Here’s what you need to know about expat taxes in Liechtenstein.

This article is not formal tax or legal advice.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

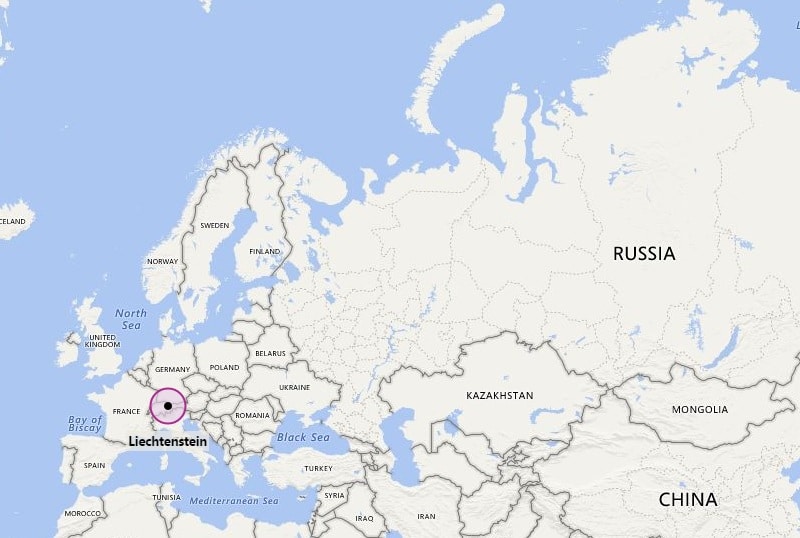

The number of Americans residing in Liechtenstein is believed to be in the thousands.

Liechtenstein is a fantastic place to live for a variety of reasons, including the friendly population, cultural attractions, beautiful scenery, and high quality of life. What precisely do you need to know about filing US expat (and Liechtenstein) taxes as an American expatriate residing in Liechtenstein?

Regardless of where they live or how their income is derived, all US citizens and green card holders who make a minimum of about $10,000 (or just $400 for self-employed persons) must submit a US federal tax return and pay taxes to the IRS.

The good news is that if you pay income tax in Liechtenstein, you can use different exclusions and exemptions to avoid paying tax to the IRS on the same income.

US Taxes for US Expats in Liechtenstein

If you make more than $10,000 (or $400 in self-employment income), you must file IRS Form 1040, regardless of where the money comes from.

While all unpaid US taxes must be paid by April 15th, expats are given an automatic filing extension until June 15th, which can be extended again until October 15th upon request.

You must also submit form 8938 to report any overseas assets worth more than US$200,000 per person, excluding your property if it is owned in your own name.

You must also submit FinCEN form 114, often known as a Foreign Bank Account Report or FBAR, if you have at least US$10,000 in one or more foreign bank and/or investment accounts at any point during the tax year.

If you pay income tax in Liechtenstein, you may be eligible for a number of exemptions that allow you to pay less or no US income tax on the same income. The Foreign Earned Income Exclusion, which lets you exclude the first US$100,000 of foreign earned income from US tax if you can prove that you live in Liechtenstein, and the Foreign Tax Credit, which gives you a $1 tax credit for every dollar of tax you paid in Liechtenstein, are the two main exemptions.

If required, these exemptions can be stacked. Even if you don’t owe any taxes to the IRS, you must submit a federal return if your earnings exceed $10,000 (or $400 if you’re self-employed).

It’s not worth not submitting or omitting anything on your return because the US and Liechtenstein governments exchange taxpayer information, and Liechtenstein banks pass on US account holders’ account information to the IRS. For expats, the consequences for improper or incomplete filing are severe to say the least.

If you’re a US citizen, green card holder, or dual citizen of the US and Liechtenstein who has been residing in Liechtenstein but didn’t realize you needed to submit a US tax return, don’t worry: the IRS Streamlined Procedure allows you to catch up on your filing without paying any penalties. However, don’t wait too long in case the IRS comes after you.

Expat Taxes in Liechtenstein

Residents of Liechtenstein pay taxes on their global earnings ranging from 2.5 percent to 22.4 percent, including communal and social security taxes. This tax is divided into two parts: a national and a community tax. The communal tax varies based on where you live in the nation. Non-residents are only subject to taxation on income earned in Liechtenstein. A little wealth tax is also imposed.

If a foreigner spends more than 6 months in Liechtenstein during a tax year, they are deemed a resident for tax reasons.

The tax year in Liechtenstein is the same as the tax year in the United States, which is the calendar year. If your only source of income is from Liechtenstein work, you will be taxed at source and will not be required to file a tax return. Tax returns are due by April 15th if not filed before. The Landesverwaltung Liechtenstein is Liechtenstein’s tax authority.

If you have any issues or questions concerning your tax status as a US expat in Liechtenstein, we highly advise you to contact a US expat tax professional.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.