This article was updated on January 26, 2021

Last year I started to take fitness and lifestyle more seriously. Quite a few experts I know talked about diet being more important than exercise.

As exercise makes us feel hungrier, and it isn’t realistic to sustainably try to starve yourself, I was told most fitness coaches tell their clients they need to change eating habits.

Therefore, 70%-75% of the progress people make in terms of their weight will be down to diet, and only 25%-30% relates to exercise. This surprised me a bit, and I am sure surprises many people.

It got me thinking. One of the things I have noticed since being in the finance industry is that many high-income individuals aren’t wealthy.

I know numerous people who are worth $2M on an income of $50,000 and others have close to zero wealth but are on huge expat packages.

One person I know has consistently made $15,000 per month after tax for about 20 years in South East Asia, and yet has only about $100,000 to his name.

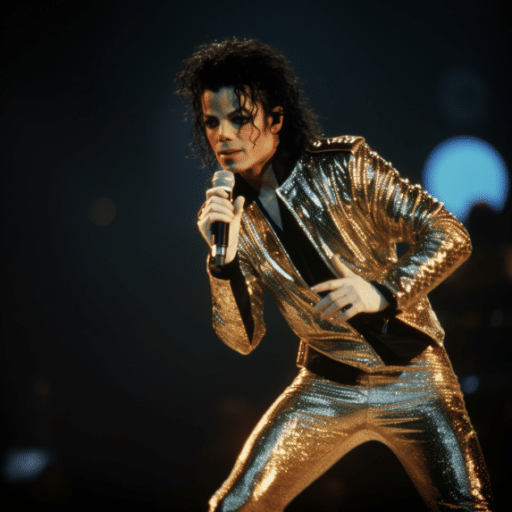

How can this be true? Well, the truth is good spending habits are actually the biggest source of wealth, compared to earning more. Michael Jackson was close to bankrupt despite earning around a billion dollars in his careers.

That is not to mention the effect of compounding. Even though markets historically go up and down, on the whole, they tend to increase over time. The US Stock Market, the S&P, has averaged a return of 10% before inflation and around 6.5% after inflation. This benefits people who are consistently disciplined and start investing at a young age.

Take a simple example of somebody who starts investing at age 22 for 40 years. Let’s say they save on average $100. If they get average historical returns, their account will be worth about $264,000 in today’s money when they are 62.

If they save $500, the account will be worth $1.3M and $1,000 would lead to $2.6M in today’s money at the age of 62. In reality, even a very well-paid person who has had bad spending habits will struggle to accumulate $1M-$3M if they start investing in their 50s.

Consider an even more startling statistic. Let’s compare two people who are investing $500 a month and they both get an unexpected lump sum of $100,000 due to inheritance.

Person 1 invests only $500 per month but spends the 100K, whilst person 2 invests the 100K and the $500 monthly. In 30 years, person 1 would have around $588,000 in today’s money. Person two would have $1,350,000 in today’s money…..a difference of $750,000 in real terms by delaying consumption and well over $1M if you don’t factor in inflation!

Perhaps it is unsurprising that many reports suggest that the rich are less likely to buy luxury goods.

The above is a sample from the 6 steps to financial freedom book.

September 16 update – I will be having a client event on November 2 with Dragon’s Den star Kevin O’Leary. To have the chance to attend, click here. All existing clients will automatically be invited.

Pained by financial indecision? Want to invest with Adam?

Get started today

Adam is an internationally recognised author on financial matters, with over 214 million answers views on Quora.com and a widely sold book on Amazon.