In today’s article I will review Commerzbank Structured notes which are widely sold within expat investments I previously looked at. I will discuss the positives and the negatives of the investments and suggest what you can do if you have an underperforming investment.

Table of Contents

How do these structured products typically work?

Structured notes are a complicated type of investment, based on derivatives. They typically combine numerous different types of investments, and give a payout if the investments doesn’t fall by a certain percentage.

As this is a complicated investment, I will give an example here:

Duration of note: 5 years

Currency: USD

Investment type: index-linked note. Based on 4 underlying. S&P500, Hong Kong Heng Seng, OMX Stockholm in Sweden and Euro Index

Coupon: 10% paid – so 2.5% quarterly

Protection barrier: 35%

So the way this note works is that every three months, provided that the 4 indexes are above the 35% protection barrier in USD terms, the 2.5% coupon will be paid.

However, if even one of the four is below the barrier, even if it is due to a currency crisis, the 2.5% will not be paid. So let’s say next quarter, the Hong Kong Market is down 10% but the Hong Kong Dollar is down 25% against the USD due to the anti-government protests, then the 2.5% won’t be paid.

This is just one type of structured note. Index-linked structured notes are safer than notes based on individual shares, because it is very common for individual shares to increase, or decreased, by 35%-40% a year, especially small cap stocks.

What are the pros?

Despite the negatives with these investments, there are a few positives, including:

- You do get limited downside protection against falling markets.

- Used in a careful and limited way, they aren’t always super high-risk.

What are the cons?

The main negatives with the structured notes are:

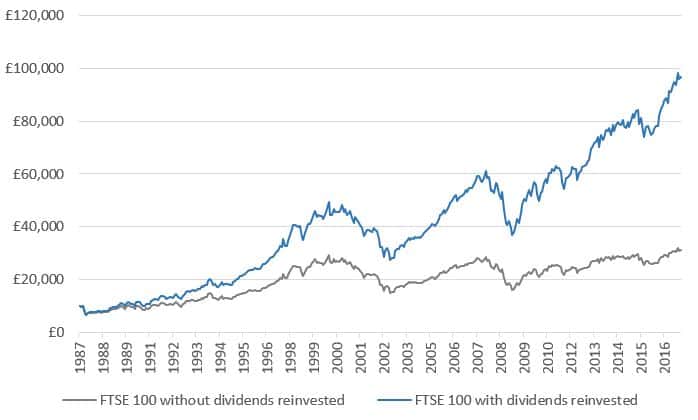

- These structured notes don’t pay dividends. This can make a huge difference, as the graph below shows:

- There are a lot of hidden costs and risks. In terms of the risk, there are many moving parts. As an example, let’s say you have 4-5 investments within the note, and they are all based on different currencies and markets. If even one of the investments reduces by 35% or more, you could lose a lot of money. 35% seems like a lot, but in recent years, many emerging market currencies have fallen by 35% or more, dragging down the USD portion of the investment.

- Markets usually go up long-term. So often people don’t need the protection barriers

- Complexity can be your enemy in investing

- Sold together with some high-fee expat investments, and those fees can eat into the returns

What’s the bottom line?

For a professional investor, structured notes can play a part in a diversified portfolio. For most expat investors, they should be avoided, or kept to a small percentage of a portfolio.

What can you do if you have an underperforming portfolio?

The article below explains what you can do, in more detail, if you have an underperforming expat portfolio. Essentially, you can already sell out completely, move some of the money penalty free or reduce the cost of your existing portfolio.

I have helped clients with all three, improving their existing portfolios in the process.

What are your contact details?

advice@adamfayed.com is my main contact email.

Further reading

In the article below, I review some of the most popular expat investments in the market, which are often sold alongside Commerzbank structured notes: