This post will shed some light on Trusts vs Foundations in Malta, explaining what they are and the types available.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

The concept of trust vs foundation differ significantly, particularly in Malta.

Trust Vs Foundation

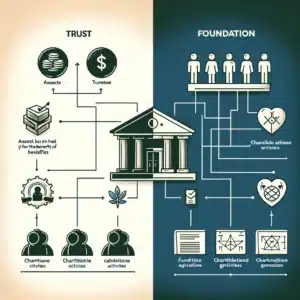

Trusts lack separate legal personalities, don’t require registration, and are funded through settlor settlements.

In contrast, Foundations have legal personality, need a minimum endowment of €1,200, and are endowed by the founder.

Trusts allow settlor reserved powers, but excessive control risks deeming it a sham trust. Foundations provide more founder control over assets.

Trusts have a maximum duration of 125 years, while private Foundations are limited to 100 years.

Trustees manage trusts, and administrators oversee Foundations, holding a fiduciary responsibility to beneficiaries.

Malta Trusts

Malta has witnessed a surge in the use of trusts by both individuals and legal entities, with applications in commercial and private spheres.

The flexibility of Maltese Trusts allows for their use in international or local contexts, as the Trusts and Trustees Act does not differentiate between the two.

Maltese Trusts serve various purposes, including acting as a guarantee mechanism.

Debtors, serving as settlors, can place assets in the trust for the benefit of creditors, streamlining the guarantee process compared to alternatives like pledges.

Moreover, trusts are employed for real estate management, where the settlor and investor (often a bank) jointly own the property, and the trustee manages funds for construction or alterations.

Trusts also facilitate fund securitization, allowing allocated funds to be invested for creditor payment assurance.

The Hague Convention incorporation into Maltese law via the Trusts and Trustees Act broadens trust recognition.

Malta treats trusts as tax-transparent, with income being taxed when distributed to beneficiaries.

Tax neutrality is maintained for tax-resident trustees with income derived outside Malta or certain prescribed dividends from Maltese companies when beneficiaries are non-residents or not domiciled in Malta.

No tax or duty implications arise upon distribution if the trustees are non-resident and assets held on trust are located outside Malta, excluding Maltese immovable property and securities in Maltese companies.

Types of Trusts in Malta

Malta offers various types of trusts that cater to different needs and purposes. Some common types of Malta trusts include:

- Fixed Trusts

- Discretionary Trusts

- Charitable Trusts

- Purpose Trusts

- Protective Trusts

- Unit Trusts

- Revocable Trusts

- Irrevocable Trusts

Malta Foundations

Malta Foundations were unregulated until July 2007 when a comprehensive law was enacted to govern them under the Second Schedule to the Civil Code.

Foundations in Malta are legal entities created by founders and confirmed by the Registrar of Legal Persons.

Administered by an appointed administrator, the foundation must align its actions with the objectives outlined in its constituting deed.

Malta law permits two common types of foundations: Private and Purpose Foundations.

Purpose Foundations may have unspecified beneficiaries at establishment but must serve charitable, philanthropic, social, non-profit, or other lawful purposes.

Private Foundations, unless specified otherwise, benefit named individuals or a class of persons.

A noteworthy feature is the option for a Malta foundation to establish segregated cells for specific purposes, as permitted by the foundation’s statute.

Although not considered legal entities eligible for registration, segregated cells maintain distinct identities, with assets held separately and distinct accounts managed for each cell.

Types of Foundations in Malta

In Malta, foundations are versatile legal entities designed for various purposes, including charitable, philanthropic, or private wealth management.

Here are some common types of Malta foundations:

- Private Foundations

- Purpose Foundations

- Family Foundations

- Charitable Foundations

- Hybrid Foundations

- Testamentary Foundations

- Common Law Foundations

- Islamic Foundations

Trust vs Foundation in Malta: Final Thoughts

It’s important to note that the legal framework surrounding Malta trust vs foundation may evolve.

Therefore, seeking advice from legal professionals familiar with Malta trust and foundation laws is advisable when considering the establishment of a trust.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.