En este artículo se describen las mejores plataformas de negociación en línea de Sudáfrica.

Sudáfrica ofrece una gran variedad de plataformas de negociación. Los valores ofrecidos, la facilidad de uso y la reputación del servicio deben tenerse en cuenta a la hora de elegir un bróker online.

Considere las diversas plataformas de negociación que han ganado popularidad en los últimos años si está interesado en hacer inversiones en bolsa pero no quiere contratar a un corredor de bolsa para que se encargue del trabajo por usted.

Utilizando un plataforma de negociación, Con esta solución, puede acceder a recursos de negociación manteniendo un control total sobre sus inversiones.

Estas plataformas operan en línea, por lo que, siempre que tenga acceso a Internet, podrá acceder a sus inversiones desde cualquier lugar y en cualquier momento.

Debido a las ligeras diferencias entre cada plataforma de negociación, las opciones y ventajas pueden no ser las mismas.

Antes de elegir, es fundamental sopesar todas las opciones.

Si desea invertir como expatriado o particular con un elevado patrimonio neto, que es en lo que estoy especializado, puede enviarme un correo electrónico (advice@adamfayed.com) o utilizar WhatsApp (+44-7393-450-837).

Las 16 mejores plataformas de negociación en línea de Sudáfrica

1. Interactive Brokers

El mejor entre los mejores plataformas de negociación en línea en Sudáfrica es Interactive Brokers.

Fundada en 1993 Interactive Brokers ofrece acceso a acciones, opciones, divisas, futuros, bonos y fondos en 150 mercados internacionales a través de su plataforma de negociación.

Proporcionan un sólido conjunto de herramientas de negociación, lo que los convierte en una opción fantástica para los operadores activos profesionales. Son una ventanilla única para todas las necesidades de los principiantes en el trading.

Los bajos costes de negociación se combinan con una ejecución de órdenes líder en el sector. Ofrecen una plataforma de negociación de escritorio (Trader Workstation), una aplicación web e IBRK móvil para su plataforma de negociación. Tanto los operadores principiantes como los experimentados pueden beneficiarse de la robusta y adaptable Corredores interactivos plataforma de negociación.

Ejecución de órdenes en Interactive Broker es uno de los mejores del sector gracias a la tecnología IB SmartRouting.

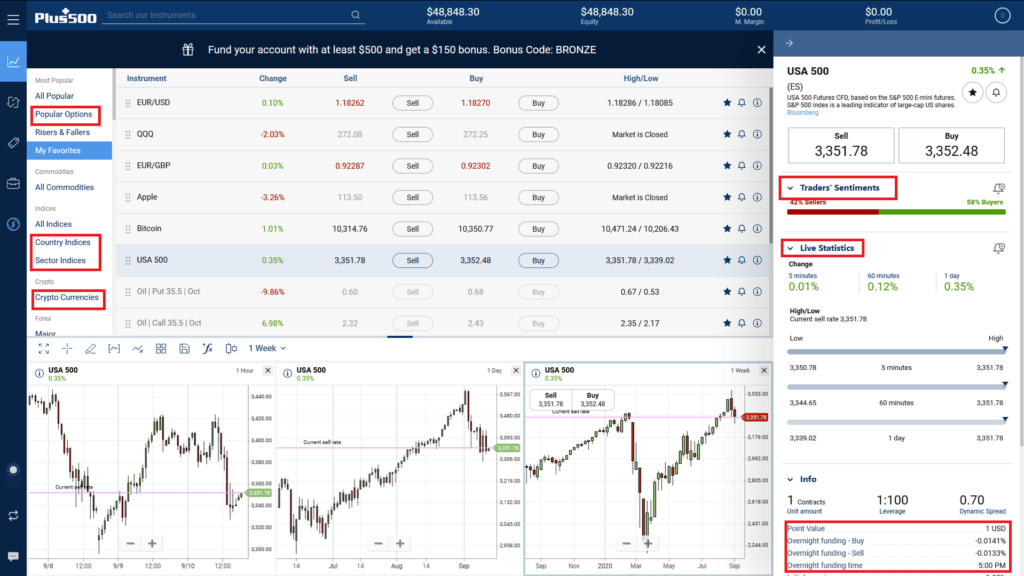

2. Plus500

Para la negociación diaria de CFD en Sudáfrica, Plus500 es el ganador indiscutible. Presume de tener más de 2.000 CFD disponibles. Opciones, criptodivisas y pares de divisas Forex son algunos de ellos.

Plus500 ofrece a sus clientes cuentas de demostración para operaciones con divisas y CFD. Los recursos educativos y de investigación de Plus500 son escasos. La necesidad de recursos adicionales obligará a los operadores a buscar en otra parte.

A inversión mínima de $100 o 100 £ para utilizar la plataforma de inversión Plus500, que ofrece a los inversores acceso a una amplia gama de productos para invertir.

Dadas las más de 30 opciones lingüísticas disponibles, esta plataforma es útil para usuarios para los que el inglés no es su lengua materna.

Los operadores pueden disfrutar de una experiencia sencilla y sin estrés gracias a la completa funcionalidad de la plataforma y a su ausencia de desorden.

3. Opción IQ

IQ Option, una de las plataformas de negociación con mayor ritmo de expansión y también una de las mejores plataformas de negociación en línea de Sudáfrica, presta servicio a clientes minoristas de todo el mundo. Se trata de una opción para Sudáfrica comerciantes de todos los niveles gracias a su sólida y fiable reputación.

Forex, opciones, opciones binarias, acciones, materias primas, criptomonedas y ETFs están disponibles a través de IQ Option.

4. Pepperstone

En esencia, Pepperstone es una plataforma de negociación de divisas. Son excelentes para el comercio de divisas en Sudáfrica y ofrecen una gran variedad de CFD.

Las características más notables de Pepperstone son su amplia selección de productos externos, incluidos MetaTrader, cTrader y spreads de divisas competitivos. Esto le da acceso a una gran variedad de herramientas y a la posibilidad de intercambiar ideas.

Pepperstone, broker australiano de CFD, opera a escala internacional y en el Reino Unido. Ha creado aplicaciones de negociación para MT4, MT5 y cTrader, las tres plataformas que ofrece.

La aplicación Pepperstone cTrader es aconsejable para aquellos que se inician en el mundo del trading o que aún no se han decidido a invertir. La aplicación móvil cTrader ofrece una experiencia de trading idéntica a la de la versión para ordenador.

Aunque este broker sólo permite operar con CFD, Pepperstone también ofrece la posibilidad de operar con copia social.

Mientras que las comisiones aplicar a los titulares de cuentas Razor, no son aplicables a la cuenta estándar. Aunque no se exige depósito mínimo, Pepperstone sugiere 500 libras.

Los clientes de fuera de la UE y Australia están sujetos a gastos de retirada.

5. AvaTrade

Con sede en Dublín, Irlanda, de se estableció en 2006. Forex, criptodivisas y una gran variedad de CFDs están disponibles a través de AvaTrade en Sudáfrica.

AvaTrade hace que el proceso de abrir una cuenta rápidamente, sencillo y totalmente digital. Tanto las retiradas como los depósitos son gratuitos. Cuenta con una interfaz fácil de usar y una gran variedad de recursos de investigación y aprendizaje.

Con más de 1.000 instrumentos financieros y numerosas plataformas de negociación, AvaTrade es un corredor regulado por CFD.

Según la normativa, ofrece un bono de bienvenida de 20% hasta $10.000 y una cuenta demo gratuita de 21 días con $100.000.

El Banco Central de Irlanda controla AVATrade EU Ltd. Ava Mercados comerciales Ltd. está sujeta a la normativa de la Comisión de Servicios Financieros de las Islas Vírgenes Británicas (nº C53877). La dirección Oriente Medio, Chipre, Israel, Sudáfrica, Australia y otros países también tienen normativas estrictas.

En el Estados Unidos, Corea del Norte, Nueva Zelanda, Irán o Bélgica, no puede comerciar con AvaTrade.

$100 de depósito mínimo, sin límite de retirada y sin comisiones adicionales.

6. XTB

XTB es conocida sobre todo por sus asequibles comisiones en el mercado de divisas. XTB tiene una plataforma de negociación fácil de usar con excelentes herramientas de gráficos. Pero tiene algunos inconvenientes. Las comisiones de los CFD sobre acciones son más elevadas que el estándar del sector. XTB ofrece una pequeña selección de productos, principalmente CFD y Forex.

XTB es un broker en el que puede confiar porque está debidamente regulado y cotiza en bolsa. La sede social se encuentra en Canary Wharf, Londres.

XTB ofrece a operadores e inversores la posibilidad de operar con materias primas, acciones, metales, divisas, índices, criptodivisas, así como ETF y CFD. Se rige por la FCA, CySEC, IFSEC y KNF en jurisdicciones de primer nivel.

Apertura de cuenta en línea es sencilla, y los operadores pueden elegir entre la cuenta Estándar, sin comisiones, y la cuenta Pro, que tiene diferenciales más ajustados, aunque hay que pagar una comisión por cada operación.

Puede utilizar MetaTrader 4 o la plataforma propia xStation en función del lugar del mundo en el que se encuentre a la hora de realizar operaciones (aunque MT4 no está disponible para los clientes del Reino Unido).

Debido a su amplia selección de recursos educativos organizados por niveles (principiante, intermedio y avanzado) y a sus limitadas opciones de atención al cliente los fines de semana y festivos, XTB es una opción fantástica para los principiantes.

Para que los nuevos usuarios practiquen sus estrategias y se acostumbren a utilizar las plataformas, existe una cuenta de demostración totalmente funcional.

Los operadores más avezados tienen a su disposición una gran variedad de herramientas de investigación, como señales de negociación, análisis técnicos, información sobre diversos instrumentos e incluso un mapa de calor y sentimientos del mercado.

7. XM

Pocas existencias Las comisiones por CFD y la sencillez en la apertura de cuentas son dos de las características de XM. Los principiantes tienen a su disposición una cuenta demo y numerosos recursos educativos.

No existe protección del inversor para sus clientes sudafricanos, lo que supone un importante inconveniente. XM solo ofrece divisas y CFD, por lo que su oferta de productos también es limitada.

8. Capital.com

Uno de los puntos fuertes de Capital.com es que todos sus productos de inversión están exentos de comisiones. En este campo, es algo extremadamente infrecuente. En Capital.com se puede acceder a acciones, índices, divisas, materias primas y criptodivisas.

Cobran tasas de inactividad, pero según normas del sector, Sólo se cobran después de que una cuenta haya estado inactiva durante un año completo.

9. Oanda

Oanda es otra fantástica opción para los inversores sudafricanos. Cuenta con una interfaz de usuario sencilla, potentes herramientas de investigación y una amplia gama de indicadores técnicos. Sin embargo, Oanda solo ofrece una selección limitada de productos de inversión.

En Sudáfrica, ofrecen operaciones tanto en divisas como en CFD. El servicio de atención al cliente podría mejorar, y no siempre está disponible.

10. MercadosX

Esta plataforma de negociación es muy apreciada por los principiantes debido a su excepcional facilidad de uso.

La plataforma ofrece una buena gama de ayudas y orientación para aprender los entresijos de la negociación, así como herramientas de investigación de primera categoría.

Sin embargo, en comparación con otras plataformas, puede resultar relativamente caro, con comisiones superiores a la media.

11. FXCM

Aunque FXCM sólo ofrece una pequeña selección de productos, los usuarios que la elijan como plataforma de negociación descubrirán que es apropiada para una amplia gama de estilos de negociación.

La plataforma también ofrece una selección de herramientas de investigación en profundidad, y se puede empezar a operar con sólo un depósito mínimo de $50.

Esta plataforma podría no ser ideal para los usuarios que prefieren una estética moderna, ya que algunas de sus funciones parecen un poco anticuadas.

Sin embargo, los consejos del Reino Unido y Australia lo controlan muy bien.

12. Mercados CMC

Una de las opciones más asequibles entre las mejores plataformas de negociación en línea de Sudáfrica es CMC Markets, que tiene un depósito mínimo de $0 y no cobra comisiones en FX y CFD.

Sin embargo, sí cobran comisiones por transacción.

Los inversores tienen una amplia variedad para elegir con más de 10.000 activos, y la plataforma ha sido reconocida constantemente por sus opciones de negociación de divisas.

Puede que a algunas personas les eche para atrás el largo proceso de registro, pero CMC ofrece cuentas de demostración a los nuevos operadores para ayudarles a familiarizarse con la plataforma.

13. Mercados IG

IG Markets, bróker con sede en el Reino Unido, es uno de los nombres más conocidos entre las mejores plataformas de negociación en línea de Sudáfrica.

Aunque se requiere un depósito mínimo antes de empezar a operar, se pueden abrir cuentas con tan sólo $1.

Los usuarios tienen acceso a más de 17.000 activos negociables a través de la plataforma. IG dispone de una demo opción de cuenta y posee licencias de la FCA, la ASIC, la CFTC y la MAS.

14. Hotforex

En comparación con otras plataformas, Hotforex ofrece a los usuarios una menor variedad de productos negociables, lo que puede significar que las opciones de los operadores son más limitadas.

Sin embargo, pone a disposición de los usuarios una enorme selección de tipos de cuenta. Por lo tanto, quien quiera puede utilizar la plataforma, independientemente de su nivel de experiencia.

Los usuarios de la plataforma se beneficiarán de características como un depósito mínimo de $5, herramientas de negociación de vanguardia y ausencia de comisiones por depósitos o retiradas.

Dependiendo del tipo de cuenta, otras comisiones y gastos pueden ser bastante elevados.

15. Saxo Bank

Saxo Bank puede parecer una de las mejores plataformas de negociación en línea de Sudáfrica para alguien que busque variedad, debido a su amplia selección de más de 40.000 opciones de negociación.

Sin embargo, el requisito de depósito mínimo de $1.000 puede impedir que algunas personas utilicen esta plataforma de negociación.

Descubrirá que hay numerosas opciones de investigación y noticias, cero comisiones y la seguridad de operar en una plataforma que está bien regulado si puede permitirse el elevado depósito mínimo.

Es un gran comercio plataforma en general para quienes puedan permitirse la inversión inicial, pero puede estar fuera del alcance de algunos.

16. Índice de ciudades

En Ganancia de capital organización incluye City Index. Como resultado, es miembro de uno de los mayores brokers minoristas mundiales y es una de las mejores plataformas de negociación en línea de Sudáfrica.

Es fácil entender por qué City Index es una opción tan apreciada dada su amplia selección de productos, sus numerosas herramientas de búsqueda y el excelente servicio de atención al cliente que ofrece las 24 horas del día.

Sin embargo, algunos inversores consideran que no hay suficiente transparencia en la fijación de precios.

A la hora de calcular o comprender los costes, esto puede dificultar las cosas.

Riesgos del comercio en línea en Sudáfrica

Todo principiante debe conocer los riesgos del trading. Es fundamental investigar a fondo antes de invertir dinero.

Riesgo de apalancamiento

El apalancamiento es el acto de invertir con dinero prestado. El apalancamiento aumenta el riesgo potencial y, al mismo tiempo, la rentabilidad potencial. Dependiendo de cómo se mueva la posición, un apalancamiento elevado conlleva riesgos elevados.

Riesgo de margen

El riesgo de alcanzar un margen previsto se conoce como riesgo de margen. Se trata de la probabilidad de que los cambios en el desarrollo económico repercutan negativamente en el flujo de caja previsto de un margen de beneficio.

Riesgo de tipos de interés

Una nación subida de los tipos de interés se traduce en el fortalecimiento de su moneda. El valor de la moneda y tipos de interés suelen aumentar. Por otra parte, una moneda más débil es el resultado de la caída de los tipos de interés. Como resultado, los inversores retiran sus dinero fuera del mercado y abandonar la nación.

Riesgo de tipo de cambio

Las variaciones de la moneda nacional de un inversor en relación con el inversión extranjera divisas conllevan un riesgo de tipo de cambio. A veces, en las 24 horas previas a la liquidación de su operación, los tipos de cambio cambian.

Aspectos a tener en cuenta al elegir las mejores plataformas de negociación en línea de Sudáfrica

Conocimientos

El tipo de plataforma de negociación que más le convenga dependerá de su nivel de experiencia.

Una plataforma con una amplia gama de herramientas analíticas sería útil si tiene mucha experiencia en este campo.

Los operadores principiantes descubrirán que estas plataformas se adaptan mejor a ellos porque ofrecen una amplia variedad de opciones educativas, lo que les permite adquirir conocimientos sobre la marcha.

¿Se ajusta a su plan de inversión?

A la hora de decidir su estrategia de inversión, Hay que tener en cuenta muchas cosas.

¿Tiene intención de hacer inversiones a largo plazo o a corto plazo ¿Qué tipo de inversión prefiere? ¿Prefiere algún tipo de inversión en particular?

¿Quiere concentrarse en hacer inversiones sólo en Sudáfrica o en todo el mundo?

Habrá una plataforma que le ofrezca lo que necesita; sin embargo, conviene estar seguro de lo que quiere antes de tomar una decisión.

¿Existe una opción de cuenta de demostración en la plataforma?

Puede practicar el trading con dinero ficticio utilizando una cuenta demo.

Antes de operar con su propio dinero, puede hacerlo para entender cómo funciona el trading y desarrollar su estrategia de trading.

Antes de decidir si unirse o no, es una buena forma de probar una plataforma de negociación.

Las cuentas de demostración son muy útiles para los principiantes.

Estas cuentas son un gran recurso de aprendizaje y ofrecen a los usuarios la posibilidad de ver cómo funcionan diversas funciones.

Alertas y notificaciones push

Si no tienes tiempo para pasarte horas perdiéndote en la plataforma, te conviene elegir una que ofrezca avisos y alertas.

Esto podría implicar que usted fija los límites y la plataforma ejecuta automáticamente las órdenes en su nombre.

Atención al cliente

La calidad del servicio de atención al cliente variará de una plataforma a otra.

Algunas empresas ofrecen asistencia los siete días de la semana, las veinticuatro horas del día, a través de diversos canales, como el teléfono y la web.

Otros sólo estarán abiertos durante el horario comercial habitual, y pueden aconsejar contactar con sus equipos de asistencia por correo electrónico.

Una plataforma con más opciones de asistencia puede ser útil si es usted muy novato o tiene problemas para utilizar la tecnología.

Facilidad de uso

Independientemente de la plataforma que elijas, asegúrate de que puedes navegar fácilmente por ella.

Dado que cada uno se elabora de forma ligeramente distinta a los demás, descubrirá que algunos son más apropiados para usted que otros.

Busque una que ofrezca cuentas de demostración si no está seguro de cuál será la mejor para usted, de modo que pueda probarla antes de decidirse a invertir su propio dinero.

Recursos educativos

Diversas plataformas proporcionarán material educativo a distintos niveles.

Otros se dirigirán a inversores más experimentados que deseen profundizar sus conocimientos, mientras que algunos sólo ofrecerán materiales que proporcionarán a los principiantes las herramientas que necesitan para empezar.

En general, elegir una plataforma que ofrezca ambas cosas es una buena idea.

De este modo, incluso un principiante completo podrá empezar; después de aprender los fundamentos, aprenderá más.

Seguridad

Es necesario un alto nivel de seguridad porque podría ser invertir sumas considerables de dinero.

Sea cual sea la plataforma por la que se decida, debe asegurarse de que al menos exige un procedimiento de autenticación en dos pasos.

Algunas plataformas de aplicaciones móviles también ofrecen reconocimiento facial o de huellas dactilares como medida de seguridad adicional.

Reflexiones finales

Es un buen punto de partida, pero no es en absoluto una lista exhaustiva de todos los comerciantes de Sudáfrica.

Puede elegir el tipo de plataforma que mejor se adapte a sus necesidades comenzando su investigación aquí con los operadores mencionados anteriormente.

¿Le duele la indecisión financiera? ¿Quiere invertir con Adam?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.

NECESITO SABER SI PUEDO SER VIGILADO PARA CONOCER LAS MEJORES PLATAFORMAS DE COMERCIO DE ACCIONES Y OPCIONES EN NIGERIA AFRICA OCCIDENTAL.

¿Quiere invertir localmente?