Como ya mencioné en este artículo, históricamente, el oro no ha sido una buena inversión a largo plazo.

Sin embargo, este artículo responderá a algunas de las siguientes preguntas:

- ¿Es el oro una buena inversión para 2020 y 2021 específicamente?

- Si le interesa el oro, ¿qué carteras son las mejores para usted?

Si quieres invertir y estás confuso con todas las opciones que hay, puedes ponerte en contacto conmigo utilizando este formulario, o utilice la función de chat que aparece a continuación.

Breve explicación de la importancia del oro en la historia

Antes de empezar, sería lógico explicar por qué el oro es una inversión popular en muchas culturas de todo el mundo, a pesar de su bajo rendimiento a largo plazo.

Cuando nos referimos a las personas más ricas del planeta, solemos hablar de Bill Gates, Warren Buffet, Jeff Bezos y otros que triunfaron en nuestra era.

Sin embargo, históricamente, los más ricos poseían oro y algunos de ellos, como Mansa Musa, con un capital neto de 400.000 millones, emperador de Malí, tenían más dinero que los ricos de hoy.

Si lo ajustamos a los estándares actuales y al precio contemporáneo del oro, podría superar el billón.

El oro, a lo largo de toda nuestra historia, ha sido un elemento de comercio debido a su rareza. Las primeras monedas de la historia se inventaron en Lidia, y estaban hechas de oro y plata.

En la Edad Media, antes de la invención de los billetes, los comerciantes caían en emboscadas en medio de los bosques y les robaban todos sus sacos de oro.

Nuestros antepasados encontraban el oro sobre todo en las corrientes de agua, hoy tenemos que excavar para encontrarlo y, como la mayor parte se excavó en la superficie, ahora tenemos que utilizar la tecnología para explorar el suelo en profundidad.

Esto explica en parte por qué la compra de oro está culturalmente arraigada en muchos países: es algo familiar desde hace muchos siglos.

¿Cuál ha sido el rendimiento a largo plazo?

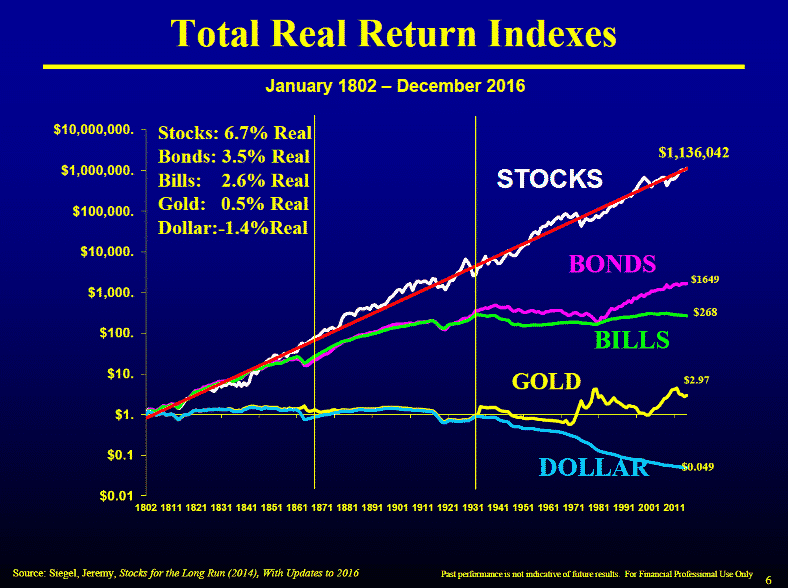

Terrible. El oro ni siquiera ha superado al efectivo en el banco si miramos a largo plazo.

Simplemente ha mantenido su valor. Incluso el efectivo ha proporcionado un pequeño rendimiento después de la inflación hasta hace relativamente poco.

Esos pequeños tipos de interés salvaron a la gente del “envilecimiento de la moneda”, como muestra el gráfico siguiente sobre la rentabilidad de las letras del Tesoro:

En última instancia, hay una sencilla razón por la que las acciones han promediado 6,5% después de la inflación y el oro ha hecho 0%-0,5% después de la inflación.

Las acciones son motores de crecimiento. No todas las acciones, pero la flor y nata se fortalece.

Esto fue innovación en 1900:

Esto es innovación en 2020:

La flor y nata del sector, que cotiza en el S&P500, el Dow Jones y el Nasdaq, se hace más fuerte.

Netflix y Amazon son 1000 veces más rentables y eficientes que las empresas de hace 200 años gracias a la tecnología.

Asimismo, a medida que nos adentramos en un mundo digital, las empresas que coticen en 2035 o 2040 serán más eficientes que Netflix y Amazon de 2020.

La tecnología no se detiene. Mientras que el oro sí. Hay una cantidad limitada de oro en circulación.

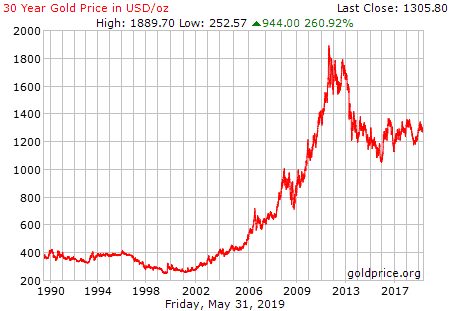

La oferta es relativamente estable, pero la demanda sube y baja. Así que el oro tiene sus periodos de bonanza, como durante 2000-2010, y sus periodos malos, como en la década de 1990 y desde 2011 hasta la actualidad.

Sin embargo, a largo plazo, permanece estancado. Está más o menos donde estaba en tiempos de Cristo y el precio era mucho más alto en la década de 1980.

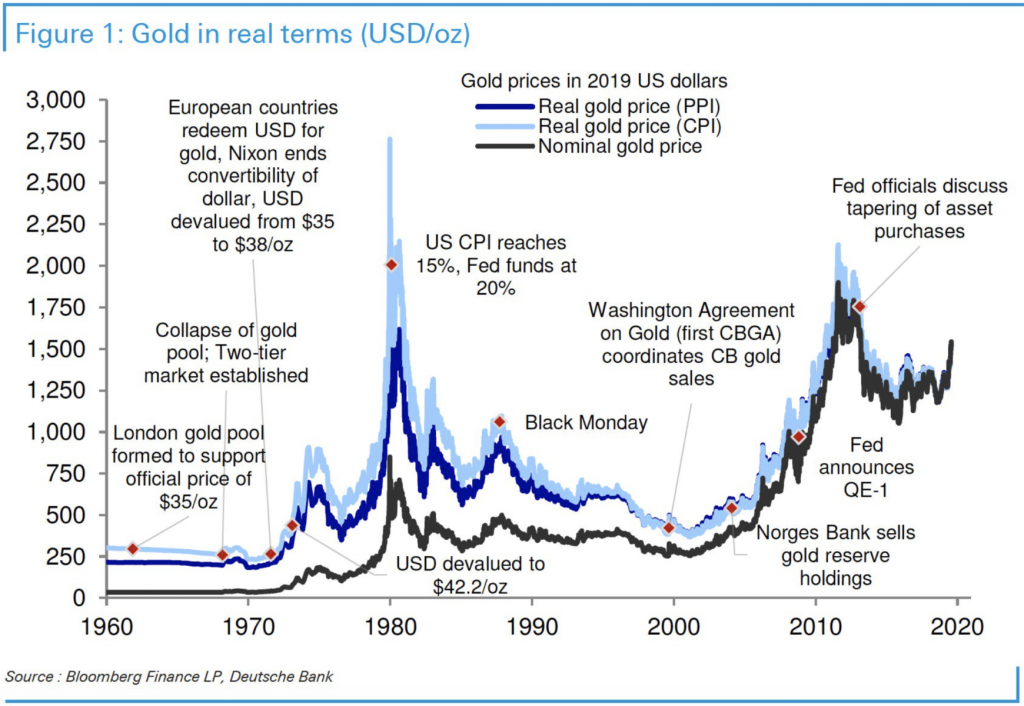

Según el gráfico siguiente, el oro alcanzó alrededor de $3.000 ajustado a la inflación en la década de 1980:

Y, a diferencia de las acciones o los bonos, no paga dividendos ni cupones. Así que en realidad ni siquiera es una inversión porque esperas que la persona que venga después de ti pague más que tú por el mismo activo que no produce nada.

Incluso muchos "gold bugs" admiten que el oro sólo mantiene su valor a largo plazo.

La cobertura durante una crisis de mercado

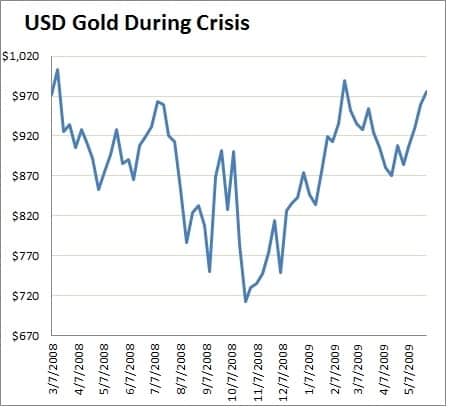

Puede que el oro sea una mala apuesta a largo plazo, pero ¿y durante una crisis? Mucha gente que sabe que el oro es una mala apuesta a largo plazo asume que es un paraíso seguro durante los malos tiempos.

Sin embargo, durante crisis muy graves como la de 2008-2009, el oro no ha tenido un buen comportamiento, como muestra el gráfico:

Por lo tanto, es un error pensar que el oro es siempre una inversión segura.

Lo más interesante es que el mercado bajista del oro de 2008-2009 se produjo durante un periodo de subida de los precios del oro (2000-2011).

La única excepción a esa racha alcista fue durante lo peor de la crisis financiera de 2008.

Del mismo modo, en marzo de 2020, la carrera alcista del oro desde 2018 se interrumpió. Solo volvió a subir después de que las cosas empezaran a calmarse un poco.

En periodos de turbulencias en los mercados, los bonos del Estado obtienen mejores resultados.

Fundamentos macroeconómicos del oro

¿Debería la gente comprar oro durante la situación del coronavirus? En primer lugar, hay que tener en cuenta que el precio del oro se ha ido recuperando desde sus mínimos de 2011-2014.

Algunas personas citan el programa QE de la Reserva Federal como argumento para invertir en oro.

Olvidan algo obvio.......¡lo que ha ocurrido en los últimos 10 años!

El oro tuvo una enorme carrera alcista desde 2000 hasta 2011, ¡pero los mejores periodos para el oro fueron antes de 2008 y del QE!

Tras el QE, el oro cayó durante lo peor de la crisis y subió en 2010 y 2011.

Después de 2011, el oro cayó constantemente hasta aproximadamente 2015-2016:

La mejor racha del oro desde sus caídas de 2011 se produjo en 2018 y 2019.....¡cuando se estaba reduciendo el QE y los Bancos Centrales de EEUU empezaron a subir los tipos!

Por lo tanto, afirmar que la QE y los bajos tipos de interés son automáticamente buenos para el oro es olvidar las lecciones de los últimos 10 años.

Además, el dólar se fortaleció en comparación con el euro, la libra esterlina y el oro durante el QE desde 2008 hasta la actualidad.

Así que la idea de que el QE es una forma de debilitamiento de la moneda a través de la deuda y que todo el mundo correrá al oro para evitarlo, es olvidar las lecciones de los últimos 12 años.

No quiero decir que el pasado reciente sea siempre una guía para el futuro.

El hecho de que el USD se haya fortalecido y los mercados estadounidenses hayan alcanzado máximos históricos después de 2008-2009 y el oro haya vuelto a caer durante lo peor de marzo de 2020, no significa automáticamente que al oro le vaya a ir mal en relación con los mercados bursátiles en los próximos 10 años.

Me refiero simplemente a señalar lo obvio:

- A largo plazo, el oro ha perdido mucho frente a los mercados.

- El oro no siempre gana en una crisis.

- El oro no siempre gana por la QE y los tipos de interés 0%.

- El USD no se debilita automáticamente bajo QE y tipos de interés 0%.

- La inflación de los precios al consumo ha sido débil durante más de 10 años. La QE no condujo a la inflación de los precios al consumo, por lo que no volverá a hacerlo automáticamente.

- Puede que la QE haya contribuido a la inflación de los precios de los activos bursátiles e inmobiliarios entre 2008 y 2020, pero no todos los activos suben....... ¡como el oro! Así que no podemos decir que todos los activos subirán debido a la QE.

Carteras

¿Y si realmente no puede resistirse a invertir en oro, a pesar de su terrible rendimiento a largo plazo y su cuestionable rendimiento en épocas de crisis como 2008 y marzo de 2020?

Lo mejor es mantener bajas las asignaciones. Carteras como estas tendrían sentido.

Edad: cartera de 25-35 años

El estilo de vida de estas personas suele ser ‘’agresivo’’ porque se están forjando una carrera, pero al mismo tiempo no tienen demasiada gente que dependa de ellos, como hijos, y por tanto pueden aceptar un mayor riesgo tanto a corto como a largo plazo.

Las personas de este rango de edad son más flexibles, es raro ver a jóvenes de 25 años que compren una casa o tengan un cónyuge y, por tanto, pueden aprender de sus errores rápidamente y solucionarlos.

Esta cartera se compone de: 15% en bonos del Estado, 10% en REITs, 65% en acciones y 10% en oro.

Edad: cartera de 35-45 años

En esta franja de edad, puede arriesgar menos por numerosas razones. El horizonte temporal de las inversiones es más corto, estás empezando a formar una familia y, por tanto, podrías tener algunos gastos más a tener en cuenta.

¿Recibe esta familia un único salario? No puede arriesgar demasiado en esta situación.

En esta cartera, tenemos 5% de efectivo, 20% de bonos del Estado, 10% en REITs, 55% en acciones y 10% en oro.

Es menos arriesgado que el anterior, pero sigue siendo muy arriesgado. A la hora de elegir las acciones, elige no solo acciones estadounidenses, sino también europeas y de países emergentes.

A la hora de elegir acciones en esta cartera, si se encuentra en esta franja de edad, debería optar por acciones menos arriesgadas en general.

Edad: cartera de 45-65 años

En esta franja de edad, hay que mirar hacia el futuro. Los ingresos que antes obtenías a través del trabajo ahora, al jubilarte, desaparecen y las inversiones que hiciste en vida deben acompañar a esta pensión.

Si hubieras sido bueno en los años anteriores eligiendo las buenas inversiones, ya estaríamos teniendo una buena cantidad de capital.

Por lo tanto, siempre tenemos nuestro 5% en efectivo, 27,5% en bonos del Estado, 12,5% en REITs, 45% en acciones y 10% en oro.

A la hora de elegir las acciones para su cartera, también debería considerar algunas acciones que le den dividendos, porque ya tenemos un gran capital que poner a trabajar.

Edad: cartera de 55-65+ años

En este momento de nuestra vida, ya estamos cerca de nuestra jubilación o ya nos estamos beneficiando de ella. Nuestro principal objetivo es proteger nuestro capital de la volatilidad de los mercados y seguir ganando algo de dinero con él.

No tiene sentido hacerlo crecer más, el único objetivo es obtener unos ingresos pasivos anuales. No podemos asumir ningún riesgo, imagínate que el mercado se desplomara a tus 85 años y tuvieras que esperar 10 años para recuperarte, eso no lo puedes aceptar. Y todas las acciones que elijas tienen que dar dividendos.

En este caso, nuestra cartera contendrá 10% efectivo, 35% bonos del Estado, 10% REITs, Acciones 30% y 10% en oro.

Conclusiones

El oro no es una buena inversión a largo plazo. Claro que tiene sus momentos buenos y malos.

“Cada perro tiene su día” y el oro tuvo un rendimiento superior durante 2000-2010, y no cabe duda de que lo tendrá durante algunos periodos en el futuro.

Sin embargo, es difícil de predecir. Determinar el momento oportuno para comprar oro no es mucho más fácil que hacerlo con la bolsa.

Pero eso no lo convierte en una inversión productiva a largo plazo. Si realmente no puedes resistirte a invertir en oro, limítalo al 5%-10% de tu cartera.

Sobre todo, hay que ser escéptico ante cualquiera que afirme que la QE y los tipos de interés 0% degradarán el USD y provocarán una subida de los precios del oro.

Son los mismos que, en general, predijeron hiperinflación, $5.000 de oro y un dólar más débil en 2008.

En cambio, el oro cayó a partir de 2011, el dólar se fortaleció y las bolsas estadounidenses volvieron a batir al oro.

Así que el oro podría tener un rendimiento inferior o superior en 2020 o 2021. La cuestión es que nadie lo sabe de antemano y que, en cualquier caso, no obtiene buenos resultados a largo plazo.

Lecturas complementarias

¿Son realmente más ricos los ricos, al menos durante muchas décadas? ¿O les habría ganado un inversor medio en el mercado?