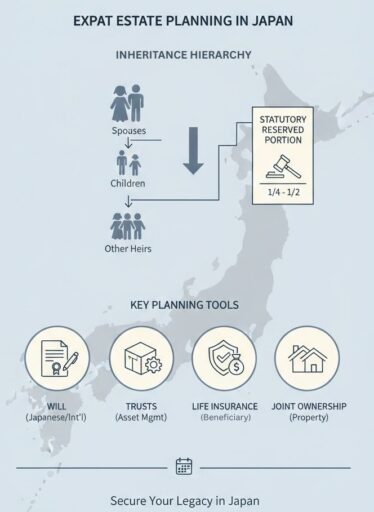

Expat wills in Japan are governed by Japanese inheritance law, which imposes fixed statutory heir shares and inheritance tax rules even on foreign nationals.

Because Japan’s civil-law system offers limited flexibility and strict formal requirements, many common overseas estate planning strategies do not function as expected.

However, alternatives do exist. For example, named beneficiaries on insurance policies allow assets to pass directly to chosen recipients, while trusts and structures like foundations provide additional legal and financial flexibility.

We can help expats design and implement these solutions, coordinating them with Japanese inheritance law to optimize efficiency, protect assets, and reduce dispute risk.

Este artículo trata:

- What are the rules around inheritance?

- What are the 3 main types of wills called?

- In which circumstances will a will be invalid?

- What is the best option, a trust or a will?

Principales conclusiones:

- Japan’s statutory reserved portions can limit how freely assets are distributed.

- Proper execution formalities are critical to avoid invalidation.

- Asset structuring affects liquidity, tax exposure, and dispute risk.

- Coordinating wills with complementary tools, like trusts or beneficiary designations, boosts efficiency.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

¿Cuál es la norma de sucesión en Japón?

Inheritance in Japan follows strict civil law principles. Assets are divided according to statutory shares, typically favoring spouses and children.

If there is no will, the estate is automatically distributed according to Japanese law, which can sometimes conflict with an expat’s wishes.

Puntos clave:

- Spouses usually inherit half of the estate.

- Children inherit the remaining half, divided equally among them.

- Foreigners can inherit property in Japan, but careful planning is essential to avoid legal complications.

What are the different types of wills in Japan?

Japan recognizes three legally valid types of wills: holographic, notarial, and secret wills.

- Holographic Will: Written entirely by hand by the testator and signed and dated personally. While simple to create, errors in format can lead to invalidation or court review after death.

- Notarial Will: Prepared with a licensed Japanese notary in the presence of witnesses. This is the most secure form, officially recorded, and far less likely to be challenged.

- Secret Will: Signed by the testator and sealed, with its existence certified by a notary, but the contents remain private until death. It is less commonly used due to procedural complexity.

For expats, a notarial will is generally recommended because it reduces disputes, ensures compliance with Japanese formalities, and simplifies the probate process.

What is the best way to draft a will?

The best way to draft a will in Japan is to execute a legally compliant notarial will that clearly defines heirs, assets, and distribution shares while coordinating with any overseas estate plans.

For expats, drafting a will should follow a clear process:

- Identify all assets, including Japanese and foreign assets such as inmobiliario, cuentas bancarias, inversiones, business interests, and seguro policies.

- Confirm statutory heirs and any reserved portions under Japanese law that may limit how freely assets can be distributed.

- Define beneficiaries and specify exact allocations, including names, relationships, and percentage shares, to avoid ambiguity or disputes.

- Coordinate with foreign wills or structures to ensure there are no conflicts with assets held abroad.

- Execute the will before a notary to reduce the risk of invalidation, loss, or administrative complications after death.

What are common mistakes when writing a will?

In Japan, wills are frequently invalidated when they are written in a language that is not legally recognized or lack proper translation.

Simply writing a will and having it witnessed does not guarantee legal validity; if formal rules are not followed, your wishes can be ignored and the courts will decide instead.

Mistakes also occur when documents are unsigned, undated, or contain ambiguous beneficiary descriptions, especially for foreign residents.

Another common error is failing to account for inheritance tax obligations, which can create unexpected liabilities for heirs.

Being meticulous about language, signatures, beneficiary details, and tax considerations ensures your estate is distributed according to your intentions.

¿Cuál es la mejor alternativa al testamento?

Alternatives such as named beneficiaries, fideicomisos, y fundaciones can provide more control and efficiency than a traditional will in Japan.

- Named beneficiaries on insurance policies: Payments go directly to the designated beneficiary, bypassing probate and ensuring faster access to funds.

- Trusts and structures like foundations: These can manage assets according to your instructions, protect privacy, and sometimes offer tax advantages.

- Joint ownership arrangements for property: Shared ownership can simplify inheritance by allowing co-owners to automatically assume full ownership, avoiding court procedures.

These alternatives are especially useful for expats with complex international assets or cross-border family arrangements, providing smoother administration and greater certainty for heirs.

We can help structure trusts, foundations, or beneficiary arrangements to align with Japanese inheritance law and your personal estate planning goals.

In which circumstances will a will be invalid?

A will in Japan is invalid if it does not meet legal formalities, the testator lacks capacity, or the testator’s intentions are unclear or compromised.

- Noncompliance with legal formalities: If the will does not follow Japanese rules for writing, signing, dating, or notarization, it can be rejected by the courts.

- Lack of mental capacity: A will is invalid if the testator was not of sound mind when drafting it, as they must understand the nature and consequences of their decisions.

- Coercion, fraud, or undue influence: Any evidence that the testator was pressured, misled, or manipulated can nullify the will.

- Ambiguity or unclear intentions: If the wording is vague or contradictory, making it impossible to determine the testator’s wishes, the will may be disregarded.

Traditional Wills and Modern Structures: Understanding Reserved Portions

One of the biggest challenges for expats in Japan is the country’s statutory reserved portions, which guarantee certain heirs a minimum share of the estate regardless of a will’s instructions.

This means that even a carefully drafted will can be partially overridden if it infringes on the statutory rights of a spouse or child.

Rather than relying solely on a traditional will, many expats structure their estate with these realities in mind.

Scenario 1: Concentrating Assets in One Heir

An expat wants to leave a Japanese property entirely to one child who lives in Japan. While the will states this clearly, the other children may still claim their statutory reserved shares.

To prevent a forced sale of the property, the expat balances the allocation by directing other assets or insurance proceeds to the remaining heirs.

Scenario 2: Protecting a Family Business

A business owner intends to pass company shares to a single successor.

If statutory heirs assert their reserved rights, the shares may need to be valued and compensated in cash.

Proper planning such as allocating non-business assets elsewhere, helps prevent disruption of the enterprise.

Scenario 3: Cross-Border Asset Allocation

An expat with investments outside Japan drafts a foreign will covering global assets but leaves Japanese property under a separate notarial will.

Without coordination, heirs may invoke statutory rights against the Japanese estate, creating administrative and legal complications. Aligning both documents reduces conflict.

Scenario 4: Using Lifetime Structuring

Some expats allocate assets during their lifetime or use designated insurance beneficiaries to provide liquidity for heirs who are entitled to reserved portions.

This approach satisfies legal rights without fragmenting key assets.

By combining a carefully drafted notarial will with thoughtful asset allocation strategies, expats can respect Japan’s inheritance framework while still preserving their broader estate-planning objectives.

The goal is not to avoid statutory reserved portions entirely, but to anticipate them and structure the estate in a way that minimizes disputes and protects long-term intentions.

Conclusión

Expat estate planning in Japan demands foresight, not assumptions. The interaction between statutory rights, documentation standards, and cross-border realities means outcomes are often shaped long before probate begins.

The most effective plans are designed with future administration in mind: how assets will be accessed, how heirs will coordinate, and how liquidity will be handled if claims arise.

When these practical considerations are addressed early, families avoid unnecessary friction and costly delays.

Ultimately, a well-structured estate plan in Japan provides something more valuable than technical compliance; it delivers predictability at a time when uncertainty is already high.

Preguntas frecuentes

What is the inheritance tax in Japan for expats?

Japan’s inheritance tax ranges from 10% to 55%.

Residents are taxed on worldwide assets, while non-residents are generally taxed only on Japan-situated assets, with significant exemptions available for spouses and statutory heirs.

Does Japan recognize trusts?

Yes, Japan has a trust system, but its use is more limited than in common law countries.

It can be effective for expats looking to manage property or assets flexibly.

Can you put the name of a beneficiary that lives abroad?

Yes, foreign beneficiaries can inherit property in Japan. Proper documentation and clear identification are essential to avoid delays.

¿Se aplica el impuesto de sucesiones a los no residentes?

Yes, but only on property located in Japan.

Non-residents are taxed differently than residents, so orientación profesional es crucial.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.