Los países con impuestos sobre el patrimonio, como España, Suiza y Noruega, gravan el patrimonio neto de un individuo en lugar de sólo sus ingresos o gastos. Estos impuestos

Estos impuestos se dirigen principalmente a las personas con grandes patrimonios y difieren ampliamente en cuanto a tipos, exenciones y cobertura de activos.

Este artículo lo explica:

- ¿Cómo funciona el impuesto sobre el patrimonio?

- ¿Cuáles son los países con impuesto sobre el patrimonio?

- ¿Cuáles son las ventajas de gravar a los ricos?

- ¿Cuáles son los argumentos en contra de gravar a los ricos?

Principales conclusiones:

- En la actualidad, sólo unos pocos países aplican activamente impuestos sobre el patrimonio.

- Europa tiene la mayor concentración de sistemas fiscales sobre el patrimonio.

- Muchos países de baja fiscalidad atraen a los residentes ricos evitando por completo los impuestos sobre el patrimonio.

- Los debates sobre el impuesto sobre el patrimonio se centran en la equidad frente al impacto económico.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

¿Qué es el impuesto mundial sobre el patrimonio?

Un impuesto sobre el patrimonio se refiere a los impuestos que gravan el patrimonio neto de un individuo en lugar de la renta o el consumo.

Suele aplicarse a activos como bienes inmuebles, acciones, bonos, La renta per cápita de las personas físicas, la propiedad de empresas, los bienes de lujo y las tenencias de efectivo, una vez deducidos los pasivos.

Aunque no existe un único sistema mundial, el concepto se debate en todo el mundo mientras los gobiernos buscan formas de hacer frente a la desigualdad y aumentar los ingresos públicos.

¿Qué países de la UE tienen impuesto sobre el patrimonio?

Sólo un país de la Unión Europea tiene actualmente un verdadero impuesto sobre el patrimonio: España.

España grava con un impuesto sobre el patrimonio neto a los residentes y a determinados no residentes, con tipos progresivos aplicados a los activos netos totales que superen determinados umbrales.

Ningún otro Estado miembro de la UE aplica un impuesto general sobre el patrimonio.

Países como Francia, Italia, Bélgica y los Países Bajos han sustituido los impuestos sobre el patrimonio por gravámenes más limitados, como impuestos exclusivos sobre bienes inmuebles, impuestos sobre activos financieros o sistemas de rentabilidad estimada, en lugar de gravar el patrimonio neto total.

Noruega y Suiza se citan a menudo en los debates sobre el impuesto sobre el patrimonio, pero ninguno de los dos es miembro de la Unión Europea.

Ambos países aplican impuestos sobre el patrimonio -Noruega a nivel nacional y Suiza a nivel cantonal-, lo que los sitúa fuera de las clasificaciones específicas de la UE.

¿Existen impuestos sobre el patrimonio en otros países?

Sí, varios países no pertenecientes a la UE han experimentado o siguen aplicando impuestos sobre el patrimonio, a menudo dirigidos a personas con patrimonios muy elevados y no a la población en general.

Estos impuestos suelen estructurarse con umbrales de exención elevados y tipos progresivos, lo que limita su impacto a un pequeño segmento de contribuyentes.

En muchos casos, los impuestos sobre el patrimonio fuera de la UE se introducen como medidas temporales o extraordinarias, con frecuencia durante periodos de tensión fiscal o crisis económica.

Algunos países latinoamericanos, entre ellos Argentina, han adoptado este tipo de enfoques, enmarcando los impuestos sobre el patrimonio como herramientas únicas o limitadas en el tiempo para recaudar ingresos de los hogares más ricos.

¿Qué países tienen impuesto sobre el patrimonio?

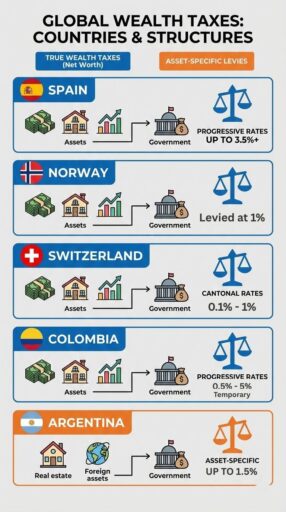

Sólo unos pocos países en el mundo recaudan actualmente un verdadero impuesto sobre el patrimonio neto: España, Noruega y Suiza.

Estos impuestos se aplican a los activos netos totales de los residentes por encima de unos umbrales definidos, con tipos progresivos que aumentan para los niveles de riqueza más elevados.

Lista de países con impuesto sobre el patrimonio:

- España: Mantiene un impuesto progresivo sobre el patrimonio neto (Impuesto sobre el Patrimonio) que grava los activos mundiales de los residentes y los activos españoles de determinados no residentes. Los tipos varían según la región, oscilando generalmente entre 0,16 % y alrededor de 3,5 % para las personas con un patrimonio neto muy elevado. Se aplican exenciones a los activos inferiores a 700.000 euros (residentes), y los umbrales y tipos aumentan progresivamente para los activos netos más elevados.

- Noruega: Para el ejercicio fiscal 2026, el impuesto sobre el patrimonio de Noruega grava con 1 % los activos netos superiores a 1,9 millones de coronas noruegas. Este umbral se incrementó desde los 1,76 millones de coronas noruegas de 2025. El impuesto se aplica a los activos mundiales de los residentes, con algunas exenciones nacionales.

- Suiza: El impuesto sobre el patrimonio se recauda a nivel cantonal y municipal sobre el patrimonio neto mundial de los residentes. No existe un impuesto federal sobre el patrimonio. Cada cantón fija sus propios umbrales y tipos, que suelen oscilar entre 0,1 % y 1 %, con exenciones para las personas con patrimonios netos más bajos (a menudo inferiores a 100.000 CHF). El patrimonio imponible incluye bienes inmuebles, activos financieros y otras participaciones.

Otros países con impuestos específicos sobre el patrimonio o los activos:

- Colombia: Tras la declaración del estado de emergencia económica En diciembre de 2025, Colombia impuso un impuesto sobre el patrimonio a los activos mantenidos a partir del 1 de enero de 2026 en virtud del Decreto 1474 de 2025. El impuesto se aplica a los activos netos superiores a 40.000 UVT (aproximadamente 2.000 millones de COP), con tipos marginales progresivos que comienzan en 0,5 % y aumentan hasta 5 % sobre los activos superiores a 2 millones de UVT (aproximadamente 104.700 millones de COP). La medida amplía significativamente la base imponible y actualmente se enmarca como un impuesto extraordinario sobre el patrimonio, impulsado por emergencias.

- Argentina: La impuesto sobre el patrimonio solidario se dirige a los activos de alto valor por encima de un importe mínimo no imponible (las reformas recientes han elevado el umbral, por ejemplo, de 27 a 100 millones de ARS), con tipos progresivos sobre los activos poseídos en Argentina que han incluido tramos desde 0,5 % hasta 1,5 % y tipos históricamente más elevados sobre medidas amplias.

- Bolivia (derogado): Bolivia aplicaba anteriormente una Impuesto sobre las grandes fortunas a las personas físicas con un patrimonio neto considerable, con tipos progresivos que oscilaban aproximadamente entre 1,4 % y 2,4 %. El impuesto fue derogado a finales de 2025 como parte de reformas fiscales más amplias destinadas a mejorar el clima de inversión.

Países con gravámenes específicos sobre los activos (no verdaderos impuestos sobre el patrimonio neto):

- Francia - Tras suprimir su amplio impuesto sobre el patrimonio en 2018, Francia impone ahora un impuesto sobre el patrimonio inmobiliario (Impôt sur la Fortune Immobilière, IFI) sobre las personas físicas cuyo patrimonio inmobiliario neto imponible supere los 1,3 millones de euros, con tipos progresivos desde 0 % hasta 1,5 % sobre la parte que supere el umbral.

- Italia - Impuestos en Italia activos financieros en el extranjero por los contribuyentes residentes sin intermediarios italianos a 0,2 % (con 0,4 % para determinados países) y los bienes inmuebles extranjeros (IVIE) a aproximadamente 1,06 %, pero no impone un impuesto sobre el patrimonio neto global sobre los activos totales.

- Bélgica - Bélgica tiene un impuesto de solidaridad (impuesto sobre cuentas de valores) de 0,15 % anuales sobre las cuentas de valores cuyo valor medio alcance o supere 1 millón de euros; se aplica a todo el valor de la cuenta, pero es no un impuesto general sobre el patrimonio neto.

- Países Bajos - El sistema neerlandés grava rendimiento de la riqueza en lugar del propio patrimonio neto. En virtud del régimen temporal (hasta 2027), el patrimonio superior a una exención personal (unos 57.684 euros) se grava sobre la base de un rendimiento atribuido a un tipo fijo del 36 % del impuesto sobre la renta sobre ese beneficio atribuido, una forma indirecta de imposición relacionada con el patrimonio en lugar de un impuesto anual estándar sobre el patrimonio neto.

¿Qué país tiene los impuestos sobre el patrimonio más altos?

España tiene los tipos impositivos más altos entre los países con un impuesto sobre el patrimonio neto permanente y recurrente.

Su sistema progresivo se aplica a los activos mundiales de los residentes y a determinados activos españoles de los no residentes, con tipos marginales máximos que rondan el 3,5 %, aunque las variaciones regionales y las exenciones pueden afectar significativamente a la carga efectiva.

Aunque Colombia aplica en la actualidad tipos generales más elevados de hasta el 5 % en virtud de un impuesto de urgencia sobre el patrimonio, estas medidas son temporales, extraordinarias y no forman parte de un sistema estable a largo plazo.

En general, la carga fiscal real sobre el patrimonio en cualquier país depende de los umbrales, las valoraciones de los activos, las normas regionales y las deducciones, lo que significa que el tipo más alto puede diferir del impacto práctico sobre los contribuyentes.

¿Qué país tiene los impuestos más bajos para los ricos?

Mónaco, Emiratos Árabes Unidos y algunas jurisdicciones caribeñas son algunos de los países con menor presión fiscal para los ricos.

These countries generally do not levy a wealth tax, and many also have low or zero personal income tax, making them particularly attractive for high-net-worth individuals seeking tax efficiency.

Sin embargo, la carga total puede variar en función de otros factores, como los impuestos de sucesiones, el impuesto de sociedades y los requisitos de residencia.

¿Cuál es la diferencia entre el impuesto sobre la renta y el impuesto sobre el patrimonio?

La principal diferencia entre el impuesto sobre la renta y el impuesto sobre el patrimonio es que el impuesto sobre la renta grava el dinero ganado durante un año, mientras que el impuesto sobre el patrimonio grava el valor total de los activos poseídos, independientemente de los ingresos.

El impuesto sobre la renta se aplica a ingresos tales como salarios, dividendos o beneficios empresariales, orientándose al flujo de caja, mientras que impuesto sobre el patrimonio se dirige al capital acumulado, como los bienes inmuebles, inversiones, y el ahorro.

En resumen, el impuesto sobre la renta mide lo que se gana, mientras que el impuesto sobre el patrimonio mide lo que se posee.

Por qué es bueno el impuesto sobre el patrimonio

Un impuesto sobre el patrimonio se considera beneficioso porque ayuda a garantizar que las personas más ricas contribuyan equitativamente a la sociedad.

Los partidarios destacan varias ventajas:

- Reduce la desigualdad económica gravando la riqueza acumulada en lugar de sólo la renta.

- Genera ingresos para servicios públicos como sanidad, educación e infraestructuras.

- Evita la concentración excesiva de riqueza entre generaciones, fomentando la movilidad social.

- Fomenta una distribución más justa de los recursos y puede complementar otras políticas fiscales progresivas.

Por qué el impuesto sobre el patrimonio es una mala idea

Un impuesto sobre el patrimonio se considera problemático porque puede crear dificultades económicas y administrativas.

Los críticos señalan varias desventajas:

- Difícil de administrar debido a la necesidad de una valoración anual precisa de los diversos activos.

- Fomenta la fuga de capitales o la evasión fiscal, ya que las personas adineradas trasladan sus activos o su residencia a jurisdicciones con impuestos más bajos.

- Puede desalentar la inversión y el espíritu empresarial, reduciendo los incentivos para la creación de empresas y el crecimiento económico.

- Puede afectar negativamente al ahorro a largo plazo y a la acumulación de activos, lo que puede repercutir en la generación de riqueza global.

¿Son eficaces los impuestos sobre el patrimonio para reducir la desigualdad?

Sí, se ha demostrado que los impuestos sobre el patrimonio reducen la desigualdad económica al gravar directamente los activos acumulados de las personas más ricas.

Su eficacia, sin embargo, viene determinada por factores como el diseño de los impuestos, su aplicación y su integración con otras políticas fiscales.

For example, Switzerland demonstrates that reductions in canton-level wealth tax rates were associated with increases in wealth concentration at the top, suggesting that sustained or stronger wealth taxes help contain extreme inequality.

En Colombia, el impuesto de emergencia sobre el patrimonio de 2026 ilustra tanto el potencial como las limitaciones: aunque algunas personas con un alto patrimonio ajustaron los activos declarados para evitar tipos más altos, el impuesto amplió temporalmente la base de ingresos e influyó en los patrones de distribución de la riqueza declarada.

La OCDE señala además que los impuestos sobre el patrimonio son más eficaces cuando se integran con medidas fiscales más amplias, como los impuestos progresivos sobre la renta, los impuestos sobre sucesiones y el gasto social, en lugar de aplicarse de forma aislada.

Los factores clave para la eficacia incluyen:

- Diseño y umbrales: Los impuestos bien estructurados capturan la riqueza significativa sin dejar lagunas.

- Ejecución y cumplimiento: La valoración exacta de los activos es fundamental; una aplicación deficiente limita tanto los ingresos como la equidad.

- Respuestas conductuales: Deslocalización, reestructuración de activos o planificación fiscal por parte de los individuos ricos puede reducir el impacto redistributivo.

- Integración con una política fiscal más amplia: Los impuestos sobre el patrimonio funcionan mejor como parte de un marco fiscal más amplio y progresivo.

Conclusión

Los impuestos sobre el patrimonio siguen siendo un instrumento polémico de la política fiscal moderna, en el que se equilibran cuestiones de justicia, equidad social y eficiencia económica.

Aunque pueden proporcionar ingresos significativos y ayudar a reducir la desigualdad extrema, su aplicación práctica es compleja y a menudo políticamente tensa.

El panorama mundial muestra que los impuestos permanentes sobre el patrimonio son raros, y los países experimentan continuamente con medidas específicas para cada activo o temporales para lograr objetivos similares.

Tanto para los responsables políticos como para los inversores, la idea clave es que la forma en que se estructura, se aplica y se percibe un impuesto puede ser tan importante como su tipo, ya que determina tanto el comportamiento económico como los resultados sociales a largo plazo.

Preguntas frecuentes

¿Cuándo se eliminó el impuesto sobre el patrimonio en India?

India suprimió su impuesto sobre el patrimonio en 2015, sustituyéndolo por un recargo más elevado para las rentas altas.

El cambio pretendía simplificar la administración fiscal y mejorar el cumplimiento.

¿Qué país de Asia tiene los impuestos más altos?

En Asia, Japón tiene los tipos marginales más altos del impuesto sobre la renta de las personas físicas, en torno a 45 % más un recargo de 2,1 % para las rentas altas.

Otros países, como Filipinas, China y Corea del Sur, también tienen tipos elevados, mientras que los impuestos formales sobre el patrimonio son, en general, escasos en toda la región.

¿Qué país tiene la mejor estructura fiscal?

Países como Singapur y Suiza suelen ser elogiados por combinar tipos competitivos, una administración eficiente y normas claras y predecibles, sin dejar de financiar servicios públicos esenciales.

¿Existe en Japón un impuesto sobre el patrimonio?

No, Japón no aplica un impuesto formal sobre el patrimonio. El país recurre a elevados impuestos sobre la renta de las personas físicas, impuestos de sucesiones, y los impuestos sobre la propiedad para recaudar ingresos de los particulares con grandes patrimonios.

¿Existe un impuesto sobre el patrimonio en China?

No, China no impone actualmente un impuesto general sobre el patrimonio. Los impuestos se recaudan principalmente a través del impuesto sobre la renta de las personas físicas, los gravámenes relacionados con la propiedad y los impuestos de sociedades, y no sobre el patrimonio neto total.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.