This article was updated on April 3, 2020

This article will review MoneyBox and ask if they are a good app to use. It will especially look at things from a UK tax residents point of view vs somebody who is an expat or plans to leave the UK in the future.

If you want to invest or ask me some questions, you can contact me using this form, or use the chat function below.

For those that prefer visual content, the video below summaries the content below:

1. Who are MoneyBox?

Moneybox is a saving and investing app that tries to make life more convenient for UK residents. They are mainly focused on being a “spare change app”.

For example, the Moneybox Round ups mean if you buy a 3.30 pound coffee at the store, and you use 4 pounds, the 70 pence will be used in your “digital piggybank”.

All of these small round-ups will build up. Every Wednesday, these small savings will be tallied together and taken to be invested into your account.

Of course, you can also invest in a more conventional way adding money to your account in bigger sums.

2. What products and services do they offer?

They offer a range of products and services including:

- Stocks and Shares ISAs for UK tax residents. With this option you can invest up to 20,000 pounds tax free every year. This is a significant tax benefit over a lifetime.

- Junior ISA for UK tax residents. Like the standard ISAs, you can invest every year tax free for your child, but the limits are lower.

- Investment Accounts.

- Pensions.

- “Ethical investments”. Their socially responsible investing is managed by Old Mutual and avoids investing into certain areas like oil & gas. The issue with socially responsible investing is what is ethical for person A, isn’t always moral for person B.

- Robo advisory services.

- Ready-made portfolios for those that don’t want to pick their own investments.

- Savings accounts. For those looking to merely save money rather than invest, Moneybox offers competitive rates of savings. The rates are currently 1.65% for a notice savings account, which means you need to give them 95 days notice before withdrawing. This is done through their partner bank Investec. They also have a lifetime ISA, offering 1.4%. However, with this option, you can only withdraw for specific purposes – for example you are buying your first house or you are 60. If you withdraw for another purpose, you are charged exit penalties.

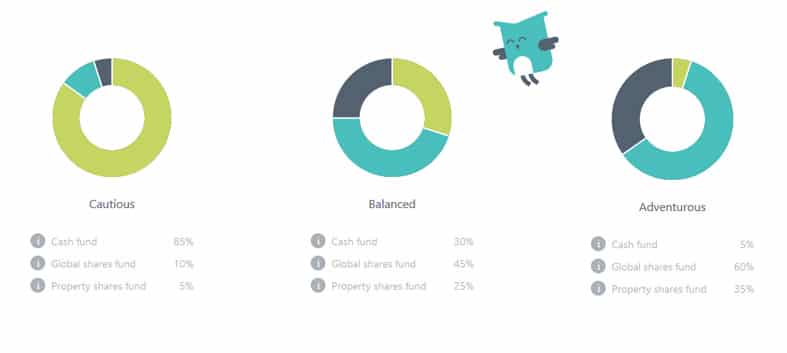

Within Moneybox, there are three main options when it comes to investing money; the cautious, balanced and adventurous funds.

The cautious fund is more diversified, and has a lot of conservative investments into government bonds and cash.

In comparison, the growth fund has a much larger percentage of money going into global stock markets, and a smaller amount into government bonds.

3. What the positives about them?

The main positives associated with this app is:

- It is a good option for beginner DIY investors that want to invest into ready-made portfolios or through robo-advice. You can invest for as little as 1GBP ($1.20 or so)!

- You can connect your card to the app, so the process is very simple.

- The fees are reasonable – less than 1% per year.

- They do have a range of services, such as the junior ISA, which can be excellent for UK tax residents, that plan to stay in the UK for the long-term.

- They are a safe company to invest with. There again, it is a misconception to suggest that most aren’t safe. Almost all companies these days are regulated and have checks and balanced. We aren’t in 1965 or 1975!

4. What are the negatives?

The main negatives with this option are:

- Whilst it might be a great option for beginner investors in the UK who don’t have a lot of capital, they aren’t well suited to people that have very specific needs. For example, an expat living in the UK, or a British person planing to move overseas, won’t be well-served in this platform.

- Most of the people using this app are trying to DIY invest. That is fine for those people who have the self-control to invest. That is easier said than done. I have lost count of the number of people who have pledged to me that they would be self-disciplined if markets went down, only to panic or invest less during periods like 2008 and the current 2020 bear market. Numerous DIY platforms have reported that money outflows has increased during 2020, just like in 2008. It is a bit like going to the gym. We all know how to use gym equipment but a good personal trainer can help us use the equipment correctly. The same thing is true for investing. A good advisor can help with emotional impulses as much as the technical side, and be a counter-voice in your head, when you are about to panic. Robo-advice is less likely to be as persuasive as a human when it comes to controlling emotions during a market crash.

- There have been numerous reports of sub-standard customer service.

- The fees are super low considering there is no professional advice being offered. Some advisors offer an “all in” charge of 1% per year, which isn’t that much more expensive than this option.

- The savings rates are below the rate of inflation and are likely to come down. Many people putting money into savings accounts are worried about market volatility, when in reality, you don’t need to worry about that as a young person. Markets have always historically risen long-term, as any long-term graph of the S&P500, FTSE All Shares or Dow Jones will show.

- The ready made portfolios aren’t as good long-term, compared to many bond and index funds.

5. Conclusion

Moneybox are an excellent option for beginner investors in the UK who are just starting out. For example, students or young professionals.

They aren’t as good for people with specific needs (expats, high net wealth or another specific niche) and are a UK-centric option.

So options like this are good for a first time investor, before migrating to a more specific and sophisticated platform.

Likewise, just like 99% of other providers, their savings accounts aren’t worth it these days, with rates below inflation in most cases.

Those interest rates are likely to decline further, after the recent moves by the Bank of England, to cute rates.

Another good service for beginners in the UK is the Money Advice Service which we talk about here.

6. Further Reading

The article below reviews Scottish Widows. They are on the opposite end of the extreme to MoneyBox in that most of their clients are older, and they have a long history as a company.

Do they offer great products?

Scottish Widows Review