This article is a review of London-based Qardus.

If you have been proposed this option and want a second opinion, you can email me (advice@adamfayed.com) or contact me here.

We can sometimes offer discounts, and other benefits, if you want to invest in it, compared to many other providers, or introduce alternatives which might be better for your situation.

Table of Contents

Who is Qardus?

Qardus is a crowdfunding platform in the UK that is dedicated to providing ethical, Sharia-compliant business financing solutions. The company is committed to promoting sustainable financial intermediation and creating a seamless marketplace that connects small and medium-sized enterprises (SMEs) with investors who are looking for ethical investment opportunities.

As part of its commitment to Sharia compliance, Qardus carefully screens all businesses that apply for funding to ensure that they meet the requirements of Islamic finance. The company uses Sharia-compliant structures on both sides of its marketplace, providing a level of transparency and integrity that is not always available in conventional financing.

Despite its Islamic framework, Qardus is open to serving the financing needs of all SMEs, regardless of their faith. The company does not discriminate on the basis of religion and is dedicated to providing ethical financing solutions to all who qualify.

By offering ethical financing solutions, Qardus is helping to bridge the gap between traditional finance and socially responsible investing. The company’s commitment to sustainability, transparency, and inclusivity makes it an attractive choice for businesses that are looking for a socially responsible way to fund their growth and expansion.

What is crowdfunding?

Crowdfunding is a way of raising funds for a project or business venture by collecting small amounts of money from a large number of people, typically through an online platform. It allows entrepreneurs, artists, and other individuals to bypass traditional financing options such as banks and venture capitalists, and instead appeal directly to the general public for financial support.

In exchange for their contributions, backers may receive rewards such as early access to products or exclusive experiences, or they may simply be motivated by the desire to support a cause or project that they believe in. Crowdfunding has become an increasingly popular way to raise capital for startups, creative projects, and social causes.

What does Sharia compliant mean?

Sharia compliant refers to financial transactions or products that comply with the principles of Islamic law, which is also known as Sharia. Islamic finance is based on the principles of risk-sharing, fairness, and ethical behavior, and it prohibits the charging or paying of interest (riba), speculation (gharar), and investment in prohibited activities (haram).

In a Sharia-compliant financial transaction, both parties must share in the risk and the profits or losses of the investment or financing arrangement. For example, in a partnership, the investors provide the capital, while the entrepreneur manages the business. Profits are shared based on a pre-agreed ratio, and losses are borne in the same proportion.

There are several types of Sharia-compliant financial products that are designed to meet the financing needs of individuals and businesses. For example, in place of conventional loans, Islamic finance offers several alternatives, such as cost-plus financing, partnership, and leasing.

Qardus Funding Services

The company offers secured and unsecured financing for healthcare and manufacturing businesses in the UK. Unsecured financing can offer funding of 50,000 pounds to 200,000 pounds with terms of up to 36 months, while secured financing provides 200,000 pounds to 500,000 pounds with terms that could go up to 5 years. Qardus targets to provide extended asset financing terms in the future.

The company also offers alternative business funding, small business loans, and working capital finance, as well as line of credit for businesses.

Secured vs. Unsecured Business Loans

Secured and unsecured loans are two common types of business loans that differ in terms of the collateral required to obtain the loan.

A secured business loan requires the borrower to pledge collateral, which is usually an asset such as property, equipment, or inventory, as security for the loan. In the event that the borrower defaults on the loan, the lender can seize the collateral to recover their losses. Because secured loans are less risky for lenders, they typically offer lower interest rates, longer repayment terms, and higher loan amounts than unsecured loans. However, the borrower bears the risk of losing the collateral if they are unable to repay the loan.

In contrast, an unsecured business loan does not require collateral. Instead, the borrower’s creditworthiness is evaluated, and the loan is granted based on the borrower’s credit score, business history, revenue, and other factors. Unsecured loans are typically easier and faster to obtain than secured loans, as there is no need to pledge collateral. However, they often come with higher interest rates, shorter repayment terms, and lower loan amounts, since the lender is taking on more risk.

It is common for businesses that do not comply with Sharia principles to apply higher interest rates on unsecured loans.

Alternative Business Funding

Alternative business funding refers to the various forms of financing that businesses can access outside of traditional banking channels such as loans and lines of credit. These alternative financing options have become increasingly popular in recent years, particularly among small and medium-sized enterprises (SMEs) that may have difficulty accessing traditional bank loans.

These choices normally provide greater flexibility, quicker approval, and less strict lending criteria.

Qardus’ alternative business funding usually takes a week to process, and it’s interest-free.

Small Business Financing

Qardus supports small businesses located in the UK to obtain the required funding for their expansion. The firm’s alternative to business loans offers similar advantages to those provided by conventional bank loans, however, it is Sharia-compliant and not classified as a loan.

You can get approved in just two days for financing worth 25,000 pounds to 200,000 pounds.

Working Capital Finance

Qardus offers working capital financing to SMEs throughout the UK. The service is a socially responsible replacement for a conventional business loan, offering the same advantages as an unsecured loan, but with a structure that aligns with the principles and values of Islamic finance (which will be elaborated on later). Qardus provides an economical substitute for a working capital loan.

Business Line of Credit

A business line of credit can be a flexible means of raising working capital, although it may not be suitable for everyone. However, if you’re contemplating a line of credit, Qardus’ strategy may offer a cheaper option for you.

The firm’s business financing product stands out from conventional finance as it is free of interest. Although the company does levy a pre-agreed fee for its financing, it is typically very competitive when compared to the expenses of initiating and sustaining a line of credit

What is the type of funding Qardus uses?

Qardus employs Islamic finance for businesses as a substitute for established business loans, as it strives to have a positive social impact.

What is Islamic finance?

Islamic finance is a system of financial transactions and products that operates according to the principles of Sharia, the Islamic law.

Islamic finance operates on the principles of risk-sharing, social responsibility, and ethical investing. Transactions are structured to avoid interest-based transactions and instead are based on profit-and-loss sharing models or asset-based financing.

Islamic finance emphasizes the importance of community and social responsibility, and thus, investments should be made in ventures that promote social welfare, such as affordable housing, education, and healthcare.

How does Qardus’ Islamic finance work?

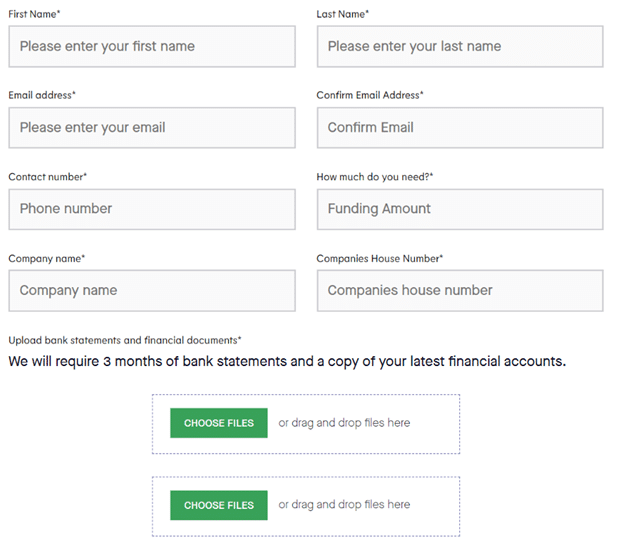

Complete your application quickly and easily online with the company’s straightforward form. It doesn’t require any unnecessary paperwork or information, which you can see in the snapshots below:

Qardus evaluates your business performance in-house to determine your approval, without affecting your credit score. Then, you’ll receive a funding offer within 2 days of approval, which reflects a quick decision-making process. Once your offer has been funded, you can expect to receive your funds within 48 hours.

You retain control over how the funds are used, as Qardus allows for autonomy and flexibility in managing your business finances.

What financing fees does Qardus charge?

Typically, small businesses seeking financing are required to pay an arrangement fee of 5% to 7% upon receiving the funds. For secured business financing, in particular, the arrangement fee starts from 2%. Such fee is deducted from the advance amount.

Late repayments may be subject to an administration fee of 15% of the arrears if the payment is overdue for more than a week. If the facility is in default, an added collections charge worth up to 15% of the outstanding financing amount at the time of default may be assessed

What types of financing can a business get on the Qardus platform?

Which businesses are eligible to apply for a financing facility? Any business registered in the UK can apply for financing through the Qardus platform, as long as they meet the following requirements:

- The business is a limited liability company with shareholders registered in the UK

- The business has been in operation for at least 3 years, so startups are excluded

- There are no outstanding County Court Judgements against the business

- The business has stable cash flows.

Qardus Investment Opportunity

Who can invest?

Residents in the UK or the European Union (EU) who fall into one of the following categories may participate in the investment alternatives Qardus offers:

- Certified High Net Worth Individuals

- Self-Certified Sophisticated Investors

- Restricted Investors who confirm that they will invest less than 10% of their net assets in this type of investment.

Qardus’ eligibility for investing is strict, as its investment opportunities are not available to the general public. However, the company’s platform does not restrict non-Muslim investors from participating.

Investing from outside the UK is subject to your individual circumstances and the regulatory requirements of the country where you live. If you are interested in investing from abroad, you can send an email to investing@qardus.com for further information.

Do note that the Qardus platform is currently off-limits to residents of the US and Canada.

What are the requirements?

For Individuals

- 18 years old and above

- A permanent UK resident (apart from the Channel Islands and the Isle of Man)

- hold an authorized UK bank or building society account

For Limited Companies or Limited Liability Partnerships

- registered with government agency Companies House

- hold an authorized UK business bank account under the name of your business

- domiciled in the UK (excluding the Channel Islands and Isle of Man)

- every shareholder are required to be permanent residents of the UK

Is there a minimum amount needed to invest?

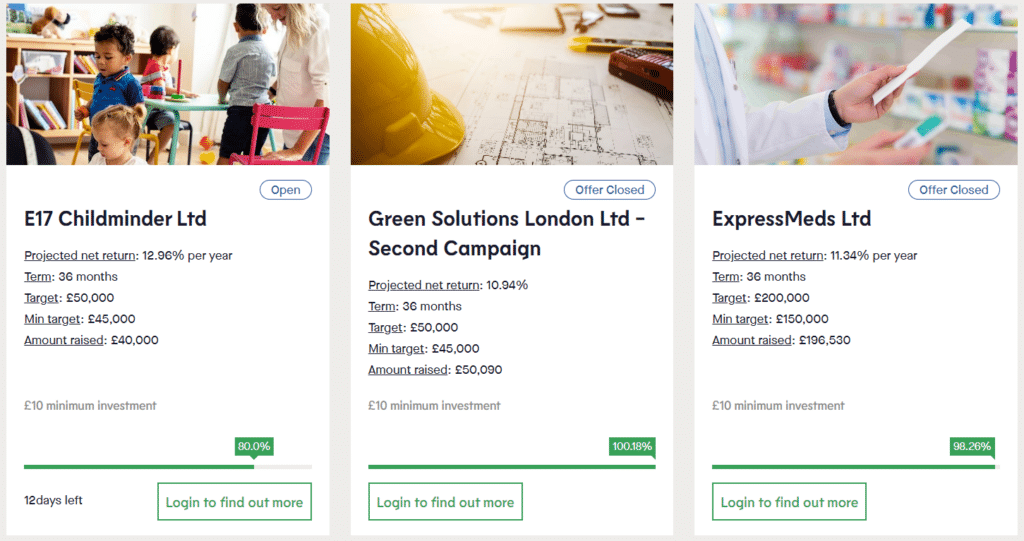

Qardus does not explicitly state any investment minimums, but all the closed offerings on its platform allowed for an investment of at least 10 pounds.

How do I earn from my investment?

Instead of receiving interest payments, investors on the Qardus platform earn “profit rates.” This is due to the fact that the practice of paying and receiving interest is forbidden in Islam. Muslims hold the belief that it encourages dishonesty in financial deals, which in turn leads to societal inequity and injustice.

How can I invest on the Qardus platform?

You may send money from your bank account into your newly opened online account, which can be done in just a few easy steps.

Start providing funding to small firms all over the UK who are searching for different types of ethical financial solutions.

When you make an investment or add money to your wallet, the money should be sent to a company called ShareIn Ltd., which keeps the money belonging to its customers in separate accounts. The Financial Conduct Authority (FCA) has granted ShareIn an operating license and regulates the company.

During the course of the facility’s duration, the companies whose operations you have supported financially will send you monthly payments including both capital and profits on those investments. These repayments can be monitored via Qardus’ investor dashboard.

All of the transfer particulars will be made accessible when you invest.

What kinds of business are part of the investment offerings?

Funding small businesses through Qardus is a straightforward process that can be completed within minutes. You’ll be investing in creditworthy UK-based limited companies that are operating ethically.

Since Qardus is a sharia-compliant platform, businesses that are primarily engaged in certain sectors will not be eligible for funding. These excluded sectors include:

- Alcohol, cloning, gambling, pork, pornography, tobacco, and other non-Islamic activities, plus those who advertise them

- Media and entertainment, except for newspapers, as well as channels dedicated for news, sports, children, and education.

- Those who produce, distribute, and broadcast music, movies, television shows, and musical shows on the radio.

- Operators of cinema

- Financials (except for Islamic banks, Islamic financial institutions, and Islamic insurance firms)

- Trading of gold or silver with payment to be settled at a later date

Will the Qardus platform charge me any fees for the investments that I make?

There are no investment fees charged to investors. Instead, all fees associated with the investment will be paid by the SME (small and medium-sized enterprise) seeking funding. This means that all of the funds you invest will go towards the business, and no fees will be deducted from your investment.

What if a company fails to pay back its loans?

Before Qardus will put a company on the platform, it first does extensive due diligence on the firm to determine whether or not it is creditworthy. In the event that anything goes wrong with the facility, a personal director guarantee may also be obtained against it to assist in the recovery of the sums that are still owed. Qardus conducts an analysis of the director’s financial situation if it becomes essential to demand payment from the director in accordance with the conditions of their guarantee.

But, if payments are still overdue by more than 2 months, Qardus will hire a debt collection agency to pursue them. Debt collection agency costs are mitigated by the defaulted business’ payment of late fines imposed under the commodity murabaha contract.

When the aforementioned expenses have been deducted, the remaining amount of any late payment charges will be donated by Qardus to charity organizations chosen at the reasonable opinion of the Shari’ah Supervisory Board.

What are the advantages and disadvantages of Qardus?

Advantages

- Sharia-compliant: Qardus adheres to the principles of Islamic finance, which may be important for investors who seek to align their investments with their religious beliefs.

- Diversification: The company gives investors access to various firms, allowing them to diversify their portfolio across multiple businesses and sectors.

- Low minimum investment: Qardus has a low minimum investment amount, making it more accessible to investors who just want to dip their toes on this type of investment.

- No investment fees: Investors on the Qardus platform do not pay any investment fees, as all fees are paid by the SMEs.

- Social impact: Investing in SMEs can have a positive impact on the economy and create jobs, which may be important for investors looking to make a social contribution.

Disadvantages

- Risk of default: Investing in SMEs can be risky, as there is a risk of default. Investors may lose some or all of their investment if the SME is unable to repay the financing.

- Lack of liquidity: Investments on the Qardus platform are not traded on any public exchanges, which means that there is a lack of liquidity and investors may not be able to sell their investments as quickly.

- Limited investment options: The firm offers a limited number of investment options compared to other crowdfunding platforms, particularly due to its focus on SMEs. This may be a drawback for investors who are looking for a wider range of investment opportunities.

- Regulatory risk: The regulatory environment for crowdfunding is constantly evolving, and changes to regulations could impact the operation of the Qardus platform and the returns that investors receive.

- Not available in all countries: Qardus is currently only available to investors who are resident in the UK or the European Union, which may be a disadvantage for investors who are based outside of these regions, especially those in the US and Canada.

Qardus Review: Bottom Line

Qardus can provide exciting opportunities to its investors. Just be mindful not only of the benefits but also of the risks of investing with the platform. It can be especially appealing to Muslim investors or those who support related causes and ventures. What’s important is to keep a balanced investment basket overall.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.