Should I exercise and hold my stock options?

Should I exercise and hold my stock options?

Should I exercise and hold my stock options?

What to Do with Your 401k Benefits When Moving Abroad

What is the difference between a trust and holding company?

What are the best asset protection strategies?

Best Investment Platforms for Accredited Investors

Form 3520: US Reporting Rules on Foreign Gifts and Inheritances

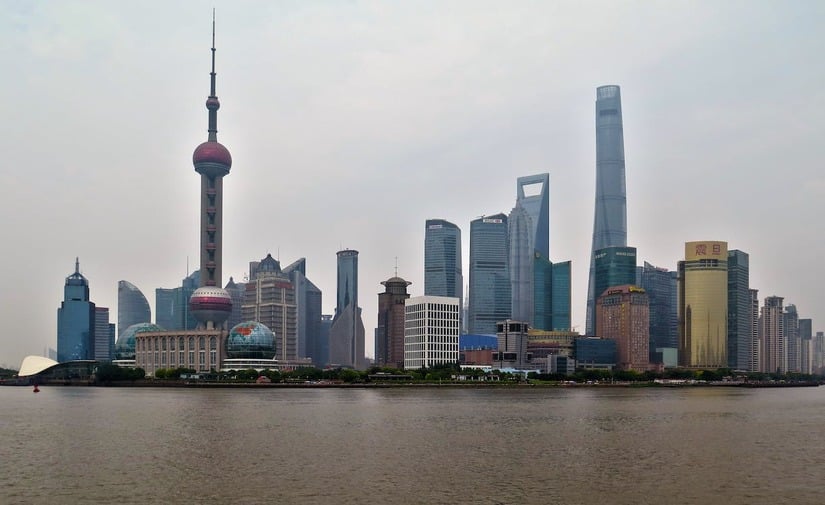

Cost of Living in Shanghai vs Kuala Lumpur

Creating an Islamic Will is not only obligatory for Muslims according to the Holy Quran and Sunnah but also necessary to ensure the proper distribution

This post will shed some light on Trusts vs Foundations in Malta, explaining what they are and the types available. If you want to invest

In this article, we will be discussing about the Downsides of Investing using AI.

Investment trends to look out for in 2024

Leaving the UK in 2024: Your Best Financial Guide

Everything to Know About Share Incentive Plans

Tips for SIP for Expats: Best Guide 2023

Moving Indian Shares Abroad: Best Guide for Expatriates 2023

Essential Steps for Moving US Shares When Relocating Abroad: Guide in 2023

This website is not designed for American resident readers, or for people from any country where buying investments or distributing such information is illegal. This website is not a solicitation to invest, nor tax, legal, financial or investment advice. We only deal with investors who are expats or high-net-worth/self-certified individuals, on a non-solicitation basis. Not for the retail market.

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.