Life Insurance For Individuals With High Net Worth

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

We’ll talk about life insurance for individuals with high net worth in this article.

High-net-worth individuals are regarded as having liquid or investable assets worth at least $1 million (HNWI). Even though HWNIs may have a sizeable amount of money saved, life insurance is still sometimes necessary.

The replacement of income in the event that the primary breadwinner dies is typically one of the most important factors for life insurance. The amount of money you plan to leave your family may drop significantly if the market declines.

Even if you have sufficient savings to provide for your family financially in the event of your passing, you might want to think about getting life insurance as a safety net for your financial plans.

Do Individuals With High Net Worth Need Life Insurance?

Economic and stock market downturns can put a significant strain on even high-net-worth individuals’ finances. HNWIs with dependents may find comfort in purchasing life insurance to ensure the security of their loved ones.

High-net-worth individuals might also think about getting life insurance to cover estate taxes. If a person’s assets exceed a certain amount after they pass away, estate taxes are levied on those assets.

For assets worth more than $12.06 million, the federal estate tax rate can be as high as 40%, while state tax rates and exemptions vary.

For instance, Oregon’s estate tax rates begin at 10% and can reach 16%, while the state’s estate tax exemption is only available for estates with taxable assets under $1 million.

Types of Life insurance for Individuals with High Net Worth

Depending on your financial objectives, you can choose different types of insurance.

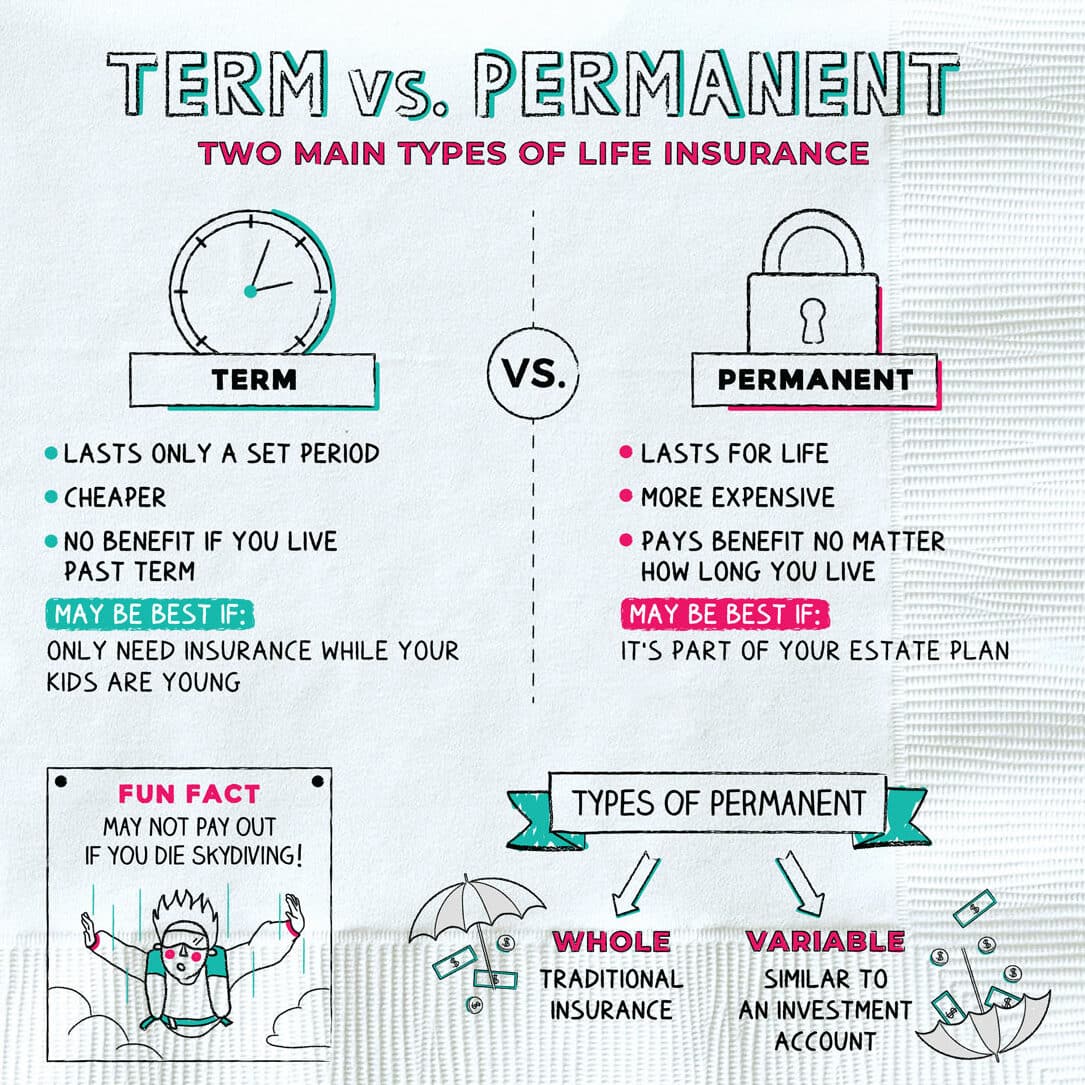

You may only need enough term life insurance to cover those costs or to build up a nest egg if you’re worried that taxes will reduce the value of the assets you hope to leave behind.

However, if you’re looking for another way to grow your tax-deferred savings, a cash value life insurance policy might be a better option.

Term Life Insurance

Term life insurance, which is much less expensive than permanent life insurance, is only valid for a predetermined number of years. Term life insurance provides your loved ones with financial security for a predetermined period of time, typically between 10 and 30 years.

If you choose term life insurance, you will only have to make a one-time annual or monthly premium payment based on the specifics of your policy.

Your beneficiary will be compensated in the event of your premature death. The policy will expire when the term is over, and no death benefits will be paid to your beneficiary.

If you still want coverage after your term has ended, you might be able to change your term life insurance policy to whole life insurance. The terms of your policy should be understood because there is typically a deadline for conversion.

High-net-worth individuals or other people most frequently use term life insurance to cover any outstanding debt, funeral costs, bills, or similar expenses.

Term life insurance does not have a cash value component, so the money you pay in premiums cannot be accessed while you are still alive.

Permanent Life Insurance

Permanent insurance stays in effect as long as premium payments are made, and it offers a cash value component that can be used as a tool for low-risk investment and tax-free borrowing at low rates.

High-income or high-net-worth individuals who already have a sizeable cushion in savings may prefer to apply for permanent insurance. Some policies cap your returns at a certain amount and come with a base dollar amount of guaranteed returns.

Irrevocable Life Insurance Trusts (ILITs)

Trusts are most likely already included in your estate plan if you are wealthy. An irrevocable life insurance trust (ILIT) is a trust that cannot be changed. It only serves to store a life insurance policy.

In this case, the trust is the policyholder, and has an appointed trustee). When you pass away, the trust receives the death benefit, which the trustee then distributes to the trust’s beneficiaries.

When transferring wealth to your children, an ILIT can be especially helpful and may even reduce estate taxes. Make sure your trust is properly set up by working with an estate lawyer.

Why High-Net-Worth-Individuals Should Consider Getting Life Insurance

1. Tax Laws Offer Tax Benefits For Life Insurance

Taxation is one factor that may influence the wealthy to buy life insurance. Tax law provides tax benefits for life insurance premiums and payouts, resulting in asset protection. The beneficiary of life insurance receives the proceeds tax-free.

Individuals with high net worth or anyone looking to reduce estate taxes may find this appealing.

According to the Internal Revenue Service, policy owners’ beneficiaries can inherit up to $12.06 million from them in 2022 without incurring estate taxes (IRS).

To account for inflation, the amount rises to $12.92 million in 2023.

When an individual’s estate exceeds the exemption amount for estate taxes, the policyholder’s heirs may be able to use the proceeds of a sizable life insurance policy to settle the tax debt.

Estate taxes won’t also apply to insurance premiums. As an illustration, if someone spends $500,000 to purchase a $2 million life insurance policy, the initial premium payment is deducted from the estate and is not subject to tax.

The family receives a $2 million guaranteed life insurance payout of $200,000 ($500,000 premium amount minus $300,000 estate tax), which is another way to look at the insurance premium. On the premium payment, there is a guaranteed return.

2. Life Insurance Protects Business Owners

If an entrepreneur co-owns a company, life insurance can help pay for a buy-sell agreement in the event of the sudden death of one of the owners.

A key person insurance plan can be advantageous for a family business as well. This is insurance for the key individual in a small company, who is typically the owner, the founder, or key personnel.

If a key employee dies before a replacement is found, a keyman policy prevents the company from failing.

The company itself is the beneficiary and can use the money for things like hiring and training replacement staff, paying off outstanding debts from the business, or covering ongoing operating costs.

3. Life Insurance is an Asset

A death benefit is only one aspect of life insurance. There may be a cash value or intrinsic value depending on the type of insurance.

A characteristic of specific permanent life insurance policies that provide lifetime coverage is cash value accumulation. As a result, the insurance can be sold as a life settlement when it is no longer required.

Whole life insurance can provide consistent, tax-free dividends when properly set up. This implies that, if required, an additional income stream could be provided by your policy.

Additionally, the insurance policy’s cash value accrues over time and can be borrowed to cover lifetime expenses like college costs.

Finally, no matter how you will be feeling in the future, your death benefit is guaranteed with whole life insurance.

This is crucial for giving the policy owner’s family and heirs long-term security. Anybody looking to use life insurance as an investment vehicle or someone with a high net worth may find value in each of these advantages.

Applying for a Life Insurance as a High-Net-Worth Individual

If you have a high net worth, your search for the best life insurance provider will largely be influenced by the requirements of your policy and your personal preferences. A great place to start is by getting and comparing life insurance quotes for the kind of policy you’re looking for. To figure out how much life insurance you require, you can also use a life insurance calculator. Additional steps that could be part of the application process include the following:

Take a Look at Your Medical Background

In order to assess the risk associated with insuring you, the insurer will typically review your medical history when you apply for life insurance and demand a medical exam. This is known as the underwriting process. Your ability to purchase life insurance and the cost will probably be impacted if you have a serious medical condition or a family history of illnesses.

Decide on Your Policy Type

Choose between term and permanent life insurance before submitting an application. To determine which type of policy best fits your needs, it might be best to speak with a financial planner or an insurance agent directly.

Decide Who Will Be Your Beneficiaries

Your primary beneficiary is the person who will be awarded your death benefit upon your passing. If your primary beneficiary passes away before you do, you can still name a secondary beneficiary. If you think you need more, ask an agent for their suggestions. Ask a financial advisor or insurance agent for additional assistance if you want your death benefit to be paid to your company during this process.

There are additional considerations if your net worth is high:

What role does your policy play in your projected financial picture? If your goal is to simply leave your heirs an inheritance rather than trying to increase your wealth, your needs will be different.

Who will profit from this? Most people’s beneficiaries are their family members. However, you might name a trust as your beneficiary if you have substantial assets and want to prevent your policy from increasing your estate taxes.

How much protection do you require? Not every provider of life insurance can promise payouts in the millions of dollars. If you require a very high coverage amount, you might have fewer options, which are typically older and more reputable companies.

Finding the best life insurance that protects your family and, at the same time meets all of your needs can be done most effectively by comparing quotes and policy details from various life insurance providers.

Regardless of your net worth, life insurance provides additional financial security. Even if you are sure that your beneficiaries won’t require the death benefit to support themselves, a policy can help you reduce your estate taxes or accumulate more wealth to boost your retirement savings.

Strategies for Life Insurance

You have a choice of several insurance scenarios. The best choice may depend on a variety of factors, including your current income requirements, your tax situation, and other assets that you are using to support your financial objectives.

Here are three situations where using life insurance as a component of a larger wealth management strategy might make sense.

Life Insurance Funds from a Retirement Plan

For wealthier individuals, retirement plan assets, including 401(k) and IRA funds, may be taxed twice. The tax is imposed after the income tax.

Let’s say James has an IRA with $900,000. James spends $900,000 on a second-to-die insurance policy to prevent losing a sizable portion of his IRA to Uncle Sam. James’ wife will get the $3 million tax-free benefit after his passing.

Increase the Death Benefit of an Existing Life Insurance Policy by Transferring It to One with a Cash Surrender Value

Kevin had a 10-year-old, $850,000 second-to-die insurance policy with a $1.53 million death benefit. His advisor advised him to exchange his insurance policies in a tax-free manner.

The increased death benefit under the new policy was $3.48 million, and there were no out-of-pocket expenses.

Using a Two-Step Annuity Strategy

For $1 million, Sarah purchases an immediate joint-life annuity that will pay $43,843 every year for as long as both she and her husband are alive.

Sarah then invests the yearly payout of $43,843 in a $5.68 million second-to-die insurance policy. In essence, Sarah turned the $1 million after taxes, or $600,000, into $5.68 million. Finally, there is a guarantee for both the annuity and the death benefits.

Best Life Insurance for Individuals with High Net Worth

Your financial requirements and the reason you’re buying life insurance will determine which is the best life insurance for individuals with high net worth.

If your income is high, you might need a provider of term life insurance with death benefits sufficient to replace your income. A permanent policy might be a better option if you want to increase your investment options.

Best Term Life Insurance for Individuals with High Net Worth: Lincoln Financial

The best-term life insurance provider for wealthy people is Lincoln Financial. Lincoln provides some of the highest death benefits. If your income and assets allow it, Lincoln will sell you insurance worth up to $60 million.

A wide range of life insurance products is available from Lincoln Financial, including affordable no-medical and high-net-worth options.

Pros and Cons of Lincoln Financial

Pros of Lincoln Financial

- Reasonable prices

- Good for a variety of existing health issues, such as depression, stroke, and heart problems

- Beneficial for cannabis users, including daily users

Cons of Lincoln Financial

- Term life insurance is not offered in New York

- Although younger applicants are technically eligible for no-medical insurance, it’s best for those between the ages of 55 and 60.

Best Whole Life Insurance For Individuals With High Net Worth: MassMutual

In general, MassMutual offers the best whole life insurance for individuals with high net worth.

Along with offering high coverage amounts of $10 million or more, MassMutual also pays dividends to its whole-life policyholders, allowing your cash value to increase more quickly.

Additionally, reputable outside organisations like A.M. have given the business excellent financial ratings. Best, so that you can trust that the business will be financially stable.

MassMutual’s whole life insurance plan offers a lifetime coverage option that accrues cash value and provides the chance to generate dividends.

Pros and Cons of MassMutual

Pros of MassMutual

- High ratings for financial stability

- Whole-life policyholders have a greater chance of receiving dividends than many rivals.

- Favourable customer reviews

Cons of MassMutual

- High-term life insurance rates

Do Only the Wealthy Need Life Insurance?

Although more affluent people might be inspired by the possibility of tax deductions or the chance to use life insurance as an investment, almost everyone can profit from having it. Without regard to net worth, you might require life insurance if you:

- Have a spouse or a child or children

- You provide the household’s main source of income.

- Have a family member with special needs

- Owe debts for which you co-signed, such as credit card debt or mortgages or student loans

- You want to leave something to cover funeral and burial costs.

These are all reasons to think about getting life insurance if you want to give your loved ones some financial security after you pass away.

The good news is that buying life insurance might be less expensive and simpler than you think.

For instance, a number of businesses provide term life insurance online at competitive premiums that are based on the customer’s age and general health.

Although it provides lifelong coverage, permanent life insurance can be more expensive. If you don’t want your permanent life insurance to build up cash value, it might not be necessary.

Is Buying Life Insurance a Smart Investment?

A chance to keep money in the family and protect it from taxes may be offered by life insurance for some high-net-worth individuals.

Moreover, if you regularly max out your retirement accounts, a life insurance policy with a cash value and an investment component is a good way to accumulate tax-free savings.

Can You Profit from a Life Insurance Policy?

You may borrow money from your policy if you buy permanent life insurance that includes a cash-value element.

Additionally, you have the option of cashing out your policy by selling it, giving it up, or surrendering it. However, despite the fact that the policyholder’s beneficiaries will profit financially from it, an insurance policy doesn’t generate much income for the policyholder.

How Does Life Insurance Increase Wealth?

The death benefit, which is paid to your beneficiaries, is the main way that life insurance can increase wealth.

Using this wealth transfer strategy, you can give surviving family members an immediate financial safety net (based on the death benefit amount).

A permanent policy, such as whole or universal life, includes a cash component that may accrue interest in addition to a death benefit.

Final Thoughts

Regardless of wealth accumulation or net worth, life insurance can provide a number of advantages.

When weighing your options for life insurance, think about your main justifications, the amount of coverage you anticipate needing, and whether term or permanent coverage is more appealing to you.

You can choose the best policy to suit your needs and financial situation by researching the top life insurance providers and obtaining quotes online.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.