The Dubai International Financial Centre (DIFC) is a beacon of financial prowess in the Middle East, Africa, and South Asia (MEASA) region.

As the leading financial hub for these areas, DIFC bridges the gap between the fast-growing markets of MEASA and the established economies of Asia, Europe, and the Americas.

With its robust legal and regulatory framework, DIFC has become essential for businesses, financial institutions, and individuals, especially when understanding DIFC wills.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

This article is here for informational purposes only, and doesn’t constitute formal legal or financial advice. What is more, the facts might have changed since this article was made.

Table of Contents

What is DIFC?

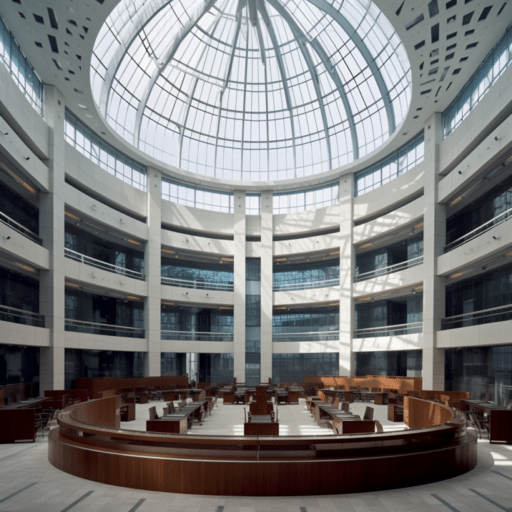

DIFC, is more than just a name; it symbolizes economic growth and diversification in the UAE. Established in 2004, DIFC has consistently served as a global financial hub catering to the Middle East, Africa, and South Asia markets.

The unique legal and regulatory framework that DIFC offers makes it an attractive and prime location for businesses and financial institutions.

With a vision to drive the future of finance, DIFC provides a comprehensive financial ecosystem, housing over 4,300 active registered companies and more than 36,000 professionals. This vast and diverse pool of industry talent sets DIFC apart as a leading financial center in the region.

Brief History of DIFC

The inception of DIFC was a strategic move by the UAE government to stimulate financial growth. They envisioned DIFC as a catalyst that would attract top global firms and financial institutions.

This vision quickly materialized as DIFC began to draw attention from global financial players. Today, DIFC not only stands as a testament to the UAE’s commitment to driving economic diversification but also showcases its success in facilitating trade and investment flows across the MEASA region.

With a GDP of US$ 8 trillion spanning 72 countries and an approximate population of 3 billion, DIFC has successfully connected these rapidly growing markets with other major economies through Dubai.

Furthermore, DIFC’s commitment to innovation is evident in its approach to FinTech and venture capital. The center offers one of the region’s most comprehensive environments for these sectors, including cost-effective licensing solutions, fit-for-purpose regulation, innovative accelerator programs, and funding opportunities for growth-stage startups.

This commitment to innovation and its rich history and strategic positioning make DIFC a pivotal player in the global financial landscape.

Importance of DIFC in the UAE Financial Landscape

DIFC boasts a vibrant business ecosystem with over 39,000 professionals working across more than 4,900 active companies. These companies benefit immensely from DIFC’s robust independent judicial system, regulatory framework, and global financial exchange.

The district itself is a blend of modernity and convenience, featuring ultra-modern office spaces, retail outlets, cafes, restaurants, art galleries, residential apartments, public green areas, and hotels.

This makes DIFC the ultimate destination where business seamlessly intertwines with lifestyle. DIFC will serve as a bedrock of security and assurance for the vast expatriate community in the UAE.

The absence of a DIFC will plunge expatriates into a quagmire of legal complications, especially concerning asset distribution upon their passing.

Legal Implications for Expatriates Without a Will

Without DIFC wills, the UAE’s Sharia law predominantly governs how assets distribute after one’s demise. This Islamic legal system has specific guidelines for inheritance, which might not align with an expatriate’s personal wishes.

For instance, in many cases, assets may divide among family members based on predetermined shares, leading to unintended beneficiaries receiving portions of the estate.

Potential Disputes Among Family Members

When assets distribute according to Sharia law, it can sometimes lead to disputes among family members. Such disagreements often arise due to differences in cultural and personal expectations regarding inheritance.

For instance, a daughter might receive half the share of a son, which can be a point of contention if it contrasts with the deceased’s intentions.

The Need for Clarity in Asset Distribution

DIFC will play a crucial role in providing clarity. Specifying how one’s assets should distribute reduces the chances of misunderstandings and disputes among heirs.

It ensures that the deceased’s wishes get respected, providing peace of mind to both the individual and their loved ones.

Benefits of Having a DIFC Will

Living and working in a global financial hub like the DIFC comes with advantages and responsibilities. One of the most crucial responsibilities is ensuring that your assets and loved ones are protected in unforeseen circumstances.’

A DIFC will is not just a legal document; it’s a testament to your foresight and care for your family’s future. Let’s explore the myriad benefits of having a DIFC will and how it can offer peace of mind in a dynamic environment like the UAE.

Clarity and Assurance in Asset Distribution

One of the primary benefits of DIFC wills is the clarity they offer. By detailing how assets should distribute, they eliminate ambiguities that might arise without a will.

This clarity ensures that beneficiaries receive their rightful shares without any complications.

Catering to Non-Muslim Expatriates

The DIFC Courts Wills Service Center uses English as its official language, making the process more accessible for non-Muslim expatriates.

This feature particularly benefits those who find Arabic legal terminologies challenging to understand. DIFC wills, therefore, provide a more familiar and comfortable avenue for these individuals to secure their assets.

Flexibility in Asset Inclusion

DIFC will offers the flexibility to include assets from multiple jurisdictions. If an individual owns properties or investments in various countries, they can consolidate these under a single DIFC will.

This consolidation simplifies the inheritance process and ensures a unified approach to asset distribution.

Streamlined Process and Updates

DIFC will stands out for its streamlined registration process. Moreover, the DIFC Courts Wills Service Center allows easy will updates.

Whether it’s a change in address, passport details, or even asset distribution modifications, DIFC offers a hassle-free amendment process, often at minimal costs.

Dedicated Probate Center

The DIFC Courts Wills Service Center boasts a dedicated section for the probate process. This specialization ensures that the probate process unfolds smoothly upon the testator’s death, further emphasizing the benefits of opting for DIFC wills.

Key Features of DIFC Wills

Within the DIFC framework, DIFC will emerge as a pivotal instrument designed to cater to the diverse needs of the international community residing in the UAE.

Delving into the key features of DIFC wills provides a clearer understanding of their significance and how they are tailored to ensure the seamless transition of assets in this unique financial hub.

Types of DIFC Wills

Understanding the different types of DIFC wills can help you make an informed decision. DIFC wills are especially important given the financial hub’s recent growth.

As of 2022, DIFC saw a 19% annual increase in non-financial firms, making securing your assets more crucial than ever.

Single Wills

A single will in DIFC covers one person’s assets. This type of will is straightforward and ideal for individuals who want a clear distribution of their assets.

If you’re one of the over 3,000 international companies or service providers in DIFC, a single will can offer you the peace of mind you need.

Mirror Wills

Mirror DIFC wills are popular among couples. These wills mirror each other, meaning the other inherits the assets if one partner passes away.

Given DIFC’s unique regulatory environment, which allows 100% ownership without a local partner, mirror wills can be particularly advantageous.

Guardianship Wills

For parents, guardianship DIFC wills are indispensable. They specify who will care for their children if both parents pass away. This is especially important in a diverse and international community like DIFC.

Jurisdiction and Scope

A DIFC will has a specific jurisdiction and scope. They primarily cover assets within the UAE, ensuring a smooth transition for beneficiaries.

This is crucial given DIFC’s role as a financial hub for the MEASA markets.

Assets Covered Under DIFC Wills

A DIFC will covers a wide range of assets, from real estate to bank accounts and investments. This comprehensive coverage is in line with DIFC’s promise of zero taxes on corporate income and profits for 50 years, making it a lucrative option for asset distribution.

Limitations and Exclusions

While DIFC wills generally cover most assets, some exclusions apply. It’s essential to consult with a legal expert to understand these nuances, especially considering DIFC’s unique legal framework, which operates separately from the Emirate of Dubai’s legal system.

Validity and Legal Recognition

DIFC wills adhere to a stringent legal framework, ensuring their validity and recognition across the UAE. This is particularly important given DIFC’s independent jurisdiction under the Constitution of the United Arab Emirates.

Requirements for a Valid DIFC Will

To ensure your DIFC will is valid, you must meet specific criteria. This includes being over 21, having a sound mind, and following the prescribed format. These requirements align with DIFC’s civil and commercial laws, which are distinct from those of the wider UAE.

How DIFC Wills are Recognized in Other Emirates

All emirates in the UAE recognize DIFC wills. This uniform recognition ensures that beneficiaries face no issues, regardless of where the assets are located. This is a significant advantage, given DIFC’s role as a financial hub serving the MEASA markets.

The Process of Drafting and Registering a DIFC Will

Drafting and registering DIFC wills is a meticulous process that ensures your assets and beneficiaries are well-protected in the UAE. With the increasing number of expatriates and international investors in the region, DIFC wills have become essential for estate planning.

Preparing to Draft a DIFC Will

Before you embark on drafting a DIFC will, adequate preparation is crucial. This simplifies the process and ensures that your will stands robust against any legal scrutiny.

Every legal process requires documentation, and DIFC wills are no exception. Start by collecting all pertinent documents. These include:

- Property deeds: If you own property in the UAE, ensure you have the original deeds or certified copies.

- Bank statements: These provide a clear picture of your financial assets. Investment portfolios: Gather all related documents if you have investments in the UAE or elsewhere.

- Other asset documents could include vehicle ownership papers, jewelry receipts, or any other significant assets.

Having all these documents at hand expedites the drafting process and ensures that every asset is noticed.

Deciding on Beneficiaries and Guardians

One of the primary purposes of DIFC wills is to designate beneficiaries. These are the individuals or entities you wish to inherit your assets.

Be clear and specific when naming your beneficiaries. If you have minor children, appointing guardians in your DIFC will is essential. This decision ensures that your children have a designated caregiver should anything happen to you.

Steps to Register a DIFC Will

Once you’ve prepared and drafted your will, the next step is registration. A DIFC will requires formal registration to be legally binding.

Meeting with a Registered Wills Draftsman

The first step in the registration process is consulting a registered wills draftsman. These professionals are well-versed in the intricacies of DIFC wills.

They guide you through the process, ensuring your will meets all legal requirements. It’s essential to be transparent and provide all necessary information to the draftsman.

Reviewing and Finalizing the Will

After drafting, take the time to review your DIFC will meticulously. Ensure that it accurately reflects your wishes and that there are no ambiguities.

Consult your draftsman or a legal expert if you need more clarification on any clauses. Once satisfied with the content, you can move on to the finalization process.

Registration at the DIFC Wills Service Centre

The DIFC Wills Service Centre is the official body registering DIFC wills. Once you’ve finalized your will, submit it to the center.

They conduct a thorough review, verifying the will’s authenticity and ensuring it adheres to all regulations. Upon successful verification, they store your DIFC will securely, making it legally binding.

Common Misconceptions About DIFC Wills

Misunderstandings and myths about DIFC will often lead individuals to make uninformed decisions, potentially jeopardizing their assets and the future of their loved ones.

By addressing these misconceptions head-on, we aim to clarify and ensure that individuals make informed choices regarding their estate planning in the UAE.

Myth vs. Reality

The world of DIFC wills is riddled with myths that can mislead individuals. Let’s address and debunk some of the most common misconceptions.

“All my assets are automatically covered.”

One of the prevalent myths is that DIFC will automatically cover all assets. However, this isn’t the case. While DIFC will do cover a broad range of assets, individuals must specify each asset in the will.

Vague or general statements can lead to legal ambiguities, potentially causing beneficiary disputes. It’s crucial to list and detail every asset to ensure clear distribution.

“DIFC Wills are only for the wealthy.”

Another misconception is that DIFC wills are exclusively for the affluent. This couldn’t be further from the truth. A DIFC will caters to individuals from all financial backgrounds.

Whether you have a modest savings account or own multiple properties, DIFC wills help ensure that your assets are distributed according to your wishes.

Regardless of their financial status, everyone benefits from having a clear asset distribution plan.

“My home country’s will is sufficient in the UAE.”

Many expatriates believe that their will from their home country is adequate in the UAE. However, while foreign wills might have some standing, DIFC wills are specifically designed for the UAE’s legal landscape.

They ensure a hassle-free asset transition and are recognized across all emirates. Relying solely on a foreign will can lead to complications, especially given the UAE’s unique legal framework.

The Risks of Homemade Wills

Homemade wills, or those prepared by unlicensed writers, often face challenges in the UAE. Such will frequently contain mistakes or lack essential clauses, making them invalid.

An invalid will can result in the estate being treated as if the person died without a will, leading to asset distribution based on the UAE’s statutory set of rules. This can significantly differ from the deceased’s wishes.

The Importance of Professional Guidance

Engaging a licensed and registered lawyer to draft a DIFC will is paramount. The administration of an estate in the UAE is more complex than in many other jurisdictions.

Homemade wills, including those based on online templates, can lead to expensive problems, unexpected legal bills, and potential disputes among family members.

The Reality of Dying Without a Will in the UAE

The Dubai Government’s official stance is clear: if an individual dies without a will, the UAE Courts adhere to Sharia law for asset distribution.

This can lead to unexpected and undesired outcomes, especially for expatriates unfamiliar with Sharia law. DIFC will provides a mechanism for non-Muslims with assets in Dubai to ensure their assets pass on according to their wishes.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.