It provides a straightforward method for managing funds while ensuring its growth at a predetermined rate for a period of time based on one’s choice.

Make sure to get in touch with an investment manager from Quilter Cheviot if you need assistance establishing and managing a Flagstone account.

You can obtain the highest possible rate of return by investing sums greater than 250,000 pounds for a variety of time frames, ranging from immediate access to five years through Flagstone.

Because the system is hosted online, it is incredibly easy to monitor both account balances and interest accrued around the clock.

The Financial Conduct Authority (FCA) regulates Flagstone and all of the banks that offer account opening services through the platform.

What are the fees and charges involved with Quilter Cheviot?

Quarterly Management Fee

There is a management fee that is assessed on a quarterly basis, and it is determined as a percentage of your portfolio. This encompasses all parts of portfolio management, including general administration, reporting, review meetings, and any costs associated with providing custody of assets, as applicable.

There are a few exemptions from the VAT that apply to the management fee, but it will be subject to VAT overall.

Annual Management Fee

There is a 1% standard fee per year that is calculated based on the portfolio’s entire valuation as of the end of each month, then averaged across the charging time frame and charged in arrears every three months. A VAT is also charged as applicable.

There is a possibility that the annual management fee would adhere to a tiered structure. This implies that the cost will decrease proportionately to the growth of the amount of money invested. In the event that a tiered structure is utilized, the Investment Proposal will provide specific information regarding its implementation.

Other Charges

ISA Initial Cost

There is a 0.50% preliminary fee for individual savings account on top of VAT, as applicable.

CHAPS Charge

There is a fee worth 20 pounds for every transfer under the Clearing House Automated Payment System (CHAPS).

SWIFT Charge

The cost for every transfer using the Society for Worldwide Interbank Financial Telecommunications (SWIFT) international payment network is also 20 pounds.

Currency Conversion Fee

After accounting for a foreign exchange brokerage fee of 0.07% from Quilter Cheviot’s broker, the exchange rate that is being used for currency conversions stands at 0.75%.

Custody Fee

There is a charge worth 45 pounds for every asset in the UK or abroad.

Dealing Commissions

The standard charges are:

- 1.90% on the first 10,000 pounds

- 0.50% on the succeeding 10,000 pounds

- and 0.30% subsequently, with a fee worth at least 50 pounds for every deal

Dealing Charge

The dealing charge is worth 40 pounds for every transaction.

There are also third-party brokerage charges like the one added for currency conversion.

The total fees will largely depend on how much your advisor charges and what platform is being used. The total net fees could exceed 2% or 3% if you factor in all the layers of charges.

Why might Quilter Cheviot investors lose to the market?

Quilter Cheviot try to use research to identify future trends. This is almost impossible to do, alongside beating the market, after the net fees.

There are so many unknown unknowns and known unknowns, that being able to “out-research” the market is almost impossible.

Even if you are able to beat the market gross, the net returns might be lower, adjusted for such charges. 80% of investors fail to beat the S&P500 over 5-year periods and around 98% of investors fail to beat it over 40 to 50 years.

Lower volatility and diversification, moreover, doesn’t always lower your risk.

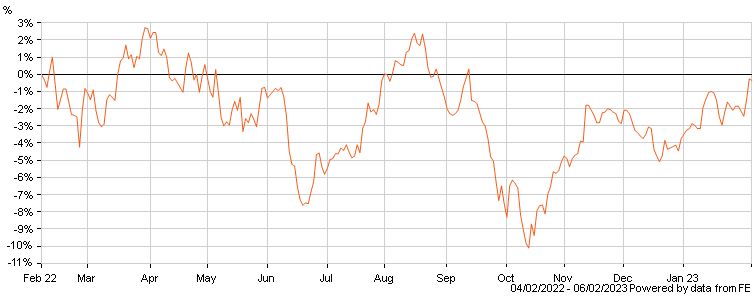

How about the performance during the 2020 bear market?

So far during the 2020 crisis, Quilter Cheviot multi-asset returns haven’t performed especially well, compared to a mixed portfolio of index and bond funds.

Their climate assets and Libero funds haven’t done well during the 2020 bear market.

Quilter Cheviot just like everybody else, couldn’t have seen such crisis coming, and markets are still recovering from its long-term impacts.

The point though is that it is hard to out-research the market by doing loads of research, if you live in a world with loads of unknown unknowns and known unknowns.

Quilter Cheviot Review: Conclusion

Quilter Cheviot is a professional company that have their fingers in many pies. Their funds aren’t bad, but they aren’t a good company either. Many of their funds and investments have underperformed the market. Plus, there are so many charges that you can get a better deal out of elsewhere.

Take note that in investing, you must ask yourself these questions:

How much of a risk are you willing to take in order to make the progress you need toward your objectives?

It is essential to determine a level that you are content with, but keep in mind that this is something that can be modified as you progress through the many periods of your life.

What is the maximum amount of time you can commit to keeping your money invested?

Are you expecting to save for something with a longer time horizon, such as a pension, or do you require access to your money in the event of an unexpected emergency?

What exactly do you want to happen with the money you have invested?

You have the option of either progressively increasing your wealth, getting constant access to your investments, or a combination of the two. Should your goals shift, you are free to adapt your plan accordingly.

What can you do if you have an underperforming portfolio?

Please email me – advice@adamfayed.com or contact me on some apps I am available on.

Further Reading

I am the most viewed writer on Quora.com for investing, wealth and personal finance, with over 221 million answer views to date.

In the answers below I focused on:

- Is $1 million enough to retire in the UK, the US, Canada and most developed countries these days?

- How about if you have $5 million or $10 million invested or saved up – is it enough for a luxury retirement?

- Is $300,000 enough to retire in a place like Thailand, Cambodia and other countries in South East Asia?

- How much do you need to retire early and is it a good idea to begin with?

Below is a preview of one of the answers

Here are some options:

Thailand

Thailand now has a huge retiree population. Hot weather, good food, and great beaches make life here easy for many., Bangkok, Hua Hin, Chiang Mai, Chang Rai and Phuket are all popular expat destinations.

Medical facilities in Thailand are world-class, so much that Thailand is now a health tourism location. With world-class facilities offering heart bypasses from around $11,000, you can see why.

Expats coming from the UK and Europe are better off still getting expat insurance though, and for the over 65s, this will cost at least $200-$300 a month, so it’s a substantial extra cost compared to being in the UK or Spain. If you have pre-existing conditions, moreover, you may not get insured.

To get a retirement visa, there are some financial requirements. You need to have a bank account with 800,000 Thai baht (about $24,000 as of the time of update) and double that (close to $50,000) for a couple, or a monthly income of 65,000 baht (around $1,935 a month), or a combination of a bank account and income that exceeds 800,000 baht.

After meeting this requirement, you must then obtain a one-year retirement visa. To get this you must be 50, have a Thai bank book and a letter from your bank in Thailand. Also, you will need to provide pictures, a passport and departure cards.

You will also need to get an `extension of stay’ notice and a re-entry permit. This will allow you to re-enter the country if you leave it. Finally, you must report to immigration every 90 days to check in and verify the address you are living in. If you have ever been deported from Thailand or had any criminal history, you may not get the visa.

For people under 50 who are financially independent and retired, you will need to find another solution. One is to enroll in a Thai language course or another education course. Spend a limited amount of money and get a student visa. In 2017, a digital nomad visa called a Smart Visa was introduced. It is designed for business people.

They have currently limited the applicants to startup business owners, investors, high-level executives, or other highly skilled professionals. Visa rules are always changing, but if you have a decent budget and you are under 50, you should be able to get a visa. Spending two to three months a year in Thailand on a tourist visa if you live elsewhere in South East Asia is very easy.

One of the biggest mistakes I have seen in Thailand is underestimating costs. Many Thais live off $1,000 a month or less, and you can too. But this doesn’t include luxuries. To travel a bit domestically and internationally, sometimes eat out, get insured and so on will cost you between $1,500 to $2,500 depending on your tastes and expectations. A luxury retirement with maids and a big house may cost at least $4,000 to $5,000 a month.

Indonesia

I lived in Jakarta in 2013-2014. Indonesia does attract expats as it is the biggest economy in South East Asia. Jakarta is an expat destination but not a retirement destination. It has some of the worst traffic I have seen that prices are high (especially for alcohol) and it is a business city.

Bali and some other beach resorts, in comparison, are laid back and cheaper. You can live in Bali in a villa and enjoy a luxury lifestyle of spas and massages, all for $2,000. A more modest lifestyle can be had for $1,000 to $1,500.

What did surprise me about Indonesia was how strict immigration could be. I found Indonesians some of the friendliest people I have met, but immigration at the airport was an exception. It was curious for me, as for most foreigners from high-income countries, why would they go to Indonesia on a tourist visa to take money from the non-existent Indonesian welfare system?

Based on that experience, it shouldn’t come as a surprise that there are numerous requirements to retire in Indonesia. In Indonesia, the age in which you can get a retirement visa is 55, five years older than Thailand. The other requirements include:

- Possess a passport or travel documents with more than 18 months remaining validity

- Copy of all passport pages

- A copy of your resume

- A copy of your marriage certificate, if you are married

- Proof of $18,000 per year of income. This will come from statements from your bank or investment funds. Married retired couples must both prove an individual income of $1,500 per month and apply separately.

- Proof of medical/health Insurance, life insurance, and third-party personal liability insurance in a country of origin or Indonesia

- Statement of living accommodation in Indonesia. The minimum cost of $35,000 if purchased house/apartment or a minimum rental cost of $500 per month in Jakarta, Bandung, and Bali; $300 per month for other cities in Java Island, Batam, and Medan; and a minimum of $200 per month for other cities.

- Statement to declare intent to employ an Indonesian maid and driver while living in Indonesia

- Payment of Immigration Fee based on effective regulations

- You must sign a lease for housing with a minimum one-year period. Alternately, you can supply proof that you own a house under an Indonesian spouse’s name.

Cambodia

Cambodia is an off-the-beaten-track location but is up and coming. People are friendly, it is cheap, growing fast and has an easy visa system. Retirees can come to the airport and get a business visa on arrival, and then renew for up to 2 years at a time. Kep and Kampot, moreover, are more relaxed than Phnom Penh or Siem Reap.

Having lived in five countries, visited 35 and visited more than 200 cities, I haven’t seen a place as good value as Phnom Penh for some things. Not cheap, but good value.

Basic goods like water are more expensive in Phnom Penh than China or Thailand, but you can go to an excellent French or other international restaurants for lunch for $10. And that is for three courses! A traditional Khmer massage can cost you $6 to $7 including a tip.

Sihanoukville has a sleazy reputation, but like Pattaya, has been trying to change its image. Some of the beaches are beautiful. It doesn’t have the same amenities as Phnom Penh or Siem Reap, but it does offer a more relaxed lifestyle.

Malaysia

One of the big positives about Malaysia is that they do have a specific retiree scheme. Started in 1997, it has become popular in particular amongst British retirees, which is unsurprising, given that Malaysia is a former UK colony. That fact means that over 90% of Malaysians speak fluent English. Coupled with the golf courses, natural scenery, and excellent climate, this puts Malaysia high on an expat retirees list.

Under the My Malaysia Second Home Program, expats should have at least 1 million ringgit ($232,369) in permanent savings plus at least 1.5 million ringgit in liquid assets declared. The program then helps expats get a 10-year visa and also helps with housing.

Like Indonesia, the capital city is more expensive, but the traffic situation is much better. Outside the capital, expat retirees can buy a house for $75,000 to $150,000.

Penang is a good destination for retirement. Cheaper and more laid back than Kuala Lumpur, with a good climate and the same excellent food, Penang offers retirees a great standard of living.

Vietnam

Vietnam doesn’t have as easy visa situation as Cambodia or Malaysia for retirees. But Vietnam is currently in the sweet spot of development in Ho Chi Minh City, the most developed city in Vietnam. It is still cheap, but it is developed enough to offer extra conveniences compared to Cambodia, such as readily available taxis and cheaper consumer goods due to economies of scale and other issues.

Even though Vietnam doesn’t currently offer retirement visas, it is relatively easy to stay on tourist and business visas long term.

However, excellent health care can only be found in bigger cities such as Ho Chi Minh in Vietnam, which is a similar case with Cambodia. If you get sick or need certain medicines, Vietnam isn’t the best option, even if you get expat medical insurance. Meanwhile, Thailand offers world-class healthcare these days and health tourism has been their reward.

According to International Living (https://internationalliving.com/the-best-places-to-retire/), Vietnam comes way down the list when considering a good place to retire. I would say most expats (both retirees and working-age individuals) seem happy in Cambodia and Vietnam if they can get used to the way of living.

Spain, Portugal, and Greece

Spain is arguably the `original` retiree destination for British, Dutch, Germany and Scandinavian expats. With cheap or subsidized healthcare if you are from the EU (at least for British people until March 2019!), Spain can compete on cost with Thailand and Cambodia once you factor in this benefit.

With relatively good costs in some parts of the country, excellent climate and proximity to other European countries, Spain, Greece, and Portugal will continue to be popular expat destinations.

In Portugal, retirees outside the EU usually hold Type I visas. That visa requires people to show proof of private health insurance valid in Europe, as well as proof of sufficient funds to support living and a criminal background check. After five years’ residence in Portugal, retirees can apply for a permanent residence visa, with associated health care benefits.

Portugal has a great reputation of having friendly locals, an easy-going lifestyle, and ease of opening bank accounts. Against that, driving is supposed to be dangerous and Portuguese is a more difficult language to learn for many expats compared to Spanish and French, but that will depend on your native language.

Bulgaria

Also in the EU, but certainly not a traditional retirement destination, Bulgaria is an up-and-coming retirement destination. With houses from $55,000, cheap costs and an ever-increasing expat community, Bulgaria’s expat community is likely to continue to grow. It’s similar to Cambodia within Europe, in some ways.

One of the advantages of Bulgaria is it is in the EU, so expats from other EU countries don’t require visas. Non-EU citizens who are retired in their home country can apply for a Bulgarian Pensioner ID visa and temporary residence permit. Documents submitted to the embassy will include:

- Documents showing you are entitled to a retirement income, legalized with a notary public.

- Document from a bank in Bulgaria ascertaining that the application has a valid bank account in Bulgaria, where regular transfers can be made

- Evidence of address in Bulgaria

- Medical insurance

Mexico/Dominican Republic/Panama/Costa Rica:

For Americans and Canadians, Mexico and the Dominican Republic are good destinations. The visa situation is very favorable in the Dominican Republic, with even over stayers fined a relatively small amount of money.

Mexico has an easy-going lifestyle, but many people are worried about safety. Most of the crimes are committed by people who know each other, such as gang members, so retirees aren’t usually targeted.

For Americans all over the world, getting expat insurance will be cheaper than back home. From experience, most Americans are happier with the overseas insurance situation compared to Europeans. For British people who have grown up in a system where healthcare is free at the point of use, people can feel it is an extra cost.

To continue reading click below:

Is 1 million enough to retire in the UK or globally?