Expat Financial Advisors in Saint Kitts and Nevis – that will be the topic of today’s article.

I will compare some of the options available locally, alongside more portable, online, and international options like what we offer.

It makes sense to have a portable option as an expat, as opposed to a localized one, and that is something we specialize in.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

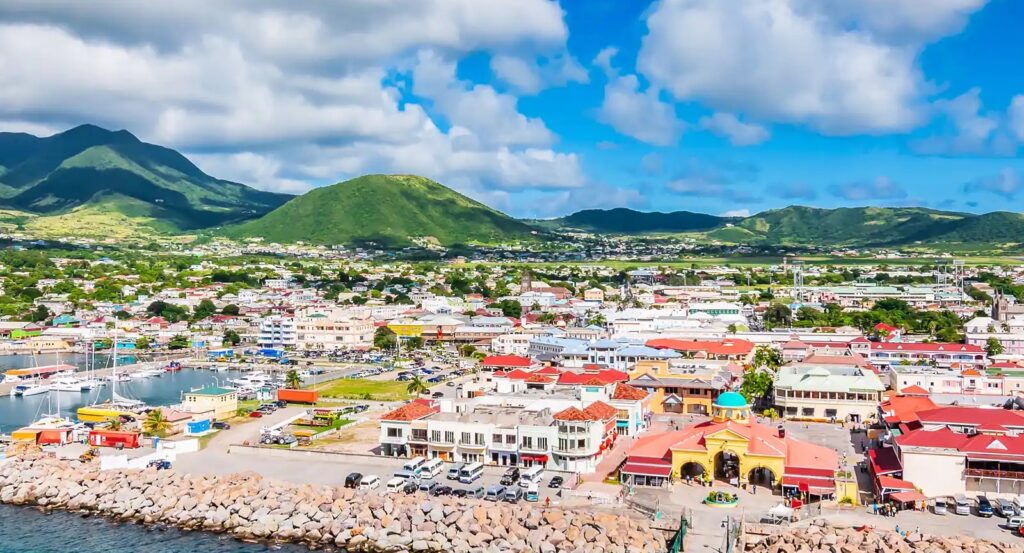

Saint Kitts and Nevis is a Caribbean country that was formed on February 27, 1967 as a result of the unification of two small states. The country has a developed economy, a high level of medicine and education.

Saint Kitts and Nevis lives off tourism, agriculture, and outside investment. Cosmopolitans obtain Saint Kitts and Nevis citizenship for visa-free travel to 157 countries of the world, including the Schengen states, Great Britain, Singapore, and Hong Kong.

Saint Kitts and Nevis is located on two islands of the same name. They are part of the Lesser Antilles archipelago of the West Indies. The eastern territory of the country is washed by the Atlantic Ocean, and the western one – by the Caribbean Sea.

The length of the island of Saint Kitts is 37 km, along it there is a ridge of peaked mountains, among which the extinct volcano Liamuiga is the highest point in the country. The top of the volcano reaches 1155 meters above sea level. The political and economic structure of the country.

Saint Kitts and Nevis is a federation, that is, a union state that consists of two independent states. The federation is based on the UK’s democratic parliamentary system. Saint Kitts and Nevis was formerly an English colony. They gained independence relatively recently – in 1983. Now the state is an independent member of the Commonwealth of Nations, the head is the monarch of Great Britain. His interests in the country are represented by the Governor-General.

Parliament is represented by a unicameral National Assembly, which is chaired by the Prime Minister. He becomes the head of the party or coalition of the majority, which won the elections. The country has a Supreme Court and a system of magistrates’ courts.

Nevis, where only 20 thousand people live, has a separate parliament and its own administration. It is also headed by the Prime Minister. Nevis has the right to secede from the Federation at any time. The southeastern part of the island is flat with an uneven coastline.

Apart from the Commonwealth of Nations, Saint Kitts and Nevis is a member of other international organizations such as the UN, CARICOM, IMF, WTO, International Bank for Reconstruction and Development and OAS.

The bulk of the country’s population is of African descent, there are descendants of the Arawak and Caribbean Indians. A small percentage of residents are European settlers and mulattoes. The official language is English, but local dialects are often used in everyday life.

The residents of Saint Kitts and Nevis are Christians. They are mainly Anglicans, Methodists, and Catholics. A small percentage of residents identify themselves with another religion or are completely atheists.

The economy of Saint Kitts and Nevis is driven by agriculture, tourism, and a citizenship investment program. Tourism brings a larger percentage of the country’s GDP, so the government is investing in infrastructure development: building a new port, marinas, hotels, and earthquake-resistant houses.

Local residents grow various agricultural crops both for themselves and for import. In the lowlands of the islands, there are private gardens and plantations of sugar cane, fruit trees, coconut palms.

The Citizenship Investment Program started in 1984. Thanks to the program, investments in tourism, the island’s infrastructure and social services are growing.

Life in Saint Kitts and Nevis

A short-term integration into society helps tourists to get acquainted with all the peculiarities of the country: they rent housing, use public transport, and buy food and goods in local stores.

Real estate. Coming on vacation, tourists can rent a room in local hotels, rent an apartment or an apartment. The cost of renting a one-bedroom apartment in Basseterre starts at $ 350. Closer to the center, prices start at $ 600.

Transport. Buses run between settlements of the country; the ticket price is about $ 1.2 one way. A ferry runs between the islands, a ticket for which will cost $ 25. Tourists can also order a taxi; prices start at $ 1.85 per kilometer.

Education. There are public and private schools in the country. Children from 5 to 16 years old study for free in public schools.

The country has four medical universities, a branch of the University of the West Indies, technical and teacher training colleges. The University of the West Indies is a higher education institution that operates only in the states of the Commonwealth of Nations. The campus of the university is located in the capital of the state, Basseterre. Initially, the university was created as a division of London College, therefore, its work is based on British educational standards.

Citizens of Saint Kitts and Nevis have the right to study at UK universities on preferential terms, because the country is part of the Commonwealth of Nations.

Medicine. Saint Kitts and Nevis has a high level of medicine based on British standards. Three state hospitals are open on the island of Saint Kitts – Joseph N. France, Molineux, Pogson. And there is one hospital on the island of Nevis – Alexandria. There are also several private clinics in the country.

The Joseph N. France is the country’s central hospital with intensive care and traumatology departments.

Tourists are advised to take out medical insurance, which will include emergency evacuation services in case of an emergency.

Other. Prices in the country are relatively low, imported goods are always more expensive. For a couple, a trip to a mid-range restaurant with a three-course menu will cost $ 90.

$ 83 is a monthly subscription to a local fitness club, and a movie ticket for an American movie is $ 6.65.

So, if you are interested in moving to Saint Kitts and Nevis, start a new life, invest or start your business, you may probably need assistance from a specialist. Later in this article we will discover who can provide you with necessary information in finance-related goals and how you can cooperate with a specialist. In other words, below we will mainly talk about financial advisors and their role in anyone’s life, who has specific or even simple financial goals and want to reach them.

How to know you need a financial advisor in Saint Kitts and Nevis?

The problem for many people is that they have no control over their cash flows. As a result, they live chaotically, not knowing where they are going financially.

We are all unwittingly involved in the constant flow of finance. After all, we make various monetary transactions every day. And it depends only on us how conscious this movement will be on the scale of our entire life.

To manage the future, you need to:

• Manage your cash flows;

• Transform the future into a set of clear, measurable financial goals;

• Make a plan to achieve these goals;

• Carry out your plan.

This is a common situation for everyone that a financial advisor works with. Along with this, special cases are also possible.

A person already clearly understands what tasks he is striving for. He only needs a specialist who will help him choose the right strategy for achieving his goal. And will offer the best tools for solving important problems. In both cases, a personal financial advisor will help you.

Who is a financial advisor?

This is a specialist who advises on financial policy issues at different levels. He can work both as an individual and in the status of a legal entity. This does not change its function.

He advises clients on saving or increasing money, assesses their financial condition, develops an investment policy, a scheme for working with banking institutions, and makes management decisions.

This category includes the following specialties:

— brokers;

— investment advisors;

— accountants;

— financial lawyers;

— insurance agents;

— financial analysts.

The consultant may be well versed in a particular area of finance but may also be a generalist. A financial advisor must have all the required professional skills. Secondly, it is excellent to know the provisions and laws of legislation in the field of finance and economics. In addition, he must understand the market economy, trends in monetary investments.

He must also be able to evaluate financial assets and their instruments. Understand the procedures for buying and selling securities in the stock markets. In addition, he should be familiar with modern systems of lending and investment, control, and taxation.

In other words, a financial advisor is an advisor with excellent knowledge in any financial, legal, and accounting area.

How can a financial advisor help you?

A financial advisor helps a client plan for both short-term and long-term financial goals. These goals may include saving for retirement, attending college, and ensuring that the client has the appropriate insurance plan to ensure a stable financial future. Their main purpose is to advise on financial security issues.

To become a certified financial advisor, a bachelor’s degree in finance, economics, accounting, business mathematics, or law is required. The Master of Business Administration will definitely improve your career opportunities. It is highly recommended to take courses in investment and risk management along with courses in tax and estate planning.

Financial advisors help clients with their financial planning. The client’s life can also suddenly change, so a financial adjustment will be required. For example, it could be a death in the family, a marriage or divorce, a chronic illness or disability, or a person may receive a large sum of money.

A financial advisor can help plan college preparation for yourself or your children. While most financial advisors work in offices, a quarter of them are self-employed. They may attend conferences and seminars to network and promote themselves to meet potential clients.

The heavy responsibility of investing in personal savings and helping them into retirement requires both financial knowledge and interpersonal skills. Personal financial advisors give advice on investments, property ownership, estate planning and more to help people manage their finances and plan for the future. Personal financial advisors begin their collaboration with the client by determining their financial needs and goals and, of course, the level of risk they are willing to take, and then help them set short- and long-term goals.

Financial advisors are experts in the benefits and limitations of various types of investments such as mutual funds, stocks and bonds, real estate, as well as related topics such as insurance and the tax implications of various investments. Marketing their services to potential clients is an ongoing part of the job. To expand their client base, personal financial advisers conduct seminars, participate in networking events, and seek referrals from existing clients. As a rule, advisors meet with clients annually to discuss their investment portfolio and make changes.

Most personal financial advisors work in finance and insurance, while many others are self-employed. They usually work in offices full time, and some may meet with clients in the evenings and weekends.

As a general rule, personal financial advisers must have a bachelor’s degree in finance, economics, accounting or law, all of the above are suitable. Finance is a highly regulated industry: certain licenses are required to sell various investment or insurance products.

Financial advisers cannot be universal. They receive various degrees and certificates. They come from different countries and offer a wide range of services. Because of this, they can do a lot more than explain confusing jargon and help you choose mutual funds.

Simply put, financial advisors can help you with all kinds of financial planning, which means they can help you with any financial activity, from budgeting to retirement savings.

To accomplish all these tasks and achieve your financial goals, from small to really large investments, as mentioned above, we will try to consider two main types of financial advisors.

But in this article, we’ll mainly focus on the two most popular types of financial advisors: local and online.

Local financial advisors

Financial advisors from Saint Kitts and Nevis can assist you in many financial transactions, from opening a simple bank account to making large investments in your home country. Their experience and knowledge cannot be less than the skills of any other financial advisor, so the main advantage here is that they are local residents and they have a local financial education, they are very familiar with all the rules that are used in Saint Kitts and Nevis, namely: an excellent tool and a great investment for your future financial goals.

But when choosing, for example, a bank financial advisor who is also considered local, keep in mind that his main goal is to sell you a banking service or product. In fact, this is not their fault, but in any case it will entail additional costs and may not be necessary at that time. With the help of a bank advisor, it is recommended to open only a savings or investment account with a bank, therefore, as a foreigner, you may need the assistance of a bank financial advisor, but nothing more.

To clarify the situation, they may offer you their mortgage options with attractive rates, but in any case, keep your main goals in mind and move forward with that in mind. For additional financial purposes, you can contact an individual consultant or online, which may be more effective than other options on the market.

Above all, individual and online consultants put their clients first and do their best to achieve their financial goals quickly and efficiently. Accordingly, they may charge small fees and commissions, but they offer good strategies, make sure all your documentation is safe.

Anyway, let’s take a look at some financial transactions in which you need the help of a consultant. For example, how to invest in Saint Kitts and Nevis? It is a developing country with a bright future, so many expats who have moved there may want to invest in real estate, so let’s take a look at the conditions and benefits.

Local expertise will help you. Saint Kitts and Nevis is a foreign country for a European expat, and for many expats, the laws may be different, investment options, savings accounts, and more may require different skills.

The key decision is a local financial advisor. They are usually educated and focused on the laws and regulations they follow in the country. So they are a great resource if you want to invest locally to drive growth in your area, city, or state.

Keep in mind that local investment can bring you two rates of return, one directly for your portfolio and the other through your community. There is growing evidence that, compared to their non-local counterparts, local businesses have two to four times the impact on local economic development for every dollar spent on them.

So, if you have an investment portfolio that includes local businesses, your dollars will continue to circulate and improve the well-being of your entire community by creating new jobs, increasing income, and ultimately supporting funding for schools, parks, police. and fire services; and safe and prosperous areas.

An expert, local financial advisor can assist you with due diligence to ensure that your local investment makes sense.

Online financial advisors

Financial planners or online consultants are people with the experience and knowledge to help their clients achieve specific financial goals.

They strive to understand your current personal financial circumstances and future goals, and then develop financial strategies to help you achieve them.

These professionals are now assisted by the addition of a range of digital financial planning tools that help minimize risk and automate critical finance and accounting processes, portfolio recommendations, portfolio rebalancing, and dividend reinvestment.

In other words, online financial planners are using new technologies to better transport you from where you are (financially) to where you want to be. This allows them to cut costs that will ultimately impact your income and reduce the time it takes to acquire customers. Time is an important commodity when investing: the earlier you start, the more time your money will work for you.

This approach in the profession creates a technology-driven financial dimension around important life decisions that helps plan actions and achieve personal goals, whether it’s early retirement, a new business, a new home, or a dream vacation.

How can you benefit with us?

There are many benefits you can get from working with a financial advisor, as well as an online financial advisor who will be available when you need one. Let’s take a look at some of the benefits:

Save your time

How can working with an online financial advisor help you save your time?

An online meeting with a financial advisor means that you do not have to go to his office in traffic jams. You can meet them during your lunch break at work, on the couch at home, or even on vacation. If you have a device and an Internet connection.

Save your money

How can working with a financial advisor online help you save money?

You don’t need to take time off from work or hire a nanny to meet with online financial advisors who don’t work strictly from 9 to 5 o’clock. You can meet them at any time convenient for you, wherever you are, and save on gas and parking costs.

Better environmental conditions

How will the work of a financial consultant affect the environment? Since they don’t drive to the office every day, their customers don’t have to drive to see them, there are fewer cars on the roads and less carbon emissions.

In addition, financial planners on the Internet do not print long plans for their clients. Whenever possible, they minimize the consumption of paper, ink and other consumables.

Freedom of location

Does it matter where you live when you work with an online financial advisor? Many online financial planners have lived in many states over the years, as have their clients. More than 40% of clients have moved to the new city since they started working with their consultants. But both were able to “move” together and remain constant for each other.

When you move to Saint Kitts and Nevis on vacation, you can find a great online financial advisor there and not worry about going back home and losing your precious job. You can still work together from anywhere in the world.

By “financial advisor” we mean someone that you fully trust and with whom you can discuss your financial situation, plans and how you handle money. By no means we are referring to banking or brokerage employees – at least not most of them. In conclusion it is worthy to note that financial advisors play a key role in every investor’s life, regardless of how much are your free funds and whether you are in control of your business.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.