Expat Taxes in Malaysia.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

You should read this guide on expat taxes in Malaysia if you are a foreigner earning income in Malaysia.

Depending on a person’s length of stay and the type of work they do while they are in the country, Malaysia uses both progressive and flat rates for personal income tax (PIT).

Understanding Malaysia’s fundamental tax system is important because expats may fall into either tax bracket.

In Malaysia, personal income taxation is governed by the Income Tax Act of 1967, but the government’s annual budget can alter the rates and other aspects of an individual’s taxation.

To better understand the expat taxes in Malaysia and to maintain compliance, it is advised for expats to use the services of registered local tax advisors.

Principles of Taxation in Malaysia and Their Exceptions

Malaysia uses a territorial system of taxation, which means that no matter where an expat is paid, only income earned in Malaysia is subject to tax.

All forms of income, including dividends and profits from employment or business endeavors, are subject to taxation.

There are three main exceptions to the rule that profits from outside sources are not subject to PIT:

1. Numerous agreements to prevent double taxation have been signed by Malaysia. The extensive network of bilateral tax agreements, which sometimes grants other nations the right to tax Malaysian tax residents’ domestically earned income, can be an exception to the territoriality taxation principle when it comes to cases of double taxation. In such circumstances, Malaysian PIT will not be due by tax residents.

2. Expats who meet the following two requirements may be eligible for a special tax regime exemption on their income:

- not being considered a fiscal resident;

- if the total number of days spent working in Malaysia during a given year does not exceed 60.

3. Last but not least, Malaysia uses a worldwide basis for taxation rather than a territorial basis for income derived from certain industries, such as banking and aviation.

Tax Residency Status in Malaysia

Not all expats in Malaysia are required to file PIT. Those who have been working abroad in Malaysia for fewer than 60 days are not required to file taxes.

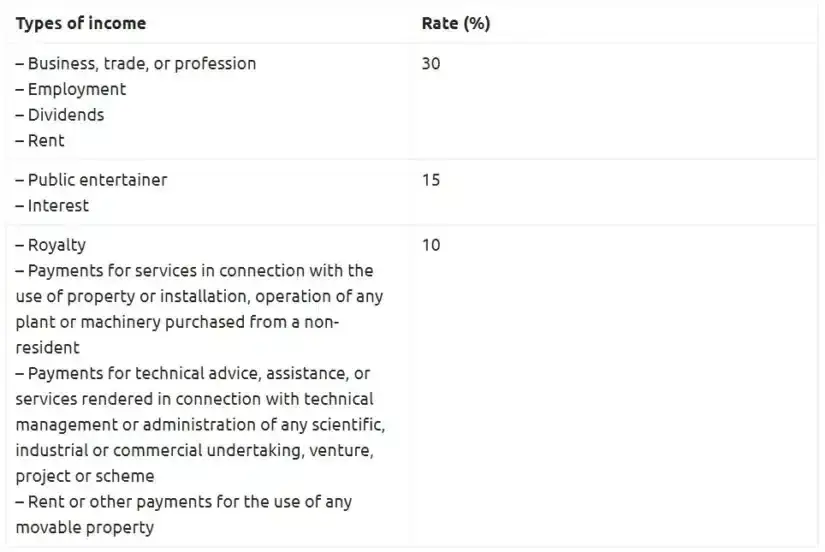

The Malaysian government classifies foreign workers who stay in the nation for more than 60 days but fewer than 182 days as “non-residents” and charges them a flat tax of 30%. There are no tax deductions available to non-residents.

expats who are considered to be “residents” for tax purposes are subject to progressive tax rates and are also entitled to tax deductions.

The Malaysian government deems a person to be a tax resident under Part II, Section 7 of the Income Tax Act, 1967 if they meet one of the following requirements, regardless of their nationality:

- The person spent 182 days of the tax year as a resident of Malaysia;

- The person has lived in Malaysia for less than 182 days of the tax year, but has lived there for a total of 182 days in a row linked to days from the year immediately before or after that tax year;

- the person lived in Malaysia for at least 90 days during the most recent tax year and at least 90 days during three of the four years before; or

- The person has lived in Malaysia for the three years prior to the tax year and will continue to do so in the year that follows.

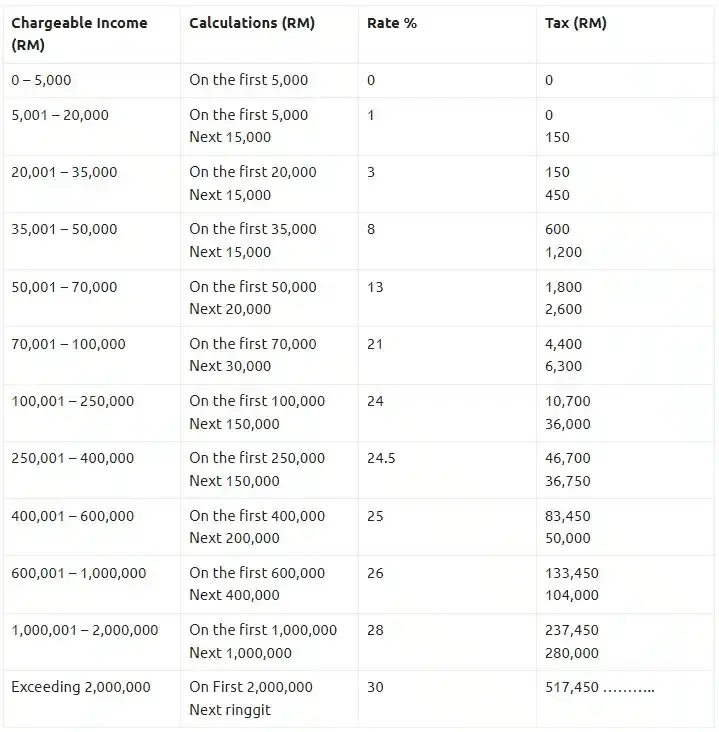

Tax Rates in Malaysia in 2022

Malaysia has a progressive personal income tax system, with a top rate of 30% and a tax rate that rises with an individual’s income starting at 0% for expats who are eligible for tax residency.

The following tax rates are in effect for 2022:

You must first determine your chargeable income, which is defined as your taxable income less any tax deductions and tax reliefs, in order to calculate your tax rate from this table.

As you can see, your tax rate rises along with your chargeable income. Your final tax burden will be lower the more your chargeable income is reduced (through tax breaks and other methods).

Consider that your taxable income is RM48,000 per year. Your tax rate is 8% based on this sum, making your overall income tax obligation of RM1,640 (RM600 + RM1,040) due.

However, if you were to claim RM13,500 in tax breaks and exemptions, your chargeable income would drop to RM34,500. With this, you can move down a tax bracket, lower your tax rate to 3%, and lower your tax obligation from RM1,640 to RM585. Taxes differ by RM1,055 in this case.

Income Tax For Foreigners (Residents and Non-Residents)

Is income tax required to be paid by foreigners or expats who work and earn money in Malaysia? Yes, to be straightforward.

The same income tax laws and rates that apply to Malaysian citizens apply to any foreigner who has worked in Malaysia for more than 182 days and is therefore considered a resident.

As for non-residents, they pay a flat rate based on their sources of income if they are employed for at least 60 days and are in Malaysia for less than 182 days.

Within two months of their arrival in Malaysia, foreign nationals who are employed there must notify the Non-Resident Branch or the closest LHDN branch of their chargeability.

Tax Deductions and Tax Reliefs for Expats in Malaysia

The Malaysian government provides a number of tax breaks and benefits to foreign employees who meet the requirements to be tax residents.

These consist of:

- Tax relief for a spouse (so long as the spouse does not earn an income in or out of Malaysia);

- Tax relief for taxpayers who have to pay parental care;

- Tax relief for each child below the age of 18; and

- Tax relief for children studying at the tertiary level.

Through the Malaysians@Work program, there is also an income tax exemption provided for women who want to resume their careers after a break.

Women between the ages of 30 and 50 are eligible for a maximum 12-month income tax exemption under this program. The following are some of the incentives:l

- Employee – 500 ringgit per month for two years; and

- Employers – 300 ringgit per month for two years.

This program was extended through Budget 2020 until 2023.

Furthermore, medical expenses for the treatment of serious illnesses are exempt from income tax up to a maximum of 6,000 ringgit. This now includes costs related to fertility treatments, per Budget 2020.

Payment and Compliance

The tax year in Malaysia runs from January 1 to December 31 and is in sync with the calendar year. The deadline for filing and submitting tax returns is April 30 of the following year.

An expat must obtain an income tax number from the Inland Revenue Board of Malaysia in order to file income taxes (IRB). For their foreign employees, businesses typically obtain income tax identification numbers.

The employee can register for an income tax number at the closest IRB office, though, if the employer is unable to obtain one.

The IRB has the authority to fine an expat 100% of the undercharged tax if they file a false tax return by omitting information or understating their income.

An additional 10% of the tax due may be charged as a penalty for late income tax submissions.

Expat Taxes in Malaysia for American Expats

Whether or not you already pay expat taxes in Malaysia, you are legally required to file a US tax return each year if you are a US citizen or green card holder.

Only timely filed tax returns are eligible for the expat foreign-earned income exclusion. If you do not file, it is not automatic and might even be lost.

As an expat living abroad, you are given a mandated extension to file until the 15th of June after the end of the fiscal year. However, in order to avoid penalties and interest, you must pay any tax that may be owed by April 15th. If you ask for one, you can file with a delay until October 15.

If you own 10% or more of a foreign corporation or foreign partnership, have foreign investment companies, or bank or financial accounts abroad, you must file additional forms.

The IRS may impose penalties of $10,000 or more per form if you fail to file them or do so late. Whether or not you owe income taxes, these penalties must still be paid.

How To File Income Tax In Malaysia

The method for submitting your income tax returns in Malaysia depends on the kind of income you bring in and, consequently, the kind of form you need to submit.

Residents who do not operate a business must complete the BE form, whereas residents who do operate a business must complete the B form. Foreigners who are not residents file the M form in the interim. The LHDN website has a list of all the available forms.

Depending on the form you are filing, the deadline for filing income tax in Malaysia also varies. The deadline is either 30 April 2022 (manual filing) or 15 May 2022 for the BE form (resident individuals who do not conduct business) (e-Filing).

The B form (resident individuals who conduct business) has a deadline of 30 June (manual filing) or 15 July (e-Filing).

Below is a step-by-step filing your expat taxes in Malaysia.

1. Registering on e-Daftar as a new taxpayer

Your income tax number and PIN are required to register for e-Filing (the online service to submit your income tax return form, or ITRF), which you must have if this is your first time filing taxes online.

You must first sign up as a taxpayer on e-Daftar in order to obtain your income tax identification number. After that, you can either visit an LHDN branch in person or get your PIN online. Here is a more comprehensive guide on how to register as a first-time taxpayer.

2. Signing into e-Filing

Either ezHASiL or MyTax, your tax dashboard, will give you access to e-Filing. You can begin filling out your ITRF online once you have created an account in e-Filing and logged in for the first time.

Please keep in mind that you have the option of viewing the e-Filing webpage, your ITRF, and the entire LHDN website in either English or Bahasa Malaysia; simply choose your preferred language at the top of the screen.

3. Filling up your ITRF

Depending on the income category you fall into, pick the appropriate ITRF:

- e-B/e-BT: For residents earning income from business/knowledge or expert worker

- e-BE: For residents earning income without a business

- e-M/e-MT: For non-resident individuals/knowledge workers

Make sure to choose YA 2021 as the appropriate assessment year as you select the appropriate form. Keep in mind that you are reporting the income you earned the previous year.

What To Do If You Want to Make Changes to Your Income Tax Form

There shouldn’t be any errors in your form if you filled out your ITRF with extreme caution.

However, there’s no need to freak out if you eventually discover a mistake and find that you need to modify your income tax declaration. You have until April 30, 2022, to file an appeal for changes.

The actions you must take are listed below:

- Print your electronic form and correct any errors there (a brief signature next to the correction). Up until the “Tax Paid” level, manually calculate the tax. Any outstanding balance must be paid on or before April 30, 2022, if there is one.

- Include a copy of your electronic form, a letter of appeal outlining the changes you want to make, and all original receipts and documents to support your claims for tax deductions, income, and other benefits. You must then send it to the branch where you registered after completing those steps.

- If it is more convenient, you may also send your letter of appeal and supporting files via the IRBM Customer Feedback Portal.

- Do keep in mind that LHDN will go over each appeal for an error as part of the audit process, and the time it takes for the amendment will depend on the data and materials provided.

You can actually submit your BE form for amendments electronically via e-Filing (e-application for amended BE form), but only in the following two situations and if you do so before the submission deadline:

- Under declared/not declared income

- Over-claimed expense

Simply go to your MyTax dashboard, click on “e-Filing,” and then select “e-Application for Amended BE” as one of your options to access this service. Complete the form and send it.

The Amended Return Form (ARF), which must be submitted within six months of the ITRF submission deadline, may be used if you need to make changes to your ITRF after April 30.

Only taxpayers who have timely filed their initial tax return (ITRF) are eligible to submit an ARF, which must be sent to the branch that handles your income tax file. Once more, the only errors for which this amendment method is acceptable are:

- Under declared/not declared income

- Overclaimed expenses

- Overclaimed capital allowances, incentives, or reliefs

How To Pay Income Taxes In Malaysia

You will be in one of two circumstances after filing your expat taxes in Malaysia and figuring out your total tax liability.

For those who are subject to MTD, you might discover that tax reliefs and rebates helped to lower your final tax amount from what was initially taken out each month.

Consequently, you are entitled to a tax refund! Within 30 working days of submission, it will be automatically credited to the bank account you’ve listed on your tax form.

However, if you discover after filing that you still owe additional taxes, you must pay them before the deadline, which is 30 April 2022. Here are some options for paying income expat taxes in Malaysia:

- Online banking through FPX. This method requires a bank account with Affin Bank, Alliance Bank, AmBank, Bank Islam, Bank Muamalat, Bank Rakyat, Bank Simpanan Nasional, BNP Paribas Bank, CIMB Bank, Deutsche Bank, Hong Leong Bank, HSBC Bank, Kuwait Finance House Malaysia, Maybank, OCBC Bank, Public Bank, RHB Bank, Standard Chartered Bank, or UOB Bank.

- Online using credit card on ByrHASiL (Visa, Mastercard, American Express accepted)

- Pos Malaysia

- Via ATM at CIMB Bank, Maybank, Public Bank, and RHB Bank

- Via cash deposit machines at Maybank

What Happens If You Pay Your Income Taxes After the Deadline

The remaining tax balance that is not paid by the deadline will be subject to a 10% penalty. If the tax and penalty are not paid within 60 days, a further 5% penalty will be added to the amount owed.

Within 30 days of receiving a Notice of Increased Assessment, you have the right to submit a written appeal to the LHDN Collection Unit if you disagree with the late payment penalty.

No matter the outcome of your appeal, you must first pay the fine; if you are successful, LHDN will reimburse you for the appropriate amount later.

How to Appeal Your Income Tax Assessment Notice

There is a chance that LHDN will serve you a notice of assessment after you file your expat taxes in Malaysia. In essence, a notice of assessment is a written declaration from LHDN that details your taxable income, the amount of tax due, and other information.

You can file an income tax appeal if you disagree with any of the information provided, perhaps due to a discrepancy in tax reliefs or other errors. The LHDN branch that issued the assessment must receive the appeal in writing within 30 days of the notice date.

You must complete the Q form, write a letter pointing out the errors, and provide documentation in support of any expenses, deductions, or reliefs you claim.

The Special Commissioners of Income Tax will receive the appeal. The N form is what you need if you have a good reason why you should have more time than 30 days to file an appeal. The Q and N forms can be downloaded from the LHDN website or picked up at the LHDN office.

When Should You Stop Filing Taxes in Malaysia

Only when their tax files have been permanently closed, which is allowed under any of the following three circumstances, are Malaysians permitted to stop paying taxes.

- A retiree with no taxable income

- An individual who is leaving Malaysia for good

- An individual aged 55 years and above, with no taxable income

So, for example, suppose you are a retiree who still works occasionally as a freelancer (with earnings not exceeding RM34,000 annually) or a person over the age of 45 who has no taxable income.

Because you do not meet the requirements to close your tax files in either situation, you must still file your taxes.

Keep in mind that just because you file your expat taxes in Malaysia doesn’t mean you have to pay them; you only have to do so if your chargeable income requires it. In contrast, submitting your taxes is a matter of accountability where you report what you made the previous year.

Finally, if you are qualified to permanently close your tax files and you wish to do so, you must send a formal letter or notification to the branch that manages your tax file.

Before submitting your income tax file closure application, you must make sure there is no outstanding debt that needs to be paid off or a pending refund status.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.