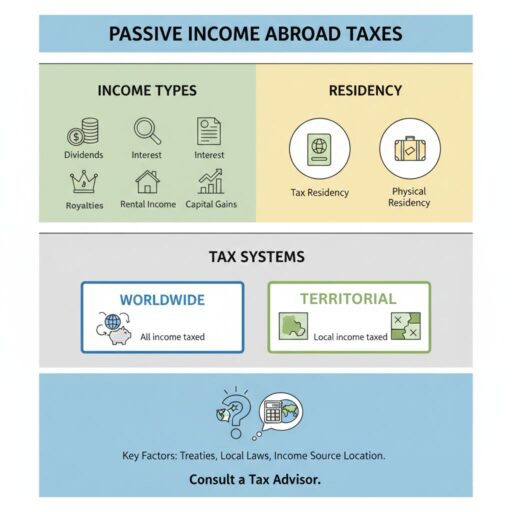

Passive income is usually taxed even if you live abroad, with your tax residency, income source, and the countries’ tax systems determining how much you pay.

Living overseas can reduce or shift taxes on passive income, but it does not automatically eliminate them.

Este artículo trata:

- What is an example of a passive income?

- Do I pay tax on passive income?

- What happens to my tax if I move abroad?

- What is the difference between worldwide and territorial tax system?

Principales conclusiones:

- Living abroad does not automatically make passive income tax-free.

- Tax residency matters more than physical location.

- Countries with worldwide tax systems may tax all foreign passive income; territorial systems often exempt it.

- Proper structuring can significantly reduce passive income taxes.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

What qualifies as passive income?

Passive income includes earnings such as dividends, interest, and rental income that require little ongoing effort once the income stream is established.

Common examples include:

- Dividends from stocks or ETFs

- Intereses de cuentas de ahorro, bonds, or fixed-income investments

- Rental income from real estate

- Royalties from books, music, software, or patents

- Income from REITs and private equity funds

Tax authorities often classify these as portfolio or ingresos por inversiones, even if they are not always passive in a practical sense.

What is not an example of passive income?

Income such as salaries, freelancing, and active business profits is not considered passive income because it requires your direct, ongoing involvement to generate earnings.

Even when paid on a recurring basis or earned remotely, these income types are treated as active income by tax authorities.

- Salaries and wages from employment, whether local or remote

- Freelancing or consulting income tied directly to your time and services

- Active business profits where you materially participate in operations

- Self-employment income from providing goods or services

- Performance-based bonuses, commissions, or incentive pay

From a tax perspective, these income streams are usually taxed at standard income tax rates and may also trigger social security or self-employment taxes, making them less tax-efficient than true passive income.

Is passive income included in taxable income?

In most countries, yes. Passive income is generally included in taxable income, though it may be taxed differently from employment income.

Some jurisdictions offer:

- Reduced tax rates on dividends or capital gains

- Exemptions for foreign-sourced passive income

- Preferential treatment for long-term investments

The key factor is whether the country taxes income based on residency, source, or citizenship.

How Different Types of Passive Income Are Taxed

Each type of passive income—dividends, interest, rental income, capital gains, and royalties—is taxed according to the rules of the country where it is earned and your country of residence.

- Dividends: Often subject to withholding tax in the country where the company is based. Living abroad may require reporting in your resident country, but tax treaties can reduce or eliminate double taxation.

- Interest: May be taxed at flat rates or exempt up to certain thresholds. Foreign bank interest is sometimes treated differently than domestic interest.

- Rental income: Usually taxed in the country where the property is located. Even if you live abroad, reporting and payment may still be required both locally and in your home country.

- Capital gains: Tax treatment varies widely by country and can depend on holding period, asset type, and location of the gain. Some countries exempt foreign-sourced gains for non-residents.

- Royalties: Commonly taxed at the source country, with tax treaties reducing withholding rates. For digital nomads or remote earners, knowing the taxing rights is crucial to avoid overpayment.

Tax treaties clarify which country has priority to tax each type of income, helping reduce double taxation for individuals living abroad.

Are there countries that don’t tax foreign passive income?

Yes. Several countries, including Panama, Malaysia, and the UAE, do not tax foreign-sourced passive income for non-domiciled residents or territorial taxpayers.

This makes them attractive for expats and investors living off dividends, interest, or rental income.

- Territorial tax countries (tax only local income, exempt foreign income):

- Panamá

- Costa Rica

- Malasia

- Low-tax or zero-tax jurisdictions (minimal or no income tax):

- Emiratos Árabes Unidos (EAU)

- Bahréin

- Mónaco

- Bermudas

- Special expat or remittance-based regimes (foreign income taxed only if brought into the country):

- Greece (Non-Dom regime)

- Malta (remittance basis for foreign income)

- Cyprus (Non-Dom program)

These countries are popular among retirees, digital nomads, and investors seeking to live abroad while legally reducing taxation on passive income.

Worldwide Tax Countries vs Territorial Tax Countries

Worldwide tax countries tax residents on all income, including foreign passive income, while territorial tax countries tax only income sourced within their borders, often exempting most foreign passive income from local tax.

Worldwide tax countries

- Estados Unidos – taxes residents (and citizens) on worldwide income.

- Canadá – residence‑based system taxing global income.

- Reino Unido – generally worldwide tax, though with some remittance‑based allowances.

- Germany, France, Italia, Spain, Netherlands – residents taxed on worldwide income (with credits/exemptions to prevent double tax).

- Australia, Japón, South Korea – worldwide tax systems requiring residents to report global earnings.

- Irlanda – traditionally worldwide tax and active global taxation on residents.

In many of these systems, foreign tax credits and treaties reduce double taxation, but passive income earned abroad still must be reported and can be taxed locally.

Territorial tax countries

- Hong Kong – territorial source principle; foreign income is not taxed locally.

- Panamá, Paraguay, Costa Rica – classic territorial systems with exemptions for foreign income.

- Singapur – taxes domestic income and generally exempts most foreign passive income.

- Uruguay, Honduras – apply territorial taxation for local‑source income.

- Georgia – exempt foreign‑sourced income under its territorial regime.

- Macau – territorial tax rules with zero tax on foreign‑sourced income in many cases.

Many territorial systems attract expats precisely because foreign‑sourced passive income is often not taxed locally, though you may still owe tax in your home country if it taxes worldwide income.

What happens to my tax if I move abroad?

When you move abroad, your passive income may still be taxed by your home country, your new country of residence, or both, based on how tax residency and income sourcing rules apply.

Common outcomes include:

- You remain taxable in your home country as a tax resident if you keep strong ties such as property, family, or significant time spent there

- Your host country taxes you on worldwide income once you qualify as a tax resident under local residency rules

- Only income sourced within the country is taxed if your host country uses a territorial tax system

- Withholding tax applies at the source of the income when dividends, interest, or royalties are paid from abroad

For some nationals, such as Ciudadanos estadounidenses, tax obligations continue regardless of where they live due to citizenship-based taxation.

Tax Residency vs Physical Residency

Physical residency is where you live, while tax residency determines where you pay tax, which directly affects whether your foreign passive income is taxed locally.

Living abroad does not always mean you are a tax resident there.

Tax residency is often based on factors such as the number of days spent in a country, the location of your permanent home, or your center of life.

Many expats unintentionally remain tax residents of their home country, meaning their foreign passive income may still be taxed there.

How to Avoid Passive Income Tax

You can legally reduce passive income taxes by establishing residency in a territorial-tax country, which often exempts foreign-sourced dividends, interest, and rental income from local taxation.

1. Tax residency: Establish residency in a territorial-tax country to shelter foreign passive income from local taxation.

2. Tax treaties: Use treaties to reduce or eliminate withholding taxes on dividends, interest, and royalties.

3. Asset location: Hold assets in tax-efficient jurisdictions to benefit from lower local taxes.

4. Investment structuring: Favor capital gains over income when gains are taxed more favorably.

5. Timing: Strategically plan distributions and realizations to optimize tax years and thresholds.

Professional tax advice is strongly recommended before making major moves, as rules vary by country and type of income.

Conclusión

Managing passive income taxes while living abroad requires clarity on residency rules, income sources, and international tax interactions.

Thoughtful planning which involves selecting the right jurisdiction, leveraging territorial systems, and structuring investments strategically, can significantly enhance the efficiency of your income.

Living overseas is not just a tax decision; it’s an opportunity to align estrategia financiera with lifestyle, making passive income work as a tool for both growth and flexibility.

Preguntas frecuentes

What is the IRS rule for passive income?

En IRS generally classifies passive income separately from earned income, but US citizens and residents must still report and pay tax on worldwide passive income, regardless of where they live.

What is the biggest passive income?

For most investors, the largest passive income sources are real estate rental income and dividend-paying investment portfolios.

What is the most profitable passive income?

Some of the highest long-term returns often come from scalable investments, including equities, income-generating real estate, and private businesses, which can grow steadily over time while requiring minimal ongoing effort.

Do you get taxed twice if you work abroad?

Double taxation can occur, but tax treaties, foreign tax credits, and exclusions often reduce or eliminate being taxed twice on the same income.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.