How to Retire in Malaysia in 2022

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

Here are important information on how to retire in Malaysia, which include costs and visa requirements.

The stunning scenery, pleasant climate, mouthwatering cuisine, and low cost of living in Malaysia draw retirees globally. The stunning nation of Southeast Asia is ideal for anyone who values peace and relaxation in their lives.

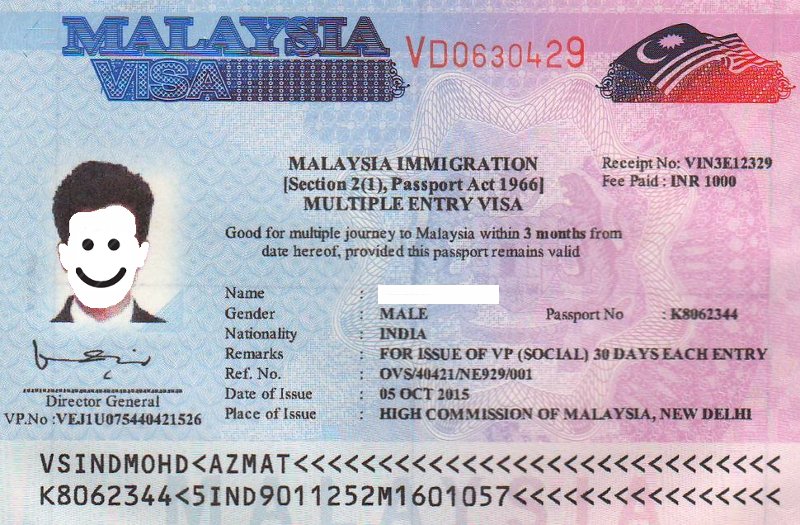

You need to submit an application for a retirement visa to settle in the country.

How to Retire in Malaysia: Malaysia My Second Home (MM2H) Scheme

The Malaysian government implemented a program called Malaysia My Second Home, which allows retirees to live in the country as long as possible on a multiple-entry social visit pass. The MM2H visa is valid for 10 years, is renewable, and doesn’t place any limitations on how often you can enter or leave Malaysia.

The government unveiled new guidelines for the program, requiring applicants to have a minimum of 1 million ringgit (US$224,467) in permanent savings and a minimum of RM1.5 million in liquid assets declared, according to a recent report from Malaysia-focused news portal Free Malaysia Today.

In the past, applicants to the MM2H scheme just need savings totaling between 300,000 ringgit and 500,000 ringgit.

The new criteria do not apply to current MM2H participants. However, they will be subject to the new pass renewal term, processing cost, and renewal fee worth 500 ringgit.

How to Retire in Malaysia: Visa Eligibility

Who is eligible for a retirement visa in Malaysia? You must meet the criteria listed below in order to be eligible for a retirement visa in Malaysia:

- You need to be at least 35 years old.

- You need to have the means to support yourself while you’re in Malaysia

- You must now have a minimum of 1.5 million ringgit in liquid assets (up from 500,000 ringgit) and a minimum of 40,000 ringgit per month in offshore income (up from 10,000 ringgit previously).

- You must have no criminal history.

How to Retire in Malaysia: Dependents

Does a retirement visa entitle you to bring your dependents to Malaysia?

With a retirement visa, you are permitted to bring your family members to Malaysia. The family consists of:

- Your legal spouse

- Unmarried children under the age of 21

You can simultaneously apply for a social visit pass for your spouse and children while you apply for the retirement visa. The application process is the same, but you will need to provide extra requirements for every member of your family.

Your family can live with you after their visa is approved and enjoy the same privileges as Malaysian citizens.

How to Retire in Malaysia: Advantages of Retirement Visa

Below are several benefits you can gain from a retirement visa in Malaysia:

1. The MM2H scheme will grant retirees with a 10-year visa. You can request to have your visa renewed indefinitely once it expires.

2. You won’t pay taxes on any money you send to Malaysia. The tax exemption is valid for transfers of other foreign monies into Malaysia as well as payments of offshore pension funds into Malaysia. You must correctly report it because Malaysia has laws requiring substantial money transfers to be reported.

3. Depending on where you choose to reside, you may be able to purchase a home for more than $237,000. However, you must secure state authorization before you can make any acquisitions.

4.As long as they adhere to the terms and restrictions, MM2H participants may import a previously owned private vehicle or buy a brand-new locally produced vehicle.

- A new locally constructed car or a used private car costs a total of $35,550 to buy or import.

- The applications must be submitted within two years after the MM2H visa’s approval date.

5. The ability to run one’s own company as a director is available to MM2H members. Additionally, there are stock exchanges, unit trusts, and local businesses where you can invest.

6. You are permitted to apply for a domestic helper in accordance with Malaysia’s immigration department’s current regulations.

7. You can enroll at Malaysia’s private colleges and universities at this time, together with any accompanying family members.

How to Retire in Malaysia: Application for Retirement Visa

1. Start your application by going to the Malaysia My Second Home program’s official website.

2. Print off every form on the website, then fill them up in accordance with the MM2H site’s instructions. A signature is required at the end of the application form.

3. The application forms must be delivered to an MM2H Center, either personally or through a courier, together with the necessary paperwork. You can find out more about the documents you need to submit as you read through this article.

4. Wait for your MM2H visa to be approved.

Take note that you can also work with a retirement agency to assist you with submitting your application; however, before you do so, make sure the organization is authorized by the Ministry of Tourism, Arts, and Culture.

How to Retire in Malaysia: Documents Required for Retirement Visa

The following documents are required to be submitted with your application for a Malaysia retirement visa:

- A copy of each page of your current, valid passport, i.e., visa and entry stamp pages

- The original and a copy of the letter of conditional approval

- The Malaysia retirement visa application form

- A single photo the size of a passport with blue background

- Documentation demonstrating your ability to sustain yourself financially in Malaysia. You must provide the three most recent bank statements to prove that you have permanent savings worth at least 1 million ringgit

- Evidence that you are a pensioner, such as a letter confirming your pension (if applicable)

- A proof of health insurance for your stay in the country

- A letter of good conduct from the appropriate government agency, like the police, from your home country

- Letter of intent for an individual or letter from the representative agency for MM2H (if applicable)

- All other necessary identification and address documents

Please take note that all paperwork must be translated into English by the Institute of Language and Literature or the Malaysian Embassy or Consulate General overseas.

Your Retirement Visa is Approved, What’s Next?

You must go to Malaysia to pick up your conditional approval letter when the Malaysian Department of Immigration grants your request for a retirement visa. Following the approval of your Malaysian retirement visa, additional requirements include:

- A medical report from any Malaysian private hospital or licensed clinic is required for you and your dependents.

- You must have access to medical insurance from any insurance provider that is valid in Malaysia.

- If you submit your own application, you must post a direct security bond, which can cost anywhere between 200 ringgit and 2,000 ringgit depending on your citizenship. Applications made through authorized businesses must be accompanied by a personal bond for each applicant.

How to Retire in Malaysia: Fixed Deposits for Retirees

After obtaining nod for your Malaysian retirement visa, you must open a fixed deposit account with a Malaysian bank to demonstrate your financial capability to support yourself. Your age will determine the deposit.

If you are more than 50 years old:

- You must set up a fixed deposit account with 150,000 ringgit.

- If you meet the fixed deposit requirements after a year, you can withdraw up to 50,000 ringgit to pay for a home, your children’s education in Malaysia, and medical expenses.

- From year two and beyond and for the duration of your participation in the MM2H program, you must maintain a balance of at least 100,000 ringgit.

If you are below 50 years old:

- You must set up a fixed deposit account with 300,000 ringgit.

- If you meet the fixed deposit requirements after a year, you can withdraw up to 150,000 ringgit to pay for a home, your children’s education in Malaysia, and medical expenses.

- From year two and beyond and for the duration of your participation in the retirement scheme, you must maintain a balance of at least 150,000 ringgit.

How to Retire in Malaysia: Retiree Employment

Can you get a job in Malaysia with a retirement visa?

A Malaysia retirement visa does permit you to work. People with the retirement visa who are 50 years of age or older and who possess specialized talents in a few recognized industries may work up to 20 hours a week.

However, whether or not the approving committee decides to authorize the part-time employment for you will depend on their assessment of whether a Malaysian is qualified to do the job.

Duration of a Retirement Visa for Malaysia

A 10-year multiple entry visa is given to retirees under the Malaysia My Second Home initiative. At the conclusion of the initial 10 years, the visa is automatically renewed.

Permanent Residency

Can you become a permanent resident in Malaysia with a retirement visa?

Sadly, having a retirement visa does not grant you the right to permanent residence in Malaysia, nor can it be converted to such status.

How to Retire in Malaysia: Cost of Living

A meal at an inexpensive restaurant is estimated to cost 10 ringgit (as of the time of writing), while a three-course meal for two in a mid-range restaurant can cost 80 ringgit, according to global cost of living data aggregator Numbeo.

Rent for one-bedroom apartments inside and outside Malaysia’s city center cost 1,554 ringgit and 1,030 ringgit on average per month, respectively. The cost per square meter for buying an apartment within the city center is at 8,232 ringgit, while that outside of the area is at 4,741ringgit.

The overall cost of living in the country for a family of four can hit an estimated average of 7,070 ringgit per month, while a single person can live off 1,980 ringgit a month, both excluding rent.

You can check out our previous article titled Expat Cost of Living in Malaysia to learn more.

How to Retire in Malaysia: Taxes

Malaysia only imposes taxes on income earned in the country. Consequently, you will not be obliged to pay taxes on your income if all of your income is retirement-related, such as a pension or Social Security benefits. Depending on your salary level, you may be taxed up to 30% if you work in Malaysia.

You must submit tax returns to the US every year if you are a citizen there. Any international bank accounts will also need to be reported. There are a few different options that you can take advantage of to lower your US taxable income if you get any income from sources outside the country. A few examples of these are the foreign tax credit, the foreign housing exclusion, and the foreign earned income exclusion.

How to Retire in Malaysia: Best Locations

There are a range of things Malaysia can offer potential retirees from beaches to jungles, delicious food, affordable living expenses, and many lovely spots.

Here are a few of Malaysia’s top retirement destinations:

Penang

Penang, also referred to as “The Island of Pearls,” is distinguished by a variety of breathtaking sceneries. The multicultural and diversified society enjoys festivities, and provides a wide range of governmental and private hospitals for your medical needs.

A meal at an inexpensive restaurant in Penang is estimated to cost 10 ringgit, while a mid-range restaurant can charge 60 ringgit for a three-course meal for two, according to Numbeo.

Renting a one-bedroom apartment within Penang’s city center costs 1,165 ringgit per month and 990 ringgit outside that area. The costs for buying apartment within and outside the city center can reach 8,477 ringgit and 5,961 ringgit per square meter, respectively.

The overall cost of living in the city for a family of four can hit an estimated average of 7,139 ringgit per month, while a single person can live off 2,010 ringgit a month, both excluding rent.

Kota Kinabalu

Kota Kinabalu is one of the most affordable places in the world for expats to reside in, making it ideal for retirees who appreciate seaside living. You can explore the city’s lush jungles, glistening waterways, breathtaking mountains, as well as its architecture in your own time.

With a wide variety of healthcare facilities, Kota Kinabalu boasts a top-notch healthcare system.

A meal at an inexpensive restaurant in Kota Kinabalu is estimated to cost 12 ringgit, while a mid-range restaurant can charge 60 ringgit for a three-course meal for two, according to Numbeo.

Renting a one-bedroom apartment within Kota Kinabalu’s city center costs 1,733 ringgit per month and 633 ringgit outside that area. The costs for buying apartment within and outside the city center can reach 8,399 ringgit and 4,654 ringgit per square meter, respectively.

The overall cost of living in the city for a family of four can hit an estimated average of 8,093 ringgit per month, while a single person can live off 2,228 ringgit a month, both excluding rent.

Kuala Lumpur

One of the most popular tourist destinations in Asia is Kuala Lumpur, a modern metropolis that provides things you need for a comfortable retirement. It is ideal for retirees who desire to live out the remaining years of their life in a diversified setting, amidst art and architecture.

A meal at an inexpensive restaurant in Kuala Lumpur is estimated to cost 15 ringgit, while a mid-range restaurant can charge 100 ringgit for a three-course meal for two, according to Numbeo.

Renting a one-bedroom apartment within Kuala Lumpur’s city center costs 1,913 ringgit per month and 1,201 ringgit outside that area. The costs for buying apartment within and outside the city center can reach 10,137 ringgit and 5,519 ringgit per square meter, respectively.

The overall cost of living in the city for a family of four can hit an estimated average of 7,941ringgit per month, while a single person can live off 2,212 ringgit a month, both excluding rent.

Malacca

The historic city is renowned for its museums, multi-religious society, historical structures, and stunning landscapes.

Government and commercial hospitals, as well as health clinics, may be found across Malacca, giving its citizens equal access to high-quality medical care.

A meal at an inexpensive restaurant is estimated to cost 11 ringgit, while a three-course meal for two in a mid-range restaurant can cost 55 ringgit, according to Numbeo.

Rent for one-bedroom apartments inside and outside Malacca’s city center cost 1,400 ringgit and 800 ringgit on average per month, respectively.

Johor Bahru

Johor Bahru is the ideal place for you if you enjoy trying out regional cuisine and if you’re addicted to coffee. Three public hospitals, four health clinics, and 13 Malaysian clinics are located in the city; therefore, you won’t have much problem with healthcare.

A meal at an inexpensive restaurant in Johor Bahru is estimated to cost 9 ringgit, while a mid-range restaurant can charge 90 ringgit for a three-course meal for two, according to Numbeo.

Renting a one-bedroom apartment within Johor Bahru’s city center costs 1,260 ringgit per month and 840 ringgit outside that area. The costs for buying apartment within and outside the city center can reach 6,269 ringgit and 3,264 ringgit per square meter, respectively.

The overall cost of living in the city for a family of four can hit an estimated average of 7,409 ringgit per month, while a single person can live off 2,077 ringgit a month, both excluding rent.

How to Retire in Malaysia: Bottom Line

You should eventually take your own desires and needs into account when determining where to settle. Before making a choice, weigh the benefits and drawbacks of a potential location. Be patient and take your time.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.