Vontobel Bank Review

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

Vontobel Group, a Swiss private bank with an international focus, was established in 1924 and has its headquarters in Zurich.

It provides asset management services to sophisticated private and institutional clients and partners.

Vontobel caters to its clients through three critical business units.

They are Private Banking, Investment Banking, and Asset Management & Investment Funds.

Bank Type

Stock exchange bank.

Services Offered

⁃ Asset management

⁃ Wealth management

⁃ Advisory services

⁃ Investment management

⁃ Pension planning

Clients Accepted

High net worth individuals.

Global Reach

Vontobel serves clients worldwide and facilitates international transfers through SWIFT and SEPA transactions.

Delivery Channels

Bank Vontobel AG offers its products and services through various channels, including physical branches and online banking.

Common Shares

Vontobel Holding AG is the publicly listed entity associated with Bank Vontobel AG.

Vontobel’s shares are traded on the SIX Swiss Exchange under the VONN ticker.

Financials

In 2020, Bank Vontobel AG reported total assets of 21,898.37 million CHF, representing a substantial growth of 40.97%.

It ranks as the 27th largest bank in Switzerland regarding total assets, holding a market share of 0.63%.

Additionally, it is the fourth largest stock exchange bank in Switzerland, with a market share of 8.53% among banks in this category.

Deposit Guarantee

The bank participates in Switzerland’s deposit guarantee scheme, provided by esisuisse – Deposit Insurance (ESI).

This scheme covers private individuals (Swiss and foreign) and legal entities (Swiss and foreign).

This offers protection of credit balances up to 100,000 CHF per depositor, per bank.

Contact Information

Address: Gotthardstrasse 43, 8022, Zurich, Switzerland

Phone: 044 283 71 11

Bank Identifiers

BIC (SWIFT): VONTCHZZXXX

LEI: 549300L7V4MGECYRM576

Company Number: CHE-105.840.858

Bank Supervision

Bank Vontobel AG is authorized and supervised by the Swiss Financial Market Supervisory Authority.

The reference number is CHE-105.840.858.

Bank History

While Vontobel Group was founded in 1924, it appears there may be a discrepancy in the provided founding year (1936), as the earlier date is widely accepted as the establishment of the bank.

Credit Ratings

Moody’s, the rating agency, has conducted assessments and provided ratings for both Bank Vontobel AG and Vontobel Holding AG.

These ratings serve as confirmation of the recognized financial strength and stability of Vontobel.

For BANK VONTOBEL AG, the following ratings and outlooks have been assigned:

Long-term deposit rating: Aa3 with a Stable outlook

Short-term deposit rating: Prime-1 with a Stable outlook

Counterparty risk rating: A2 with a Stable outlook

Long-term counterparty risk assessment: A1 (cr)

Short-term counterparty risk assessment: Prime-1 (cr)

For VONTOBEL HOLDING AG, the following ratings and outlooks have been assigned:

Long-term rating (issuer rating): A2 with a Stable outlook

Additional Tier 1 Subordinated Bonds: Baa2(hyb)

Understanding Moody’s Ratings

When conducting credit evaluations, Moody’s analysts undertake thorough assessments of an entity’s:

• Financial well-being

• Management practices

• Industry trends

• Economic circumstances

They scrutinize a wide range of quantitative and qualitative factors to develop an understanding of the entity’s credit risk.

Once they have comprehensively understood the entity, Moody’s assigns credit ratings.

This is done by using a standardized scale that indicates the likelihood of default or the inability to meet financial obligations.

This scale includes both letter grades and numerical modifiers.

Global Long-Term Rating Scale:

- Aaa

This rating signifies the highest quality with the lowest credit risk.

- Aa

It indicates high quality with shallow credit risk.

- A

This rating represents an upper-medium grade with low credit risk.

- Baa

Obligations with this rating are considered medium-grade with moderate credit risk and may have some speculative characteristics.

- Ba

This rating designates obligations as speculative with substantial credit risk.

- B

It is used for obligations considered speculative with high credit risk.

- Caa

This rating is assigned to obligations of poor standing, highly speculative, and very high credit risk.

- Ca

Obligations with this rating are highly speculative and likely to be in or very near default, with some chance of recovering principal and interest.

- C

This is the lowest rating and is typically assigned to obligations in default, with little hope of recovering principal or interest.

Global Short-Term Rating Scale:

- P-1 or Prime-1

These ratings indicate a superior ability to repay short-term obligations.

- P-2 or Prime-2

These ratings reflect a solid ability to repay short-term obligations.

- P-3 or Prime-3

These ratings indicate an acceptable ability to repay short-term obligations.

- NP or Not Prime

Issuers (or supporting institutions) that are rated Not Prime do not fall within any Prime rating category.

Note – Moody’s adds numerical modifiers (1, 2, or 3) to each generic rating classification from Aa through Caa.

These include:

Prime-1

⁃ Aaa

⁃ Aa1

⁃ Aa2

⁃ Aa3

⁃ A1

⁃ A2

⁃ A3

Prime-2

⁃ A3

⁃ Baa1

⁃ Baa2

Prime-3

⁃ Baa2

⁃ Baa3

Not Prime

⁃ Ba1

⁃ Ba2

⁃ Ba3

⁃ B1

⁃ B2

⁃ B3

⁃ Caa1

⁃ Caa2

⁃ Caa3

⁃ C

Modifier 1 indicates a higher-end ranking, modifier 2 suggests a mid-range ranking, and modifier 3 signifies a lower-end ranking within that generic rating category.

A “(hyb)” indicator is added to ratings of hybrid securities issued by banks, insurers, finance companies, and securities firms.

Hybrid securities allow for the omission of scheduled payments, potentially leading to impairment.

The long-term obligation rating for a hybrid security reflects its relative credit risk.

As I said before, Moody’s considers various factors when assigning these credit ratings.

These factors may include:

⁃ Financial ratios

⁃ Cash flow

⁃ Debt levels

⁃ Market position

⁃ Industry trends

⁃ Regulatory environment

⁃ Geopolitical factors

⁃ Quality of management

Additionally, Moody’s compares the entity being rated to its peers within the same industry or sector to provide context for the rating.

This enables investors to gauge how the entity’s credit risk compares to others in a similar position.

It’s important to note that higher-risk ratings do not necessarily imply negative attributes.

Investors seeking higher potential returns may consider entities with lower ratings.

The utility of Moody’s ratings extends to various entities and individuals, including:

⁃ Mutual funds

⁃ Pension funds

⁃ Insurance companies

⁃ Hedge funds

⁃ Retail investors

Institutional investors with substantial portfolios use credit ratings to assess the risk associated with debt securities like corporate bonds.

This helps those investors assist their portfolio diversification and risk management decisions.

Individual investors rely on credit ratings as a simplified gauge of the risk linked to investing in a particular company’s debt.

Banks and lenders utilize credit ratings when evaluating the creditworthiness of corporations seeking loans or credit facilities.

These ratings influence the terms and interest rates offered to borrowers.

When companies plan to issue debt securities, they consult credit ratings to comprehend the credit risk assessment of potential investors.

This is because higher credit ratings can lead to lower borrowing costs for the issuing company.

Additionally, regulatory bodies and government agencies use credit ratings.

This includes central banks and financial regulators.

They use these ratings to evaluate institutions’ financial stability and risk profile. Such institutions fall under their supervision.

This information helps in establishing regulatory requirements and monitoring systemic risk.

The extensive details regarding Moody’s would take up much time to cover.

I’ll cover it in another article because we are focusing on Vontobel Bank for today.

Are the Credit Ratings good for Vontobel?

As we discussed earlier, Moody’s credit ratings for Vontobel were quite good.

This includes the Bank Vontobel AG as well as Vontobel Holding AG.

However, the hybrid rating provided for Vontobel Holding AG’s Additional Tier 1 Subordinated Bonds was “Baa2”.

This means these bonds can be significantly risky, and at the same time, there could be higher returns for bondholders.

More Details about Bank Vontobel AG

Let us have a look at some more details about Bank Vontobel AG as mentioned on their website.

Wealth Management Services

In the context of Vontobel Wealth Management, clients have the advantage of a dual consulting concept.

Clients have the flexibility to choose between personal guidance from their Relationship Manager.

(or)

They have the ability to utilize the digital platform Vontobel Wealth.

The extent to which they wish to integrate these options depends on their individual preferences.

Vontobel Wealth Management offers a wide range of services tailored to meet clients’ unique needs.

These services encompass various mandate types, including discretionary and advisory service mandates.

They also have the option to combine additional services such as financing solutions, financial planning, and consulting.

Clients benefit from having a dedicated Personal Relationship Manager who prioritizes their needs, wishes, and financial goals.

Vontobel strongly emphasizes maintaining continuity and fostering long-term sustainability in client relationships.

This is done while ensuring that the Relationship Manager remains a reliable and knowledgeable point of contact over many years.

Furthermore, Vontobel Wealth Management provides sustainable investment solutions.

This allows clients to align their investment decisions with their values.

By leveraging these options, clients can support companies that have a proven record of sustainable practices.

At the same time, this can be done while reducing portfolio risks in the process.

The advisory approach at Vontobel considers various aspects of the client’s financial situation.

This includes evaluating their assets, liabilities, professional and family circumstances, and values and ideals.

The advisory process also involves prioritizing the client’s plans and goals.

This defines an appropriate investment strategy, assessing risk tolerance, and determining the following steps to achieve their financial objectives.

Leverage Investments

Vontobel Wealth Management offers clients a dual consulting approach.

Depending on their preferences, clients can choose between personal guidance from a Relationship Manager or using the digital platform Vontobel Wealth.

Various services are available to clients, including discretionary and advisory mandates.

Additional options like financing solutions, financial planning, and consulting are available.

Coming to the dedicated Personal Relationship Manager, you get prioritized solutions for your needs and goals.

This ensures continuity in the relationship over the long term.

Vontobel also provides sustainable investment solutions, allowing clients to align their investments with their values.

This supports companies with strong sustainability practices.

The advisory process considers the client’s financial situation, values, goals, and risk tolerance.

This provides experience with financial products to create a tailored strategy for achieving their objectives.

deritrade

deritrade is a leading global platform for creating personalized and structured investment products.

This open-architecture marketplace connects buyers and sellers, allowing users to design custom financial products.

Professional financial service providers and some private investors can use deritrade to create tailored investments.

- Key benefits of deritrade:

Enhanced Investment Performance

The platform optimizes investment performance with advanced technology.

It offers a wide range of structured product categories and underlyings, with a minimum investment of CHF 10,000.

— Real-time Price Comparison

Professional financial providers can instantly compare prices among suppliers, ensuring price transparency.

— Integrated Risk and Compliance

deritrade includes risk and compliance checks throughout the product lifecycle to comply with evolving regulations.

— Streamlined Client Experience

The platform’s modern interface automates the entire process, enhancing the client journey.

Relationship managers can quickly access prices and create structured products, all in seconds.

EAMNet

EAMNet by Vontobel is here for external asset managers and their clients.

EAMNet offers external asset managers a centralized platform for trading, reports, research, and more.

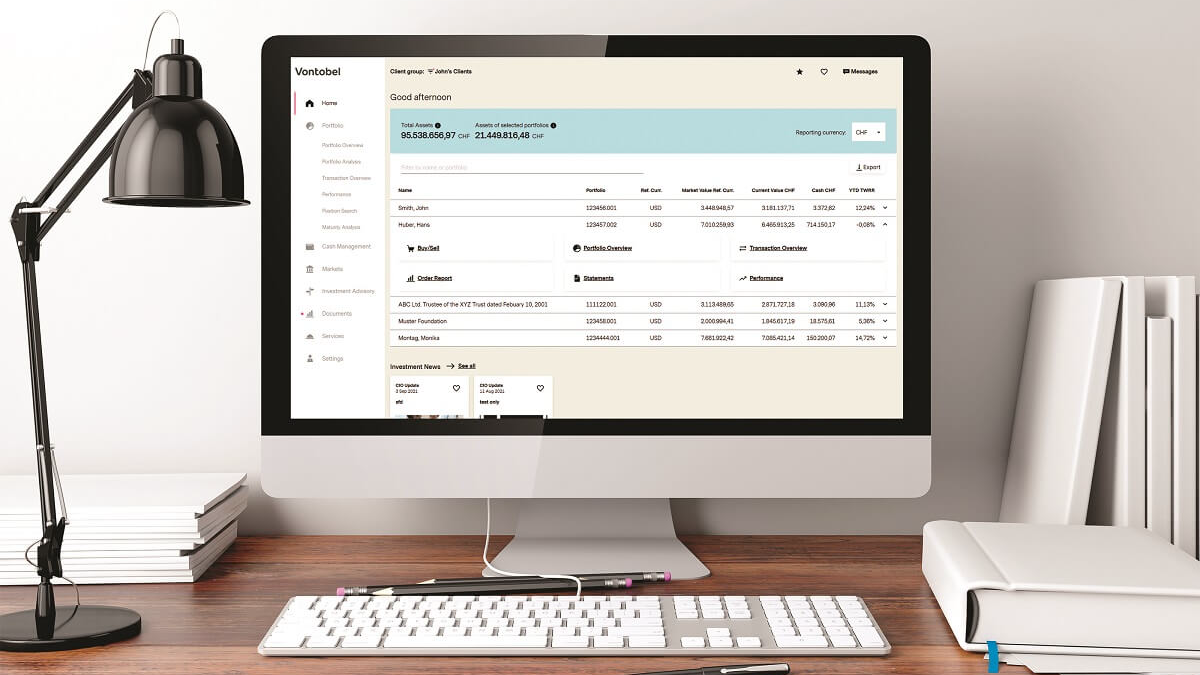

With added digital services, Vontobel Wealth lets clients access their portfolios anytime, anywhere.

With EAMNet, you can:

⁃ Keep track of clients and their portfolios.

⁃ Conduct transactions, including bulk trades, across multiple portfolios.

⁃ Monitor maturities and generate reports.

⁃ Access Vontobel Research and investment ideas.

⁃ Explore structured products through deritrade.

Vontobel Wealth provides clients with:

⁃ A comprehensive view of their portfolios.

⁃ Details on individual positions and performance.

⁃ Digital payment services and secure communication.

⁃ User-generated reports and Vontobel information.

The platforms are available 24/7, ensuring efficient action when needed.

Vontobel’s Relationship Management and Investment Advisory services seamlessly integrate with digital capabilities.

Corporate Responsibility

On February 28, 2023, Vontobel released its Sustainability Report for 2022.

The report aims to provide clear insights into Vontobel’s sustainability initiatives, progress, and plans.

Vontobel is dedicated to actively contributing to positive change and striving to achieve its sustainability objectives.

Sustainability

Sustainability is a long-standing commitment for Vontobel’s owner families, now in their fourth generation.

As responsible corporate citizens, they support local community well-being.

Vontobel, as a global investment firm, equips investors with knowledge, tools, and sustainable investment options for shaping better futures.

These efforts align with the UN’s Sustainable Development Goals (SDGs), aiming for a meaningful impact on a global scale.

Vontobel’s Sustainability Commitments

— Achieve net zero by 2030 in banking book investments and operations.

— Provide equality, diversity, and inclusion within the workplace.

— Promote governance and transparency for stakeholder engagement.

— Educate private clients about ESG investments.

— Integrate ESG considerations into active investment decisions.

— Actively engage with the local community.

Sustainable Investing

Vontobel offers sustainable investment solutions that meet environmental, social, and governance criteria.

All of this is being maintained while maintaining competitive earnings potential.

Vontobel strictly avoids investments in controversial weapons like cluster munitions and landmines.

Sustainability is vital in investment decisions, focusing on positive and long-term impacts on the ESG principles without sacrificing returns.

Vontobel has been a pioneer in sustainable investments since the 1990s.

At the same time, it has been providing a wide range of solutions, including equity funds, thematic strategies, and structured products.

For private individuals and entrepreneurs, Vontobel offers modern pension solutions with professional wealth management.

Economic sustainability at Vontobel centers on client focus, long-term growth, and sound capital and risk policies.

Vontobel’s Dedication to Environmental Sustainability

Vontobel prioritizes environmental protection across all its business activities.

It supports the Paris Climate Agreement’s goals, actively contributing to the sustainable transformation of the economy for future generations.

High environmental and sustainability standards guide Vontobel’s:

⁃ Operations

⁃ Emphasizing material efficiency

⁃ Energy conservation

⁃ Reduced greenhouse gas emissions.

Vontobel’s Commitment to Social Sustainability

Corporate responsibility is an integral part of Vontobel’s culture and identity.

This means it extends to the well-being, cohesion, and stability of societies where it operates.

Vontobel values its employees and invests in their development, fostering an inclusive workplace and work-life balance.

It engages in community support.

Vontobel partners with organizations like the ICRC, Munich Security Conference, etc.

It also promotes contemporary photography through its modern art initiative.

Since 2007, Vontobel has actively participated in National Future Day, opening its doors to children across Switzerland.

Sustainable Report

Vontobel strives to offer transparent insights into its sustainability efforts, achievements, and future objectives.

This has been made clear in their sustainability report for 2022.

Investment:

Vontobel has been a trailblazer in sustainable investing since the 1990s.

They manage CHF 107.6 billion in investment solutions integrating ESG criteria.

Their investment teams adhere to four core ESG Investment Principles.

Vontobel is a founding Swiss Sustainable Finance (SSF) association member.

Environment:

They have achieved carbon neutrality for Scope 1, Scope 2, and Scope 3 emissions from operations since 2009.

Their Zurich campus utilizes lake water for heating and cooling, promoting sustainability.

They prioritize collaboration with local providers whenever feasible.

Vontobel is also a founding member of the Swiss Climate Foundation.

Social:

Vontobel is a part of the Corporate Support Group for the International Committee of the Red Cross (ICRC).

They conduct an annual fundraising initiative to support an ICRC project.

Their “A New Gaze” photography prize encourages young contemporary artists.

Alternatives for Bank Vontobel AG

Based on aspects like business focus, total assets, etc., other alternatives for Bank Vontobel AG are as follows.

— Union Bancaire Privee, UBP SA

— Banque Pictet & Cie SA

— Banque Lombard Odier & Cie SA

— Edmond de Rothschild (Suisse) S.A.

— Swissquote Bank SA

What Do I Think?

Whether individuals should become clients of Vontobel depends on their specific financial needs, goals, and values.

Here’s a bottom line based on the information provided in this specific article:

Pros of Becoming a Vontobel Client:

- Sustainable Investing

Vontobel strongly emphasizes sustainable and responsible investing, offering an array of ESG-focused investment solutions.

If you prioritize environmentally and socially responsible investments, Vontobel’s offerings align with those values.

- Long-Term Sustainability Commitments

Vontobel has outlined sustainability commitments, including achieving net-zero emissions by 2030 and promoting diversity and inclusion.

Clients who value companies committed to such goals may find Vontobel appealing.

- Financial Services

Vontobel offers various financial services, including wealth management, investment solutions, and advisory services.

This broad range of offerings can cater to different financial needs and objectives.

- Transparency

Vontobel emphasizes transparency in reporting its sustainability efforts.

This can reassure clients who want clear information about the company’s practices and progress.

Cons of Becoming a Vontobel Client:

- Investment Goals

Individuals should assess whether Vontobel’s investment options align with their financial goals and risk tolerance.

- Location

Vontobel operates globally but has its roots in Switzerland.

Potential clients should consider whether the bank’s geographic presence aligns with their needs and location.

- Risk Tolerance

Like any financial institution, Vontobel carries certain risks.

Clients should carefully evaluate these risks and ensure they are comfortable with the risks associated with their investments.

How You Can Benefit From Me

It is true that I only deal with expats and high-net-worth individuals (HNWIs), even though my team can accept others.

Due to our firm’s size, we can also offer institutional assets at reduced prices.

For example, if you wanted to invest in a relatively safe fixed-return investment, the rates could be 4%–6% per year, as an example.

These things might be unusual, but they aren’t unique.

My approach is no longer unique.

Some other advisors excelled after COVID-19.

Even if few online firms have the reach that we have, docu-sign and Zoom became fashionable, years after I started using them.

I have since decided to take the model one step further.

I noticed something when dealing with other providers, such as the banks.

I’m not too fond of it when forced to go through a specific process, such as needing a call.

That is why we partner with lawyers, banks, trusts, accountants, and others to help us and our clients.

However, the important thing is that I have been there.

I have moved around the world.

I have had bank accounts closed like the countless British expats who have recently been reporting this issue, which is all too familiar to those living overseas.

I also understand how difficult it is for business owners to get corporate bank accounts, mainly if they are based in certain countries.

Especially as I have lived the life myself, I can also give you first-hand experience.

My primary service will always be to help expats and HNWIs invest and protect their wealth.

Despite that, I can share my network and knowledge besides doing that.

Bottom Line

As a last word, individuals considering Vontobel as their financial partner should conduct thorough research.

They should assess their financial objectives and seek professional advice to determine if Vontobel fits their financial journey.

That being said, I strongly hope that the information provided within this article was proven to be helpful for you.

If you feel that you can benefit from the best-in-class services provided by me, feel free to contact me.

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.