Asesores financieros para expatriados en San Cristóbal y Nieves - que será el tema del artículo de hoy.

Compararé algunas de las opciones disponibles a nivel local, junto con otras más portátiles, en línea e internacionales, como las que nosotros ofrecemos.

Tiene sentido tener una opción portátil como expatriado, frente a una localizada, y eso es algo en lo que nos especializamos.

Si desea invertir como expatriado o particular con un alto patrimonio neto, que es en lo que estoy especializado, puede enviarme un correo electrónico (advice@adamfayed.com) o utilizar WhatsApp (+44-7393-450-837).

Introducción

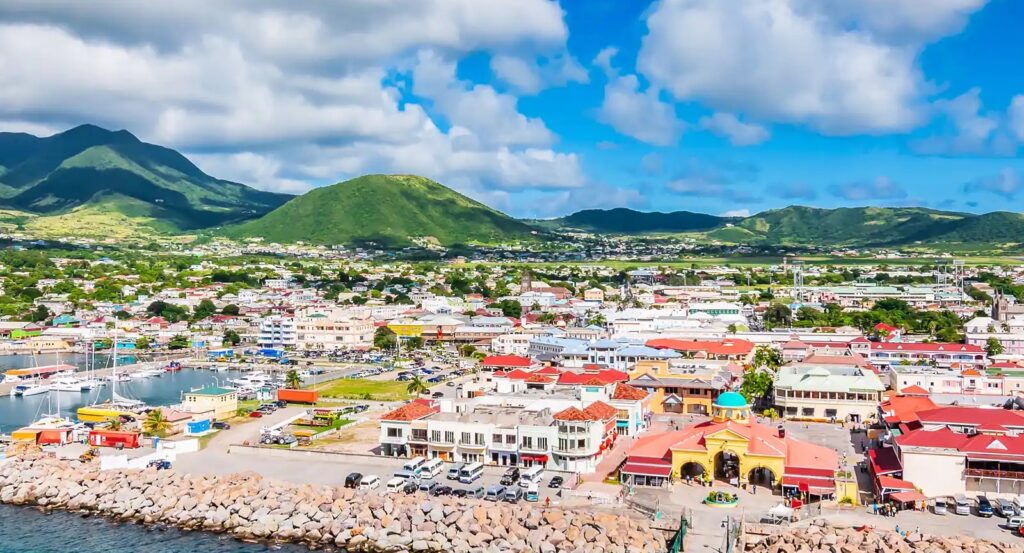

Saint Kitts and Nevis is a Caribbean country that was formed on February 27, 1967 as a result of the unification of two small states. The country has a developed economy, a high level of medicine and education.

Saint Kitts and Nevis lives off tourism, agriculture, and outside investment. Cosmopolitans obtain Saint Kitts and Nevis citizenship for visa-free travel to 157 countries of the world, including the Schengen states, Great Britain, Singapore, and Hong Kong.

Saint Kitts and Nevis is located on two islands of the same name. They are part of the Lesser Antilles archipelago of the West Indies. The eastern territory of the country is washed by the Atlantic Ocean, and the western one – by the Caribbean Sea.

The length of the island of Saint Kitts is 37 km, along it there is a ridge of peaked mountains, among which the extinct volcano Liamuiga is the highest point in the country. The top of the volcano reaches 1155 meters above sea level. The political and economic structure of the country.

Saint Kitts and Nevis is a federation, that is, a union state that consists of two independent states. The federation is based on the UK’s democratic parliamentary system. Saint Kitts and Nevis was formerly an English colony. They gained independence relatively recently – in 1983. Now the state is an independent member of the Commonwealth of Nations, the head is the monarch of Great Britain. His interests in the country are represented by the Governor-General.

Parliament is represented by a unicameral National Assembly, which is chaired by the Prime Minister. He becomes the head of the party or coalition of the majority, which won the elections. The country has a Supreme Court and a system of magistrates’ courts.

Nevis, where only 20 thousand people live, has a separate parliament and its own administration. It is also headed by the Prime Minister. Nevis has the right to secede from the Federation at any time. The southeastern part of the island is flat with an uneven coastline.

Apart from the Commonwealth of Nations, Saint Kitts and Nevis is a member of other international organizations such as the UN, CARICOM, IMF, WTO, International Bank for Reconstruction and Development and OAS.

The bulk of the country’s population is of African descent, there are descendants of the Arawak and Caribbean Indians. A small percentage of residents are European settlers and mulattoes. The official language is English, but local dialects are often used in everyday life.

The residents of Saint Kitts and Nevis are Christians. They are mainly Anglicans, Methodists, and Catholics. A small percentage of residents identify themselves with another religion or are completely atheists.

The economy of Saint Kitts and Nevis is driven by agriculture, tourism, and a citizenship investment program. Tourism brings a larger percentage of the country’s GDP, so the government is investing in infrastructure development: building a new port, marinas, hotels, and earthquake-resistant houses.

Local residents grow various agricultural crops both for themselves and for import. In the lowlands of the islands, there are private gardens and plantations of sugar cane, fruit trees, coconut palms.

The Citizenship Investment Program started in 1984. Thanks to the program, investments in tourism, the island’s infrastructure and social services are growing.

Life in Saint Kitts and Nevis

A short-term integration into society helps tourists to get acquainted with all the peculiarities of the country: they rent housing, use public transport, and buy food and goods in local stores.

Inmobiliario. Coming on vacation, tourists can rent a room in local hotels, rent an apartment or an apartment. The cost of renting a one-bedroom apartment in Basseterre starts at $ 350. Closer to the center, prices start at $ 600.

Transport. Buses run between settlements of the country; the ticket price is about $ 1.2 one way. A ferry runs between the islands, a ticket for which will cost $ 25. Tourists can also order a taxi; prices start at $ 1.85 per kilometer.

Education. There are public and private schools in the country. Children from 5 to 16 years old study for free in public schools.

The country has four medical universities, a branch of the University of the West Indies, technical and teacher training colleges. The University of the West Indies is a higher education institution that operates only in the states of the Commonwealth of Nations. The campus of the university is located in the capital of the state, Basseterre. Initially, the university was created as a division of London College, therefore, its work is based on British educational standards.

Citizens of Saint Kitts and Nevis have the right to study at UK universities on preferential terms, because the country is part of the Commonwealth of Nations.

Medicine. Saint Kitts and Nevis has a high level of medicine based on British standards. Three state hospitals are open on the island of Saint Kitts – Joseph N. France, Molineux, Pogson. And there is one hospital on the island of Nevis – Alexandria. There are also several private clinics in the country.

The Joseph N. France is the country’s central hospital with intensive care and traumatology departments.

Tourists are advised to take out medical insurance, which will include emergency evacuation services in case of an emergency.

Other. Prices in the country are relatively low, imported goods are always more expensive. For a couple, a trip to a mid-range restaurant with a three-course menu will cost $ 90.

$ 83 is a monthly subscription to a local fitness club, and a movie ticket for an American movie is $ 6.65.

So, if you are interested in moving to Saint Kitts and Nevis, start a new life, invest or start your business, you may probably need assistance from a specialist. Later in this article we will discover who can provide you with necessary information in finance-related goals and how you can cooperate with a specialist. In other words, below we will mainly talk about financial advisors and their role in anyone’s life, who has specific or even simple financial goals and want to reach them.

How to know you need a financial advisor in Saint Kitts and Nevis?

El problema para muchas personas es que no tienen control sobre sus flujos de caja. Como resultado, viven de forma caótica, sin saber hacia dónde se dirigen financieramente.

Todos participamos involuntariamente en el flujo constante de las finanzas. Al fin y al cabo, cada día realizamos diversas transacciones monetarias. Y sólo depende de nosotros lo consciente que sea este movimiento a escala de toda nuestra vida.

To manage the future, you need to:

• Gestione sus flujos de tesorería;

• Transforme el futuro en un conjunto de objetivos financieros claros y mensurables;

• Elabore un plan para alcanzar estos objetivos;

• Lleva a cabo tu plan.

This is a common situation for everyone that a financial advisor works with. Along with this, special cases are also possible.

A person already clearly understands what tasks he is striving for. He only needs a specialist who will help him choose the right strategy for achieving his goal. And will offer the best tools for solving important problems. In both cases, a personal financial advisor will help you.

¿Quién es un asesor financiero?

This is a specialist who advises on financial policy issues at different levels. He can work both as an individual and in the status of a legal entity. This does not change its function.

He advises clients on saving or increasing money, assesses their financial condition, develops an investment policy, a scheme for working with banking institutions, and makes management decisions.

Esta categoría incluye las siguientes especialidades:

— brokers;

— investment advisors;

— accountants;

— financial lawyers;

— insurance agents;

— financial analysts.

The consultant may be well versed in a particular area of finance but may also be a generalist. A financial advisor must have all the required professional skills. Secondly, it is excellent to know the provisions and laws of legislation in the field of finance and economics. In addition, he must understand the market economy, trends in monetary investments.

He must also be able to evaluate financial assets and their instruments. Understand the procedures for buying and selling securities in the stock markets. In addition, he should be familiar with modern systems of lending and investment, control, and taxation.

In other words, a financial advisor is an advisor with excellent knowledge in any financial, legal, and accounting area.

How can a financial advisor help you?

A financial advisor helps a client plan for both short-term and long-term financial goals. These goals may include saving for retirement, attending college, and ensuring that the client has the appropriate insurance plan to ensure a stable financial future. Their main purpose is to advise on financial security issues.

Para ser asesor financiero certificado se requiere una licenciatura en finanzas, economía, contabilidad, matemáticas empresariales o derecho. El Máster en Administración de Empresas mejorará sin duda tus oportunidades profesionales. Es muy recomendable seguir cursos de gestión de inversiones y riesgos, así como cursos de planificación fiscal y patrimonial.

Financial advisors help clients with their financial planning. The client’s life can also suddenly change, so a financial adjustment will be required. For example, it could be a death in the family, a marriage or divorce, a chronic illness or disability, or a person may receive a large sum of money.

A financial advisor can help plan college preparation for yourself or your children. While most financial advisors work in offices, a quarter of them are self-employed. They may attend conferences and seminars to network and promote themselves to meet potential clients.

The heavy responsibility of investing in personal savings and helping them into retirement requires both financial knowledge and interpersonal skills. Personal financial advisors give advice on investments, property ownership, estate planning and more to help people manage their finances and plan for the future. Personal financial advisors begin their collaboration with the client by determining their financial needs and goals and, of course, the level of risk they are willing to take, and then help them set short- and long-term goals.

Financial advisors are experts in the benefits and limitations of various types of investments such as mutual funds, stocks and bonds, real estate, as well as related topics such as insurance and the tax implications of various investments. Marketing their services to potential clients is an ongoing part of the job. To expand their client base, personal financial advisers conduct seminars, participate in networking events, and seek referrals from existing clients. As a rule, advisors meet with clients annually to discuss their investment portfolio and make changes.

La mayoría de los asesores financieros personales trabajan en finanzas y seguros, mientras que muchos otros son autónomos. Suelen trabajar en oficinas a tiempo completo, y algunos pueden reunirse con clientes por las tardes y los fines de semana.

As a general rule, personal financial advisers must have a bachelor’s degree in finance, economics, accounting or law, all of the above are suitable. Finance is a highly regulated industry: certain licenses are required to sell various investment or insurance products.

Financial advisers cannot be universal. They receive various degrees and certificates. They come from different countries and offer a wide range of services. Because of this, they can do a lot more than explain confusing jargon and help you choose mutual funds.

En pocas palabras, los asesores financieros pueden ayudarle con todo tipo de planificación financiera, lo que significa que pueden ayudarle con cualquier actividad financiera, desde la elaboración de un presupuesto hasta el ahorro para la jubilación.

To accomplish all these tasks and achieve your financial goals, from small to really large investments, as mentioned above, we will try to consider two main types of financial advisors.

But in this article, we’ll mainly focus on the two most popular types of financial advisors: local and online.

Asesores financieros locales

Financial advisors from Saint Kitts and Nevis can assist you in many financial transactions, from opening a simple bank account to making large investments in your home country. Their experience and knowledge cannot be less than the skills of any other financial advisor, so the main advantage here is that they are local residents and they have a local financial education, they are very familiar with all the rules that are used in Saint Kitts and Nevis, namely: an excellent tool and a great investment for your future financial goals.

But when choosing, for example, a bank financial advisor who is also considered local, keep in mind that his main goal is to sell you a banking service or product. In fact, this is not their fault, but in any case it will entail additional costs and may not be necessary at that time. With the help of a bank advisor, it is recommended to open only a savings or investment account with a bank, therefore, as a foreigner, you may need the assistance of a bank financial advisor, but nothing more.

Para aclarar la situación, pueden ofrecerte sus opciones hipotecarias con tipos atractivos, pero en cualquier caso, ten en cuenta tus objetivos principales y avanza con eso en mente. Para fines financieros adicionales, puede ponerse en contacto con un asesor individual o en línea, que puede ser más eficaz que otras opciones en el mercado.

Por encima de todo, los asesores individuales y en línea dan prioridad a sus clientes y hacen todo lo posible por alcanzar sus objetivos financieros con rapidez y eficacia. En consecuencia, pueden cobrar honorarios y comisiones pequeños, pero ofrecen buenas estrategias, se aseguran de que toda su documentación esté a salvo.

Anyway, let’s take a look at some financial transactions in which you need the help of a consultant. For example, how to invest in Saint Kitts and Nevis? It is a developing country with a bright future, so many expats who have moved there may want to invest in real estate, so let’s take a look at the conditions and benefits.

Local expertise will help you. Saint Kitts and Nevis is a foreign country for a European expat, and for many expats, the laws may be different, investment options, savings accounts, and more may require different skills.

La decisión clave es un asesor financiero local. Suelen estar formados y centrados en las leyes y normativas que rigen en el país. Por eso son un gran recurso si quieres invertir localmente para impulsar el crecimiento en tu zona, ciudad o estado.

Keep in mind that local investment can bring you two rates of return, one directly for your portfolio and the other through your community. There is growing evidence that, compared to their non-local counterparts, local businesses have two to four times the impact on local economic development for every dollar spent on them.

Por tanto, si tiene una cartera de inversiones que incluya empresas locales, sus dólares seguirán circulando y mejorando el bienestar de toda su comunidad al crear nuevos puestos de trabajo, aumentar los ingresos y, en última instancia, apoyar la financiación de escuelas, parques, servicios de policía y bomberos; y zonas seguras y prósperas.

An expert, local financial advisor can assist you with due diligence to ensure that your local investment makes sense.

Asesores financieros en línea

Los planificadores financieros o asesores en línea son personas con experiencia y conocimientos para ayudar a sus clientes a alcanzar objetivos financieros concretos.

Se esfuerzan por comprender sus circunstancias financieras personales actuales y sus objetivos futuros, y luego desarrollan estrategias financieras para ayudarle a alcanzarlos.

Estos profesionales cuentan ahora con la ayuda de una serie de herramientas digitales de planificación financiera que contribuyen a minimizar el riesgo y automatizar los procesos financieros y contables fundamentales, las recomendaciones de carteras, el reequilibrio de carteras y la reinversión de dividendos.

In other words, online financial planners are using new technologies to better transport you from where you are (financially) to where you want to be. This allows them to cut costs that will ultimately impact your income and reduce the time it takes to acquire customers. Time is an important commodity when investing: the earlier you start, the more time your money will work for you.

This approach in the profession creates a technology-driven financial dimension around important life decisions that helps plan actions and achieve personal goals, whether it’s early retirement, a new business, a new home, or a dream vacation.

How can you benefit with us?

There are many benefits you can get from working with a financial advisor, as well as an online financial advisor who will be available when you need one. Let’s take a look at some of the benefits:

Ahorra tiempo

How can working with an online financial advisor help you save your time?

An online meeting with a financial advisor means that you do not have to go to his office in traffic jams. You can meet them during your lunch break at work, on the couch at home, or even on vacation. If you have a device and an Internet connection.

Ahorra dinero

How can working with a financial advisor online help you save money?

You don’t need to take time off from work or hire a nanny to meet with online financial advisors who don’t work strictly from 9 to 5 o’clock. You can meet them at any time convenient for you, wherever you are, and save on gas and parking costs.

Mejores condiciones ambientales

How will the work of a financial consultant affect the environment? Since they don’t drive to the office every day, their customers don’t have to drive to see them, there are fewer cars on the roads and less carbon emissions.

In addition, financial planners on the Internet do not print long plans for their clients. Whenever possible, they minimize the consumption of paper, ink and other consumables.

Freedom of location

¿Importa dónde viva usted cuando trabaja con un asesor financiero online? Muchos asesores financieros online han vivido en muchos estados a lo largo de los años, al igual que sus clientes. Más del 40% de los clientes se han mudado de ciudad desde que empezaron a trabajar con sus asesores. Pero ambos han podido “mudarse” juntos y seguir siendo constantes el uno para el otro.

When you move to Saint Kitts and Nevis on vacation, you can find a great online financial advisor there and not worry about going back home and losing your precious job. You can still work together from anywhere in the world.

By “financial advisor” we mean someone that you fully trust and with whom you can discuss your financial situation, plans and how you handle money. By no means we are referring to banking or brokerage employees – at least not most of them. In conclusion it is worthy to note that financial advisors play a key role in every investor’s life, regardless of how much are your free funds and whether you are in control of your business.

¿Le duele la indecisión financiera? ¿Quiere invertir con Adam?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.