One thing to know about this business is that while it is often dubbed Mercury bank, the firm isn’t one; it’s a financial technology company. FDIC-insured banks Choice Financial Group and Evolve Bank & Trust, deliver the actual banking services.

For the purposes of our discussion (and since many refer to it as a bank anyways), we’ll call the company Mercury Bank throughout the article.

Let’s discover various Mercury Bank account offerings as we move along and see for yourself if anything catches your eye.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Table of Contents

Mercury Bank Background

Mercury was founded in 2019 by Immad Akhund, Jason Zhang, and Max Tagher with the intention of challenging the status quo of conventional banking.

Mercury’s main focus is on building banking solutions for new businesses or startups. Checking and savings accounts, debit cards, ACH payments, check payments, local and international wire transfers, and other handy tools are all part of their product set.

Top-tier VC firms, angel investors, and celebrities from the sports and entertainment worlds have all put significant resources into Mercury. Companies including Andreesen Horowitz, CRV, Coatue, and others have invested a total of $163 million. Over 100,000 clients in 180 countries are currently being served by Mercury Bank.

Mercury is able to focus on creating modern products for new businesses because it has established relationships with US banks that adhere to strict regulations. Banks that meet Mercury’s stringent criteria for a partner include those that are subject to federal regulation, have healthy capital ratios and stable assets, are profitable, have a wide range of deposit options and service various customer industries.

Patriot Bank is Mercury’s credit card issuer, while Choice Financial Group and Evolve Bank & Trust are its primary banking partners (providing services such as keeping checking and savings deposits through a network of reputable, FDIC-insured institutions). Apex Clearing Corp, a FINRA-regulated brokerage firm, acts as Mercury Treasury’s counterpart in meeting the same high standards as its partner banks.

Customers with a Mercury Treasury account can invest in mutual funds offered by Morgan Stanley and Vanguard and receive SIPC protection in place of FDIC insurance.

Mercury uses a sweep network scheme to safeguard customer funds by spreading them out over several banks to spread the risk of any one bank failing. Deposits in Mercury’s checking and savings accounts are now insured by the FDIC up to a maximum of $5 million, 20x the normal per-bank limit.

The sweep networks of both Choice Financial Group and Evolve Bank include numerous well-established, FDIC-insured financial institutions. If a customer has more than $5 million in deposits, they can use Mercury Treasury to invest in mutual funds that invest in short-term securities, further diversifying their holdings.

Who can apply for a Mercury Bank account?

With Mercury’s help, American-based businesses can set up shop without having to prove their citizenship or even be physically present in the country. Cayman Islands, British Virgin Islands, and UAE-based startups, e-commerce businesses, and VC firms make up their clientele. All current formation documentation must be made available by these organizations.

However, Mercury does not accept new accounts from people who live in the following territories:

- Belarus

- Burundi

- the Central African Republic

- the Democratic Republic of the Congo

- Cuba

- Iran

- Iraq

- North Korea

- Lebanon

- Liberia

- Libya

- Nicaragua

- Pakistan

- Russia

- Somalia

- South Sudan

- Sudan

- Syria

- Venezuela

- Yemen

- Zimbabwe

With several exceptions, they will work with most American businesses. These exceptions include those in the financial services, adult entertainment, cannabis, and online gambling industries. It’s possible that organizations that regularly deal with cash may be better served by a different solution, given their product is tailored mostly toward the technology sector. In addition, trust accounts cannot be created at Mercury Bank.

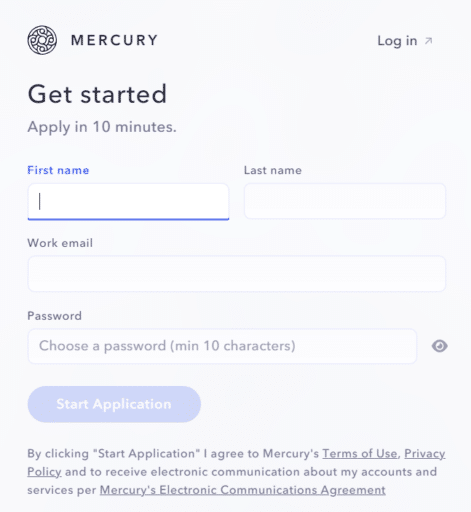

How to apply for a Mercury Bank account

Your company’s unique identification, its Employer Identification Number (EIN), must be provided first. In addition to the articles of incorporation and articles of organization, Mercury Bank also requires a photocopy of your government-issued identification. These conditions guarantee the application for an account is genuine and legitimate, making the application procedure go more quickly and easily.

What are the fees?

Customers may enjoy a stress-free banking experience with Mercury Bank’s free checking and savings accounts, which don’t require a minimum balance or charge any monthly maintenance costs. Overdraft costs are not assessed, giving you even more leeway with your money.

Mercury provides detailed information about up front charges for wire transfers. Wiring money internationally may require the use of several different banks, each of which will add their own fee. Meanwhile, transaction fees are typically hidden from senders since they are subtracted from the recipient’s final balance.

Clients can send money to other clients within the country via free domestic wire transfers. For USD international wire transfers, Mercury not only covers the sending expenses, but also gives consumers the option to pay the recipient’s fees for a flat amount of $15. This method guarantees that the entire money will be received by the receiver.

Moreover, Mercury Bank covers the fees associated with non-USD international wires through a flat 1% foreign exchange rate.

Mercury Bank Products and Services

Checking and Savings Accounts

Since Mercury is not a bank, it works with Evolve Bank & Trust and Choice Financial Group to provide its customers with checking and savings accounts. In just 10 minutes, anybody can apply for these services. They can finance their accounts, give investors wire instructions, and distribute cards to their staff after approval.

Both a regular business checking account and a savings account are available to Mercury Bank clients. Users can restrict company spending by setting spending limits, locking cards at specific merchants, and granting varying levels of access to different members of the team.

Users can make new checking accounts and provide them useful names, such as “payroll” or “accounts payable,” based on their individual needs. They can also schedule periodic automated transfers to move money quickly and easily.

Users of the Mercury mobile app or desktop interface have the added convenience of initiating one-time or recurring ACH and international wire transfers with a few clicks. Unlike the prior limit of six transfers per month, which was temporarily altered during the COVID-19 pandemic, the current federal regulation regarding savings accounts enables unlimited transfers.

Mercury Treasury

Customers with balances over $250,000 have the option of investing in US government securities and money market funds through Mercury Treasury, an automated cash management account.

By investing in low-risk and highly liquid portfolios with partners like Vanguard and Morgan Stanley, Mercury Treasury guarantees the security and scalability of one’s financial resources. Mercury Treasury Solutions with Morgan Stanley is an optional service that provides individualized portfolio management to clients with balances in excess of $25 million.

Regardless of the size of your deposit, your money is safer with Mercury Treasury than with the FDIC. Two of Mercury Treasury’s investment options are the ultra-conservative Vanguard Treasury Money Market Fund and the moderately risky Morgan Stanley Ultra-Short Income Portfolio. The former mainly invests in US government-backed securities, while the latter invests in commercial paper and certificates of deposit.

Apex Clearing Corp, a broker-dealer supervised by FINRA with a successful four-decade history, holds your Treasury accounts exclusively in your name. Apex’s role as a broker-dealer prevents it from using or commingling customer funds or securities for its own benefit.

Your money is completely safe at Apex, even if Mercury or its network of partner banks experiences liquidity problems. If Apex ever came into trouble, your money would be transferred without a hitch to another respectable broker-dealer. If something were to happen to your primary bank, your money and securities housed at Apex would continue to be safe and easily accessible.

Apex Clearing is a member of the Securities Investor Protection Corporation (SIPC) which insures investors’ cash and securities up to $500,000 in the extremely unlikely event that Mercury Bank’s brokerage firm goes bankrupt.

Although there is a minimal administrative fee associated with using Mercury Treasury, there are no fees associated with creating an account or making a purchase. Instead, a small percentage of the sum of a customer’s monthly Mercury Treasury positions is charged, with the exact amount dependent on the total amount deposited in all of the customer’s Mercury accounts.

When cash is needed, it can be taken out of Mercury Treasury. Withdrawals typically post to accounts within 1-2 business days, while some transfers may take up to 5 business days to finalize.

Credit

If you have an IO Mastercard, you can start making purchases immediately using your virtual card and then receive your actual card in the mail. There is no minimum purchase requirement and no annual charge. Cashback of 1.5% per month is automatically applied to both domestic and foreign purchases made with your IO card.

The user’s credit limit is based on the amount currently stored in their Mercury account, and may increase or decrease after large deposits or withdrawals.

IO permits the distribution of an unlimited number of digital cards and a single physical card to each member of a team. Mercury’s dashboard allows managers to keep tabs on team spending, issue cards with predetermined limitations, and more all while staying inside the confines of Google Workspace.

It’s easy to keep track of your finances and manage your cards from one central location online. You can make as many cards as you like, keep tabs on how much each employee spends, and set individual spending limitations.

Benefits offered by IO include insurance against fraudulent charges, access to MasterRental’s protection against damage and theft in rented cars, ShopRunner’s free two-day shipping, and special offers for new users of services like Salesforce, TurboTax, and QuickBooks Online.

Due to the monthly automated payment of the debt, IO cards have no fees and no interest charges. Payments are automatically debited from a Mercury account on the due date each month, but you can switch to a different account, pay early, or change the due date.

Businesses can apply for IO if they have at least $50,000 in their Mercury account.

A Mercury account is now required in order to receive an IO card, however Mercury checking and savings accounts are free to use and offer a single hub from which to monitor and control a company’s expanding financial obligations.

There is no need to provide a personal guarantee or worry about how your credit score will be affected during the IO application procedure. Physical cards are mailed quickly after approval and usually arrive within 7-10 business days.

Venture Debt

Startups that have just received venture capital financing are prime candidates for venture debt, a special sort of borrowing. Mercury Venture Debt differs from standard commercial loans by placing a higher value on the quality of the VC investors and the founding team, as well as the company’s potential for growth.

Startups can get additional time to reach milestones and raise growth capital by taking on venture loans rather than diluting their stock. Additionally, this type of financing might provide insurance against down rounds.

When a company raises new equity capital, it often chooses to refinance its venture debt with a new lender. If a business has just finished an equity round or is planning to do so soon, Mercury may be able to offer revised conditions and modify the size of the loan to match their needs.

A loan agreement is complete when its conditions are accepted by both parties. Funds can be withdrawn from the Mercury account at any moment during the interest-only term, which can last for up to 18 months. After that, the loan’s repayment term begins, with a maximum term length of 48 months. After securing the next equity round, many founders prefer to ask for refinancing and negotiate new loan terms.

To offset the cost of processing your loan application, Mercury will charge you an origination fee. In addition, they are given a modest warrant that entitles them to buy common shares in the company once it goes public. Mercury, unlike some other providers, does not charge any sort of termination fee, back-end fee, or prepayment penalty.

Capital Raise

Mercury Raise facilitates the fundraising process and expedites the acquisition of financing by linking entrepreneurs with important investors. Mercury Raise has worked with over 630 businesses from 32 countries since 2020 and has helped them raise over $1.7 billion.

All Raise program applications are closed at the moment, but will open again soon. Individuals can sign up to be notified by email when registration reopens.

Raise First Check

Support and introductions to possible investors are provided by the “Raise First Check” initiative, which is of great value to businesses in their early stages. Everyone who joins can try to win a $15,000 investment from Mercury. Through a public vote, the community will select the receiver of this funding.

Rather than imposing a valuation cap or markdown in exchange for the investment, Mercury will use a SAFE (Simple Agreement for Future Equity) note with a Most Favored Nation clause.

No new submissions are being accepted at this time for this grant cycle.

Raise Seed

High-growth startups can use the Raise Seed platform to publicize their seed round to high-profile investors and tap into our vast professional network. The application portal is now closed but will reopen in July.

Applicants will be asked to provide information about their businesses before a panel of judges decides on 50 winners. The entrepreneurs who made the cut can request individual feedback on their pitches from seasoned businesspeople and investors.

Mercury Bank then informs its network of over 800 investors about these 50 firms. They help set up one-on-one introductions between startups and investors who have shown interest in them. Investors have access to the pitch deck for two months after the application is submitted.

Keep in mind that Raise Seed is more concerned with facilitating the fundraising process than actually supporting the businesses that join. The idea, the team, and the growth/metrics since debut all play a role in the final decision.

Mercury maintains a secure database where only its investor network has access to the startup companies’ data. Participants have the opportunity of scheduling a 30-minute, one-on-one pitch review with a mentor, though introductions are not guaranteed.

In previous Raise events, eligible startups received an average of 10 introductions, and this number has grown steadily with each subsequent round.

Raise Series A

The “Raise Series A” initiative is geared toward rapidly expanding businesses who have already acquired seed funding and are now planning to raise Series A capital of $5 million to $20 million within the next six months. In-person advice from successful businesspeople, investors, and industry veterans is invaluable to startups at this stage.

When the Raise Series A application window opens, business owners who are interested in participating can submit an application with information about their firms. A screening committee then evaluates the applications and accepts the top 30–40 applicants based on their demonstrated readiness for venture capital fundraising.

A day-long bootcamp is hosted in San Francisco for selected startups. There will be mentors and feedback on your pitch, your pipeline, how you handle investor dynamics, your budget, and the goals you set for your company. Experts on many fields, including law, finance, and equity considerations in fundraising, share their knowledge with attendees.

The growth and readiness of the startups for Series A fundraising is evaluated throughout the bootcamp by the program’s crew and external judges. When assessing a startup, Mercury Bank looks at their distinctive idea, the quality of their team, whether or not their product is a good fit for the market, and how much growth and measurable progress they’ve made since their seed round.

The program uses these assessments to find and choose the businesses that are most prepared to begin a fruitful Series A fundraising campaign.

Raise DTC

Raise DTC is on the lookout for international direct-to-consumer (DTC) brands in their early, seed stages of development. They don’t have to be a current Mercury Bank customer to apply.

If your company is chosen, you can pitch your product or service live on the Stonks platform in front of a receptive audience and seasoned investors.

Stonks is a live-streaming platform created for business pitches, where investors can make instantaneous investment decisions or request follow-up communication for future connections. Additionally, businesses can use the Stonks dashboard to connect with a group of investors, schedule meetings, and ultimately raise capital.

During the open application period, interested businesses can submit information about their direct-to-consumer brand to Raise. Six firms will be selected after the application evaluation process is complete, and information about them will be presented to a panel of judges and an investor network during a live pitch event.

One of the main advantages of this platform is the possibility of instantaneous funding offers from investors considering your firm. Investors can also choose to get in touch at a later date if they choose. Pitching on Stonks also has the additional benefit of introducing your business to hundreds of new clients.

Based on criteria including branding, product quality, team composition, and growth/metric indications, the Raise DTC team will choose which brands will pitch live.

Pros and Cons of Mercury Bank

Pros

There are no recurring costs and no minimum opening deposit, so it’s very accessible. The customer is also exempt from overdraft fees and can make an unlimited number of fee-free transactions.

Moreover, local and international wire transfers are available at no additional cost, and there are no fees associated with utilizing Allpoint ATMs. Customers may automate and tailor their banking experience thanks to the account’s powerful digital tools, such as API access.

Cons

Clients who need quick assistance may be frustrated by the lack of phone support that is offered. Furthermore, help is only available via email outside of normal business hours and on weekends, which can slow down responses and cause problems to linger.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.