La elección entre una renta vitalicia y un pago único determina si sus ahorros para la jubilación se reciben como ingresos garantizados de por vida o como un único pago en efectivo.

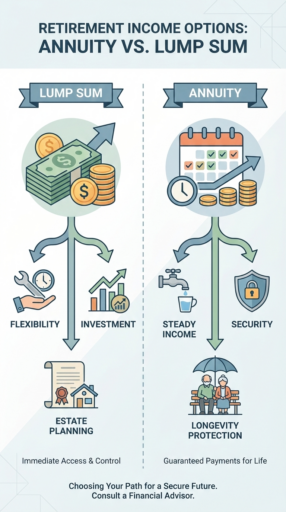

In an annuity vs lump sum decision, the core trade-off is income certainty versus flexibility and control.

Este artículo trata:

- Is it better to choose annuity or lump sum?

- Why is annuity more than lump sum?

- What are the advantages and disadvantages of a retirement annuity vs lump sum?

Principales conclusiones:

- Annuities prioritize predictable income and longevity protection.

- Lump sums offer flexibility, liquidity, and estate planning control.

- Tax outcomes vary significantly based on payout timing and structure.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

What is the difference between a lump sum and an annuity?

A lump sum pays your retirement money all at once, while an annuity pays it out as a structured income stream over time.

The primary difference between a lump sum and an anualidad lies in how retirement funds are paid out and managed.

- A lump sum provides a single payment of your entire retirement balance, giving you full control over how the money is invested, spent, or passed on to heirs.

- An annuity, by contrast, converts part or all of your savings into regular payments, typically monthly or annually and often for life, with the insurer or pension provider managing longevity and market risk in exchange for reduced flexibility.

In essence, a lump sum prioritizes control and access to capital, while an annuity prioritizes predictable, long-term income security.

Why is lump sum less than annuity?

A lump sum is often quoted as a smaller figure than the total value of annuity payments because the annuity reflects projected lifetime income rather than an immediate cash value.

Annuity payouts are calculated using actuarial assumptions, including life expectancy, interest rates, and insurer risk pooling.

The longer the expected payout period, the larger the total nominal value appears over time.

The lump sum, on the other hand, represents the present value of those future payments discounted to today’s dollars.

Because future income is converted into immediate cash, the total amount appears lower even though it may still be financially equivalent under reasonable assumptions.

What are the pros and cons of lump sum vs annuity?

A lump sum offers flexibility and control but carries market and longevity risk, while an annuity provides guaranteed income with reduced access to capital.

Lump sum advantages

- Full control over investments and withdrawals

- Ability to leave remaining assets to heirs

- Flexibility to adjust spending as financial needs change

Lump sum disadvantages

- Exposure to market volatility and the risk of outliving savings

- Requires disciplined financial management

- No guaranteed lifetime income

Annuity advantages

- Predictable and stable income stream

- Protection against longevity risk

- Reduced need for ongoing investment decisions

Annuity disadvantages

- Limited liquidity and flexibility

- Restricted access to principal once payments begin

- Payments may lose purchasing power without inflation protection

When to use lump sum vs annuity?

A lump sum is generally better for retirees who are comfortable managing inversiones, while an annuity is better for those who want guaranteed income without ongoing investment decisions.

A lump sum may be suitable for individuals who can manage market risk, have other dependable income sources, or want flexibility for spending and planificación patrimonial.

An annuity may be more appropriate for retirees who prioritize income certainty, lack other reliable income streams, or want protection against longevity risk.

In practice, many retirees use both—allocating part of their savings to an annuity to cover essential expenses, while keeping the rest as a lump sum for flexibility and growth.

Can I withdraw a lump sum from my annuity?

In most cases, annuities allow limited lump sum withdrawals, but the terms are defined by the specific contract.

Some annuities permit partial withdrawals during an accumulation phase, while others impose surrender charges or penalties for early access.

Once an annuity is fully annuitized, access to a lump sum is usually restricted or unavailable.

Before withdrawing funds, it is important to review contract provisions carefully, as withdrawals may also trigger tax consequences.

What is the best way to take money out of an annuity?

The best way to take money out of an annuity is gradually, in line with your income needs and tax situation, rather than withdrawing a large amount at once.

Many annuities allow scheduled withdrawals or regular income payments, which can help spread taxable income over time and reduce the risk of penalties or higher tax brackets.

Taking withdrawals only up to the contract’s free-withdrawal limit can also help avoid surrender charges, especially during the early years of the annuity.

Before accessing funds, it is important to consider the annuity’s phase—accumulation or payout—as well as any surrender periods, early withdrawal penalties, and tax implications.

A structured withdrawal approach generally preserves income stability while minimizing unnecessary costs.

Guaranteed Income vs Lump Sums: The Psychological Trade-Off

Beyond financial calculations, the choice between a lump sum and an annuity often comes down to emotional comfort and peace of mind.

Guaranteed income provides psychological stability by turning uncertain future outcomes into predictable cash flow.

Knowing a fixed amount will arrive regularly, regardless of market conditions, can reduce stress for retirees without employment income.

This certainty simplifies decision-making. When essential expenses are covered by annuity income, retirees may feel less pressure to monitor markets, rebalance portfolios, or time withdrawals, particularly during periods of volatility.

Lump sums, while offering flexibility and potential upside, place more responsibility on the individual.

Managing investments and coping with market fluctuations can create ongoing anxiety, even when finances are objectively sound.

Importantly, the value of guaranteed income is not always proportional to its mathematical return. Many retirees accept lower expected returns in exchange for reduced uncertainty and greater peace of mind.

In this sense, annuities function as emotional risk management tools, explaining why many retirees combine both approaches.

Conclusión

Choosing between an annuity and a lump sum comes down to how much control you want over managing your retirement income.

One approach places the burden of timing, investment performance, and withdrawals on you, while the other shifts much of that responsibility to a provider in exchange for structure and certainty.

Rather than viewing the choice as strictly one or the other, many retirement plans benefit from aligning each option to a specific purpose, securing baseline income first, then allowing flexibility where risk is acceptable.

Framing the decision this way helps ensure your retirement income supports both long-term security and day-to-day financial confidence.

Preguntas frecuentes

Is it better to take cash payout or annuity?

A cash payout is better if you want full control and flexibility, while an annuity is better if you want guaranteed, predictable income for life.

The right choice depends on how much income certainty you need versus how much investment control you are willing to manage.

How much does a $300000 annuity pay per month?

A $300,000 annuity typically pays about $1,200 to $1,700 per month.

The exact amount varies based on factors such as your age at purchase, interest rates, payout options, and whether payments are for a single life or include survivor benefits.

Why do people say to avoid annuities?

Some people avoid annuities due to concerns about high fees, limited liquidity, complexity, or lower long-term returns compared to self-managed investments.

These drawbacks are most relevant when flexibility and growth are higher priorities than income stability.

What is the 6% rule for lump sum pension?

En 6% rule for lump sum pension is a guideline used to compare the value of a monthly pension versus a lump sum by dividing the annual pension amount by the lump sum offer.

If the resulting percentage is 6% or higher, the guaranteed pension may be favorable; if it’s below 6%, the lump sum may offer better financial flexibility.

How much money do you get if you take the lump sum?

The lump sum amount is typically the present value of future pensión or annuity payments, calculated using life expectancy and discount rates.

The exact amount varies based on plan rules, interest rates, and the age at which the lump sum is taken.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.