This is a review of Tonik neobank, or known as Tonik Bank.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

Digital banks are making inroads into the Philippine economy. Tonik Bank is one of the country’s earliest neobanks. But, before we get into our Tonik Bank review, here’s a quick summary of our thoughts.

Tonik is an excellent digital bank that enables consumers to check their accounts from the comfort of their own homes using only a smartphone. Because of the high interest rate on the savings account, it is also an excellent bank for saving. Tonik Neobank is the ideal option for you if you require an online bank with a highly secure platform.

Tonik Neobank

Tonik is officially the Philippines’ first challenger bank to be granted a digital banking license by the Bangko Sentral ng Pilipinas (BSP). All deposits are protected by the Philippine Deposit Insurance Corporation (PDIC).

The bank, which was established in 2018, is tackling the Philippines’ US$100 billion unsecured retail loan and US$140 billion retail deposit potential.

The bank offers retail financial products including as loans, savings and deposit accounts, payments, a highly secure digital banking app, and cards to the 70 percent of Filipinos who are still unbanked.

Tonik Financial Pte Ltd, situated in Singapore, controls the bank’s product development and technological integration.

Pros of Having a Tonik Neobank Account

- ATM withdrawals are free.

- On a Time Deposit account, you may earn 6% p.a.

- It comes with debit cards, both virtual and physical

- Stash accounts with an interest rate of 4% or higher

- Deposits are protected by the PDIC up to a limit of PHP 500,000 per depositor.

- A simple onboarding procedure

- Security aspects of high quality

Cons of Having a Tonik Neobank Account

- There are no physical branches.

- Charges on third-party ATMs that are not refundable

Financial Products That Tonik Offers

When you create an account with Tonik Bank, you will have access to the following financial products and services.

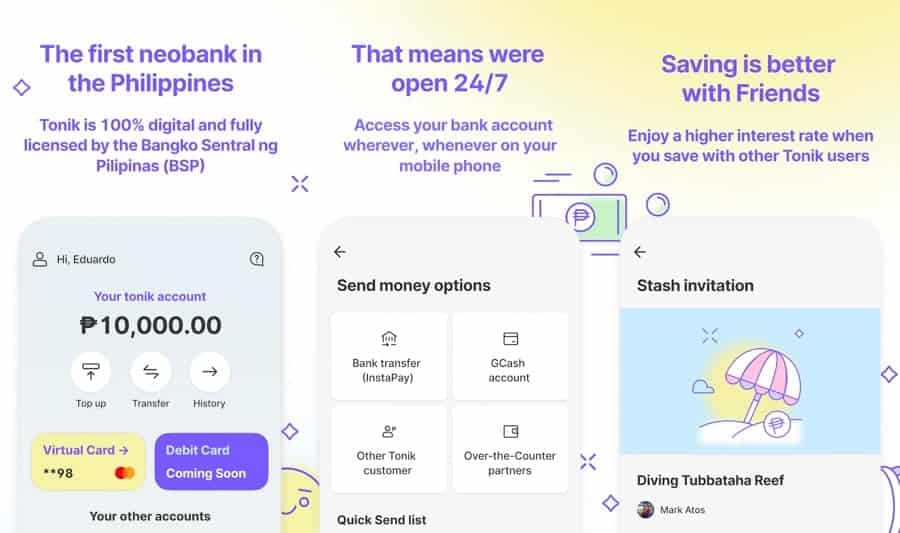

Tonik Account

This is your main checking account. You will obtain this primary account after completing your registration with an ID upload, and you may additionally open up to five Time Deposit and five Stashes accounts within the Tonik App. If you did not submit an ID, you will still be able to open up to two Solo Stash accounts and the they will be active for 12 months.

Best Features:

- There are no monthly fees.

- There are no account maintenance fees.

- Deposits are guaranteed by the PDIC for up to P500,000 per depositor.

- 1.00 percent interest rate on end-of-day balance

Stash Account

Accounts at Tonik Stash are classified as Solo or Group. The annual interest rate for a Solo Stash account is 4%. The Group stash option offers a 4.5 percent annual interest return and allows you to save with relatives and friends. You may establish up to 5 accounts to make the most of this feature.

Stashes serve as distinct savings accounts for various purposes. As a result, you may split your savings based on the precise need you’re saving for, such as a trip, an emergency, or medical expenses.

The bank will not charge you any fees to withdraw cash from your stockpile and transfer it to your Tonik account. Furthermore, the interest crediting history will be shown on your transaction history.

Best Features:

- A maximum of five stashes are permitted.

- Solo stash account earns 4% interest.

- Interest rate of 4.5 percent on group stash account

- There is no minimum quantity.

- Deposits up to P500,000 are insured by the PDIC.

Time Deposit Account

A Time Deposit account is a type of savings or investment account that allows you to pledge a set amount of money for a set period of time in exchange for interest. The Tonik Time Deposit account offers a high annual interest rate of 6%. You can begin saving into this account with P5,000 over a six-month period. There is no minimum deposit amount required by the bank.

Time Deposits are not locked and can be withdrawn at any time. If you remove your funds within five days of opening the account, you will receive a 1% interest rate. You may choose a period of 6, 9, 12, 18, or 24 months for your account.

Best Features:

- P5,000 is the required minimum deposit.

- The maximum limit per account is P100,000

- There are five possible terms.

- Create an account using the mobile app.

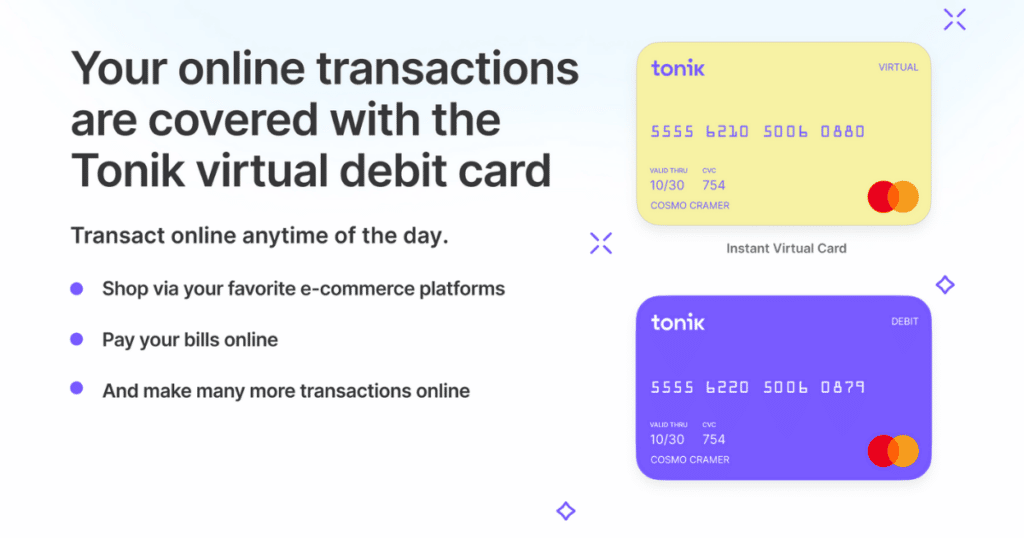

Debit Cards

Tonik bank allows you to have both a real and a virtual card. The virtual card is great for making online purchases. You can receive it for free if you create a Tonik account. You may use this debit card to shop on e-commerce sites, pay bills, and conduct other online activities.

The physical card is also available upon request via the app. You may use this card to withdraw money from thousands of ATMs around the country. Furthermore, the card is secure; hence, you may turn it off via the app in the event of a security compromise.

The balance inquiry and withdrawals are both free of charge. Some banks, however, may charge an extra P10 – P250 for transactions made using their Mastercard ATMs. Remember that these costs are non-refundable; thus, before making any withdrawals, you should always verify the ATM’s policies. Tonik also charges PHP for card ordering, PHP200 for manufacturing fees, and PHP 100 for delivery.

Best Features:

- 2.5 percent international transaction fee

- Lock Card Function

- Cards, both virtual and physical

What Makes Tonik Bank Special?

As the Philippines’ first neobank, the firm is at the vanguard of innovation. They prioritize their customers’ demands by offering secure financial technology.

They provide a greater interest rate on their Time Deposit accounts than other banks, allowing consumers to increase their money. For those who want to save, they do not only offer a solo stash account, but also the option to join a group stash account and earn greater interest.

To accommodate in-person and online transactions, they provide both virtual and real debit cards.

How Does Tonik Bank Operate?

Tonik Bank offers new solutions and high-interest accounts to its customers with the purpose of improving people’s financial life through technology.

This Fintech works in the same way as a regular bank. Customers may use the app to create a primary Tonik account, five stash accounts, and five Time Deposit accounts. Solo and Group Stashes are two types of savings accounts known as Stashes.

Tonik Bank offers both physical and virtual debit cards. With the exception of some banks, which may levy third-party fees, ATM withdrawals are free. When buying online or paying payments, the virtual cards come in helpful.

Because the organization is totally digital and has no physical locations, you may use the mobile app to access all of the services, which is accessible on both iOS and Android.

How Do You Open A Tonik Bank Account?

To create a Tonik account, you must first download the program. It just takes five minutes to get you set up.

To begin, enter your registered cellphone number. After that, the app will take you to the terms and conditions, which you must accept. To continue, the bank will email you an OTP to your phone.

You must then snap a photo and present a valid ID for verification. If a consumer does not have an ID, Tonik Bank provides an alternative. To open the account without the ID, you must have a $50,000 account balance limit, a $100,000 transactional limit, no group stash, no time deposit, two solo stashes, and a 12-month validity period.

If you have a photo of your ID, passport, or driver’s license, scan it. After you’ve double-checked that all of the facts are right, you may enter your personal information. The bank will require the following:

- Your complete name

- Your address and location

- Your place of employment

- Salary and source of income

- Contact information through email

- Mother’s surname

After entering these data, you must answer a question about the Foreign Account Tax Compliance Act to authenticate your citizenship. To activate the account, you’ll need to add a signature and password.

Tonik Mobile App

The Tonik app may be downloaded from the App Store or Google Play. Customers must have a smartphone with a front-facing camera for a selfie which will serve as a profile photo because all services and onboarding activities are carried out through the app.

The software provides the option to use face ID or fingerprints for security. You can use one of these choices to log into your account once you have activated them. These two functions prevent unauthorized access to your account.

You may add money to the app with a debit card, online, or over the counter. Select Coins.ph, GCash, UnionBank, or BPI on the app if you use online banking. SM Payment, Cliqq, 7-11 Connect, M Lhuillier, Cebuana Lhuillier, or SM Payment are the options for over the counter purchases on the app.

The Tonik app has a 3.7-star rating on Google Play and a 3.0-star rating on the App Store.

Is Tonik Bank Secure and Regulated?

Tonik Bank was granted the first digital bank license by the Philippines’ central bank, the Bangko Sentral ng Pilipinas (BSP). This indicates that the bank complies with all applicable regulations. Furthermore, the Philippine Deposit Insurance Corporation (PDIC) insures all client deposits for up to P500,000 per depositor.

Is Tonik Bank Safe for My Money?

Tonik Bank is concerned about the security of its customers’ accounts. To assist safeguard client accounts, the app includes a Face ID and a fingerprint scanner. Furthermore, the app has a lock card function that prevents fraudulent online payments and transactions.

The bank has worldwide security partners that ensure that the money of its customers is safe and secure. The software offers limit management, which allows clients to set their daily maximum expenditure. For simplified security administration, their fraud monitoring and controls are also automated.

Final Thoughts

Tonik, is growing increasingly popular in the Philippines. Tonik provides fantastic options for anyone trying to save money.

High-interest rates allow you to build your money without paying any additional fees. The bank also pays special attention to the protection of its customers’ funds by offering account-protecting tools.

As the country’s first neobank, it offers cutting-edge technology and benefits to consumers transitioning to digital banking. There are several advantages to banking with Tonik. Furthermore, the mobile app is critical in guaranteeing that all banking services are available to all consumers from any location.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.