What are the best retirement plans for young adults?

Retirement may not be top of mind right now if you are a young adult, have young children or are still advancing in your career. However, if you’re fortunate and consistently save money, it will be someday.

It’s a good idea to make a plan early in life, or right now if you haven’t already, to help ensure you have a secure retirement.

For example, your wealth can grow exponentially if you divert a portion of your income into a tax-advantaged retirement savings plan. This will give you peace of mind during your so-called golden years.

Yet, according to a 2020 survey by the Employee Benefit Research Institute, only two-thirds of current employees find it simple to comprehend the retirement benefits provided to them.

Si desea invertir como expatriado o particular con un elevado patrimonio neto, que es en lo que estoy especializado, puede enviarme un correo electrónico (advice@adamfayed.com) o WhatsApp (+44-7393-450-837).

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

How To Get Access To The Best Retirement Plans For Young Adults

You may be able to access the best retirement plans for young adults through your employer. Therefore, you really don’t have that option at all if your employer doesn’t provide them. However, if you work for yourself or make any kind of income, you have the option to set up a retirement plan for yourself.

You must first decide what kind of account you require. An IRA is an option if you don’t own a business, but you’ll have to choose between a traditional and a Roth IRA.

If you do run a business, even a one-person operation, you have a few more options, so you’ll need to choose the most appropriate one for your circumstances.

After that, you can get in touch with a financial organization to see if they provide the kind of plan you’re looking for. Almost all major financial institutions provide some kind of IRA, and you can easily open an account at one of the top online brokerages.

You might need to look a little harder for self-employed plans since not all brokers offer every kind of plan, but reputable brokers do offer them and frequently don’t charge a fee to set one up.

5 Best Retirement Plans For Young Adults

1. Defined Contribution Plans

401(k)s are examples of defined contribution (DC) plans. Since they were first offered in the early 1980s, DC plans have virtually monopolized the retirement market.

According to a recent study by insurance broker Willis Towers Watson, about 86 percent of Fortune 500 companies only offered DC plans in 2019 as opposed to traditional pensions.

The 403(b) plan, which has a similar structure, is available to employees of public schools and some tax-exempt organizations, while the 457(b) plan is most frequently offered to state and local governments. The 401(k) plan is the most common DC plan among employers of all sizes.

In 2022, each plan’s employee contribution cap is set at $20,500 ($27,000 for those over 50).

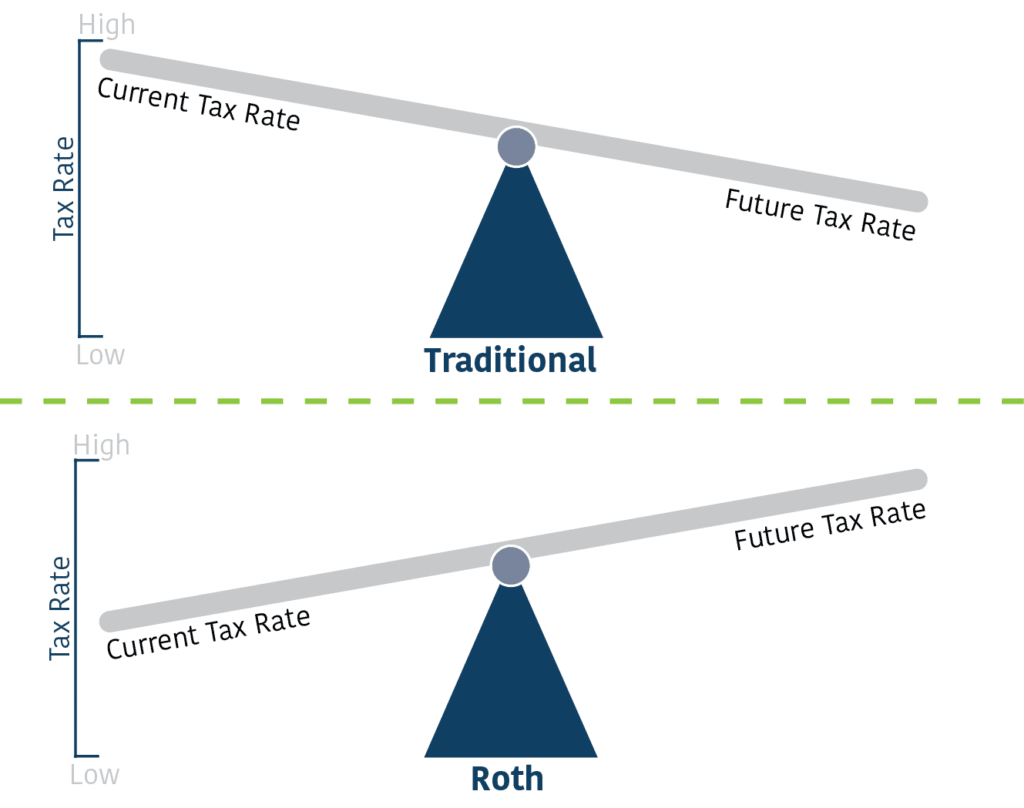

Many DC plans provide a Roth option, such as the Roth 401(k), in which you make contributions with after-tax money but can withdraw the funds tax-free when you reach retirement.

According to David Littell, professor emeritus of taxation at The American College of Financial Services and a specialist in retirement planning, the Roth option makes sense if you anticipate that your tax rate will be higher in retirement than it is now.

A. 401(k) plans

One of the best retirement plans for young adults is the 401(k) plan, and you can save even faster if your employer offers a bonus “match” contribution.

A tax-advantaged plan called a 401(k) provides a way to save money for retirement. With a traditional 401(k), an employee makes contributions to the plan out of pre-tax income, which means that the contributions are not taxable.

These contributions can grow tax-free in the 401(k) plan until they are withdrawn at retirement. Although withdrawals made prior to the age of 59 and a half may be subject to taxes and additional penalties, distributions at retirement result in a taxable gain.

An employee makes after-tax contributions to a Roth 401(k). Gains are also not taxed if they are withdrawn after the age of 59 and a half.

Pros of 401(k) Plans

You can schedule money to be deducted from your paycheck and invested automatically with a 401(k) plan, making it simple to save for retirement. You won’t have to pay tax on the gains from the investments until you withdraw the money (or never in a Roth 401(k)).

The money can be invested in a variety of high-return investments, such as stocks. Furthermore, a lot of employers will match your contributions, giving you free money and an automatic profit just for saving.

Cons of 401(k) Plans

One significant drawback of 401(k) plans is the possibility of paying a fee if you need to access the money in an emergency. There is no assurance that your employer’s plan will permit you to borrow against your funds for permissible purposes, even though this is permitted under many plans.

You might not be able to invest in the things you want to because your investments are restricted to the money offered in your employer’s 401(k) program.

B. 403(b) plans

For young employees in certain industries, a 403(b) plan is one of the best retirement plans for young adults, especially if they are eligible for matching funds. You can estimate your ahorro para la jubilación potential using this 403(b) calculator.

Similar to a 401(k) plan, a 403(b) plan is one that is provided by organizations like public schools, charities, and some churches.

Since the employee makes pre-tax contributions, the funds can grow tax-free up until retirement because the contributions are not viewed as taxable income.

At retirement, distributions are considered ordinary income, and if they are made before the age of 59 and a half, they may result in additional taxes and penalties.

A Roth 403(b) enables you to set money aside after taxes for tax-free withdrawals in retirement, much like a Roth 401(k).

Pros of 403(b) Plans

Setting up a 403(b) is a popular and efficient way to save money for retirement. You can schedule the deductions to occur automatically from your paycheck, which will maximize your savings.

You won’t have to pay taxes until you withdraw the funds, and the money can be invested in a variety of investments, such as annuities or high-return assets like stock funds. If you contribute money to a 403(b), some employers might also match your contribution.

Cons of 403(b) Plans

Unless you have a valid emergency, it may be challenging to access the money in a 403(b) plan, similar to the 401(k). Despite the fact that you can still borrow from your 403(b) plan without an emergency, doing so could result in additional fees and taxes.

Another drawback is that since your options are constrained to the plan’s investment options, you might not be able to invest in what you want.

C. 457(b) plans

Despite having some disadvantages when compared to other defined contribution plans, a 457(b) plan is one of the best retirement plans for young adults.

The 457(b) can be advantageous for retired public servants who might have a physical disability and need access to their funds because it allows withdrawals before the standard retirement age of 59 and a half without a penalty.

Similar to a 401(k), a 457(b) plan is only available to employees of state, local, and some tax-exempt organizations. An employee may make a contribution to the tax-advantaged plan using pre-tax earnings, which results in no taxation of the income.

The 457(b) allows for tax-free growth of contributions up until retirement; however, when an employee withdraws funds, they are subject to tax.

Pros of 457(b) Plans

Because of its tax benefits, a 457(b) plan can be a good way to save for retirement. The plan also provides older workers with some unique catch-up savings provisions that other plans do not.

Since the 457(b) is a supplemental savings plan, withdrawals made before age 59 and a half are not subject to the 10% penalty that applies to 403(b) plans.

Cons of 457(b) Plans

Unlike 401(k) plans, typical 457(b) plans do not provide employer matching contributions, which makes them significantly less appealing. A 457(b) plan is also more difficult to take an emergency withdrawal from than a 401(k).

2. IRA plans

An IRA is a useful retirement program developed by the American government to assist workers in saving for retirement. In 2022, individuals can make up to $6,000 in account contributions, and employees over 50 can make up to $7,000 in account contributions.

A traditional IRA, a Roth IRA, a spousal IRA, a rollover IRA, a SEP IRA, and a SIMPLE IRA are just a few of the different types of IRAs available.

A. Traditional IRA

One of the best retirement plans for young adults is a traditional IRA, though if you can find a 401(k) plan with a matching contribution, that’s even better.

However, if your employer does not provide a defined contribution plan, you are still able to contribute to a traditional IRA; however, at higher income levels, the tax benefits of doing so are lost.

Traditional IRAs are tax-advantaged plans that give you significant tax breaks as you save for retirement.

Anyone who receives income from employment is eligible to make pre-tax contributions to the plan, which means that any contributions are not considered to be income for tax purposes.

Until the account holder withdraws them at retirement, when they become taxable, the IRA allows these contributions to grow tax-free. Early withdrawals could subject the employee to more taxes and penalties.

Pros of Traditional IRA

Traditional IRAs are very popular retirement investment vehicles because they provide significant tax advantages and let you buy virtually an unlimited variety of securities, including stocks, bonds, CDs, inmobiliario, and other assets.

The fact that you won’t have to pay taxes on the money until you withdraw it in retirement is possibly the biggest advantage.

Cons of Traditional IRA

Due to taxes and additional penalties, withdrawing funds from a traditional IRA when you need them can be expensive.

Furthermore, an IRA mandates that you invest the funds yourself, whether you choose to do so in a bank, stocks, bonds, or something else entirely. Even if it’s just asking an advisor to invest it, you’ll need to decide where and how you’ll put the money to work.

B. Roth IRA

Due to the significant tax benefits it offers, a Roth IRA is one of the best retirement plans for young adults if you want to grow your retirement income while avoiding further taxation.

An updated version of the traditional IRA, the Roth IRA, provides significant tax advantages.

Roth IRA contributions are made with after-tax funds, which means that the funds that are deposited into the account have already been taxed. In return, you will not be subject to tax on any contributions or earnings that are withdrawn from the account at retirement.

Pros of Roth IRA

The Roth IRA has a number of benefits, one of which is the unique ability to avoid taxes on all withdrawals made from the account during retirement, beginning at age 59 and a half or above.

The Roth IRA also offers a great deal of flexibility because you can frequently withdraw contributions—rather than earnings—at any time without paying taxes or incurring penalties. Due to its flexibility, the Roth IRA is a fantastic retirement option.

Cons of Roth IRA

Just like a traditional IRA, a Roth IRA gives you complete control over the investments made, so you’ll have to decide how to invest the money or hire someone to do it for you.

Although there is a back-door way to deposit money into a Roth IRA, there are income restrictions on contributions.

C. Spousal IRA

Unlike in most cases, the spousal IRA enables you to handle your spouse’s retirement planning without requiring your spouse to have a job. That might enable your spouse to take care of other family responsibilities or stay at home.

The Spousal IRA gives the spouse of a worker with earned income the ability to contribute to an IRA as well. Normally, IRAs are only available to workers with earned income. The spousal IRA can be either a traditional IRA or a Roth IRA, but it must have a value greater than the working spouse’s taxable income.

Pros of Spousal IRA

The spousal IRA’s biggest advantage is that it enables non-working spouses to take advantage of all of a traditional or Roth IRA’s benefits.

Contras of Spousal IRA

A spousal IRA doesn’t have any particular drawbacks, but you will need to choose how to invest the funds, just like with all IRAs.

D. Rollover IRA

Moving from a 401(k) or IRA to another IRA account is simple with a rollover IRA. The rollover IRA gives you the option to switch from a traditional to a Roth IRA or vice versa, which may help your financial situation.

When you transfer a retirement account, such as a 401(k) or IRA, to a new IRA account, you create a rollover IRA. The funds are “rolled” from one account to the rollover IRA so that you can continue to benefit from the tax advantages of an IRA.

There is no cap on how much can be transferred into a rollover IRA, which can be either a traditional IRA or a Roth IRA, and you can establish a rollover IRA at any institution that permits you to do so.

However, these types of transfers can result in tax liabilities, so it’s important to understand the implications before you decide how to proceed. A rollover IRA also enables you to change the type of retirement account from a traditional IRA or 401(k) to a Roth IRA.

Pros of Rollover IRA

If you decide to no longer participate in a former employer’s 401(k) plan for any reason, a rollover IRA enables you to keep receiving favorable tax benefits.

Rolling over your account to a different provider is an option if all you want to do is switch IRA providers for an already-existing IRA. You can purchase a wide range of investments in your IRA, as with all IRAs.

Contras of Rollover IRA

Just like with all IRAs, you’ll have to make an investment decision, which could be problematic for some. If there are any tax repercussions for rolling your money over, you should pay close attention because they can be significant.

But in most cases, this only becomes a problem if you’re switching from a traditional IRA or 401(k) to a Roth IRA.

E. SEP IRA

Account holders are still responsible for choosing their investments. Don’t give in to the urge to early account access. In addition to income tax, you’ll probably have to pay a 10% penalty if you withdraw the money before age 59 and a half.

The SEP IRA is structured similarly to a traditional IRA, but it is only available to owners of small businesses and their staff.

This plan allows for contributions only from the employer, and instead of funding a trust fund, contributions are made directly to each employee’s SEP IRA. A SEP IRA can also be created by self-employed people.

In 2022, the maximum contribution is limited to either 25% of the applicable salary or $61,000. It is a little trickier to determine contribution caps for people who work for themselves.

Given that contributions may be made at the employer’s discretion, Littell says it is “very similar to a profit-sharing plan.”

Pros of SEP IRA

Benefits include a free retirement account for employees. The higher contribution limits make them far more appealing to self-employed people than a traditional IRA.

Cons of SEP IRA

The amount that employees will accrue under this plan is uncertain. Additionally, it is simpler to access the money. Although there may be more benefits than drawbacks, Littell sees only negative aspects.

F. SIMPLE IRA

Just like with other DC plans, employees must decide how much to contribute and how the money will be invested. The SIMPLE IRA is favored by some business owners over the SEP IRA.

Employers with 401(k) plans must pass a number of anti-discrimination tests each year to ensure that highly compensated employees aren’t contributing excessive amounts compared to the rank-and-file.

Due to the fact that all employees receive the same benefits, the SIMPLE IRA gets around these restrictions. Even if the employee doesn’t save anything in their own SIMPLE IRA, the employer can choose to make a non-elective contribution of 2 percent or a 3 percent match.

Pros of SIMPLE IRA

The majority of SIMPLE IRAs, according to Littell, are built to offer a match, giving employees the chance to defer pre-tax salary in exchange for a matching contribution. This plan appears to the employee to be very similar to a 401(k).

Cons of SIMPLE IRA

For 2022, the employee contribution is capped at $14,000 as opposed to other defined contribution plans’ $20,500 cap. But according to Littell, most people don’t actually make that much of a contribution.

3. Solo 401(k) plan

This strategy won’t work if you intend to grow and hire personnel. As soon as you bring on new employees, the IRS requires that, if they are eligible, they be included in the plan and that non-discrimination testing be performed on the plan.

Additionally, the solo 401(k) compares favorably to the well-liked SEP IRA.

The Solo 401(k) plan, also referred to as a Solo-k, Uni-k, or One-participant k, is intended for a business owner and his or her spouse.

The business owner serves as both the employer and the employee, allowing for elective deferrals of up to $20,500 and non-elective contributions of up to 25% of pay, for a total annual contribution for businesses of $61,000, excluding catch-up contributions.

Pros of Solo 401(k) Plan

According to Littell, a solo IRA is preferable to a SIMPLE IRA if you don’t employ other people because you can make larger contributions to it. Setting up and ending the SEP is a little less difficult. The setup of your plan as a Roth, however, is not possible in a SEP, but it is possible in a Solo-k.

Cons of Solo 401(k) Plan

It’s a little more challenging to set up, and you’ll need to submit Form 5500-SE annually once your assets reach $250,000 in value.

4. Traditional Pensions

The decision to leave a company can be significant if you are fortunate enough to have a company pension because they are becoming more scarce and valuable.

Do you want to stay or leave? It depends on your employer’s financial stability, how long you’ve worked there, and how far away from retirement you are. You can also take into account how happy you are with your job and whether there are better job opportunities elsewhere.

Because there is so little that you as an employee are required to do, traditional pensions are one of the simplest defined benefit (DB) plans to manage.

Employers contribute 100% of the cost of pensions, which offer workers a set monthly benefit when they retire. However, because fewer businesses are offering DB plans, they are now considered an endangered species.

Data from Willis Towers Watson shows that only 14% of Fortune 500 companies offered pension plans to recruit new employees in 2019, compared to 59% in 1998.

Why? Employers who offer DB plans must fulfill a costly commitment to contribute a sizable sum toward your retirement. In general, pensions, which are payable for life, replace a certain percentage of your pay based on your position and pay.

According to Littell, a standard formula is 1.5 percent of the final average compensation times the number of years of service. For instance, a worker with an average salary of $50,000 over a 25-year career would be paid $18,750 annually, or $1,562.50 per month, in pension benefits.

Pros of Traditional Pensions

The longevity risk, or the risk of running out of money before you die, is addressed by this benefit.

According to Littell, knowing that your employer will replace between 30 and 40 percent of your income for the rest of your life and that you will also receive 40 percent from Social Security gives you a strong foundation of financial security. Although they are not as essential to your retirement security, additional savings can be helpful.

Cons of Traditional Pensions

Since the formula is typically based on years of service and pay, the benefit increases more quickly as your career comes to an end. You might receive much less than the benefit you anticipated if you switch jobs or if the company cancels the plan before you reach retirement age.

5. Life insurance Policy with Cash Value

These products are one of the best retirement plans for young adults who have exhausted all other retirement savings options. You might think about purchasing this kind of seguro de vida if your 401(k) and IRA contribution limits have been reached.

As a perk, some businesses provide insurance vehicles.

There are several types, including universal life, variable universal life, whole life, and variable life. They offer a death benefit while generating cash value that could help you with retirement expenses. Your cost basis—the premiums you paid—comes out first and is not taxed if you withdraw the cash value.

The Roth tax treatment is more complicated, but there are some similarities. While there is no deduction on the way in, with the right planning, there may be tax-free withdrawals on the way out.

Pros of Life Insurance Policy with Cash Value

Advantages: It reduces a variety of risks by offering either a death benefit or a source of income. Additionally, you receive tax deferral on the increase in your investment.

Cons of Life Insurance Policy with Cash Value

You could incur a significant tax bill if you don’t do it correctly and the policy expires. Like other insurance options, once you purchase it, you are essentially committed to the plan for the long run. Another risk is that the products don’t always function as well as the examples might suggest.

Reflexiones finales

The decision is not a problem for those who are qualified to contribute to multiple retirement account types and have the funds to do so. Choosing the best retirement plans for young adults can be difficult for those who lack the funds to fund multiple accounts.

In many cases, the choice comes down to whether you prefer to take tax breaks with traditional IRAs or Roth IRAs on the front end of your savings.

Another important consideration is the account’s ultimate goal, such as retirement or estate planning. People who are dealing with these issues can get practical advice from a qualified retirement planning advisor.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.