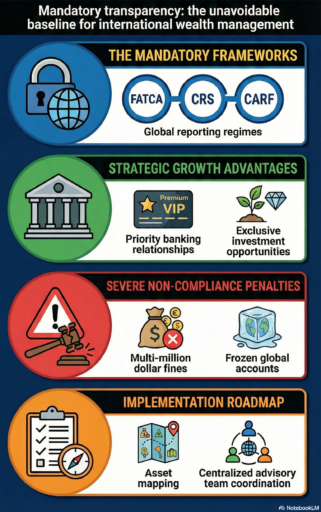

Cross-border wealth management has entered a new era where optional compliance no longer exists. CRS, FATCA, and CARF make transparency mandatory for high-net-worth individuals.

Beyond avoiding penalties, proactive compliance strengthens credibility, opens doors to international banking and investments, and positions investors to navigate complex jurisdictions confidently.

Ignoring these requirements exposes investors to severe financial, legal, and reputational consequences.

Principales conclusiones:

- Compliance with CRS, FATCA, and CARF is mandatory and enforceable globally.

- Strategic compliance can unlock banking access, investments, and credibility.

- Non-reporting jurisdictions are supplemental, not exemptions.

- Coordinated advisory teams and monitoring reduce risks.

Mis datos de contacto son hello@adamfayed.com y WhatsApp +44-7393-450-837 si tiene alguna pregunta.

La información contenida en este artículo es meramente orientativa. No constituye asesoramiento financiero, jurídico o fiscal, ni una recomendación o solicitud de inversión. Algunos hechos pueden haber cambiado desde el momento de su redacción.

Why cross-border compliance is unavoidable

Global reporting regimes like CRS, FATCA, and CARF have transformed international finance. Investors and financial institutions can no longer treat reporting as optional.

- FATCA: US citizens and residents must report foreign accounts; foreign banks report to the IRS.

- CRS: Over 100 jurisdictions share account information automatically to tax authorities.

- CARF: Expanding reporting to crypto-assets worldwide.

High-net-worth investors must factor these regimes into every aspect of planning, as penalties, frozen accounts, and audits can arise from non-compliance in any participating jurisdiction.

What was once optional is now a baseline expectation.

Why ignoring compliance is riskier than ever

Non-compliance now exposes investors to multi-jurisdictional penalties, reputational risk, and potential criminal liability.

- Financial penalties: Both investors and institutions can face multi-thousand- to multi-million-dollar fines.

- Access restrictions: Banks in compliant jurisdictions may refuse to open or maintain accounts for non-compliant clients.

- Reputational exposure: Asset tracing and media coverage make privacy violations more visible.

- Compounding risk across regimes: Failure in one jurisdiction can trigger reporting and enforcement in others, magnifying consequences.

What advantages come from strategic reporting?

Compliance with CRS, FATCA, and CARF can be used to strengthen wealth strategy and unlock opportunities.

- Enhanced banking relationships: Banks favor fully compliant clients for high-value services.

- Access to investment opportunities: Structured products and cross-border credit often require transparency.

- Legal flexibility: Compliance creates a foundation for using non-CRS or non-CARF jurisdictions safely.

Transparency is increasingly a form of currency in international wealth planning. Compliance can improve reputation, market access, and even negotiating power with financial institutions.

Who benefits most from strategic compliance?

High-net-worth, multi-jurisdictional, and crypto-exposed investors gain the most from proactive compliance with CRS, FATCA, and CARF, unlocking access, credibility, and risk management advantages across borders.

- Families with international wealth structures: Compliance protects generational assets.

- Entrepreneurs with complex global income streams: Reduces exposure across multiple tax regimes.

- Investors holding crypto or alternative assets: Ensures digital holdings meet reporting obligations.

How Compliance Can Be Leveraged Strategically

Proactive compliance enhances tax efficiency, access, and risk mitigation across jurisdictions.

By planning around CRS, FATCA, and CARF, you can turn mandatory reporting into a strategic advantage.

- Proactive reporting reduces enforcement risk.

- Jurisdiction selection aligns compliant countries with planning goals.

- CARF compliance ensures digital assets are managed legally.

- Integrated advisory teams maximize strategy effectiveness.

Investors who integrate compliance into planning don’t just avoid penalties. They unlock growth, diversification, and credibility that siloed or reactive approaches cannot provide.

Compliance Overview

| Regime / Jurisdiction | Scope | Reporting Requirement | Asset Type | Strategic Implication |

| FATCA | US persons worldwide | Mandatory foreign account reporting to IRS | Bank accounts, securities | Access to US-friendly institutions, avoid penalties |

| CRS | 100+ jurisdictions | Automatic exchange of tax info | Bank accounts, investments | Ensures transparency; non-participation limited |

| CARF | Global crypto holdings | Reporting of digital assets | Crypto, tokens, stablecoins | Compliance ensures legal use of crypto abroad |

| Non-CRS / Non-CARF | Select jurisdictions | No automatic reporting | Bank accounts, alternative investments | Can be leveraged for privacy/diversification, but home-country compliance still dominates |

How to Structure Compliant Global Wealth Strategies

Compliance must be integrated into every aspect of planning, from account location to asset type and reporting structure.

Proactive structuring ensures that regulations become tools rather than hurdles.

Jurisdiction selection: Use countries with strong regulatory alignment to minimize reporting gaps.

Entity structuring: Choose fideicomisos, companies, or foundations that meet compliance requirements while optimizing governance.

Crypto oversight: CARF compliance is increasingly relevant; even non-traditional assets require reporting.

Continuous monitoring: Laws and agreements evolve; proactive compliance prevents surprises.

Practical Steps to Implement Strategic Compliance

Audit assets, centralize advisors, integrate reporting, and align compliance with wealth strategy.

- Map all assets: Include traditional and digital holdings.

- Consolidate advisory teams: Tax, legal, and investment experts coordinated centrally.

- Leverage compliance proactively: Signal credibility and gain access to preferred services.

- Monitor evolving regimes: CRS, FATCA, CARF rules change frequently; stay ahead.

Viewing compliance as a strategic asset rather than a burden allows investors to signal credibility, gain access to preferred financial services, and unlock opportunities that reactive approaches would miss.

Who still benefits from non-CRS, non-CARF jurisdictions?

Investors seeking supplemental privacy, diversification, or estate planning options may find non-CRS and non-CARF jurisdictions useful.

Non-participating countries can provide some privacy advantages, but strategic compliance is still required.

- Selective planning: Investors can use non-CARF or non-CRS countries for diversification, estate structuring, or privacy, but must remain transparent in their home jurisdiction.

- Crypto and digital assets: Non-CARF jurisdictions sometimes provide temporary reporting gaps, useful for planning but risky if misunderstood.

- Legal guidance is mandatory: Expertise ensures that temporary advantages do not become liabilities.

Even in non-reporting jurisdictions, the legal obligation in the investor’s country of tax residence always dominates, making compliance proactive, not optional.

How Advisory Practices are Changing

Advanced compliance tools and automated reporting are transforming the way investors and advisors manage international obligations.

Real-time software can flag potential reporting triggers across jurisdictions, allowing teams to act before small issues escalate into major compliance problems.

Integrated advisory practices are also becoming the norm.

Coordinating tax, legal, and investment advice centrally ensures that every decision aligns with global reporting requirements, reduces gaps, and avoids conflicting guidance.

Data-driven reporting has further streamlined obligations under FATCA, CRS, and CARF.

By automating routine tasks, advisors minimize human error and reduce operational exposure, freeing time to focus on strategic planning rather than just regulatory maintenance.

As a result, compliance is no longer just a regulatory burden—it is evolving into a strategic advantage.

Investors who leverage these modern practices can improve efficiency, manage risk proactively, and maintain credibility across jurisdictions.

Preguntas frecuentes

What is the difference between CRS, FATCA, and CARF?

CRS, FATCA, and CARF are global tax reporting rules: CRS is for automatic exchange of financial info between countries, FATCA targets US taxpayers’ foreign accounts, and CARF requires reporting of cross-border crypto assets.

Can investors still use non-CRS or non-CARF countries?

Yes, but only as part of a fully compliant strategy.

Non-reporting jurisdictions can support diversification, estate planning, or privacy, but home-country obligations always take priority. Misunderstanding this can create serious legal and financial risks.

What are the penalties for non-compliance?

Penalties can include financial fines ranging from thousands to millions of dollars, frozen accounts, reputational damage, and in some cases, criminal exposure.

Non-compliance in one jurisdiction can also trigger reporting or enforcement actions in others.

Does compliance limit privacy?

Yes, transparency is required, but carefully structured strategies can balance legal reporting with confidentiality.

Investors can maintain privacy while fully adhering to CRS, FATCA, and CARF rules.

How often should compliance strategies be reviewed?

Compliance strategies should be reviewed at least annually, or whenever new assets, jurisdictions, or digital currencies are added.

Laws and reporting requirements evolve rapidly, and regular reviews ensure ongoing adherence and strategic advantage.

¿Le duele la indecisión financiera?

Adam es un autor reconocido internacionalmente en temas financieros, con más de 830 millones de respuestas en Quora, un libro muy vendido en Amazon y colaborador de Forbes.