Retirement and Pensions in Luxembourg – that will be the topic of today’s article.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

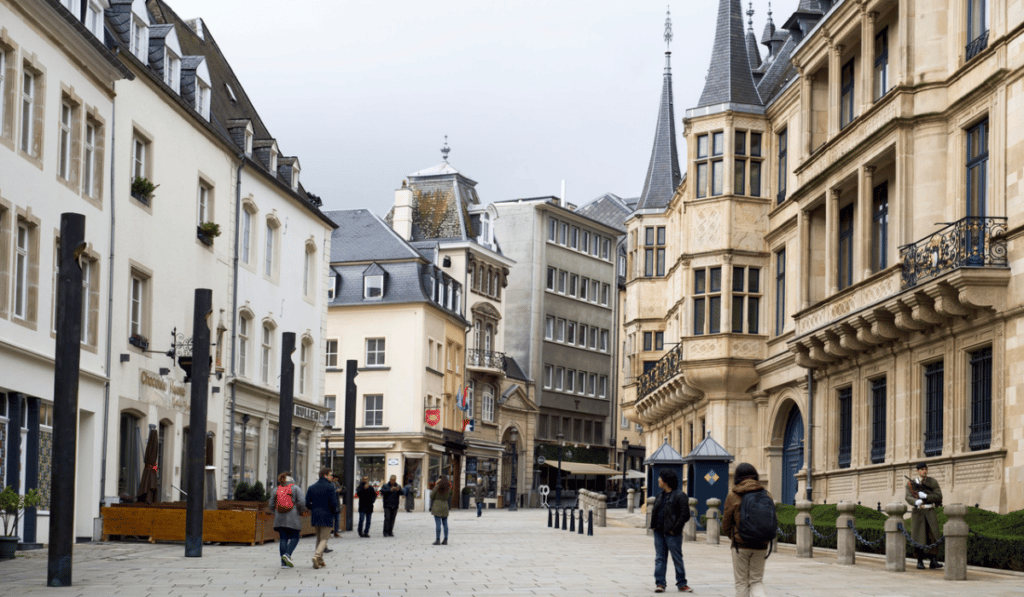

Luxembourg can be an excellent place in terms of safety, beauty, and diversity. Moreover, it is gaining rapid popularity as a retirement destination these days.

Are looking to retire in Luxembourg and don’t know how to proceed? Do you want to know various details related to your pensions in Luxembourg?

Are you already living as an expat in Luxembourg and want to know the retirement details like pensions?

So, today I will cover all the aspects related to retiring in Luxembourg as an expat.

This applies to those who want to go over there and retire as well as those already living as expats.

Let us start by discussing the information for the individuals who want to retire in Luxembourg.

Permanent Residency and Citizenship

Any individual who wishes to stay in Luxembourg should declare their arrival in their municipality of residence.

This is the case when such individual wishes to stay more than 90 days in Luxembourg.

This applies to:

— EU nationals,

— People from countries with similar privileges

— People from third-world countries

In simpler terms, everyone who wishes to stay in Luxembourg for more than 90 days must do this.

While registering, you are required to submit the following documents.

— A valid ID Card.

— A valid Travel Document.

— An Entry Visa (if necessary).

— Residence Permit from another EU member state. This is for individuals who are from third-world countries.

— Family booklet. This should include the details of your family such as marriage certificates, birth certificates of children, etc.

To get access to specific details based on your nationality, click here.

EU/EEA Nationals

There is no particularly dedicated retirement visa in Luxembourg. To become a citizen, you must get permanent residency in Luxembourg.

An individual from the EU will automatically have the right to permanent residence in Luxembourg.

For that, they should have been staying in their country for at least five years.

Just remember that EU nationals have the right to permanent residence. This does not mean they can just go over there and stay for more than 90 days.

For staying more than 90 days, they should obtain a Registration certificate.

Non-EU/EEA Nationals

Those who are not EU/EEA nationals should obtain a residence permit for staying more than 90 days.

To get permanent residence, they would first have to apply for a temporary residence permit.

Upon arrival, you must register your residency within three working days.

We have already talked about declaring your arrival in Luxembourg. Now let us have a look at the Residence Permit in Luxembourg.

Those who are applying for a resident permit are needed to apply within three months. They should provide:

— ID or Passport

— Photo Identity

— Declaration of Arrival (registration certificate)

— Marriage Certificate (if any)

— Birth Certificates of Children (if any)

— Proof of Financial Sustenance

— Proof of long-term relationship (applies to non-registered partners)

The process of getting a residence permit might take as long as six months. The Immigration Directorate is responsible for the approval of such residence permits.

During this time, you are provided with a receipt of an application for the residence permit. This receipt will serve the purpose of your stay until you get the residence permit.

In Luxembourg, a residence permit would be valid for a period of five years. This should be renewed at least two months before expiry.

What happens when any EU family member dies or an EU partner gets divorced? Don’t worry, the individual’s residence permit will not be taken away.

Permanent Residence

The major requirement for getting a permanent residence is to reside in the country for at least five years.

A declaration of arrival, which has been issued five years ago should suffice.

However, the individual should have been staying in the country for at least six months in a consecutive year.

There is an exception for longer periods of absence in the country ins situations such as:

— Complete military service

— Pregnancy

— Childbirth

— Serious Illness

— Education

— Professional training

— Posted for employment in a member state of the EU/non-EU country

Usually, people can qualify for permanent residence within a period of five years. The conditions are given below.

Retired people involved with professional activity in Luxembourg or any other member state of the EU region for the last year.

Retired people who have been living continuously in the country for three years.

People who stopped working as they are unable to work and have been living in the country for two years.

People who stopped working because of an accident at work or occupational illness.

Individuals who start working in another EU member state as cross-border workers. Such individuals should return to their place of residence at least once a week. If this is the case, they can get permanent residence after three years of uninterrupted activity and residence in Luxembourg.

It is a straightforward process to apply for permanent residence in Luxembourg.

— Download the application.

— Complete it.

— Send copies of supporting documents.

— Submit everything to the Immigration Directorate of the Ministry of Foreign and European Affairs.

— Upon approval, the residence permit is sent through the post within one month of applying.

Yes, the permanent residence permit will allow you to live in the country for a lifetime. Nonetheless, you will lose this if you live outside the country for a period of two consecutive years.

Those who have a permanent residence permit will not have to face too many administrative formalities.

It is beneficial if you have a dependent non-EU family member living with you. This includes a spouse or a registered partner or a child, who is a non-EU national.

Such individuals will have the right to permanent residence and get a permanent residence card.

Investor Visa

Those who wish to get a residence can also do it by investing in Luxembourg.

To qualify for the investor visa scheme of Luxembourg, one must meet the following conditions.

— Invest in an existing business

— Invest in ventures

— Invest in a management and investment entity

— Make a bank deposit

The first method is to make an investment of at least €500,000 in Luxembourg company.

A commitment of at least five years is needed regarding the investment lock-in period.

The second method is to invest at least €500,000 in a new company that is yet to be formed.

With this method, at least five full-time positions must be offered within three years of the company’s formation.

The staff requirements are to be handled with the assistance of the National Employment Agency.

The third method is by investing at least €3 million into a structure of management and investment. This entity should not be an already existing entity in Luxembourg.

The final method is by making a deposit of at least €20 million into a financial institution. The institution should be based in Luxembourg and the deposit should be locked in for at least five years.

For more details about the Luxembourg investor visa, click here.

Citizenship

After being a resident of Luxembourg for at least five years, you can apply for citizenship through naturalisation.

As Luxembourg allows dual nationality, one need not renounce his/her citizenship.

To get extensive information regarding the citizenship requirements in Luxembourg, click here.

Pensions

Having discussed the paths to achieving residency and citizenship in Luxembourg, let us discuss pensions.

To begin with, the pension system of Luxembourg consists of the following types of pensions.

— State Pensions

— Occupational Pensions

— Personal Pensions

The administration of all these pensions is carried out by the Caisse Nationale d’Assurance Pension (CNAP).

Individuals working in Luxembourg can claim a full state pension or a partial version of it.

The amount they receive depends on the number of years they’ve made social security contributions.

These contributions are to be taken into consideration until they reach the age of 65 years.

This is the retirement age in Luxembourg and since that age, they receive state pensions.

It was estimated that more than 98,000 people are receiving state pensions in 2022.

Out of these people, more than 35,000 people receive full pensions. Whereas the remaining people (63,000 plus) receive partial pensions.

It has been reported that most of the people receiving partial pensions are expats. Such people are anticipated to claim pension income from other sources as well.

Eligibility

As said before, the primary requirement is to be of an age of at least 65 years.

At least 10 years’ worth of social security contributions is to be made before the pension age.

Such people become eligible for claiming partial pensions in Luxembourg.

Only the people who have made at least 40 years’ worth of social security contributions get a full state pension.

People can also start to claim pension payments starting at an age of 57 years. For this, they must have made at least 480 months’ worth of contributions.

You can even retire after reaching the age of 60 upon making the required number of contributions.

There are no hurdles for expats in Luxembourg to receive the state pension.

The rights for claiming a pension are the same for both foreigners and residents in Luxembourg.

The minimum number of social security contributions to be made by expats is 120.

Insufficient contributions

What if you only moved to Luxembourg after reaching the age of fifty? Can you get the money made in the form of social security contributions back?

Of course. You can.

Yes, the people who don’t qualify for the minimum number of contributions can claim their money.

This is with the help of a service that allows your social security contributions to be reimbursed.

Additionally, people can also apply for reimbursement if they paid more than 40 years of contributions.

This will be reimbursed before they start claiming their pension in Luxembourg.

However, there are some conditions to be satisfied by those who wish to get a reimbursement.

First, they should be at an age of 65 years or more.

They shouldn’t be receiving pension benefits from contributions anywhere (including Luxembourg).

The application is to be submitted before the time when the pension gets paid.

Pensions for expats

Expats moving to Luxembourg from the UK can transfer their pensions with QROPS.

With a Qualified Recognized Overseas Pension Scheme (QROPS), expats can combine their pensions.

Adding to that, individuals can handle their retirement funds in an efficient manner. This would even allow them to steer clear of currency fluctuations.

QROPS may or may not be apt for all types of UK pensioners. To know whether or not you can benefit from a QROPS, it is wise to seek the services of a financial adviser.

Do you find it hard to find an expert financial professional to take care of your financial needs? If so, click here.

Pension Contributions

Any individual living and working in Luxembourg is necessitated to pay 24% of their earnings.

This is contributed to the government for state pensions and other relevant benefits.

There are some ongoing discussions regarding whether or not the contributions will be enough.

This is primarily being discussed considering the millennials and the increasing number of retirees.

The increasing number of retiring individuals is a scenario that can be understood. But why the millennials?

Well, youngsters (18 to 27) usually be in their education or professional training.

Yet, those years would still be counted in the number of years contributions were made.

This means that their contributions will be considered even though haven’t actually made any.

Therefore, the university education period (four years) would still be counted as the years when contributions were made.

To claim these, individuals must provide their educational certificates and enrolment certificates. These should be included while applying for a pension in Luxembourg.

Pension Rates

As a rule of thumb, the pension payments claimed by you should sum up to 71% of your average salary.

Usually, the monthly payments range from €1,840 to a maximum of €8,500.

This means the people receiving a full state pension should get a monthly payment of €3,000 to €4,000.

You must also factor in the number of contributions made while estimating this.

Generally, those who had a higher salary and paid the contributions in full should receive more.

As an estimated average, people receiving partial pensions can get around €745 to €1,245.

Company Pensions

The majority of the companies in Luxembourg pay pensions to their expat employees.

Right after state pensions, company pensions play a key role in Luxembourg.

In company pensions, both the employer as well as the employee contribute to the fund.

The contributions get deducted from a person’s monthly salary automatically. Expats or residents can claim these pensions once they reach retirement age.

Company pensions offer some other exclusive benefits compared to other pensions.

One of the biggest benefits is that the monthly payments deducted from the salary are tax-free.

Another advantage is that the amount contributed by the employer is almost as much as yours.

People can start claiming their company pension payments starting from an age of 60 years.

This is comparatively earlier than that of the state pension.

Sometimes there is also a death-in-service benefit that is provided with company pensions.

The money would be offered to a person’s family in case anything fatal happens to them at work.

When talking about company pensions, some people don’t know how much they need for retiring. You can consult a pension planner or a financial adviser to help you with such matters.

Personal Pensions

After the state pension and the company pension, the next is a personal pension in Luxembourg.

Figuratively speaking, these are nothing but savings accounts you can access through your bank.

Nonetheless, you cannot be able to access these funds until you reach retirement age.

You will be held accountable for making all the contributions to this type of pension plan. Neither the government nor an employer will offer additional help.

Upon reaching retirement age, you can either opt for a lump sum withdrawal or monthly payments.

You should take this into notice that the lump sum withdrawals cannot exceed 50% of the total amount.

I suggest you weigh in on the taxes while planning on making a lump sum withdrawal.

Lump sum amounts would be deemed extraordinary income in the year you make the withdrawal.

There can be extreme complications related to this, and therefore, choose accordingly.

An income tax return is to be declared while receiving any payment from a personal pension plan.

If you are knowledgeable about the situation, then it’s okay to deal with the taxes on your own.

Otherwise, it is highly advantageous to take the help of an accountant or a tax planner to do it properly.

Expats might be subject to taxes in their country of residence if they are not residents of Luxembourg.

Some rules apply to storing your personal pension fund. When an individual passes away early, there can be some restrictions for payouts.

Applying for a pension

For a state pension, the application should be submitted to the CNAP a few months before you retire.

Following a review period, your pension can either be rejected or approved.

Those who get rejected can make an appeal to the CNAP stating your discussion.

Those with company pensions or personal pensions should also apply to the CNAP. This should also be done a few months before when you want to make the withdrawals.

If you are an expat in Luxembourg, self-employed or employed, click here to know the process of applying.

Survivor’s Pension

When an active employee or recipient of an invalidity/old-age pension dies, their spouse or legal partner is entitled to a pension.

This is called Survivor’s pension, also called survivor’s benefit, and is paid by the National Pension Insurance Fund (CNAP).

Who are the so-called spouses or legal partners eligible for this benefit? Given below is a list.

— The surviving spouse or partner

— Divorced spouse or former partner

— Relatives by blood or marriage

— The children of the insured person, and if any, their dependent children as well

To be eligible for a survivor’s pension, the spouse must meet the following conditions.

The deceased person should have been receiving a pension, either an old-age pension or an invalidity pension. There is no specific qualifying period for this.

The deceased person should have been an active employee by the time of death.

This is only applicable when the insured person has at least 12 months of insurance coverage.

The insurance cover period should be continuous and should not be before three years before death.

To access more details regarding the in-depth information and the process, click here.

Invalidity Pension

Invalidity pension is offered to those who are disabled to work due to the following reasons.

— Long-term illness

— Accident, which can be at work or anywhere else

— Incurable disease

— Premature wear and tear of an individual’s body

— Occupational disease

— Non-occupational disease

— Physical or mental weakness

The recipient should be under the age of 65 years in order to receive the invalidity pension in Luxembourg.

Furthermore, their disability should have been recognized by the Social Security Medical Board.

To get more details regarding the invalidity pension in Luxembourg, click here.

Useful information for expats

If you want to retire in Luxembourg as an expat, you can get some important information through the links provided below.

Expat taxes in Luxembourg

Cost of Living in Luxembourg

Best wealth management banks in Luxembourg

Some of the best places to retire in Luxembourg are:

— Moselle Valley

— Echternach

— Mamer

— Larochette

— Esch-sur-Sûre

— Vianden

— Clervaux

Bottom Line

Luxembourg can be a great destination for those who want to enjoy their retirement.

In this article, I’ve covered some useful information for expats who want to retire there. Especially when it comes to permanent residency and pensions in the country.

I strongly hope that you found this information useful related to your queries.

Are you looking to find a financial planner or wealth manager as an expat? Do you seek someone efficient in taking care of your expat investment needs?

Don’t worry. I’m here to help. I offer best-in-class financial services, with which, you can overcome your financial difficulties and achieve financial freedom.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.